- KWEB: Alibaba (10.5%), Tencent (9.5%)

- AAXJ: Alibaba (9.7%), Tencent (7.4%)

- SPEM: Alibaba (7.7%), Tencent (6.2%)

Our lives in their hands now

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Nov 14 2020, 07:25 AM Nov 14 2020, 07:25 AM

Return to original view | Post

#61

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

Wow, just realised our 36% portfolio very heavy on Alibaba & Tencent. Got 3x ETF where they have a lot of weight: - KWEB: Alibaba (10.5%), Tencent (9.5%) - AAXJ: Alibaba (9.7%), Tencent (7.4%) - SPEM: Alibaba (7.7%), Tencent (6.2%) Our lives in their hands now brokenbomb liked this post

|

|

|

|

|

|

Nov 18 2020, 05:14 PM Nov 18 2020, 05:14 PM

Return to original view | Post

#62

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(lee82gx @ Nov 18 2020, 11:45 AM) so much gold is being purchased now....the adherence to the portfolio formula is so strict lol.. i guess i'm the unlucky one. my GLD is the lowest earner in my 36% portfolio so far. I go to my Portfolio > Assets > Performance and this is the breakdown of my profitability (TWR - last 6 months) of each ETF:Anyway for those of you dissing on GLD, remember that at some point in the past, it was the ONLY thing holding up the whole portfolio green. EDIT - At that time there was those folks who comment why not buy more GLD! So, cheers and hang tight. Stick to the plan...haha. - AAXJ: +30.72% - KWEB: +41.78% - SPEM: +29.90% - IJR: +35.54% - XLV: +10.47% - XLY: +29.57% - VNQI: +19.75% - GLD: +8.49% i guess GLD is great to cushion the ups and downs of the market. to prevent weak hands from selling when the market dips too low. This post has been edited by encikbuta: Nov 18 2020, 05:14 PM |

