My 36% portfolio now got 12% return (layman term - return / investment amount) & 26% portfolio got 4.7% return. Don't know should lock the profit before US election ?

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Oct 13 2020, 10:00 AM Oct 13 2020, 10:00 AM

Return to original view | Post

#81

|

Junior Member

524 posts Joined: May 2019 |

My 36% portfolio now got 12% return (layman term - return / investment amount) & 26% portfolio got 4.7% return. Don't know should lock the profit before US election ?

|

|

|

|

|

|

Oct 13 2020, 05:10 PM Oct 13 2020, 05:10 PM

Return to original view | Post

#82

|

Junior Member

524 posts Joined: May 2019 |

|

|

|

Oct 15 2020, 11:29 AM Oct 15 2020, 11:29 AM

Return to original view | Post

#83

|

Junior Member

524 posts Joined: May 2019 |

QUOTE(footie_ft @ Oct 15 2020, 11:24 AM) My buy order this week does not include KWEB... Anyone noticing the same? No changes to risk profile for me. Maybe SA rebalancing your portfolio. footie_ft liked this post

|

|

|

Oct 28 2020, 08:56 AM Oct 28 2020, 08:56 AM

Return to original view | Post

#84

|

Junior Member

524 posts Joined: May 2019 |

i also get the 2nd time rebate from Simple (Invest since Jun 2020).

|

|

|

Oct 28 2020, 09:00 AM Oct 28 2020, 09:00 AM

Return to original view | Post

#85

|

Junior Member

524 posts Joined: May 2019 |

|

|

|

Oct 28 2020, 09:04 AM Oct 28 2020, 09:04 AM

Return to original view | Post

#86

|

Junior Member

524 posts Joined: May 2019 |

|

|

|

|

|

|

Oct 28 2020, 09:07 AM Oct 28 2020, 09:07 AM

Return to original view | Post

#87

|

Junior Member

524 posts Joined: May 2019 |

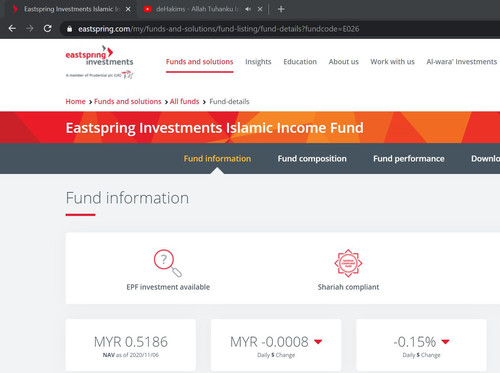

QUOTE(GrumpyNooby @ Oct 28 2020, 09:05 AM) The rebate comes from Eastspring Investment as part of their "deal" in bringing sales and meeting the sales quota. Required so huge amount of initial investment but the return just so so.Do remember that if you buy this fund directly from Eastspring the initial investment amount is RM 50k. |

|

|

Oct 28 2020, 10:47 AM Oct 28 2020, 10:47 AM

Return to original view | Post

#88

|

Junior Member

524 posts Joined: May 2019 |

The rebate seem like not follow the total investment.

|

|

|

Nov 3 2020, 02:21 PM Nov 3 2020, 02:21 PM

Return to original view | Post

#89

|

Junior Member

524 posts Joined: May 2019 |

Yesterday morning i jompay to SA, today already complete whole process. So unbelievable

|

|

|

Nov 3 2020, 03:32 PM Nov 3 2020, 03:32 PM

Return to original view | Post

#90

|

Junior Member

524 posts Joined: May 2019 |

QUOTE(AureusX @ Nov 3 2020, 03:22 PM) Sorry, noob question here but how do you jompay to SA? I have always done debit and that takes sooooo long... When you had set the amount of Monthly deposit, you can choose either Jompay or Giro, if choose Jompay, you can found Jompay Biller code & Ref-1 at bottom part. AureusX liked this post

