Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

ZeneticX

|

Jul 31 2020, 12:18 AM Jul 31 2020, 12:18 AM

|

|

QUOTE(zstan @ Jul 30 2020, 04:55 PM) Wish more financial institutions can be as transparent whenever there's a screw up incident like this Looking at you octopus bank |

|

|

|

|

|

ZeneticX

|

Aug 26 2020, 12:18 PM Aug 26 2020, 12:18 PM

|

|

Is recurring direct debit enabled already? Or is it still disabled?

I checked from my app, saw my direct debit plan is 'In Progress'...

|

|

|

|

|

|

ZeneticX

|

Oct 26 2020, 09:28 AM Oct 26 2020, 09:28 AM

|

|

Didnt have time to go through all pages so not sure if this had been discussed....

Anyone planning to withdraw out before US election and wait for the results? Normally I dont agree with timing your investment on robo advisor but for some reasons I've been thinking about this...

This post has been edited by ZeneticX: Oct 26 2020, 09:29 AM

|

|

|

|

|

|

ZeneticX

|

Jan 14 2021, 08:49 PM Jan 14 2021, 08:49 PM

|

|

I've been investing RM400 into SA monthly since last year Feb. RM200 each into 2 seperate portfolio, 20% and 22% risk (higher risk is locked for me)

Been reading a lot of talk about weekly DCA lately. Is it worth to go for weekly DCA for the amount I'm putting in? Or it will not make a noticeable difference?

|

|

|

|

|

|

ZeneticX

|

Feb 7 2021, 11:26 AM Feb 7 2021, 11:26 AM

|

|

QUOTE(svchia78 @ Feb 7 2021, 11:15 AM) The level of effort some fellow SAMY investors going just to squeeze tad bit more "profit" (and maybe losing along the way).... 😂 I believe they would be better off trading direct. As long they happy lor. Whatever works for them |