|

|

Dec 21 2020, 12:16 AM Dec 21 2020, 12:16 AM

Return to original view | Post

#63

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(Vint @ Dec 20 2020, 09:11 PM) OMG this looks like fun! I saw his video and thought it would cool to offer my two cents (wall of text coming).To start off, CF Lieu is an independent financial advisor who can offer mutual funds from practically all the fund houses in Malaysia. Think of him as FundSupermart Managed Portfolio but with A LOT more funds. So it is understandable that he is on a warpath to keep mutual funds on top and RoboAdvisors six feet under. I myself have about 70% of my overall investments in mutual funds in FSM and 15% in StashAway, so I am still more pro mutual funds. It's mainly because I still have faith in active investing over index investing. No other real reason. So with that out of the way, my comments on CF Lieu’s video as below: Timeline 0:32: CF Lieu showed a negative YouTube review (of another user) saying that the actual amount withdrawn in StashAway is lower than the published amount when he clicked withdraw. Argument: Is this not the same case with mutual funds? If you withdraw today and the market turns red the next few days when the system cashes out, you’ll of course get a lower than published amount in your bank account. Misleading that he implies mutual funds have no such issues. Timeline 0:55: CF Lieu says that StashAway hides the fact we will be charged a 30% withholding tax since the ETFs are domiciled in USA. Argument: Agreed, there is a 30% withholding tax ON THE DIVIDEND. CF Lieu seem to purposely leave this phrase out in his rant and gives this impression that the 30% tax is hit on the entire investment. He never actually says the words ‘tax on dividend’ and instead just says ‘tax on the investment’, repeatedly. Misleading. Timeline 2:55: CF Lieu compares Franklin Templeton Tech Fund (19% p.a. in 10 yrs) vs XLK (15% p.a. in 10 yrs). He says that Franklin Tech Fund is domiciled in Luxemborg to bypass the withhholding tax on dividend. Argument: Yea no issues here. Active investing does sometimes beat index investing. As for the tax bypassing tactic, it feels like being penny wise, pound foolish. 30% withholding tax on DIVIDEND is just so miniscule to affect the overall investment. Timeline 5:30: CF Lieu mentions that investing in StashAway means you are subjected to foreign exchange risk when you buy in or cash out your position. (I think) he goes on to suggest using a MYR-hedged mutual fund that his company offers. Not too clear. Argument: I could be wrong because I could not clearly interpret his video, so say he does suggest using MYR-hedged funds to alleviate FOREX risk. I reckon FOREX risk is unavoidable when investing in foreign funds. Having a MYR-hedged fund won’t reduce the risk especially when the foreign currency (say USD) is on an uphill climb vs the MYR. With FOREX, you win some, you lose some, whether hedged or not. Timeline 7:30: CF Lieu made fun of StashAway’s bank-emptying issue on 30th July 2020. Argument: It’s a cheap shot. I’m looking for constructive criticism of RoboAdvisors (vs mutual funds) but no need to go below the belt with software issues. Even Bursa recently experienced a glitch in July 2020 for the whole afternoon. Such is life. Timeline 9:05: CF Lieu talks about why mutual funds (again, his bread & butter) sometimes lose money. He says it’s because of sleazy unit trust agents from Company A who recommends only his Company A mutual funds which could suck. So he suggests to hire an independent advisor (CF Lieu) who has access to ALL the mutual funds in Malaysia to make an objective judgement for you. I guess he insinuates that the advisor would also revamp underperforming portfolio from time to time. Argument: I 100% agree with everything he says here but it feels like he is talking about his mutual fund rather than trying to compare it with RoboAdvisors. So let’s do it properly by comparing fund selection side of Mutual Fund vs RoboAdvisor. Like the financial advisors, the RoboAdvisor company would already select the set of ETFs that they think is the best for your risk profile and the current climate. In fact, the RoboAdvisor would reoptimize the portfolio with a new set of ETFs if they think the investment climate has changed quite a bit. We have seen this happen about once a year in StashAway. So how would one BEAT the other if the fund has been selected and reoptimization happens for both mutual fund and RoboAdvisor? Whoever that selected the ‘right’ fund of course. But without a crystal ball, who is to say one advisor is better than another at fund picking? Timeline 11:15: CF Lieu argues that RoboAdvisors has very limited (and subpar) funds. He argues that he can provide a lot more funds and increase the likelihood of selecting a better fund. Argument: Yea this is a repeat from the previous one. Without a crystal ball, who is to say one advisor is better than another at fund picking? On top of that, more choice doesn’t automatically mean a better choice can be made. There is such a thing as paralysis by analysis. Timeline 13:20: CF Lieu says that there a lot of people making YouTube videos praising StashAway and asking other people to sign up with their referral code. He blatantly compares StashAway to a pyramid scheme (there’s a chart he shows where the top earns most money and bottom loses money – i.e. pyramid scheme). Argument: I do sometimes feel a bit suspicious that these YouTubers may be paid to review the app. But even if they were, I don’t see what’s wrong with it. It’s just marketing. And the only benefit they get from having their promo code used is the free management fees for 6 months (for both parties). I cannot for the life of me, see how this can turn into a pyramid scheme with the late joiners losing out. Seems incredibly misleading. Timeline 15:15: CF Lieu suggests having RoboAdvisors invest in Malaysian ETFs instead of USA ETFs to avoid the 30% withholding tax (on the dividend). Argument: Oh this is easy. Malaysian ETFs is not as popular worldwide, so it is not as liquid and has higher spreads. And I’m pretty sure we’d still get hit with the 30% withholding tax on dividends as well if say we invested in the MyETF Dow Jones US Titans 50. Final Thoughts: I am always up for constructive criticism on investing methods & platforms but this one by CF Lieu is just riddled with misinformation. That’s all, thanks for reading! |

