oh for this, you need to explore a bit, not all bank e-banking got Auto Transfer

for JOMPAYsome summary hereMaybankGot auto transfer for JOMPAY (but MONTHLY only)

Got auto transfer for IBG (but MONTHLY only)

UOBGot auto transfer for JOMPAY, (MONTHLY, weekly, daily, quarterly)

Got auto transfer for IBG, (MONTHLY, weekly, daily, quarterly)

OCBCNO auto transfer for JOMPAY (thou they have website saying got this, but I cant get it to work thou)

Got auto transfer for IBG (MONTHLY, weekly, daily)

HLBGot auto transfer for JOMPAY (MONTHLY, weekly, daily, quarterly, bi-weekly, half yearly)

Got auto transfer for IBG (MONTHLY, weekly, daily, quarterly, bi-weekly, half yearly)

Other bank i dunno, dont have so much bank accounts

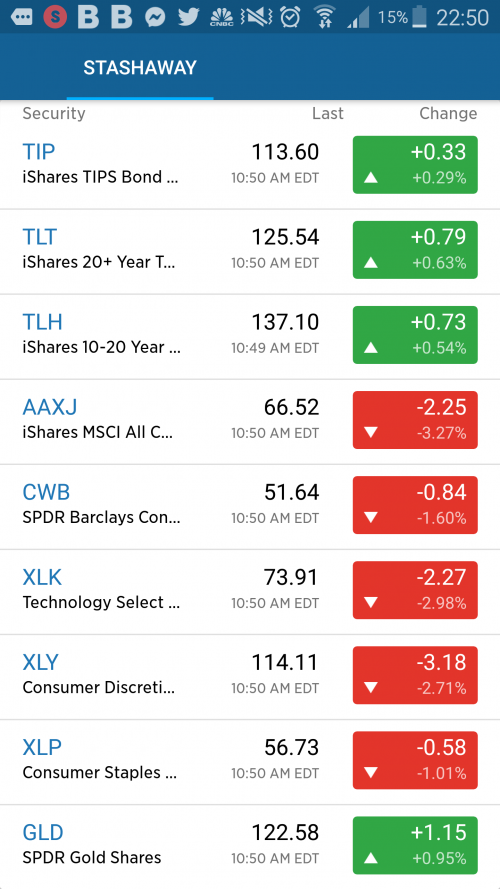

If DCA every month can use the recurring deposit right, then if i want to DCA few times per week, i need deposit manually? or is there a setting for it?

May 8 2019, 03:13 PM

May 8 2019, 03:13 PM

Quote

Quote

0.2738sec

0.2738sec

0.83

0.83

7 queries

7 queries

GZIP Disabled

GZIP Disabled