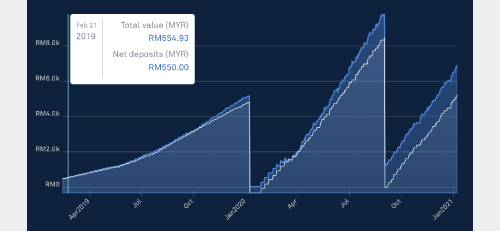

My net deposit also showed odd figure (withdraw once to do testing).

Just leave it and can't do anything.

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Dec 9 2020, 12:20 PM Dec 9 2020, 12:20 PM

Return to original view | Post

#101

|

Junior Member

524 posts Joined: May 2019 |

My net deposit also showed odd figure (withdraw once to do testing).

Just leave it and can't do anything. |

|

|

|

|

|

Dec 9 2020, 12:37 PM Dec 9 2020, 12:37 PM

Return to original view | Post

#102

|

Junior Member

524 posts Joined: May 2019 |

|

|

|

Dec 9 2020, 01:31 PM Dec 9 2020, 01:31 PM

Return to original view | Post

#103

|

Junior Member

524 posts Joined: May 2019 |

QUOTE(ericlaiys @ Dec 9 2020, 01:14 PM) Click on view transaction, i saw they buy got odd number. probably due to currency conversion and some left behind. You set 1k Simple & 200 ETF, why not you bank in RM 1.2k instead of RM 1K.Example:- deposit 100 into portfolio 1, deposit 100 into portfolio 2. they invest 99.09 into portfolio 1 . the remaining on portfolio 2 i always saw this when i make changes on deposit money before they commit buy. Sometimes, they dont follow on what we set on deposit. I have set 1k in stashaway simple & 200 on ETF. but they just invest 980+ on stashaway simple. and remaining to ETF. speechless when i saw this.... this cause my stashway simple and ETF dont have fix round up value taiping... liked this post

|

|

|

Dec 9 2020, 01:39 PM Dec 9 2020, 01:39 PM

Return to original view | Post

#104

|

Junior Member

524 posts Joined: May 2019 |

|

|

|

Dec 10 2020, 05:19 PM Dec 10 2020, 05:19 PM

Return to original view | Post

#105

|

Junior Member

524 posts Joined: May 2019 |

QUOTE(chichabom @ Dec 10 2020, 08:21 AM) Is this the same for withdrawal in a portfolio as well? As in any amount withdrawn will be reflected under net deposit as well up to the cent level? After withdrawal, it will deduct the net deposit. Due to the foreign exchange and the change of ETF's price, the amount you get may not be round figure. |

|

|

Dec 11 2020, 03:00 PM Dec 11 2020, 03:00 PM

Return to original view | Post

#106

|

Junior Member

524 posts Joined: May 2019 |

|

|

|

|

|

|

Dec 11 2020, 05:57 PM Dec 11 2020, 05:57 PM

Return to original view | IPv6 | Post

#107

|

Junior Member

524 posts Joined: May 2019 |

Good case for study, if my portfolio perform like this, I will withdraw all and leave SAMY.

|

|

|

Dec 18 2020, 03:38 PM Dec 18 2020, 03:38 PM

Return to original view | Post

#108

|

Junior Member

524 posts Joined: May 2019 |

QUOTE(DragonReine @ Dec 18 2020, 02:57 PM) If you want to make it as passive as possible and don't want to think too hard. Spend less time to check and rebalance your portfolio. SAMY always do rebalance (if you continue DCA, they can rebalance your portfolio during purchase of ETF), only re-optimisation once earlier this year.I have it auto enabled and it only rebalanced once earlier this year for me for a few portfolios. SA generally doesn't rebalance too often, because with currency changes you'll lose money in long run. This post has been edited by tsutsugami86: Dec 18 2020, 03:54 PM |

|

|

Dec 29 2020, 01:40 PM Dec 29 2020, 01:40 PM

Return to original view | Post

#109

|

Junior Member

524 posts Joined: May 2019 |

QUOTE(lee82gx @ Dec 29 2020, 01:28 PM) Kweb has drop quite a bit, and that is the reason most portfolios having it cannot fly higher even though sp500 is having record gains. Anyhow not to fret, this is all part of the plan. Its rare and unsustainable have all funds all up all the time. The KWEB still quite high compare to the price i invested on May 2020, that time KWEB only around USD 50 - 55. These few month keep buy at high price |