|

|

Dec 21 2020, 10:55 AM Dec 21 2020, 10:55 AM

Return to original view | Post

#64

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(honsiong @ Dec 21 2020, 09:46 AM) I do enjoy other blog posts by CF Lieu on insurance. But this robo advisor thing, he best stays away from the fight, it is looking bad on him now. Yea, i read his earlier blog post titled "Stashaway Malaysia Review: 23 Secrets Exposéd" where he is rightfully telling us to be careful when investing into StashAway. I thought it was a good reminder to not just shift into the 6th gear with RoboAdvisors. But this latest video outright just tries to belittle StashAway with misinformation. Uncool. That said though, it does seem like his "23 Secrets" article have been edited to bash StashAway too. I didn't remember it being so one-sided when I first read it a few months back.I like to see negative reactions from competitors, that means robo advisors actually pose a real threat to these established offerings. QUOTE(tehoice @ Dec 21 2020, 10:16 AM) Can post your observation in the comment box in his youtube video? i thought of it but it just may get deleted and i'll get pissy. I'll just leave it here in Lowyat where it's safe Yes, it seems like it is really threatening his mutual funds rice bowl now. QUOTE(tehoice @ Dec 21 2020, 10:16 AM) I think that one should have diversified investments, it won't hurt to have both mutual funds and robo-investment. yea, i think mutual funds, index funds, individual stocks, bonds, real estate, ASB, FD, money markets, etc all have its place in our portfolio. i just take issue when anyone says one is ABSOLUTELY 100% better than the other.anyway, i think robo investing is way to go and my robo investment will definitely outgrow my mutual funds Quazacolt liked this post

|

|

|

Jan 10 2021, 05:27 PM Jan 10 2021, 05:27 PM

Return to original view | Post

#65

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

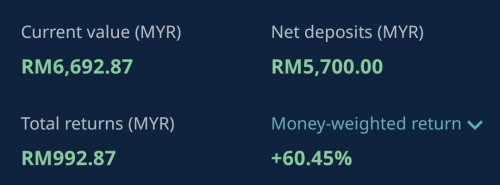

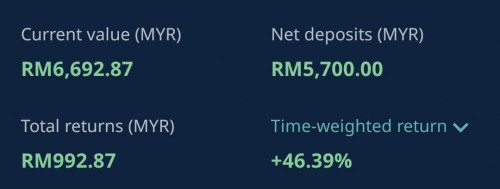

QUOTE(scriptkiddie44 @ Jan 10 2021, 03:21 PM) Wanna ask, any one has an idea how StashAway calculated the returns? My returns is ridiculously high, but the return on the capital it's not what shown in the return % regardless time-weighted / money-weighted. a few forumers here have explained ROI/MWR/TWR but I'm going to try and chip in:  Return of Investment (ROI): This is the simplest way to calculate your returns which is 992 / 5700 = 17.4%. Laymen much prefer to refer to this number but it does not do very well to tell a 'story'. That's why the more experienced prefer the MWR figures. Money Weighted Return (MWR): This is ROI with a 'story'. The MWR calculation takes into account the timing & amount of the DCA you have added over the period. Achieving a high MWR means you have increased contribution during market down days (buy cheap MORE) and reduced contribution during market up days (buy expensive LESS). And vice versa. There is actually a lot more to my short explanation but I fear explaining the formula in detail may add to the confusion so I'll just leave it at that. Basically MWR takes into account market timing. If you see your MWR > TWR, it clearly means you have successfully timed the market. Which brings us to TWR. Time Weighted Return (TWR): This is your returns if THEORETICALLY you invested just once (lump sum) and never DCA ever. For example if you invested RM100 on 1st Jan 2019 and never DCA-ed. Your net asset value would be RM100 + 46.39% = RM 146.39 today. Seems meaningless right? But TWR is very useful if you want to compare your investment to another investment. So say you compare your last one year StashAway TWR of 46.39% versus a fund on FSM like the Franklin US Opportunities Fund last one year TWR of 38.06%. You can immediately conclude that StashAway outperformed the Franklin fund. The MWR and ROI is unable to make such comparisons as the figures has been 'polluted' by our DCA. hope this helps! and it if made things even worse, i apologise P/S: i noticed you mentioned that you calculated a 15% ROI. i think you calculated as follows: 992 / 6692 = 14.8%. Just wanted to point this difference in calculation in case you were confused why your 15% figure is not up there in the explanation. |

