QUOTE(Xenopher @ Jan 10 2021, 10:07 PM)

I disagree. MWR lower than TWR actually means you time the market wrong. Hence putting lumpsum at the beginning and leave it (TWR) is higher than adjusted returns due to cash flows (MWR).

If you DCA consistently and never try to time the market, your MWR will always be higher than TWR due to the auto rebalancing.

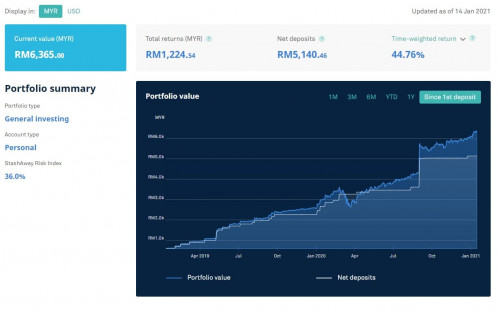

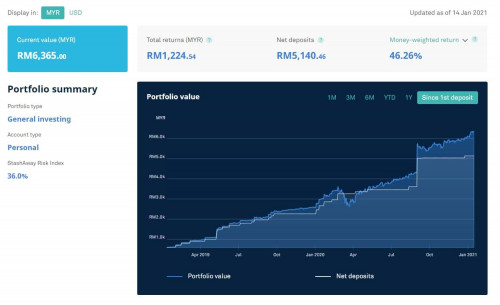

Mine MWR is 8% higher than TWR since last year hence mine timing is right for the past 14 months If you DCA consistently and never try to time the market, your MWR will always be higher than TWR due to the auto rebalancing.

DCA too frequently has the effect of loss of conversion spot rates are high due to flunctuations of exchange only to be masking the true gains because everyone is looking at the number since day 1 deposit not on monthly, quarterly, half yearly, YTD and yearly hence the difference

Mine YTD gain an extra 1.1% last week because of spot FX rate conversion and the right buy order when the USD was the lowest since mid 2017 against the ringgit so you already proven wrong with XIRR formula

This post has been edited by xander83: Jan 11 2021, 06:43 AM

Jan 11 2021, 06:31 AM

Jan 11 2021, 06:31 AM

Quote

Quote

0.4351sec

0.4351sec

1.47

1.47

7 queries

7 queries

GZIP Disabled

GZIP Disabled