QUOTE(tiramisu83 @ Apr 29 2019, 10:16 PM)

Hi guys, anyone of you investing in US stock using Ameritrade currently? I just registered and want to deposit the fund into my account now.

May I know for those using Ameritrade now, you deposit via TT? Or using Instarem or Transferwise? Which one has the lowest rate?

Note: TDAmeritrade US doesn't accept Asia-based customers. They move all of us to TDA SG liao (earlier called TDA Asia)

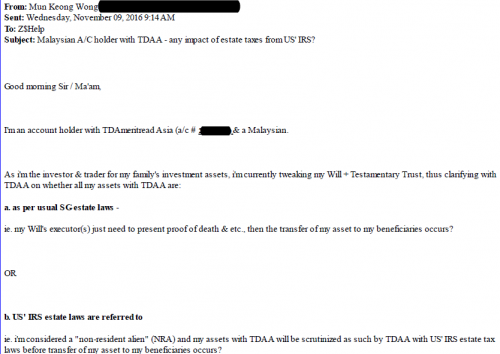

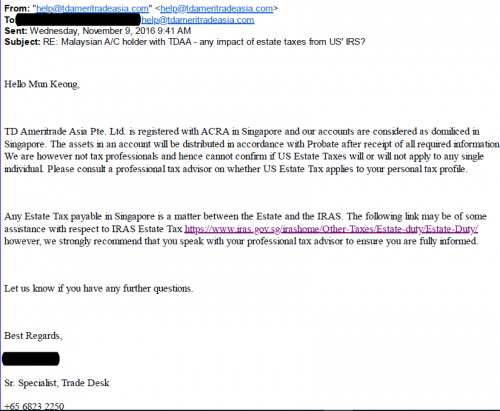

A. based on my Qs and As received from TDA SG & Transferwise:

TDA SG needs transfers from 1st party - ie. from your bank a/c, not 3rd party like Transferwise.

B. based on my multiple transfers in 2014 to 2016:

1. MBB & CIMB online TT least hassles VS going to bank and sometimes get stupid Qs from holier-than-thou bank officers

2. HOWEVER, note that U can transfer a max of $30K (earlier limit) or $50K (2016 limit) per day only

AND each transfer, TDA SG charges USD20 or USD25 - can't recall offhand as i was doing both OptionsXpress & TDASG earlier.

C. based on other investors/traders in a facebook group i'm in:

still same kaka, diff Gov like (B.) now - some still face hassles doing transfer via banks' officers quoting BNM saythisthat but wont give in writing

VS online

This post has been edited by wongmunkeong: Apr 30 2019, 10:37 AM

Apr 29 2019, 10:16 PM, updated 7y ago

Apr 29 2019, 10:16 PM, updated 7y ago

Quote

Quote

0.0278sec

0.0278sec

1.13

1.13

6 queries

6 queries

GZIP Disabled

GZIP Disabled