^^ the harder the it drop the better as long I am confident with the underlying stuff, I got plenty of time.

Been eyeing SPY all morning hoping it to drop by 10%

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Oct 1 2021, 04:09 PM Oct 1 2021, 04:09 PM

Return to original view | Post

#181

|

Senior Member

1,210 posts Joined: Nov 2011 |

^^ the harder the it drop the better as long I am confident with the underlying stuff, I got plenty of time.

Been eyeing SPY all morning hoping it to drop by 10% |

|

|

|

|

|

Oct 3 2021, 11:24 PM Oct 3 2021, 11:24 PM

Return to original view | Post

#182

|

Senior Member

1,210 posts Joined: Nov 2011 |

Been reconsidering about being in Stashaway recently, and it's not about KWEB, I'm actually okay with that.

I originally entered Stashaway because: 1. It was the easiest way for me to access international market 2. I wasn't able to trust IBKR with my portfolio 3. Great automatic way to pay myself first and manage money, cheap way to turn my MYR into USD. 4. My monthly investment amount generate too much fees anywhere else. Fast forward ~6 months later: 1. I am comfortably using IBKR now. 2. I am happy to have my entire portfolio in IBKR. 3. Sunway Money + IBKR offers me easy and cheap exchange to SGD and any other currency. 4. My income is increasing that I might be able to invest monthly with 4USD fee / <1% of my monthly investment amount. So I am slowly losing a reason to pay SA ~1% p.a. to be stuck in arbitrary sector ETFs. Admittedly this isn't much at all if SA is indeed bringing me ~15% p.a. returns. Opinions welcomed! This post has been edited by Hoshiyuu: Oct 3 2021, 11:29 PM |

|

|

Oct 4 2021, 02:40 AM Oct 4 2021, 02:40 AM

Return to original view | Post

#183

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(onthefly @ Oct 4 2021, 01:59 AM) I run a two fund portfolio on IBKR - I "rebalance" just by deciding whether I deposit into asset A or asset B per deposit, and since I deposit once per month, the portfolio is basically rebalanced monthly barring major crashes (>10%) which then I'll do it manually.SA's ~0.7% is purely SA management fee not accounting for underlying ETF's expense ratio, which is ~0.2% - i highly doubt this is the case for thematic ports. The ETF I hold are all accumulating ETFs - the dividends get reinvested automatically. |

|

|

Oct 4 2021, 10:07 AM Oct 4 2021, 10:07 AM

Return to original view | IPv6 | Post

#184

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(Medufsaid @ Oct 4 2021, 09:42 AM) how about the ETFs in SRI 36%? will "reinvesting" help evade the 30% tax? Withholding tax is deducted first before reinvestment, and if I am correct, SA tries to claim back a portion of the WHT for the users.SA simple will take 3 business days assuming you send the transfer order before 2pm. 1 day to sell, 1 day to exchange to USD, 1 day to buy ETFs. I don't know how fast FPX is, nor if there's any cutover time |

|

|

Oct 5 2021, 11:49 AM Oct 5 2021, 11:49 AM

Return to original view | IPv6 | Post

#185

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(DragonReine @ Oct 5 2021, 11:38 AM) IMO StashAway Simple is really only useful for two reasons: I'd rather just put it in OCBC Frank and call it a day after testing Versa, SA Simple and the other guy, forgot the name.1) extra layer of "forced" financial discipline (the slow withdrawal time means you're less likely to impulsively withdraw) 2) if you're going to DCA regularly into SA + you can't qualify for high yield savings account + you also need reason #1, so you deposit your short term savings in SA Simple and then set up a recurring transfer from Simple to SA investment portfolio but as several have mentioned, the interest rate is not that much better to begin with, and the slow transfer times makes it not optimal, and that extra few 0.0x% p.a. gain is not much in actual money unless you're high net worth (and if you're high net worth, pretty sure it's super easy to qualify for high yield savings account anyway) don't be penny wise pound foolish |

