QUOTE(lee82gx @ Nov 9 2021, 11:48 AM)

perhaps its not nett worth, but more like investing portfolio. In that case it is more "safe" and another thing is crypto is up 100% so perhaps the capital injected was only 7.5% which is not unheard of.

Its really depend on your risk tolerance and cup of tea / coffee / milo. I've been staring at this crypto thing for years and the bus has come and gone countless times. I'm still probably gonna stare at it a few more times.

Personally I would've bought some crypto if there was much "safer / more renowned" system in Malaysia, like coinbase, greyscale etc.

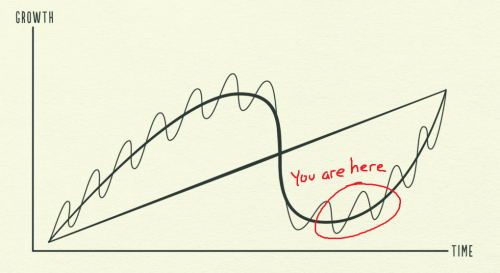

I've been staring at it for a few years too, still not convinced it isn't a massive ponzi scheme built on top of proper future looking technology. When the bubble burst and the tech matures into what it's suppose to be, I'll put my full weight behind it.Its really depend on your risk tolerance and cup of tea / coffee / milo. I've been staring at this crypto thing for years and the bus has come and gone countless times. I'm still probably gonna stare at it a few more times.

Personally I would've bought some crypto if there was much "safer / more renowned" system in Malaysia, like coinbase, greyscale etc.

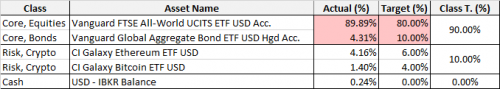

In the meantime, I just put 5-10% of my total port into it for suppressing my FOMO - if it goes beyond 15%, then I rebalance it into my core portfolio and secure my earnings

( I bought ETHX/BTCX via Toronto Stock Exchange, trade commission only around 0.1 USD per trade, if you don't own too much and is less strict about "not your wallet, not your coin" maybe can look into it. Maximum TER 1% for these two fund managed by CI Galaxy. Way cheaper than whatever exchange fee/gas fee you might pay. Only downside is if a massive crash happens outside trading hours, you will be a very sad man. I don't mind because I don't own much, and even if it does crash, chances are the DEX will be down from all the traffic and gas fee will skyrocket to a point you cant even cash out anyway - in that sense, a traditional brokerage will probably fare better, LOL!)

This is what my current allocation looks like after exiting Bursa, Stashaway, Wahed, MyTheo and LUNO.

This post has been edited by Hoshiyuu: Nov 9 2021, 01:14 PM

Nov 9 2021, 01:11 PM

Nov 9 2021, 01:11 PM

Quote

Quote

0.0520sec

0.0520sec

0.85

0.85

7 queries

7 queries

GZIP Disabled

GZIP Disabled