QUOTE(omegaoracle @ Aug 20 2020, 05:12 PM)

You don't just put into high yield saving account.Liquidity is extremely liquid.

You can have RHB Smart Account, SC PSA and/or OCBC 360.

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Aug 20 2020, 05:24 PM Aug 20 2020, 05:24 PM

Return to original view | IPv6 | Post

#421

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Aug 20 2020, 05:36 PM Aug 20 2020, 05:36 PM

Return to original view | IPv6 | Post

#422

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(omegaoracle @ Aug 20 2020, 05:31 PM) Sorry I forgot to mention, I have cash reserves in CASA accounts and cash in hand. OPR is on the downward trend.It's more to accrue some funds monthly for the next 12 months The best MMF (PMMMF) is only quoting for 2.3% pa for July return. Most of the MMF are more or less the same if the asset holdings are purely deposits. Opus MPF is not pure MMF as it has 10% allocated into "Fixed income securities, money market instruments and deposits which have a remaining maturity period of more than 365 days but less than 732 days" aka short term debt paper with maturity less than 732 days. omegaoracle liked this post

|

|

|

Aug 20 2020, 09:42 PM Aug 20 2020, 09:42 PM

Return to original view | IPv6 | Post

#423

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(omegaoracle @ Aug 20 2020, 09:26 PM) Will visit thanks, but would prefer something like Simple with no lock-in period and I can live with T+7 working days in case of withdrawal. Of course 2.5% in this market is good, given that another BNM rate review is coming up If there's going to be another OPR cut on 10/9/2020, all existing promotion FD campaign could cease and subjected to a new campaign with revised rate. |

|

|

Aug 20 2020, 10:07 PM Aug 20 2020, 10:07 PM

Return to original view | IPv6 | Post

#424

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(omegaoracle @ Aug 20 2020, 10:02 PM) Well, inflation muted (no inflationary pressure), growth slow (pick up not fast enough) and high saving rate, there's a very high chance that it'll be another OPR cut.And it'll stay as it is till next year. BNM governor said that the worst is behind us but she don't paint a very bright recovery path in the 2nd half. Above is just my personal view. Do take it with a pinch of salt! |

|

|

Aug 21 2020, 11:58 AM Aug 21 2020, 11:58 AM

Return to original view | Post

#425

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(tsutsugami86 @ Aug 21 2020, 11:44 AM) My total return around USD 95, why convert to ringgit just RM 288 ? Return in MYR = Return in USD x Forex rate + Currency ImpactThe exchange rate is USD 1 : RM 3 ? Currency Impact details: https://www.stashaway.my/r/how-currency-imp...haway-portfolio |

|

|

Aug 21 2020, 08:41 PM Aug 21 2020, 08:41 PM

Return to original view | IPv6 | Post

#426

|

All Stars

12,387 posts Joined: Feb 2020 |

I found something interesting about dividend:

For normal SAMY portfolio: Where do dividends go? For goal-based portfolios and general investing portfolios, our system automatically reinvests any dividends you may earn. All dividend payments are reflected in your "Transactions" tab. https://www.stashaway.my/faq/900000812706-w...o-dividends-go/ For SAMY Simple™: How do the dividends accrue? The dividends accrue on a daily basis and are paid out monthly. https://www.stashaway.my/faq/900001298363-h...vidends-accrue/ |

