QUOTE(MNet @ Jun 6 2020, 10:47 AM)

Overall, I'm at -5.75% returns Now tone change a bit. StashAway is going to be the next big thing!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Jun 6 2020, 11:25 AM Jun 6 2020, 11:25 AM

Return to original view | Post

#21

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(MNet @ Jun 6 2020, 10:47 AM) Overall, I'm at -5.75% returns Now tone change a bit. StashAway is going to be the next big thing! |

|

|

|

|

|

Jun 7 2020, 03:29 PM Jun 7 2020, 03:29 PM

Return to original view | Post

#22

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

|

|

|

Jun 9 2020, 09:50 AM Jun 9 2020, 09:50 AM

Return to original view | Post

#23

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(walnut6363 @ Jun 9 2020, 01:26 AM) Hi guys. Newbie here. Wanna ask, i already have a 36% risk portfolio and the returns are very impressive so far. i think this is a good idea!However, i wanted the Core S&P 500 in my portfolio which is in the 30% risk portfolio. Should i create a 30% risk level portfolio just because of the IVV ETF (Core S&P 500)? Or do you guys think it's redundant and unnecessary? but i have a question to add, maybe others can help answer. if say i didn't want to create a new portfolio and instead change my 36% to 30%, would that be a smart move? means my portfolio would have to sell/buy funds to re-allocate into the new 30% portfolio. i'm just worried that i might incur transaction costs. i don't see it on the app (when a transaction to buy/sell ETF is made), but maybe it's built into the spread? |

|

|

Jun 12 2020, 02:32 PM Jun 12 2020, 02:32 PM

Return to original view | Post

#24

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(ironman16 @ Jun 12 2020, 02:23 PM) If u really can't stomach it, better reduce ur risk to the stage that suit u risk appetite. this reply reminds me a lot about the recent book i read, A Random Walk Down Wall Street.If not, u can't sleep well every night. If in this situation, i just don't log in stashaway or any forum, sure sleep well, lol the author said in our investment portfolio, try to find our balance between eating well vs sleeping well which i thought was quite clever. eat well means take more risk, sleep well means take less risk. |

|

|

Jun 15 2020, 08:17 AM Jun 15 2020, 08:17 AM

Return to original view | Post

#25

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(abcn1n @ Jun 15 2020, 12:56 AM) Ohh, I thought that if I park $ in SA simple, then when I want to transfer the $ to my portfolio, it will be as fast as doing it as per jompay. I guess not then. Bubble burst Same here! I park my funds in RHB Cash Management (in FSM) which gives similar returns. So unless, parking my funds in StashAway Simple means i can 'immediate' top up my regular StashAway funds from there, no point having 2 parking accounts.but still, StashAway Simple is a good avenue if one is looking for something better than FD. |

|

|

Jun 15 2020, 02:45 PM Jun 15 2020, 02:45 PM

Return to original view | Post

#26

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(honsiong @ Jun 15 2020, 01:39 PM) StashAway said FD should not be used for emergency - I disagree. yea agreed. they could have just said that StashAway Simple rates (2.4%) are better than FD rates (1.8% - 2.0%) then leave it at that.Emergency fund should be withdrawable at a moment's notice at the expense of interest lost. StashAway blog keeps saying FD like they only have 6-12 months of lock up period. Guess what, you can save in FD and set 1 month maturity. Even if you set say 3-6 months, you can withdraw instantly and lose just the interest earned, no big deal when its emergency kan? i have a feeling the article more targeted to those FD rate hunters where they transfer fresh funds from one bank to another with minimum lock-in periods (~ 1 year). The rates for those FD promos quite high ler, close to 3.0% wan. but the effort to constantly transfer funds and long lock-in period is a huge deal-breaker, for me at least. nguminhuang and zstan liked this post

|

|

|

|

|

|

Jun 16 2020, 02:27 PM Jun 16 2020, 02:27 PM

Return to original view | Post

#27

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

|

|

|

Jun 16 2020, 10:00 PM Jun 16 2020, 10:00 PM

Return to original view | Post

#28

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(responsible poster @ Jun 16 2020, 05:53 PM) Invested since July 2019 in 36% highest risk portfolio:TWR: 5.7% MWR: 27.3% ROI: 7.6% The MWR quite inflated coz starting from Feb 2020, I decided to quit P2P Lending and gradually transfer all the repayments to StashAway. Ngam ngam market crashed. So you can say I 'accidentally' timed the market. |

|

|

Jun 17 2020, 10:35 AM Jun 17 2020, 10:35 AM

Return to original view | Post

#29

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

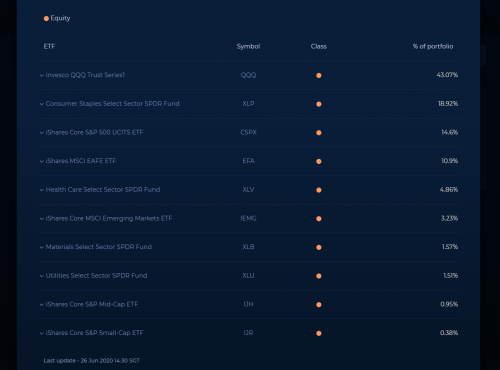

QUOTE(backspace66 @ Jun 17 2020, 10:28 AM) This is my current screenshot for the current asset allocation. I rejected the optimisation and still exposed around 70++% to US stock market hey this is awesome!  did they send an email or notification of any sorts that they will soon 'force' you to revert to the new allocation? P/S: look at the XLE (Energy) share, my goodness. deteriorated until left 0%. i'm guessing they never rebalanced coz there was no DCA into this portfolio? This post has been edited by encikbuta: Jun 17 2020, 10:41 AM |