|

|

|

Nov 9 2020, 08:53 AM Nov 9 2020, 08:53 AM

Return to original view | Post

#91

|

Junior Member

524 posts Joined: May 2019 |

QUOTE(AnasM @ Nov 9 2020, 06:45 AM) Does it mean that SA simple losing money? Because got income distribution. https://iili.io/Fdw9ob.md.jpg <a href="https://freeimage.host/i/Fdw9ob"><img src="https://iili.io/Fdw9ob.md.jpg" alt="Fdw9ob.md.jpg" border="0"></a><br /><a target='_blank' href='https://freeimage.host/'>how to add pictures</a><br /> honsiong liked this post

|

|

|

Nov 17 2020, 04:41 PM Nov 17 2020, 04:41 PM

Return to original view | Post

#92

|

Junior Member

524 posts Joined: May 2019 |

Hope they can reduce a bit the % of gold for 36% portfolio. Since we accept the 36% risk portfolio, the investment should not be so prudent

|

|

|

Nov 20 2020, 02:19 PM Nov 20 2020, 02:19 PM

Return to original view | Post

#93

|

Junior Member

524 posts Joined: May 2019 |

|

|

|

|

|

|

Nov 25 2020, 06:51 AM Nov 25 2020, 06:51 AM

Return to original view | IPv6 | Post

#94

|

Junior Member

524 posts Joined: May 2019 |

|

|

|

Nov 26 2020, 04:31 PM Nov 26 2020, 04:31 PM

Return to original view | Post

#95

|

Junior Member

524 posts Joined: May 2019 |

QUOTE(mybutthasteeth @ Nov 26 2020, 04:28 PM) huh i didnt know we can choose what to invest in. i thought we choose the risk appetite and let the experts do their job? We just can blame and can't choose what to invest in. We only can choose to invest any risk portfolio they have or withdraw all & leave SAMY btw i thought they would build a balance portfolio where nothing is too heavy.. |

|

|

Nov 27 2020, 04:28 PM Nov 27 2020, 04:28 PM

Return to original view | Post

#96

|

Junior Member

524 posts Joined: May 2019 |

QUOTE(CyberKewl @ Nov 27 2020, 04:04 PM) How do i see that from the SA app on my phone? I went to "Account Transactions it just says "In Progress" that's it. Since they show "In Progress" mean they already received your money, your money already safely reach their account.Hopefully its due to thanksgiving that got the delay. Will wait till end of Monday before contacting SA support. They may need 1 - 2 days to convert your Myr to USD, then buy ETF for you. |

|

|

Dec 2 2020, 10:44 AM Dec 2 2020, 10:44 AM

Return to original view | Post

#97

|

Junior Member

524 posts Joined: May 2019 |

QUOTE(taiping... @ Dec 2 2020, 10:08 AM) For me i will keep the 22% (maybe DCA little amount or stop put in money)Then start a new portfolio 36% and pump in money. 22% portfolio got fixed income and government bond, it should need time to cumulate return. This post has been edited by tsutsugami86: Dec 2 2020, 10:45 AM |

|

|

Dec 2 2020, 03:58 PM Dec 2 2020, 03:58 PM

Return to original view | Post

#98

|

Junior Member

524 posts Joined: May 2019 |

QUOTE(gundamsp01 @ Dec 2 2020, 03:11 PM) i am going to make a call to SA support and ask. But till now still unable to connect Maybe not much ppl sell, so they cannot match with your purchase.after double checked my transaction date on SA, it shows as below: 1-Dec portfolio investment (each of my portfolio's transaction) 2-Dec deposit 2-Dec currency conversion ok now i see that the "deposit" and "currency conversion" are slower by 1 day compared to my previous transfers which happened on the same day of "portfolio investment"...seems like the change of buying process that was announced by SA didn't make the process faster. |

|

|

Dec 9 2020, 09:56 AM Dec 9 2020, 09:56 AM

Return to original view | Post

#99

|

Junior Member

524 posts Joined: May 2019 |

QUOTE(tehoice @ Dec 9 2020, 09:41 AM) withdraw RM 2.62 cannot round the figure, because you don't know how much you will get after currency exchange. honsiong liked this post

|

|

|

Dec 9 2020, 10:25 AM Dec 9 2020, 10:25 AM

Return to original view | Post

#100

|

Junior Member

524 posts Joined: May 2019 |

|

| Change to: |  0.0456sec 0.0456sec

0.46 0.46

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 11:21 PM |