|

|

Jan 10 2021, 10:03 PM Jan 10 2021, 10:03 PM

Return to original view | Post

#66

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(encikbuta @ Jan 10 2021, 05:27 PM) Time Weighted Return (TWR): This is your returns if THEORETICALLY you invested just once (lump sum) and never DCA ever. QUOTE(idyllrain @ Jan 10 2021, 07:33 PM) This is incorrect. The Time Weighted Return is the compounded ROI of each subperiod after accounting for deposits and withdrawals within that subperiod. Money Weighted Return calculation does not take into account the month-to-month performance and focuses entirely on deposits, dates, and final values. MWR returns large numbers when the period is short. Here's a comparison of ROI, TWR, MWR:  I could've sworn i got this right. refer this website. According to it, the TWR "is the return generated when you invest $1 at the beginning of the period while no money is added or taken out since then." Your calculator is kinda echoing the same as well. Let's take the 2.13% subperiod TWR return figure on 30th Jun. You got that by taking the current month end net value (5200.89) minus the previous month end value (3134.15) minus the fresh deposit (2000). Then dividing it all by the previous month end value: (5200.89 - 3134.15 - 2000) / 3134.15 = 2.13% So what the table is essentially doing is removing the effects of the RM2000 deposit i.e. it is assuming no money is added or taken out after the first deposit. Anyway I could be very well wrong as I'm not a trained accountant, haha. |

|

|

|

|

|

Feb 16 2021, 10:39 PM Feb 16 2021, 10:39 PM

Return to original view | Post

#67

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

|

|

|

Mar 11 2021, 09:58 PM Mar 11 2021, 09:58 PM

Return to original view | Post

#68

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(ChessRook @ Mar 11 2021, 09:26 PM) Can anyone help explain to me? I'm pretty sure it's the 2nd one [we pay 0.8% (annual fee) + 0.2% (ETF expense ratio)]. that's why some ppl advocate investing in the ETF directly From this link: https://www.stashaway.my/pricing The Annual fee rate (incl. GST) for first RM50,000 is 0.8% but expense ratio charged by ETF manager is approximately 0.2% p.a. I am wondering whether the 0.2% expense ratio already included in the annual fee or the total feel we pay is 0.8% (annual fee) + 0.2% (ETF expense ratio) anyway, i myself (along with most ppl here) belong in the 'i don't mind the fees' camp. |

|

|

Mar 25 2021, 01:52 PM Mar 25 2021, 01:52 PM

Return to original view | Post

#69

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

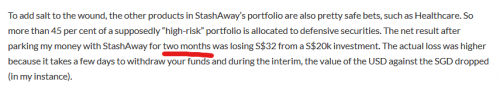

QUOTE(Hoshiyuu @ Mar 25 2021, 12:36 PM)  PACK IT UP BOYS SAMPLE SIZE OF TWO MONTH I hate it so damn much when 9 out of 10 reviews on both blogs and youtube ALWAYS review Stashaway on a less than 3 month time frame. It boggles my mind. i fully resonate with that statement. i am a pretty crap investor and only made about an average of 4 - 5% p.a. in my past 10 years of investing. so that's what i am expecting the market will return me in the long run. last year in 2020 alone, i made 20% p.a. which is insane. but due to experience, i know very well that this is not normal and the market will be correcting itself in the next few years. i can't imagine myself just starting out investing in year 2020. take out money from FD, dump all into stock market / unit trust and make 20% p.a. in just 2020 alone. and then proceed to make like -4% p.a for the next 3 years. not sure what it would do to me as a human being, lol. This post has been edited by encikbuta: Mar 25 2021, 02:02 PM |

|

|

Jul 21 2021, 02:16 PM Jul 21 2021, 02:16 PM

Return to original view | Post

#70

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

just like the last portfolio reallocation in Mid 2020, did u guys receive any email or web article where they explain the reallocation? if yes, can send over?

i mean we did all agree to the new T&C and will allow StashAway to reallocate our portfolio as they wish, but would be nice get some justification. am particularly interested to hear about EWA, haha. |

|

|

Jul 22 2021, 10:34 PM Jul 22 2021, 10:34 PM

Return to original view | Post

#71

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

StashAway Malaysia has decided to conduct another round of portfolio re-optimization amidst the changing environment. You can read their original article here but to sum it up, they believe that while the U.S. indices are skyrocketing right now, it does seem that inflation in the U.S. is starting to speed up from its current figure of 5.4% p.a. in June 2021.

