Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Apr 14 2019, 10:51 PM Apr 14 2019, 10:51 PM

Return to original view | Post

#1

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

I've just started with SA MY since early this month. Thanks to reading all the comments by the sifus of this forum since last month, I managed to get 36% risk without taking any test

|

|

|

|

|

|

Apr 16 2019, 04:25 PM Apr 16 2019, 04:25 PM

Return to original view | Post

#2

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

QUOTE(annoymous1234 @ Apr 15 2019, 09:41 PM) Don't say like that.... I just gave the appropriate answers to the questions asked lah QUOTE(FunnyNinja @ Apr 16 2019, 03:57 PM) Oops, typo. Yeah, definitely can straight away go for 36% risk if fit the risk profile and you choose general investmentI mean if in my 1st time created the account and topup rm100, can i straight away go for 36% risk? Or have to start from lower risk 1st which forced by the system by default? And also, all in auto? Just topup and watch? |

|

|

Apr 16 2019, 04:44 PM Apr 16 2019, 04:44 PM

Return to original view | Post

#3

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

|

|

|

Apr 16 2019, 06:00 PM Apr 16 2019, 06:00 PM

Return to original view | Post

#4

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

|

|

|

Apr 16 2019, 06:05 PM Apr 16 2019, 06:05 PM

Return to original view | Post

#5

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

|

|

|

Apr 16 2019, 06:22 PM Apr 16 2019, 06:22 PM

Return to original view | Post

#6

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

|

|

|

|

|

|

Apr 16 2019, 06:28 PM Apr 16 2019, 06:28 PM

Return to original view | Post

#7

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

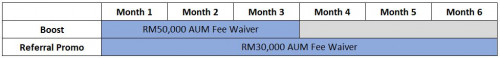

QUOTE(David83 @ Apr 16 2019, 06:24 PM) No, no. It will run concurrently with your referral promo and you will get up to RM80,000.00 managed for free. But if your referral promo ends earlier than this Boost promo (3 months) then you will continue getting RM30,000.00 managed for free, after your referral promo ends.My case, my referral promo ends on 4.10.2019, so I would not really benefit from this Boost promo. |

|

|

Apr 16 2019, 06:32 PM Apr 16 2019, 06:32 PM

Return to original view | Post

#8

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

QUOTE(David83 @ Apr 16 2019, 06:28 PM) Depends how you look at it... Like for me, if I use the voucher on the very last day, before expiry, I can get extra a few days free between 4.10.2019 to 15.10.2019 This post has been edited by Shalidar: Apr 16 2019, 06:33 PM |

|

|

Apr 17 2019, 10:16 AM Apr 17 2019, 10:16 AM

Return to original view | Post

#9

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

|

|

|

Apr 20 2019, 09:22 AM Apr 20 2019, 09:22 AM

Return to original view | IPv6 | Post

#10

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

QUOTE(xHj09 @ Apr 20 2019, 02:59 AM) Dumb question Is the total return = dividend? Or just profit? Coz FAQ says dividend reinvestment will be shown in transaction. Joined shortly longer than a month only. Total return 3% now. QUOTE(honsiong @ Apr 20 2019, 08:21 AM) In layman terms, total returns would just be profits. It'll include whatever dividend you receive which is automatically reinvested, any appreciation of the shares you're holding and profit from MYR dropping like sh*t. However, what I learned from this forum is that you can check your total returns in USD to know how well your portfolio is doing minus the currency impact.I stand ready to be corrected by any of the other sifus |

|

|

Apr 21 2019, 08:01 PM Apr 21 2019, 08:01 PM

Return to original view | Post

#11

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

|

|

|

Apr 21 2019, 08:43 PM Apr 21 2019, 08:43 PM

Return to original view | Post

#12

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

QUOTE(beyinbe @ Apr 21 2019, 08:32 PM) Thanks all for the quick response! I just made a one time deposit so I guess I just gotta wait for it to get processed, it's okay for me to navigate away from the "Manage Deposits" page rite? Yes, there's no issue at all since the "Manage Deposits" page merely informs SA that you plan to deposit money, and you still have to transfer the money to SA separately through JomPay or IBG transfer. After you've transferred, you can just close everything and wait awhile for SA to receive the money and then process it i.e. convert to USD and purchase the shares according to your Risk Portfolio |

|

|

Apr 25 2019, 05:28 PM Apr 25 2019, 05:28 PM

Return to original view | Post

#13

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

|

|

|

|

|

|

Apr 25 2019, 11:14 PM Apr 25 2019, 11:14 PM

Return to original view | IPv6 | Post

#14

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

|

|

|

Apr 29 2019, 09:26 PM Apr 29 2019, 09:26 PM

Return to original view | Post

#15

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

QUOTE(coolguy99 @ Apr 29 2019, 08:07 PM) Bear in mind that only the amounts stack, i.e. you get RM300,000.00 managed for free for 6 months if you get 10 referrals on the same day, but the time all run concurrently, so you still only get free waiver for 6 months. The benefit is that each time you get a new referral, your free 6 months start running again, so you really want to try and space out your new referrals |

|

|

Apr 30 2019, 10:03 AM Apr 30 2019, 10:03 AM

Return to original view | Post

#16

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

QUOTE(sue1388 @ Apr 30 2019, 09:32 AM) There are loads of info that the TS had kindly compiled and put all in the first page of this thread. It's practically the summarised main points of everything discussed in the old thread.Other than that you may also look at SA FAQS itself here https://www.stashaway.my/help-center |

|

|

Apr 30 2019, 05:57 PM Apr 30 2019, 05:57 PM

Return to original view | Post

#17

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

I would love to get feedbacks from other SA users. I am currently depositing on a monthly basis (on the 1st of every month) and am considering whether to switch to weekly basis. For those who practise DCA on a weekly basis, do you (1) deposit on a fixed day of every week, or (2) deposit 4 times a month max? Since some months would have 5 weeks, you would end up depositing more on such months for mode (1).

I'm considering to deposit on a fixed date every month, which is on the 7th, 14th, 21st and 28th. Would there be any negative impact because of the long delay in depositing between 28th to 7th of the next month? Looking forward to hearing from all of you |

|

|

May 6 2019, 11:22 AM May 6 2019, 11:22 AM

Return to original view | Post

#18

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

I've been quite consistent at +1-2% so far. Time to stick to my 36% risk and test SA throughout the bad and good period

|

|

|

May 8 2019, 10:44 AM May 8 2019, 10:44 AM

Return to original view | IPv6 | Post

#19

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

|

|

|

May 8 2019, 10:47 AM May 8 2019, 10:47 AM

Return to original view | Post

#20

|

Junior Member

65 posts Joined: Sep 2010 From: KL |

|

| Change to: |  0.0468sec 0.0468sec

0.42 0.42

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 06:51 AM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote