Outline ·

[ Standard ] ·

Linear+

myTHEO MY, Invest in a Moment

|

SUSCardNoob

|

Jul 5 2019, 07:55 PM Jul 5 2019, 07:55 PM

|

|

QUOTE(j0nn @ Jul 5 2019, 07:54 PM) Saw that but what's the % allocation like within Growth? I have a 80% growth portfolio on SA, 45% ends up in US equities. 15% Asia ex-Japan. I don't have as the current UI only shows amount invested not % of the portfolio and I'm lazy to do manual calculation. FYI, I'm on 100% Growth. |

|

|

|

|

|

bourse

|

Jul 5 2019, 08:05 PM Jul 5 2019, 08:05 PM

|

|

QUOTE(Leo the Lion @ Jul 4 2019, 02:54 PM) Finally the thread dis open! I put small small amount only first. However, MyTheo cant add new portfolio though. And MT, if you hear me, PLEASE add "Preferred Name" feature. What purpose ? Please share. Thanks. |

|

|

|

|

|

SUSCardNoob

|

Jul 5 2019, 08:38 PM Jul 5 2019, 08:38 PM

|

|

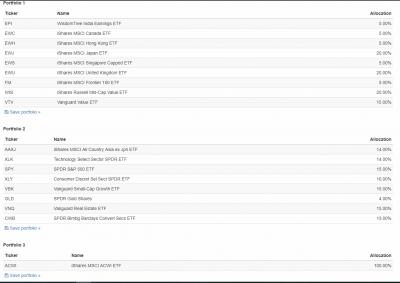

For those who are curious of the asset allocation for Growth profile: | WISDOMTREE INDIA EARNINGS (EPI) | 4.24% | | ISHARES MSCI CANADA (EWC) | 7.15% | | ISHARES MSCI HONG KONG (EWH) | 7.05% | | ISHARES MSCI JAPAN (EWJ) | 19.20% | | ISHARES MSCI SINGAPORE (EWS) | 4.97% | | ISHARES MSCI UNITED KINGDOM (EWU) | 19.88% | | ISHARES MSCI FRONTIER 100 (FM) | 5.40% | | ISHARES RUSSELL MID-CAP VALUE (IWS) | 20.09% | | VANGUARD VALUE (VTV) | 14.54% |

*estimation only based on NAV VTD This post has been edited by CardNoob: Jul 5 2019, 08:39 PM |

|

|

|

|

|

bourse

|

Jul 5 2019, 08:41 PM Jul 5 2019, 08:41 PM

|

|

Income: ISHARES IBOXX INVESTMENT GRADE (LQD) Hedge: ISHARES TIPS BOND ETF (TIP) Growth: ISHARES MSCI JAPAN (EWJ)  ONLY 3 funds same with SAMY. should be okay. |

|

|

|

|

|

David_Yang

|

Jul 5 2019, 08:41 PM Jul 5 2019, 08:41 PM

|

|

Just checked one: QUOTE(CardNoob @ Jul 5 2019, 09:38 PM) | ISHARES MSCI JAPAN (EWJ) | 19.20% | Sounds not so good: QUOTE Morningstar Research

This fund is not the best vehicle for investors seeking passive exposure to the Japanese large-cap equity market. An unreasonably high management fee and the availability of peers that track broader and more representative indexes such as the... If want to read full report need to pay  |

|

|

|

|

|

SUSCardNoob

|

Jul 5 2019, 08:44 PM Jul 5 2019, 08:44 PM

|

|

QUOTE(bourse @ Jul 5 2019, 08:41 PM) Income: ISHARES IBOXX INVESTMENT GRADE (LQD) Hedge: ISHARES TIPS BOND ETF (TIP) Growth: ISHARES MSCI JAPAN (EWJ)  ONLY 3 funds same with SAMY. should be okay. I don't have any of these in my 36% risk SAMY portfolio |

|

|

|

|

|

ViktorJ

|

Jul 5 2019, 08:51 PM Jul 5 2019, 08:51 PM

|

|

QUOTE(David_Yang @ Jul 5 2019, 08:41 PM) Just checked one: Sounds not so good: If want to read full report need to pay  EWJ is in my SAMY 6.5 portfolio. Yup, not the best at what it does, but it kind of serves its purpose. Currently +5.81% |

|

|

|

|

|

honsiong

|

Jul 5 2019, 11:07 PM Jul 5 2019, 11:07 PM

|

|

QUOTE(CardNoob @ Jul 5 2019, 08:44 PM) I don't have any of these in my 36% risk SAMY portfolio These can be found in lowest risk 6.5% I think. |

|

|

|

|

|

honsiong

|

Jul 5 2019, 11:23 PM Jul 5 2019, 11:23 PM

|

|

QUOTE(CardNoob @ Jul 5 2019, 08:38 PM) For those who are curious of the asset allocation for Growth profile: | WISDOMTREE INDIA EARNINGS (EPI) | 4.24% | | ISHARES MSCI CANADA (EWC) | 7.15% | | ISHARES MSCI HONG KONG (EWH) | 7.05% | | ISHARES MSCI JAPAN (EWJ) | 19.20% | | ISHARES MSCI SINGAPORE (EWS) | 4.97% | | ISHARES MSCI UNITED KINGDOM (EWU) | 19.88% | | ISHARES MSCI FRONTIER 100 (FM) | 5.40% | | ISHARES RUSSELL MID-CAP VALUE (IWS) | 20.09% | | VANGUARD VALUE (VTV) | 14.54% |

*estimation only based on NAV VTD So in Stashaway, Japan & EU are used in low risk portfolio, but here they go heavy on them for high risk port? Maybe will try it out once I have some initial capital. But 1% + using more expensive ETFs... this robo is almost as expensive as typical mutual funds. |

|

|

|

|

|

ViktorJ

|

Jul 5 2019, 11:28 PM Jul 5 2019, 11:28 PM

|

|

QUOTE(honsiong @ Jul 5 2019, 11:07 PM) These can be found in lowest risk 6.5% I think. TIP & EWJ, yeah |

|

|

|

|

|

~Curious~

|

Jul 6 2019, 12:41 AM Jul 6 2019, 12:41 AM

|

|

Hello all,

wow Ive been readng from the first post until here,trying to understand what is being said/posted - all quitte technical

i'm a noob with not so much capital,but Id liketo grow my capital so that in the near future I cann invest in stocks on Bursa. I think until Im more well versed in investing, I'd like to put my money ina robo-advisor.

Is myTHEO recommended or StashAway (its d SA mentoned in the thread rite)?

|

|

|

|

|

|

honsiong

|

Jul 6 2019, 01:04 AM Jul 6 2019, 01:04 AM

|

|

QUOTE(~Curious~ @ Jul 6 2019, 12:41 AM) Hello all, wow Ive been readng from the first post until here,trying to understand what is being said/posted - all quitte technical i'm a noob with not so much capital,but Id liketo grow my capital so that in the near future I cann invest in stocks on Bursa. I think until Im more well versed in investing, I'd like to put my money ina robo-advisor. Is myTHEO recommended or StashAway (its d SA mentoned in the thread rite)? Absolutely. These are very hands off approach to investment, you pay the pros let them do it. For now, I gonna be sticking with StashAway bcoz: - Its very clear for you how much value at risk you undertake - Both platform and ETFs used carry lower expense ratio |

|

|

|

|

|

l4nc3k

|

Jul 6 2019, 03:21 AM Jul 6 2019, 03:21 AM

|

|

Growth portfolio going heavy on Japan is weird for me.. but still gonna do dca for 6 months then only judge by end of year. Don’t really like Japan because even now in FSM its the only negative port for me this year  |

|

|

|

|

|

TS[Ancient]-XinG-

|

Jul 6 2019, 08:01 AM Jul 6 2019, 08:01 AM

|

|

QUOTE(honsiong @ Jul 5 2019, 11:23 PM) So in Stashaway, Japan & EU are used in low risk portfolio, but here they go heavy on them for high risk port? Maybe will try it out once I have some initial capital. But 1% + using more expensive ETFs... this robo is almost as expensive as typical mutual funds. Yea. Their selection of etf seems weird to me. EWJ at most also 5% in SA. And it's only available in low risk profile. Japan market isn't that healthy as compared to emerging and other developed country. But MT other etf seems promising. MT is more diversified then SA. Selection etf in SA is highly specific to each risk index. |

|

|

|

|

|

SUSCardNoob

|

Jul 6 2019, 08:59 AM Jul 6 2019, 08:59 AM

|

|

SA for 36% risk is rather US heavy.

|

|

|

|

|

|

zacknistelrooy

|

Jul 6 2019, 04:19 PM Jul 6 2019, 04:19 PM

|

|

QUOTE(CardNoob @ Jul 6 2019, 08:59 AM) SA for 36% risk is rather US heavy. It isn't Most of the top holdings in SA are MNC expect the small cap and reit holdings for the high risk holders If the world and US are doing well then ultimately those companies do well Would you rather that then take country and currency exchange risk like South Korea where Samsung just announced a plunge in profits. This is the EWU vs EWJ vs SPY with dividend reinvested