|

|

|

|

|

Aug 21 2020, 10:52 PM Aug 21 2020, 10:52 PM

Return to original view | IPv6 | Post

#427

|

All Stars

12,387 posts Joined: Feb 2020 |

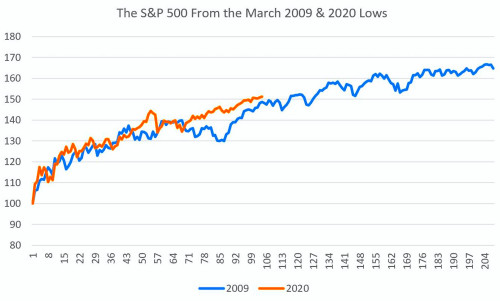

Record-high prices is no reason to dump stocks

What’s next for the all-time high stock market The S&P 500 (^GSPC) set a new record high this week for the first time since Feb. 19, surging an eye-popping 51% from its March 23 closing low of 2,237 to a closing high of 3,389 on Tuesday. This represents the shortest bear market and third fastest bear-market recovery ever. And Wall Street’s top stock market forecasters think there could be more gains ahead. “If you’re bullish, the fact that the 2009 experience points to a further 11% gain between now and year end is welcomed news,” Colas added. Obviously, 2009 and 2020 are very different. Colas notes that in 2009, financials led the way. Today, it’s tech. Back then, a new U.S. president was just put into office. This year, that seat is up for grabs. In both instances, fiscal and monetary policy was very aggressive. Should the market continue to follow the 2009 path, the S&P 500 could end the year close to 3,800. That makes Goldman Sachs’ recently updated bullish 3,600 target seem modest. Getting to 3,800 would be surprising. But, what else would you expect from 2020. https://finance.yahoo.com/news/record-high-...NOUyf55GRU7Cg4Q Goldman recent forecast: https://finance.yahoo.com/news/stock-market...-100455932.html |

|

|

Aug 26 2020, 04:49 PM Aug 26 2020, 04:49 PM

Return to original view | IPv6 | Post

#428

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(gundamsp01 @ Aug 26 2020, 04:43 PM) that means it is still the same as 1 month FD? Basically there's nothing so special about Simple™.i think there was a reply showing there is record of few cents added everyday then there will be a dividend payout at the end of the month. Correct me if i am wrong. It's just a money market fund that works in unit trust/mutual fund mechanism governed by the daily movement of NAV and pays out distribution in monthly basis. In short it is just a FD without the need to commit for maturity tenure by offering flexible withdrawal at any time. |

|

|

Aug 26 2020, 04:57 PM Aug 26 2020, 04:57 PM

Return to original view | IPv6 | Post

#429

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(gundamsp01 @ Aug 26 2020, 04:53 PM) just wondering, if the NAV drops, any impact to the money i put in? If NAV drops, of course there's impact to the valuation of your Simple™ holding. and since the distribution is being paid out on monthly basis, what if i withdraw now, will they realize the amount from the day i put in until the day i withdraw? does it work that way? But given the risk rated by SAMY, it is very unlikely as you can the graph, the drop in NAV is mostly due to paid out distribution. https://www.eastspring.com/my/funds-and-sol...s?fundcode=E026 Regarding the second part of your question, I'm not sure how it works. If using unit trust working mechanism, on ex-distribution date, if you don't have any units held at fund manager registrar, you won't be entitled for the distribution. gundamsp01 liked this post

|

|

|

Aug 26 2020, 05:08 PM Aug 26 2020, 05:08 PM

Return to original view | IPv6 | Post

#430

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(gundamsp01 @ Aug 26 2020, 05:00 PM) The risk rated by SAMY is 1.8% only.QUOTE This is an investment, so there is a level of risk, but it’s incredibly low. The StashAway Risk Index for StashAway Simple™ is 1.8%. That means you have a 99% chance of not losing more than 1.8% of your AUM in a given year. When NAV drop due to distribution, you'll be paid for the distribution. The money will be credited into your Simple™ portfolio and won't be reinvested until new deposit comes in. |

|

|

Aug 26 2020, 08:59 PM Aug 26 2020, 08:59 PM

Return to original view | IPv6 | Post

#431

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(gundamsp01 @ Aug 26 2020, 08:57 PM) The money market fund is prone to OPR risk. The projected return by Simple™ is 2.4% pa. In unit trust, it's called distribution aka dividend. Distribution is not instant like FD interest and normally there's ex-date and pay out could take days up to 2 weeks. Also remember that SAMY is just a distributor of underlying fund for Simple™; processing speed depends on both parties (SAMY and Eastspring Investments). This post has been edited by GrumpyNooby: Aug 26 2020, 09:03 PM |