|

|

|

|

|

ZeneticX

|

Mar 10 2021, 10:03 PM Mar 10 2021, 10:03 PM

|

|

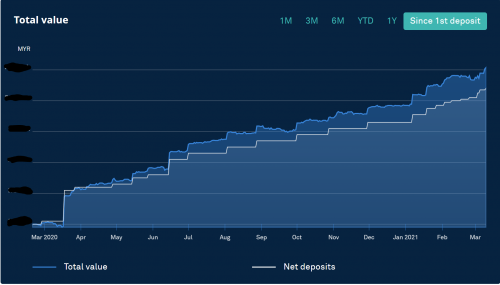

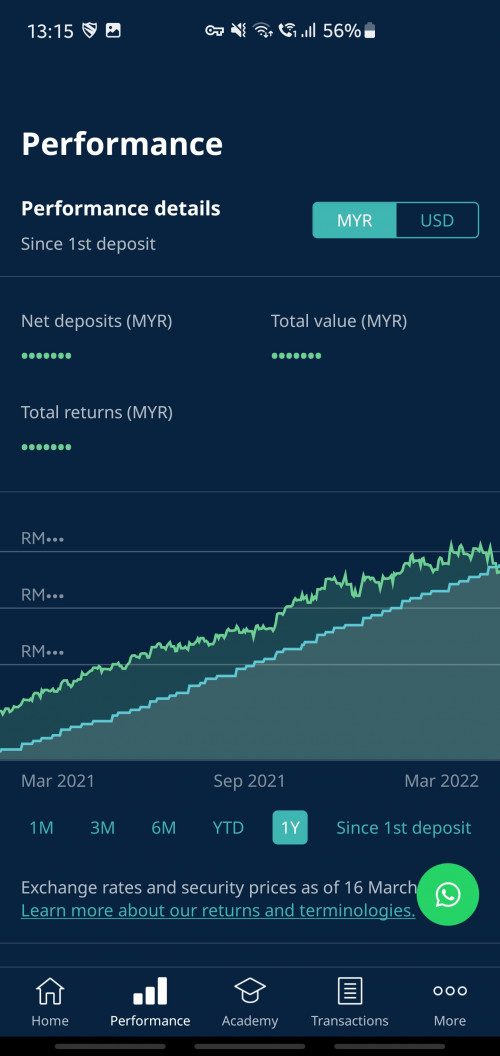

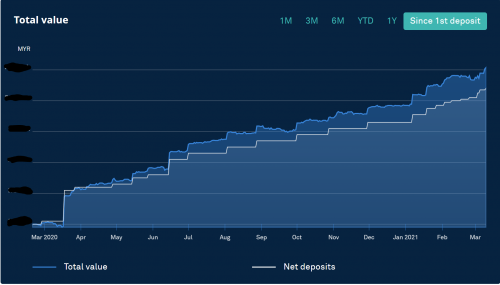

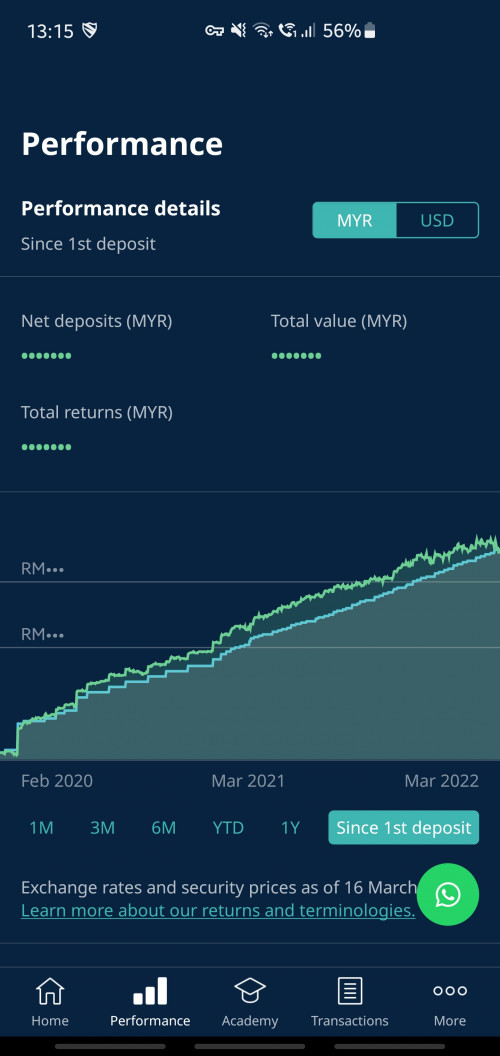

my turn to be 1 year on SA. started my first deposit on Feb 20 last year  2 portfolios. 1 goal based the other just general investing. 20% and 22% risk thinking to increase the 22% portfolio to 36% now |

|

|

|

|

|

ZeneticX

|

Mar 10 2021, 10:47 PM Mar 10 2021, 10:47 PM

|

|

QUOTE(neo_lam @ Mar 10 2021, 10:21 PM) so can i know this portfolio got how many percent return? 20% portfolio - TWR 9.18%, MWR 15.31% 22% portfolio - TWR 14.25%, MWR 24.95% |

|

|

|

|

|

ZeneticX

|

Jun 17 2021, 12:54 PM Jun 17 2021, 12:54 PM

|

|

QUOTE(honsiong @ Jun 17 2021, 11:05 AM) It's very rare for everything to underperform cash holdings, like in 2018. Very rare, don't count on it. Hell, cash SHOULD fall against other assets most of the time in history. That's why stashaway is safer than you think. especially if said cash is MYR |