To paraphrase a page from the "Intelligent Investor by Benjamin Graham", when inflation shot above 6%, stocks stank. The stock market lost money in 8 of the 14 years in which inflation exceeded 6%; the average real return for those 14 years was a measly 2.6%. While mild inflation allows companies to pass the increased costs of their own raw materials on to customers, high inflation wreaks havoc - forcing customers to slash their purchases and depressing activity throughout the economy. So StashAway Malaysia has decided to re-optimise the aggressive 36% portfolio as follows: Consumer Staples (XLP), Energy (XLE), REITS (VNQ & VNQI), Precious Metals (GLD) & US High Grade Bonds (AGG): These stock types have historically proven to perform very well (vs the stock market) in times of high inflation. You will notice they are commodity or 'basic necessity' type of stocks. Australia (EWA): What better way to capture commodity returns than investing in a commodity-exporting country? Small Cap (IJR): This is more to do with capturing the momentum rather than the inflation returns. Value stocks have been in the shadows of growth stocks for a few years. Now that value stock is back in the spotlight again, they foresee this to trend for quite a while to make up for lost times (vs growth stocks). China Tech (KWEB): This is more to do with capturing the potential rather than the inflation returns. With a population of 1.4 billion, rapidly growing economy and laser focus on becoming a technology superpower, it only makes sense to keep invested in this ETF. As for my opinion, I am pretty glad that they did not give up on KWEB despite their horrible run in year 2021. KWEB is a high risk, high reward ETF which I don't mind holding on for a while. As for the overall strategy, it does makes sense but only if their prediction that the inflation will continue to rise to uncontrollable levels comes true. |

|

|

Sep 24 2021, 12:48 PM Sep 24 2021, 12:48 PM

Return to original view | Post

#72

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

ah crap, i was hoping their new feature was the ability to fully invest in the IVV. instead they went the other way Medufsaid liked this post

|

|

|

Jan 27 2022, 10:51 AM Jan 27 2022, 10:51 AM

Return to original view | Post

#73

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(Medufsaid @ Jan 27 2022, 09:44 AM) 36% oh cool, i might actually like the re-opt this time around.KWEB 20 EWA 8 EWC 9 IJR 12.6 XLE 6 XLP 8 XLK 9.4 XLF 8 VNQ 8.6 GLD 9.4 Cash 1 - reduce % in XLE (Energy), XLP (Consumer Staples) and VNQ (US REITS) coz they climbed a bit too much - add % in Gold (GLD) coz inflation - add Banks (XLF) coz US hiking interest rate - add Tech (XLK) to buy the dip - remove ex-US REITS (VNQI) coz climb high enuf - keep KWEB (China Tech). i was SOO worried they might drop it due to its shit performance. glad they kept it. i just think this etf is poised for a massive rebound. there are some head scratchers like adding Canada (EWC). i guess they looking to place more bets in banks? |

|

|

|

|

|

Mar 13 2022, 04:06 PM Mar 13 2022, 04:06 PM

Return to original view | Post

#74

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(CoolStoryWriter @ Mar 13 2022, 03:47 PM) i could have misunderstood the article but i think they're just saying KWEB is trying to convert all their basket of holdings with dual listings to buy only the shares in HKEX counterparts (if available) right?example like Alibaba/Baidu/JD is dual listed in NYSE and HKEX, the KWEB will just buy the shares in HKEX and sell off all the holdings in NYSE. They also seem to be expecting those Chinese companies that only list in NYSE and cannot comply to NYSE rules will make effort to list in HKEX anyway. but yea, they never clarified by the dateline of 2024 and (if) all the KWEB stocks in NYSE cannot comply to NYSE rules, is KWEB itself allowed to list on NYSE, lol. by right can gua, since some other global ETFs hold stocks that are not listed on NYSE anyway. |