|

|

Aug 26 2020, 09:05 PM Aug 26 2020, 09:05 PM

Return to original view | IPv6 | Post

#432

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(gundamsp01 @ Aug 26 2020, 09:01 PM) yea, i am aware that it is just projected and affected by OPR, that means it may be lower or higher. If you want to feel "safer", opt for PMMMF. But still better than putting in bank for now, this amt of emergency fund is wasteful to be just put in bank, and not required immediately...hence, i opt for Simple. It is a fixed price fund and distribution will be declared by end of the month. Refer to the other thread: https://forum.lowyat.net/index.php?showtopi...hl=money+market PMMMF: https://www.phillipmutual.com/products-serv...ey-market-fund/ PMMMF at eUT: https://www.eunittrust.com.my/Home/FundDetail/?fcode=001100 This post has been edited by GrumpyNooby: Aug 26 2020, 09:19 PM |

|

|

Aug 27 2020, 05:20 AM Aug 27 2020, 05:20 AM

Return to original view | IPv6 | Post

#433

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(majorarmstrong @ Aug 26 2020, 09:42 PM) i want to ask is Opus Cash Extra Fund is it the same as well? Read Opus CEF monthly FFS and its PHS.Also doing monthly distribution but i still dont know how to calculate how many % did it return on monthly basis  This post has been edited by GrumpyNooby: Aug 27 2020, 05:20 AM |

|

|

|

|

|

Aug 28 2020, 01:40 PM Aug 28 2020, 01:40 PM

Return to original view | Post

#434

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Aug 28 2020, 06:40 PM Aug 28 2020, 06:40 PM

Return to original view | IPv6 | Post

#435

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Aug 29 2020, 07:25 PM Aug 29 2020, 07:25 PM

Return to original view | IPv6 | Post

#436

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(K0MR4DE @ Aug 29 2020, 07:22 PM) Hi all Sifoo / Sensei / Guru, You can create another portfolio with higher risk % while maintaining your current 10% portfolio within the same account.Currently I'm on 10% StashAway Risk and StashAway assigned me as Balanced Investor (inside the settings can see 'investment profile'). Is it wise if I upgrade my 'investment profile' to Growth or Aggressive while maintaining my 10% risk investment? All answer are deeply appreciated and I end my post with thanks in advance! |

|

|

Sep 1 2020, 04:53 PM Sep 1 2020, 04:53 PM

Return to original view | IPv6 | Post

#437

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Ramjade @ Sep 1 2020, 04:51 PM) Of course not. Market at all time high. Still pumping money into S-REIT?If you think valuation does not matter then buy. If you think companies can be profitable next year buy. If you have a roaring economy, rising stock price yes. Make sense. But economy like shit and stocks going up even though stock fundamental s are bad. Nope. Not for me |

|

|

Sep 2 2020, 02:16 PM Sep 2 2020, 02:16 PM

Return to original view | Post

#438

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(majorarmstrong @ Sep 2 2020, 02:10 PM) question - how come total return in USD vs total return in MYR has such a huge difference? Currency impact, uncle!USD show 10 which suppose MYR to show at least 40 but in my case USD show 10 MYR show 25 https://www.stashaway.my/r/how-currency-imp...haway-portfolio This post has been edited by GrumpyNooby: Sep 2 2020, 02:17 PM |

|

|

Sep 2 2020, 06:38 PM Sep 2 2020, 06:38 PM

Return to original view | IPv6 | Post

#439

|

All Stars

12,387 posts Joined: Feb 2020 |

SAMY app for Android got update.

|

|

|

Sep 2 2020, 08:33 PM Sep 2 2020, 08:33 PM

Return to original view | IPv6 | Post

#440

|

||||||||||

All Stars

12,387 posts Joined: Feb 2020 |

Distribution declared for underlying fund for Simple™:

Source: https://www.fundsupermart.com.my/fsmone/fun...on-announcement This post has been edited by GrumpyNooby: Sep 2 2020, 08:42 PM honsiong liked this post

|

||||||||||

| Change to: |  0.4746sec 0.4746sec

0.73 0.73

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 03:13 AM |