|

|

Oct 5 2021, 12:03 PM Oct 5 2021, 12:03 PM

Return to original view | IPv6 | Post

#186

|

Senior Member

1,210 posts Joined: Nov 2011 |

|

|

|

|

|

|

Oct 5 2021, 07:27 PM Oct 5 2021, 07:27 PM

Return to original view | IPv6 | Post

#187

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(pinksapphire @ Oct 5 2021, 07:03 PM) How's everyone holding up? -11%, not within expectation but still very much within tolerances. Not increasing monthly amount anymore and no longer doing extra lump-sum when market drops. Just gonna maintain this amount of DCA and ride it out.Still DCA-ing, although can't lie to say that I'm not down when seeing bigger deficit now than before, lol Might consider fully withdrawing and exit Stashaway when I am net positive in a few years because I have not much use for Stashaway anymore. |

|

|

Oct 6 2021, 09:45 AM Oct 6 2021, 09:45 AM

Return to original view | Post

#188

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(honsiong @ Oct 6 2021, 09:33 AM) If you still use Stashaway, that means you agree with Stashaway. 🤣🤣🤣 The feedback probably not proportional too, up 17% before correction "not bad not bad, not as much as I hope but good return, I made a good decision to enter", down 1% "haih I knew Freddy cannot be trusted, sohai fake ai (nobody said it was), sohai Complaining more on forums won't prevent that from happening, they need to see a drop in AUM before they uturn. Also I have been using it for 4 years, it's the same thing - When it goes up everybody diam2 happy, when it goes down people start to bash the team. Same thing for 4 years. Most that complained here seems to have a common trend of losing around 10% in a portfolio rated to have swing up to 36% per year .... This post has been edited by Hoshiyuu: Oct 6 2021, 09:47 AM Quazacolt, DragonReine, and 3 others liked this post

|

|

|

Oct 7 2021, 10:16 AM Oct 7 2021, 10:16 AM

Return to original view | IPv6 | Post

#189

|

Senior Member

1,210 posts Joined: Nov 2011 |

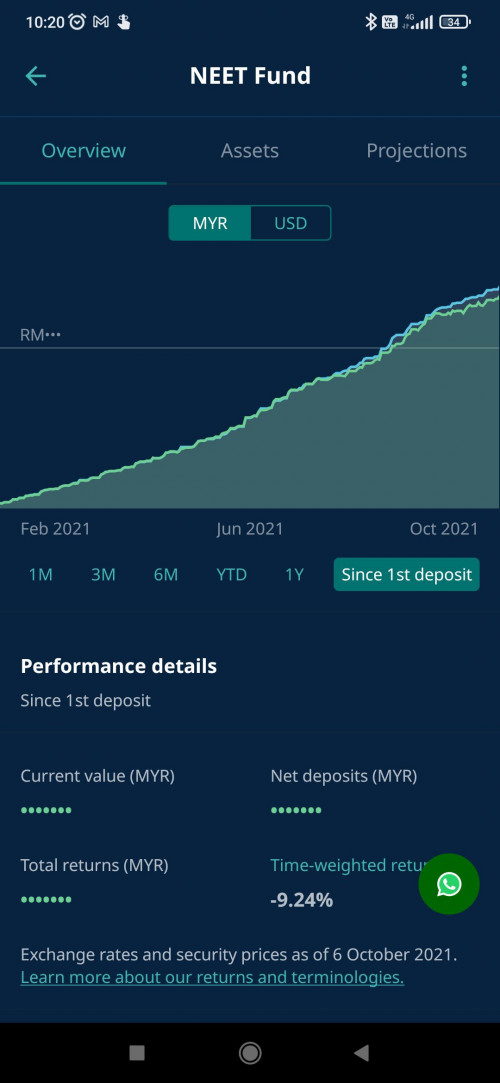

QUOTE(Cubalagi @ Oct 7 2021, 08:59 AM) Hi Hey bro! I think I saw you before in Bursa ETF thread.I'm not an SA investor, but Im on their email.list. What's the YTD performance of SA high risk portfolio? Anyone knows? Here's a benchmark portfolio I made to track this since February. I created this near peak so should be representative of one shot lump-sum during ATH.  Here's the same portfolio under daily deposits. The drawdown is bigger because I increased my deposit during the first major drop.  This post has been edited by Hoshiyuu: Oct 7 2021, 02:48 PM |