|

|

Jun 22 2020, 01:15 PM Jun 22 2020, 01:15 PM

Return to original view | Post

#30

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(marineer @ Jun 21 2020, 06:30 PM) StashAway need above 90% to unlock the riskier index? i actually took the quiz a few months back and only scored 80%. i didn't read about the 90% min requirement so i just submitted my results to SA.I scored 75% in 2 hrs 🤣, hope they accept my result. they replied that although i didn't fulfill the minimum 90% score, they are fine to just unlock the highest risk portfolio for me hopefully they give u the same leeway as well, haha. |

|

|

Jun 23 2020, 01:44 PM Jun 23 2020, 01:44 PM

Return to original view | Post

#31

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(honsiong @ Jun 23 2020, 01:27 PM) Waiting for dividend tax reimbursements. oh this is something new. i only started investing in July 2019 so no chance to receive tax refund.04 Oct for 2018, 17 Jun for 2019, not sure when will they do tax refund this year. i thought the dividend we receive alrdy deducted the mandatory 30% withholding tax. so we can actually get some of the portion back? very cool. honsiong liked this post

|

|

|

Jun 23 2020, 01:55 PM Jun 23 2020, 01:55 PM

Return to original view | Post

#32

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

|

|

|

Jul 1 2020, 12:58 PM Jul 1 2020, 12:58 PM

Return to original view | IPv6 | Post

#33

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(tadashi987 @ Jul 1 2020, 10:26 AM) https://www.syfe.com/equity100 Thanks for sharing. One can only hope SA follows suit. Syfe SG launches 100% equity which is US and NASDAQ 100 heavily allocated. sharing for guys reading  too bad Syfe is not available in Malaysia or else is a good alternative to SA for those who like US weighted portfolio That, or Syfe sets up shop in Msia |

|

|

|

|

|

Jul 20 2020, 02:18 PM Jul 20 2020, 02:18 PM

Return to original view | Post

#34

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(WhitE LighteR @ Jul 19 2020, 06:26 PM) I would be damn happy if this is really become a reality. I think the local UT companies will move heaven and earth to block this from happening. Low fees will totally kill all of their business model. Most Malaysia UT underperformed the market. If someone can offer an alternative index tracker with low fees n no need robo advisory. Even SA also will be affected I think. I think I read somewhere in the US for every 10k invested in index tracker ETF blackrock only charge an average of 17 USD per year for fees. This 'research' done in 2016 so may be a bit outdated ler. But it kinda challenged my thinking that most actively managed mutual funds under perform the market (index). I guess it's true for USA but things looks a bit different in Malaysia. Wish someone would renew this research for year 2020, haha.Link: https://klse.i3investor.com/blogs/invest_ma..._Performing.jsp |

|

|

Jul 24 2020, 03:12 PM Jul 24 2020, 03:12 PM

Return to original view | Post

#35

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

|

|

|

Jul 25 2020, 08:43 AM Jul 25 2020, 08:43 AM

Return to original view | Post

#36

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(zstan @ Jul 24 2020, 10:50 PM) looking at the snapshot, the 20% GLD weightage in our 36% portfolio managed to cushion the drop yesterday.that said tho i am still a gold hater, haha! GLD is an awesome asset to hold now when the economy is so unsure of itself. but once this all blows over, GLD will just go back to being stagnant and other EQ will begin to rise at a higher rate. however, maybe it makes sense for a dynamic model like STASHAWAY to hold GLD right now. later when the economy recovers, STASHAWAY would pandai pandai switch back to full EQ portfolio. so we're kinda depending on their system to time the market. Attached thumbnail(s)

B500 liked this post

|

|

|

Jul 25 2020, 09:48 AM Jul 25 2020, 09:48 AM

Return to original view | Post

#37

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(joshtlk1 @ Jul 25 2020, 09:02 AM) Curious what is the website or tool you are using for portfolio management with the picture you attached? oh i use investing.com but i quite extra la. i religiously update the unit purchases on the app/website to properly mirror my actual portfolio. it can get quite tedious but i enjoy it |

|

|

Jul 25 2020, 09:51 AM Jul 25 2020, 09:51 AM

Return to original view | Post

#38

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

|

|

|

Jul 26 2020, 06:31 AM Jul 26 2020, 06:31 AM

Return to original view | Post

#39

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

the powah of market timing, haha! anyway, i didn't do it on purpose

ngam ngam i got fed up with P2P Lending and decided to gradually transfer all my repayments to StashAway, it was when the market was crashing (March 2020 onwards). i've only stuck with a 36% portfolio and have been DCA-ing RM500 since July 2019. my TWR sits at 13.52%. Attached thumbnail(s)

|

|

|

Jul 27 2020, 04:02 PM Jul 27 2020, 04:02 PM

Return to original view | Post

#40

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(chenkiong @ Jul 27 2020, 02:44 PM) https://howtofinancemoney.com/stashaway-malaysia-review man, i'm all about independently written articles but this one tastes a bit sour, haha.i just read this long thread from internet. my confident is drop.... question on this article: he said independent advisor like him can offer 0% sales charge but don't they (independent advisor) charge per annum management fee on our assets? |

| Change to: |  0.0433sec 0.0433sec

0.67 0.67

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 12:45 AM |