|

|

Dec 30 2020, 05:16 PM Dec 30 2020, 05:16 PM

Return to original view | Post

#110

|

Junior Member

524 posts Joined: May 2019 |

QUOTE(honsiong @ Dec 30 2020, 04:00 PM) Me here but I opened that account when I was working there. Maybe he got overseas income StashAway SG should be open to all, provided you have the means to deposit USD/SGD to it. StashAway Malaysia is the more restrictive one when it comes to residency. But why do you wanna invest there? You get the same portfolios anyway. |

|

|

Dec 30 2020, 05:20 PM Dec 30 2020, 05:20 PM

Return to original view | Post

#111

|

Junior Member

524 posts Joined: May 2019 |

|

|

|

Jan 8 2021, 09:49 AM Jan 8 2021, 09:49 AM

Return to original view | Post

#112

|

Junior Member

524 posts Joined: May 2019 |

QUOTE(brokenbomb @ Jan 8 2021, 09:05 AM)  Nah lagi smooth 😜 April 2019 - deposit daily RM50 January 2020 - switch to wahed. So wed Friday stash. Tues Monday Thursday wahed. Tuesday rest. Lol. Both on 36% and aggressive portfolio Took out some money to fund for tax payment etc 😅 So everyday you busy to do banking transaction ? |

|

|

Jan 8 2021, 10:12 AM Jan 8 2021, 10:12 AM

Return to original view | Post

#113

|

Junior Member

524 posts Joined: May 2019 |

|

|

|

|

|

|

Jan 11 2021, 10:18 PM Jan 11 2021, 10:18 PM

Return to original view | IPv6 | Post

#114

|

Junior Member

524 posts Joined: May 2019 |

QUOTE(blur19755 @ Jan 11 2021, 09:59 PM) Understand the feeling as each time i deposit in, i see the price difference from start till now. Yes, i tracked it still with yahoo finance app. Mostly ETF in 36% risk all price increase 20% - 50% (after re-optimisation on May 2020). Good job did by SA.I can no longer buy KWEB at USD50.3, same goes with other ETFs at much lower price. No matter what rate you chase, you can't buy the same product at much lower price. |

|

|

Jan 13 2021, 04:05 PM Jan 13 2021, 04:05 PM

Return to original view | Post

#115

|

Junior Member

524 posts Joined: May 2019 |

|

|

|

Jan 14 2021, 06:46 PM Jan 14 2021, 06:46 PM

Return to original view | IPv6 | Post

#116

|

Junior Member

524 posts Joined: May 2019 |

I choose DCA because I don't have big amount of money to invest.

Don't care about DCA or time the market, just choose the way you are comfort and affordable |

|

|

Jan 19 2021, 03:32 PM Jan 19 2021, 03:32 PM

Return to original view | Post

#117

|

Junior Member

524 posts Joined: May 2019 |

SAMY & SASG share the same app ? Just need different email to log in ?

|

|

|

Jan 30 2021, 02:19 PM Jan 30 2021, 02:19 PM

Return to original view | IPv6 | Post

#118

|

Junior Member

524 posts Joined: May 2019 |

QUOTE(GrumpyNooby @ Jan 30 2021, 12:17 PM) Actually I'm more interested with the ewallet portion and the ewallet can be funded with credit cards/other ewallets and ewallet allows to use to buy the funds. Soon touch n go e-wallet should be able use to buy fund.Also, hope Affin can open more fixed income funds apart from MMF to Versa like Opus Touch. |

|

|

Jan 31 2021, 09:39 PM Jan 31 2021, 09:39 PM

Return to original view | Post

#119

|

Junior Member

524 posts Joined: May 2019 |

|

|

|

Feb 1 2021, 06:54 AM Feb 1 2021, 06:54 AM

Return to original view | IPv6 | Post

#120

|

Junior Member

524 posts Joined: May 2019 |

QUOTE(djhenry91 @ Feb 1 2021, 12:36 AM) got one..no fees involve.. Maybe he feel buy / sell share only charge 1 time fees but SA charge monthly fees.FD lo.. u think like stock market meh each transaction u do only charge brokerage,clearing fees,stamp duty and SST Not only FD, EPF & SSPN also no fees involve. |

| Change to: |  0.0447sec 0.0447sec

0.36 0.36

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 08:10 PM |