|

|

Oct 9 2021, 07:31 PM Oct 9 2021, 07:31 PM

Return to original view | Post

#190

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(guy3288 @ Oct 9 2021, 07:28 PM) yeah i made a mistake added 10k each to my 3 old SRIs 10,14,26%. should have opened new SRi, you can have any amount of portfolio at any amount of SRI, just that whether its meaningful or not...eaiser to see the performance from different date entry. So i opened a new SRI 16% to monitor the return, one account can have multiple SRI 14% ,since i already have one earlier.? |

|

|

Oct 15 2021, 04:35 PM Oct 15 2021, 04:35 PM

Return to original view | Post

#191

|

Senior Member

1,210 posts Joined: Nov 2011 |

i went from -13 to -7%, thats pretty nice

|

|

|

Oct 15 2021, 10:02 PM Oct 15 2021, 10:02 PM

Return to original view | Post

#192

|

Senior Member

1,210 posts Joined: Nov 2011 |

|

|

|

Oct 15 2021, 11:06 PM Oct 15 2021, 11:06 PM

Return to original view | Post

#193

|

Senior Member

1,210 posts Joined: Nov 2011 |

Hmm, it just occurred to me, that if I needed withdraw a little during market downturn, I can't exactly have SA to withdraw only from the less affected "ballast" assets, similar like how you would spend from the bonds assets for a couple years during bad times while waiting for equities to recover.

If I have to withdraw ever I'll just have to realize the whole thing 🤔 This post has been edited by Hoshiyuu: Oct 15 2021, 11:07 PM |

|

|

|

|

|

Oct 19 2021, 11:21 PM Oct 19 2021, 11:21 PM

Return to original view | Post

#194

|

Senior Member

1,210 posts Joined: Nov 2011 |

Today is a good day 👀

|

|

|

Oct 20 2021, 02:04 AM Oct 20 2021, 02:04 AM

Return to original view | Post

#195

|

Senior Member

1,210 posts Joined: Nov 2011 |

yeap XLE is at 18% gain for me, still, only 10% weight

only at 6% loss now, not bad. Expected to be -10% until mid 2023 at least. This post has been edited by Hoshiyuu: Oct 20 2021, 02:05 AM |

|

|

Oct 20 2021, 02:10 AM Oct 20 2021, 02:10 AM

Return to original view | Post

#196

|

Senior Member

1,210 posts Joined: Nov 2011 |

|

|

|

Oct 20 2021, 02:38 AM Oct 20 2021, 02:38 AM

Return to original view | Post

#197

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(xander83 @ Oct 20 2021, 02:34 AM) You bought this ETF or through fund? I bought it at 9.2? I think via ETF, I did lose 1/3 of value. It wasn't too much so I didn't mind. Probably just holding until break even then I'll exit, I didn't like the ETF that much anyway and it was bought when I haven't got an IBKR/Stashaway account If ETF will be a long hold at least 5 years to profit while through fund will be 3 years because smaller depreciation Bought the fund with very minimum amount and just managed to picked up 2 weeks from bottom low and now barely break even at the current level Those who bought ETF at 9 will see 1/3 value lost at the bottom low |

|

|

Oct 20 2021, 07:35 PM Oct 20 2021, 07:35 PM

Return to original view | Post

#198

|

Senior Member

1,210 posts Joined: Nov 2011 |

wow first time see -5% haha

|

|

|

Oct 20 2021, 09:18 PM Oct 20 2021, 09:18 PM

Return to original view | Post

#199

|

Senior Member

1,210 posts Joined: Nov 2011 |

the ironic thing is, I am going to fully withdraw if i hit 10% profit, but I would happily continue DCAing if i lost 30% tomorrow 😂

|

|

|

Oct 22 2021, 03:35 AM Oct 22 2021, 03:35 AM

Return to original view | Post

#200

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(kelvinfixx @ Oct 21 2021, 11:52 PM) Any one try to use fsmone manage fund? the fees is slightly cheaper, but is based on risk portfolio. I think there is a FSMone thread, might be able to get value added reply there, not sure if much people use that in this thread.Subscription Fee 0.00% for Conservative portfolio 0.25% for Moderately Conservative portfolio 0.50% for Balanced portfolio 0.75% for Moderately Aggressive portfolio 1.00% for Aggressive portfolio And their ETF fees charges looks complex. So anyone use it? |

| Change to: |  0.0479sec 0.0479sec

0.41 0.41

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 09:59 AM |