QUOTE(idyllrain @ Jan 11 2021, 01:37 AM)

The link you showed explains it that way because it is attempting to calculate a TWR for a fund.

If you look at the mathematical formula shown on the page for the calculation, you can see that it is a compounded ROI of subperiods: R = [(1+r1)(1+r2)...(1+rn)]-1. You can also see that the definition for r1...rn is the ROI for a single subperiod: (value_curr + income - input + output)/value_prev. In their formula they’re using unit price (or NAV) for value_curr and value_prev.

Yes to calculate the TWR that is what we must do. There are 6 subperiods in that table. We need to get the ROI for each subperiods minus the net deposit and compound those. The Feb-May subperiod ROI = ((3134.15 - 2000)/1023)-1 = 0.1086 = 10.86%. The granularity of the subperiods is entirely up to us.

If we want the performance of RM 1 from the beginning until the end, we can just multiply each month’s return to get the final 17.06%. Alternatively if we have no deposits past the first month, calculating the TWR on a monthly subperiod will just give you the same 17.06%.

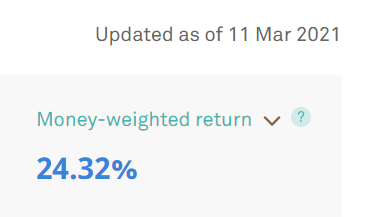

This isn’t correct. MWR being higher or lower than TWR has nothing to do with rebalancing nor timing the market. The calculation for MWR seeks to find a rate of return (called the discount rate) so that the total cash inflow equals total cash outflow; in other words the net present value of all inflows and outflows equal 0. I have an

old post that shows how this is computed manually. If you have Excel or GSheets, you can just use the function XIRR to compute this easily.

Whether DCA’ing is better versus Lump Sum, or whether a higher DCA frequency is better depends entirely on opportunity costs and the increase/decrease of the average price you’re buying at. As such, DCA’ing into a market that is progressively more expensive will increase your average price; increased cost means your returns would be less. On the other hand, a market that is trending down will result in lower average prices. It should be obvious that if the market is going to be much more expensive 5 months later, a Lump Sum right now would result in lower prices.

I could be wrong but this is how I look at it.

If everything else is constant, as in market increment/decrement rate over time (0% fluctuation), DCA amount, DCA frequency etc, the final calculated MWR will be exactly equals to TWR.

Auto-rebalancing makes MWR higher than TWR because different market assets fluctuate in different direction all the time, hence rebalancing act somehow buy some assets at lower fluctuation point, at any point of time.

The assumption here is market always go up in the long run, no matter how it fluctuate in the process. And this assumption should stay correct in today's monetary system where the volume of money supply always increase over time.

Oct 27 2020, 11:32 AM

Oct 27 2020, 11:32 AM

Quote

Quote

0.4059sec

0.4059sec

0.37

0.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled