QUOTE(GrumpyNooby @ Dec 13 2020, 08:53 PM)

management fee waive 6 mths if using referral code.finish 6 mths waive time, now have to pay

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Dec 13 2020, 08:58 PM Dec 13 2020, 08:58 PM

Return to original view | Post

#81

|

Junior Member

304 posts Joined: Apr 2019 |

|

|

|

|

|

|

Dec 13 2020, 09:03 PM Dec 13 2020, 09:03 PM

Return to original view | Post

#82

|

Junior Member

304 posts Joined: Apr 2019 |

|

|

|

Dec 17 2020, 01:00 PM Dec 17 2020, 01:00 PM

Return to original view | Post

#83

|

Junior Member

304 posts Joined: Apr 2019 |

PMed GloryKnight

This post has been edited by bourse: Dec 17 2020, 01:05 PM |

|

|

Dec 17 2020, 08:31 PM Dec 17 2020, 08:31 PM

Return to original view | Post

#84

|

Junior Member

304 posts Joined: Apr 2019 |

my transactions as usual.

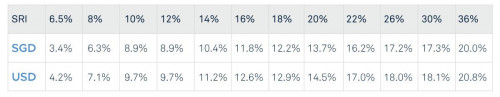

Maybe I do top up 2x per month, so SAMY manage to re-adjust back the asset allocation once fresh fund deposited. https://www.stashaway.sg/r/looking-ahead-to...terDecember2020 Here’s how each of our portfolios have performed year to date: Figure 3 - Gross Returns Year to Date, 14 December 2020 (Before Fees)  This post has been edited by bourse: Dec 17 2020, 10:30 PM |

|

|

Dec 27 2020, 09:35 PM Dec 27 2020, 09:35 PM

Return to original view | Post

#85

|

Junior Member

304 posts Joined: Apr 2019 |

QUOTE(ali00 @ Dec 27 2020, 02:26 PM) Had 4k in SA for 1+ year divided into 3 portfolio - 14, 18, and 36%. My total ROI is 200 on 14% and 18%. 36% i'm not having any return due to many ups and down. Only 5%? Lmao gg QUOTE(ali00 @ Dec 27 2020, 03:41 PM) Can still keep 3 portfolio in SAMY. Just focus on 1 portfolio for further deposit. Another 2 portfolio just leave it. Read few posts back, if keep transferring the portfolio is like realizing the loss. However, it is still up to you to decide. |

|

|

Jan 5 2021, 04:06 PM Jan 5 2021, 04:06 PM

Return to original view | Post

#86

|

Junior Member

304 posts Joined: Apr 2019 |

QUOTE(KenshinX @ Jan 5 2021, 02:43 PM) Thanks for the help but it shows nothing under M2U, linked account, pay future & recurring also is empty. From Pay limit till Standing instruction option all try already? if really cant find, have to call Maybank customer services to search for you. Or, can this account balance keep lower than the recurring deposit figure? |

|

|

|

|

|

Jan 9 2021, 01:08 PM Jan 9 2021, 01:08 PM

Return to original view | Post

#87

|

Junior Member

304 posts Joined: Apr 2019 |

|

|

|

Jan 11 2021, 05:02 PM Jan 11 2021, 05:02 PM

Return to original view | Post

#88

|

Junior Member

304 posts Joined: Apr 2019 |

|

|

|

Jan 16 2021, 01:01 PM Jan 16 2021, 01:01 PM

Return to original view | Post

#89

|

Junior Member

304 posts Joined: Apr 2019 |

the deal is not done completely, then continue the next day lo... SAMY will continue buying till the cash holding nearest to 1%.

sometimes it do happen when buying stock as well. same theory. |

|

|

Jan 18 2021, 11:05 PM Jan 18 2021, 11:05 PM

Return to original view | Post

#90

|

Junior Member

304 posts Joined: Apr 2019 |

today is Martin Luther King, Jr. Day. So market tutup, tonight confirm no buy order.

|

|

|

Jan 28 2021, 09:46 PM Jan 28 2021, 09:46 PM

Return to original view | Post

#91

|

Junior Member

304 posts Joined: Apr 2019 |

|

|

|

Feb 4 2021, 10:23 AM Feb 4 2021, 10:23 AM

Return to original view | Post

#92

|

Junior Member

304 posts Joined: Apr 2019 |

QUOTE(Daniel Joseph @ Feb 3 2021, 11:49 PM) OK good. Mine is a malaysian account. Hopefully they can change it to high risk portfolio without any problem. from past LYN member sharing. Just go for the test and send them the result, they can open it for you. Even 10/20 pass okay already, no need 18/20. The test got 2 diff sets. Note down the answer, then can re-sit again and get a good result. Good Luck This post has been edited by bourse: Feb 4 2021, 10:24 AM |

|

|

Feb 5 2021, 02:43 PM Feb 5 2021, 02:43 PM

Return to original view | Post

#93

|

Junior Member

304 posts Joined: Apr 2019 |

QUOTE(ali00 @ Feb 4 2021, 08:28 PM) 2 years with SA and I'm still jealous of everybody returns. ☹️ Equals to ASB but ASB safer believe you have keep changing portfolio. 22% risk at 3.5% roi 36% risk at 5% roi if you loss confident, try keep 22% and 36% for one year w/o doing anything. next year baru decide to keep or withdraw. if you still hv faith, just continue DCA in 22% and 36% for 1 year. Actually you have pick the best port performance if keeping them for one whole year. https://www.stashaway.my/r/our-returns-2020 |

|

|

|

|

|

Feb 25 2021, 11:02 PM Feb 25 2021, 11:02 PM

Return to original view | Post

#94

|

||||||||||||||||||||||||||||

Junior Member

304 posts Joined: Apr 2019 |

QUOTE(svchia78 @ Feb 25 2021, 09:29 PM) Well, that's my understanding of re-balancing and re-optimisation. WRONG? SRI 36% before and after 14th May 2020 re-optimisation.

QUOTE(honsiong @ Feb 25 2021, 09:51 PM) |

||||||||||||||||||||||||||||

|

|

Mar 10 2021, 08:10 AM Mar 10 2021, 08:10 AM

Return to original view | IPv6 | Post

#95

|

Junior Member

304 posts Joined: Apr 2019 |

Quazacolt and jacksonpang liked this post

|

|

|

Mar 17 2021, 08:00 PM Mar 17 2021, 08:00 PM

Return to original view | Post

#96

|

Junior Member

304 posts Joined: Apr 2019 |

QUOTE(Hoshiyuu @ Mar 17 2021, 11:48 AM) Quoting Stashaway FAQ: Assets under management (AUM) = total market value of the investments"The annual management fee is calculated as a percentage of the total assets under management, ranging from 0.2% - 0.8%, and is charged monthly on a pro-rata basis. i.e if you invested on the 15th of a particular month, we will not charge you for the first 15 days." You can likely read it as: Every month, they charge bill you 0.2-0.8% of your total invested amount. Functionally, this works out to 0.2-0.8% P.A. You don't lose or gain fee advantage by interval or frequency. Correct me if I am wrong. Assuming bank in once with USD2500 and no more top up. if today portfolio value is USD3000, then the fee should be USD3K X 0.8% / 12mths if today portfolio value is USD2200, then the fee should be USD2.2K X 0.8% / 12mths no? |

|

|

Mar 26 2021, 03:44 PM Mar 26 2021, 03:44 PM

Return to original view | Post

#97

|

||||||||||||||||||||||||||||||||||||||||||||||

Junior Member

304 posts Joined: Apr 2019 |

QUOTE(guy3288 @ Mar 26 2021, 01:40 PM) I am new to Stashaway, read from here seems better than MMF so try it out. Stashaway Simple = Eastspring Investments Islamic Income FundI click the performance chart, i move cursor across X axis, can see it show the value changes in my SA Simple on certain days and i copy down each day the value changed, here is the summary 3.3.21 368k test WD 30k 4.3.21 338k 9.3.21 338 130.19 again WD 45k 10.3.21 263 127.88 - value can drop? penalty from WD? 12.3.21 263 178.63 16.3.21 263 229.38 22.3.21 263 280.13 23.3.21 263 330.88 abit confused, Value increase means= dividend in? not at fixed interval eg every Xdays? dividend can be credited daily also ? 22.3.21 and 23.3.21 already showed increased then i try switch MYR to USD it show loss so much?? Anyone can shed some light https://www.fsmone.com.my/funds/tools/factsheet?fund=MYESIIF » Click to show Spoiler - click again to hide... « Ignore the USD performance as this MMF is MYR only. Unless you have SRI portfolio, then you might interest to view the whole performance (SRI + Simple). The Value drop due to NAV diff each day.

net deposit = 368k - 30k - 75k total value @ 23.3.21 = 0.5189 x (708782.74 - 57781.20 - 144648.02) + dividend *sorry the total value not tally with the graph figure... please check back the transaction date and NAV then do the calculation again. This is how Simple work. This post has been edited by bourse: Mar 26 2021, 03:51 PM |

||||||||||||||||||||||||||||||||||||||||||||||

|

|

Mar 26 2021, 09:04 PM Mar 26 2021, 09:04 PM

Return to original view | Post

#98

|

Junior Member

304 posts Joined: Apr 2019 |

QUOTE(guy3288 @ Mar 26 2021, 06:32 PM) I used your info provided above, back calculate it seems SA gave me extra 604.71 units as ??dividend View your transaction record at:or we calculated the dividend wrongly? Stashaway > Transactions > Simple 1. is there any rebate? 2. WD30K does not means it will be 57781.20 units. it could a bit more say 57800 units bcoz SAMY dunno the NAV when placing the sell order. 3. Once the WD and sell order done, there might have some MYR leave in Simple account, SAMY will buy back the unit again if it more than MYR5. 4. Since you have big dividend, the dividend MYR will auto buy back the unit. You need to check the buy back date to trace the NAV. my mistake on earlier post: dividend actually is MYR0.0009 per unit. QUOTE(guy3288 @ Mar 26 2021, 06:32 PM) 8.8.21 Dividend @ 0.0008 x 651 001.54 = 520.8 units = Total 651 522.34 units 520.80 not unit. it should be RM520.80. refer item 4 above. dividend need to convert back to unit.This post has been edited by bourse: Mar 26 2021, 09:20 PM |

|

|

Mar 27 2021, 05:25 PM Mar 27 2021, 05:25 PM

Return to original view | Post

#99

|

Junior Member

304 posts Joined: Apr 2019 |

QUOTE(guy3288 @ Mar 26 2021, 10:15 PM) No rebate. click all the buy order, dividend entitlement and sell order, there might have information on how many unit and it NAV.Seems not so easy to understand I cannot get the dividend amount right, so hopefully others member can help. S = Simply C = Cash delete image This post has been edited by bourse: Mar 29 2021, 09:59 PM |

|

|

Apr 1 2021, 04:21 PM Apr 1 2021, 04:21 PM

Return to original view | Post

#100

|

Junior Member

304 posts Joined: Apr 2019 |

QUOTE(calvincty @ Apr 1 2021, 04:16 PM) go to setting > Promotion > Enter Promotional Code > key in BFM$100,000 MYR managed for free for 3 months. calvincty liked this post

|

| Change to: |  0.0705sec 0.0705sec

0.44 0.44

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 26th November 2025 - 03:34 AM |