|

|

|

|

|

ZeneticX

|

Jul 21 2021, 08:26 PM Jul 21 2021, 08:26 PM

|

|

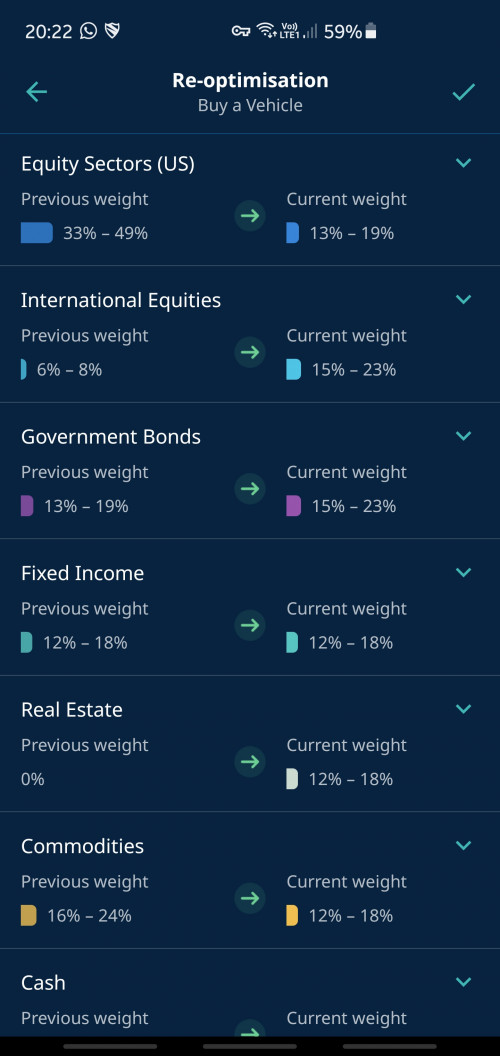

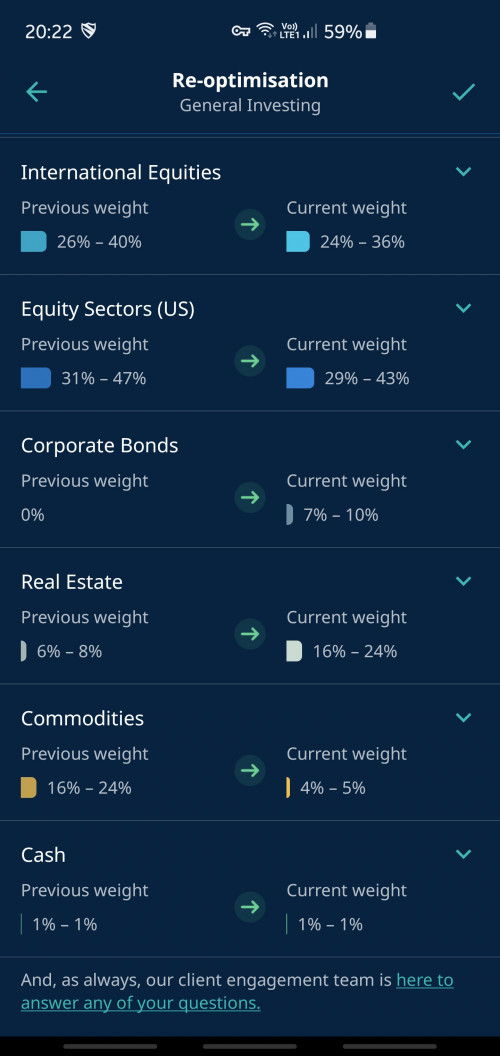

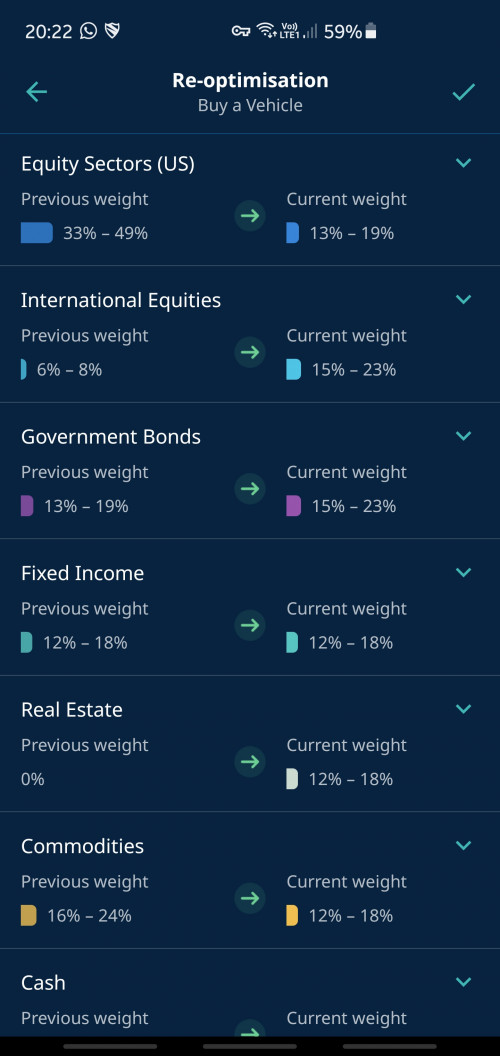

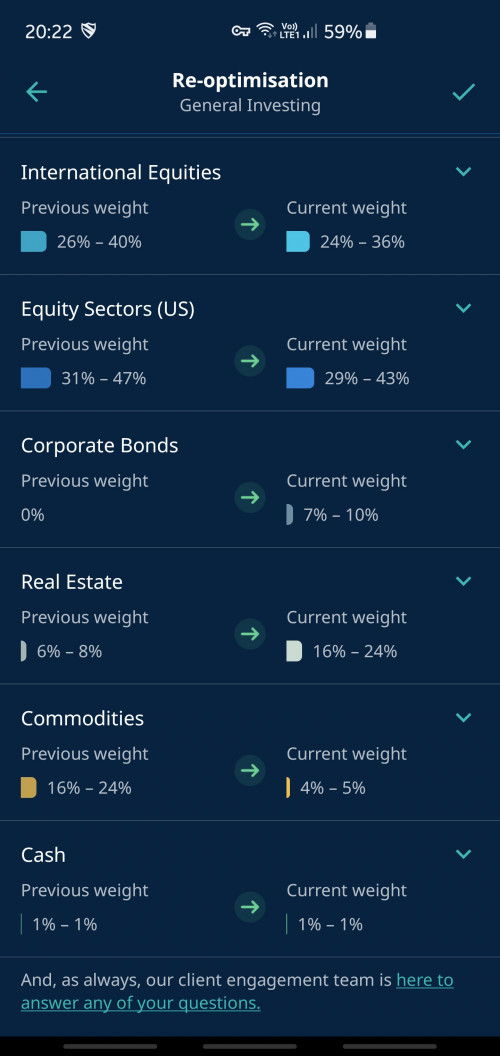

Seems like there's quite a significant switch over to Real Estate for this re-optimisation... for both my 20% and 36% portfolios. What do you guys think about this? Especially the 20%... a huge switch from US equity sector 20%  36%  This post has been edited by ZeneticX: Jul 21 2021, 08:26 PM This post has been edited by ZeneticX: Jul 21 2021, 08:26 PM |

|

|

|

|

|

ZeneticX

|

Sep 24 2021, 04:08 PM Sep 24 2021, 04:08 PM

|

|

Anyone considering migrating their 36% SRI general investment portfolio over to the new thematic tech portfolio? Seems tempting but the SRI can go up to 45%

|

|

|

|

|

|

ZeneticX

|

Feb 23 2022, 04:56 PM Feb 23 2022, 04:56 PM

|

|

So from what I can gather based on previous few replies... if u want to stick with SA but at the same time you want to get rid of KWEB.... best option is switch to ESG?

