QUOTE(chiangth @ Jun 5 2020, 02:42 PM)

Hi, newb here.

May I ask everyone here have different portfolios on different risk index? Or do you only invest in just 1 risk index portfolio?

And which risk index do you recommend putting in? I putting in 20% because it has lower corp bond compared to the other lower risk index.

Again, I am really a novice in investing so seeking a little advise from various sifus here.

Have two portfolio with risk index 36% and 22%. My 22% seems to be doing better than the 36% overall, both are invested at the same time around mid March right after the crash.May I ask everyone here have different portfolios on different risk index? Or do you only invest in just 1 risk index portfolio?

And which risk index do you recommend putting in? I putting in 20% because it has lower corp bond compared to the other lower risk index.

Again, I am really a novice in investing so seeking a little advise from various sifus here.

Maybe in the longer term I would see a more different numbers with the higher risk index portfolio, but my main is with 22%. The split ratio between my 36% and 22% is about 1:2.

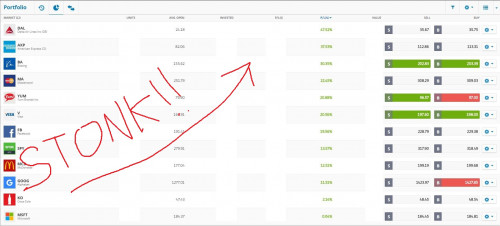

Return wise are as follow as of today in USD: 36% (MWR/TWR) vs 22% (MWR/TWR)

36% risk(19.17%/21.28%) vs 22% risk (23.64%/22.43%)

The diff is marginal lol, but then again keep in mind these portfolios are barely 3 months old.

Can't give you any recommendation though, as the name of the "risk" ratio implies, ask yourself how much loss can you stomach before you go mad? Stick with that and sleep well at night

This post has been edited by awyongcarl: Jun 5 2020, 03:03 PM

Jun 5 2020, 02:59 PM

Jun 5 2020, 02:59 PM

Quote

Quote

0.4506sec

0.4506sec

0.56

0.56

7 queries

7 queries

GZIP Disabled

GZIP Disabled