|

|

Mar 14 2022, 09:07 AM Mar 14 2022, 09:07 AM

Return to original view | Post

#75

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

» Click to show Spoiler - click again to hide... « le sigh. quite disappointed with the KWEB sell-off. wonder wat justification they will give. maybe something like, "lol, we caved" This post has been edited by encikbuta: Mar 14 2022, 09:08 AM |

|

|

Mar 16 2022, 09:56 AM Mar 16 2022, 09:56 AM

Return to original view | Post

#76

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

haha, i had to check whether i accidentally lowered my risk index.

it's funny to see my aggressive 36% portfolio has almost half of its allocation in bonds, REITS & commodities. |

|

|

Mar 16 2022, 07:46 PM Mar 16 2022, 07:46 PM

Return to original view | Post

#77

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

yes, i know. nasi sudah jadi bubur. but damn it, look at all that pre-market gains we're missing out from KWEB! Attached thumbnail(s)

jacksonpang liked this post

|

|

|

Apr 8 2022, 09:33 PM Apr 8 2022, 09:33 PM

Return to original view | Post

#78

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

another one bites the dust, lol This post has been edited by encikbuta: Apr 8 2022, 09:33 PM Attached thumbnail(s)

imforumer, CoolStoryWriter, and 3 others liked this post

|

|

|

Apr 9 2022, 11:44 PM Apr 9 2022, 11:44 PM

Return to original view | Post

#79

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

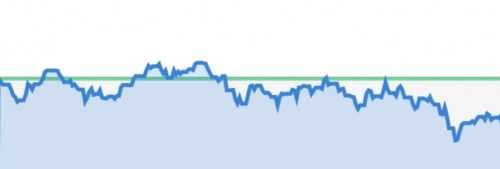

QUOTE(gooroojee @ Apr 9 2022, 10:14 PM) High five. I also requested to cash out after SA helped me lose 8% while taking mgmt fees for throwing darts in the dark. yea, i really should have bailed a lot earlier when all the red flags started coming up i.e. high fees, constant re-optimisation and introduction of trending ETFs (Thematic & ESG). i guess i just stuck to it because i believed too much into the 'buy and hold' mantra.While withdrawing, SA put up the 30 year projection with a line saying imagine how much you are going to lose out... and compared their projected returns for me against an FD projection based on today's FD rate maintained over 30 years. Thing is, I don't need fancy optimistic projections when the actual performance is like the below...  And then the recent Rational Reminder episode came up (link here - at specific timestamp) that brought me to my senses. The podcasters (Ben & Cameron) basically called out WealthSimple (roboadvisor in Canada) for being hypocritical. WealthSimple is externally promoting the passive investing 'buy & hold' mantra but internally kept actively switching their ETF compositions. I mean, I knew StashAway was doing the same but what gave me a smack to the head was how Ben & Cameron were just smirking and laughing at WealthSimple's hypocrisy, as if also laughing at me for still investing in StashAway So after almost 3 years with StashAway, i've decided to heed the podcaster's advice to just buy and hold ETFs on my own instead of going through a roboadvisor. P/S: if you bothered to click the video link, it goes on for 7 minutes (23:35 - 32:38). But bare with them as they got sidetracked in the middle for about 5 mins talking about the US vs Canada returns, lol. Podcasts, what do you do. blackchides, langstrasse, and 3 others liked this post

|

|

|

Apr 28 2022, 10:41 AM Apr 28 2022, 10:41 AM

Return to original view | Post

#80

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

when i made the full withdrawal about 2 wks ago, 2x StashAway reps actually called me up to kinda do an 'exit interview'

basically asking me why i withdraw all and what they can do to improve. |

| Change to: |  0.4905sec 0.4905sec

0.68 0.68

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 12:45 AM |