|

|

|

|

|

|

ZeneticX

|

Mar 14 2022, 05:51 PM Mar 14 2022, 05:51 PM

|

|

QUOTE(Ancient-XinG- @ Mar 14 2022, 05:24 PM) Lol how much u lose with SA… haha So bitter. Issues isn’t that big but you magnify it like end of the world. i actually doubt if he have any signifcant investment into SA another one of those guys from /k farming post counts here? |

|

|

|

|

|

ZeneticX

|

Mar 15 2022, 06:21 PM Mar 15 2022, 06:21 PM

|

|

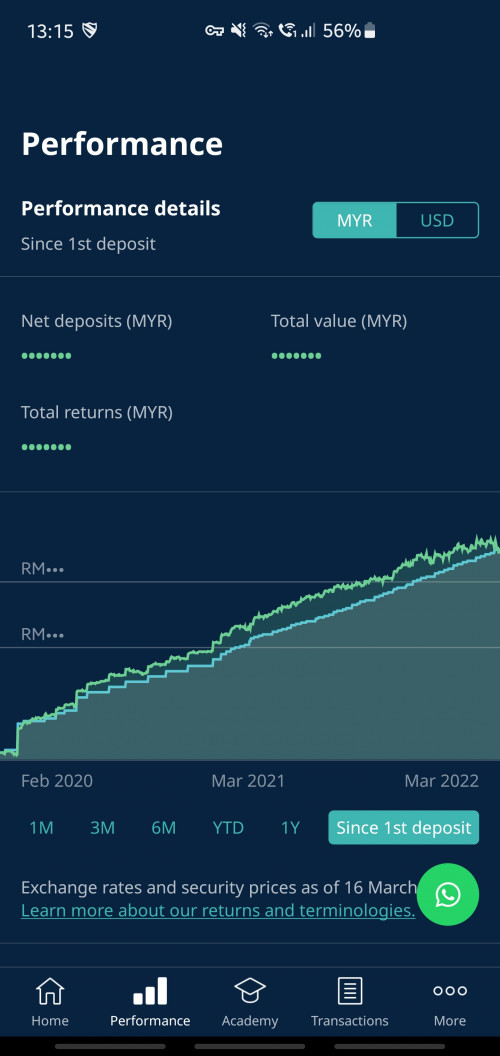

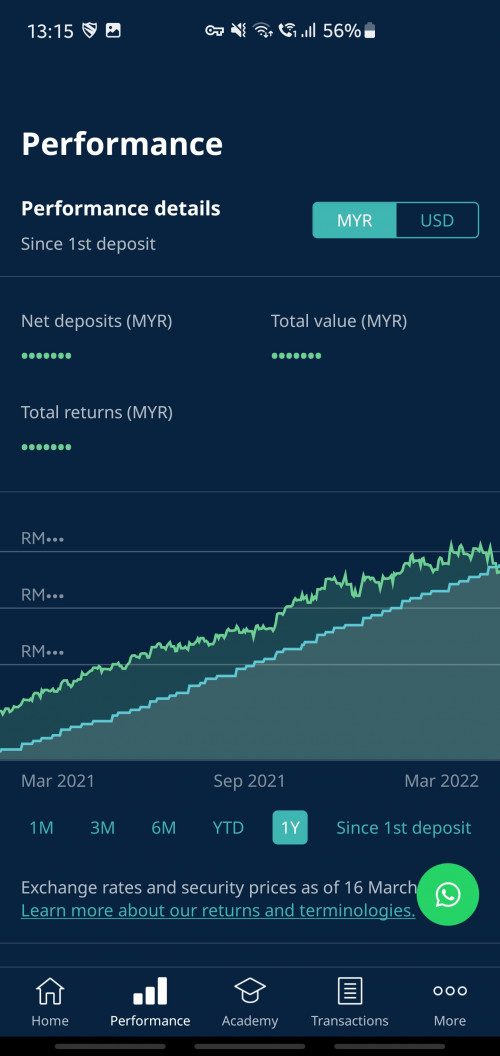

Damm just realised my 22% and 36% is on a loss now for the first time ever. For context I've been DCA-ing steadily since Feb 2020....

