QUOTE(watabakiu @ Feb 27 2020, 01:11 PM)

excess money available for discretionary use. was trying to understand why DCA is the preferred method for investing in SAMY.

say got 1k, and if one choose to DCA 100/month, the balance of the money go where?

some1 mentioned invest in other place, but let say that SAMY is the only place one invests... shouldnt lump sum be better?

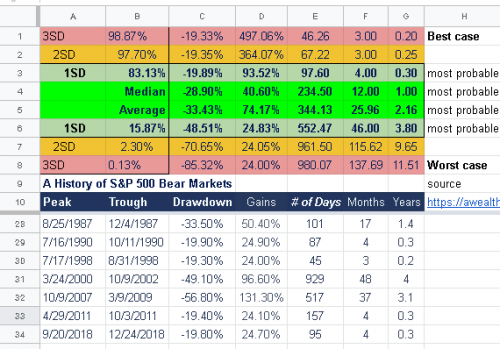

statistically, based on some research i read awhile back, lump sum is best for long term IF U can stomach it.say got 1k, and if one choose to DCA 100/month, the balance of the money go where?

some1 mentioned invest in other place, but let say that SAMY is the only place one invests... shouldnt lump sum be better?

most folks have "buyer's remorse" or "investor's regret" when they lump sum in, then markets go to hell.. for the 1-3 years..

BUT the same folks didnt see after the 3 years to 10 years+

These kinda folks will do better with DCA even if they have the lump sum. It's not the investment - it's the investor, kinda problem.

PS:

hm.. StashAway's portfolio thinggy seems different a bit now VS when first launched. I noticed my unfunded account have no fixed income and commodities even when it's still 36% risk-on like my previous.

<rubs hand in glee> time to move in

Feb 27 2020, 02:13 PM

Feb 27 2020, 02:13 PM

Quote

Quote

0.0424sec

0.0424sec

0.38

0.38

7 queries

7 queries

GZIP Disabled

GZIP Disabled