Yea.. Is people choice to lose money professionally as well.

U still think it wait for years to recover. During the recovery (which is actually the dip), u won't buy, that's the problem there.

like i mentioned earlier,...what if you are in retirement age or having see other markets are better that SP500 during the SP500 "bad" years? Then it will be same even if u use SA or anything else.

There is no guarantee SA is predictable. Is just a projection Freddy and his team.

a diversified portfolio will be in common sense les volatile than focusing on just a market like SP500. thus will be more predictable

If I say, I can make u alot alot money. The right question to ask is how much?

I say I make u 2% per year. U will be like wtf this guy, fd does the same. Why invest in me.

Same goes when SA says they promise some projection, this projection or past performance compare to what?

SA does not invest with promises of ROI,...but more to controlling to less than 1% chance of losing your equivalent money of your selected %SRI in any given yearWhich I said, if SA can't beat a sp500 as benchmark that is widely known in the investment world. Is a waste of time, if u earn less than that, is a waste of money.

does SA benchmark SP500? does investors buy into SA thinking that it will beat SP500? This includes everything, u buy property, crypto, businesses, land etc etc.

Ok since u don't understand. I use another benchmark. Cimb give fd, 1.8% PA,

If an investment csnt beat FD, will u invest? Let's keep it fair, let's say for the span of 15 years.

investment has risks....your money can goes up and it can goes down too....FD does notso are many other people that ha invested fully in it for the last 13 years.

that is my conclusion in your perspective of SP500.

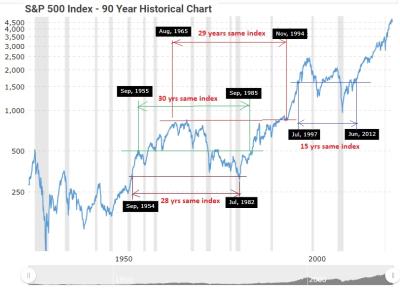

what you are comparing is just based on historical results on performance,...not forgetting the r\ate it can fall and the durations it will stay low.

Dec 12 2021, 08:30 PM

Dec 12 2021, 08:30 PM

Quote

Quote

0.4103sec

0.4103sec

0.56

0.56

7 queries

7 queries

GZIP Disabled

GZIP Disabled