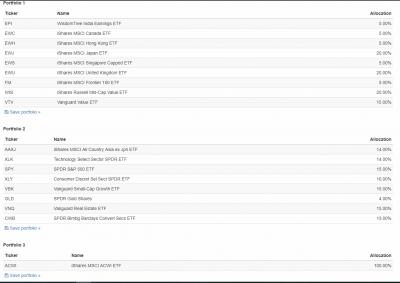

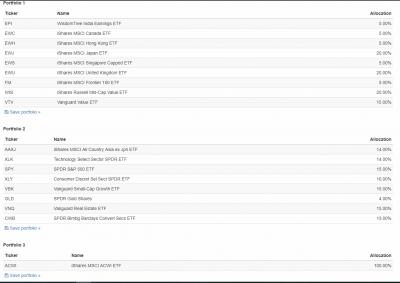

For anyone interested here is a simple back test of the assets Port 1 is MyTheo, Port 2 is Stashaway and Port 3 is All country world index ETF Allocations will be slightly off but should give everyone the general idea Dividends are reinvested and port is rebalanced quarterly Asset Allocation Performance

Performance Annual Returns

Annual Returns This post has been edited by zacknistelrooy: Jul 6 2019, 04:26 PM

This post has been edited by zacknistelrooy: Jul 6 2019, 04:26 PM |

|

|

|

|

|

TS[Ancient]-XinG-

|

Jul 6 2019, 05:23 PM Jul 6 2019, 05:23 PM

|

|

QUOTE(zacknistelrooy @ Jul 6 2019, 04:19 PM) It isn't Most of the top holdings in SA are MNC expect the small cap and reit holdings for the high risk holders If the world and US are doing well then ultimately those companies do well Would you rather that then take country and currency exchange risk like South Korea where Samsung just announced a plunge in profits. This is the EWU vs EWJ vs SPY with dividend reinvested

For anyone interested here is a simple back test of the assets Port 1 is MyTheo, Port 2 is Stashaway and Port 3 is All country world index ETF Allocations will be slightly off but should give everyone the general idea Dividends are reinvested and port is rebalanced quarterly Asset Allocation Performance

Performance Annual Returns

Annual Returns

Hmmm. Based on the graph, SA>MT |

|

|

|

|

|

zacknistelrooy

|

Jul 7 2019, 05:54 PM Jul 7 2019, 05:54 PM

|

|

QUOTE(Ancient-XinG- @ Jul 6 2019, 05:23 PM) Hmmm. Based on the graph, SA>MT Yes A lot of MyTheo ETF has currency exposure which is one of the main reason for underperformance Also a couple of them have a high dividend yield I am not sure if they are trying to just differentiate themselves or have another reason for their picks. Only their CIO would be able to answer that question. They have essentially taken a value and weak dollar view overall based on their picks Also they have a significantly higher allocation towards financial firms and industrials which are notoriously cyclical sectors

|

|

|

|

|

|

zacknistelrooy

|

Jul 7 2019, 06:03 PM Jul 7 2019, 06:03 PM

|

|

QUOTE(David_Yang @ Jul 5 2019, 08:41 PM) Just checked one: Sounds not so good: If want to read full report need to pay  This is the best that I could get QUOTE Role in Portfolio

This fund is not the best vehicle for investors seeking passive exposure to the Japanese large-cap equity market. An unreasonably high management fee and the availability of peers that track broader and more representative indexes such as the MSCI Japan IMI and Topix means we cannot award this fund a positive rating.

The market-cap-weighted MSCI Japan Index tracks the performance of around 320 large- and mid-cap Japanese companies, which represent around 85% of the total market value. With an ongoing charge of 0.59%, the fund is one of the most expensive exchange-traded funds tracking Japanese equities and much pricier than other ETFs tracking the very same index (for example, the HSBC MSCI Japan ETF with an ongoing charge of 0.19%).

There are also numerous funds that track broader and more representative indexes such as MSCI Japan IMI and FTSE Japan for a lower fee. The excessively high management fee has seen the fund shrink in a market in which rivals have gathered assets.

Fund performance has been uninspiring, having matched or slightly edged out surviving category peers on a risk-adjusted basis over three, five, and 10 years.

The annual tracking difference (fund return less index return) has hovered around the ongoing charge over the past three years. This suggests that the fund has tracked its benchmark tightly (gross of fees). Net of fees, however, the fund has unsurprisingly been one of the worst-performing MSCI Japan trackers.

Investors in all foreign markets should be aware of the potential impact that currency movements can have on returns. For example, a UK investor in the Japanese equity markets is exposed to both the returns on the underlying market and the fluctuations in the pound/yen exchange rate. Although the fund offers broad and representative market exposure, several broader and more representative passive offerings exist.

The fund also charges an indefensibly high fee, which has helped make it one of the worst performing MSCI trackers over recent years. For these reasons, we have awarded this fund a Morningstar Analyst Rating of Neutral. |

|

|

|

|

|

lifenoregret

|

Jul 7 2019, 06:14 PM Jul 7 2019, 06:14 PM

|

Getting Started

|

Unable to make full withdrawal, anyone have same issue as myself?

|

|

|

|

|

Jul 5 2019, 07:55 PM

Jul 5 2019, 07:55 PM

Quote

Quote

0.0228sec

0.0228sec

0.69

0.69

6 queries

6 queries

GZIP Disabled

GZIP Disabled