Must've been really bad this time

|

|

|

|

|

|

ZeneticX

|

Mar 15 2022, 07:29 PM Mar 15 2022, 07:29 PM

|

|

QUOTE(CoolStoryWriter @ Mar 15 2022, 06:54 PM) Guys watch me on March 17, I will tiao kao Freddy in his shit show. That is if he evens allow me to unmute the mic. QUOTE(CoolStoryWriter @ Mar 15 2022, 06:58 PM) He probably won't let us unmute our mics, just the stupid moderated chatbox. And he doesn't allow.people to ask hard questions, only filtered questions. Someone please record the session or take screenshot of the chat  |

|

|

|

|

|

ZeneticX

|

Mar 16 2022, 08:27 PM Mar 16 2022, 08:27 PM

|

|

This time SA really dropped the ball eh.... sigh just can wait for overall market to recover in following months

|

|

|

|

|

|

ZeneticX

|

Mar 16 2022, 11:10 PM Mar 16 2022, 11:10 PM

|

|

SA could've shut all the haters if they persisted in KWEB like how they did for the past year... but alas pressure and fear of not meeting KPI caught up to them I guess Now even those who was supporting their decision to maintain KWEB are disappointed... double whammy. I guess only those who are really not keen with China market are still feeling ok with the decision. Tmr's QnA session gonna be interesting indeed Come to think of it.... this is maybe the biggest shit hit the fan incident for SA since the auto debit fiasco in 2020  This post has been edited by ZeneticX: Mar 16 2022, 11:24 PM This post has been edited by ZeneticX: Mar 16 2022, 11:24 PM |

|

|

|

|

|

ZeneticX

|

Mar 17 2022, 01:18 PM Mar 17 2022, 01:18 PM

|

|

Tsk tsk tsk Freddy.... lets hope the other markets recover now   QUOTE(honsiong @ Mar 17 2022, 01:16 PM) I actually bought SG STI and some KLSE blue chips after reading that. Also my maybank stock just did a +22% after 3 xd in 1 year LOL. Maybank is literally the only counter I still maintain on bursa. Good dividends and performance so far |

|

|

|

|

|

ZeneticX

|

Jun 16 2022, 09:56 PM Jun 16 2022, 09:56 PM

|

|

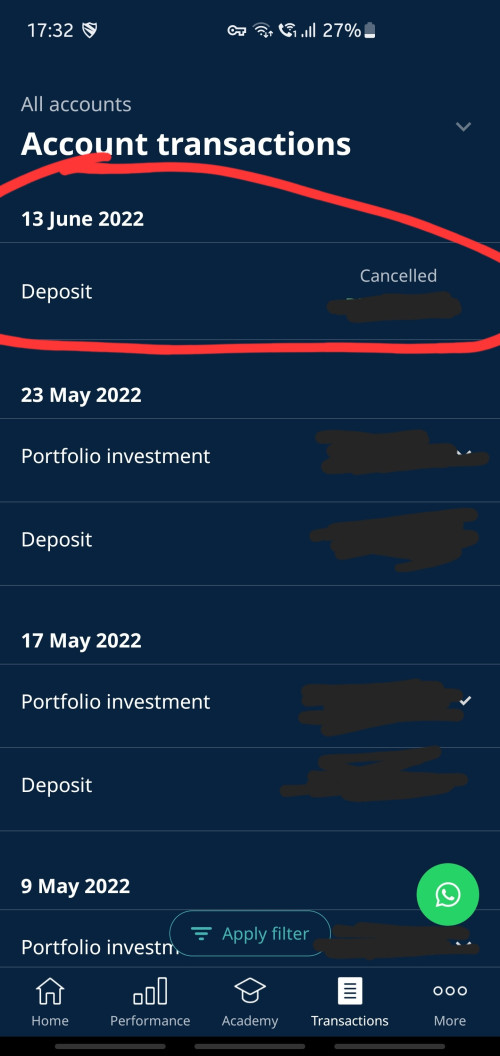

QUOTE(Medufsaid @ Jun 16 2022, 09:44 PM) ZeneticX what does SA whatsapp team say? Havent tried contacting them about it. I just rescheduled another deposit Maybe I should ask |

|

|

|

|

Jul 31 2020, 12:18 AM

Jul 31 2020, 12:18 AM

Quote

Quote

0.0623sec

0.0623sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled