Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

wKkaY

|

May 24 2021, 11:51 AM May 24 2021, 11:51 AM

|

misutā supākoru

|

QUOTE(gooroojee @ May 24 2021, 10:54 AM) Sometimes I see a RM150 return on my RM10000 SA fund and I'm tempted to cash out and wait for the funds to drop before I top up again... It just keeps zig zagging between a +150 to -150 range but after a few months it still never actually goes up steadily on average. Now it's negative return again. SA is too slow and unreliable for you to time the stock market. Get an online brokerage account if you want to do that. |

|

|

|

|

|

wKkaY

|

May 24 2021, 05:39 PM May 24 2021, 05:39 PM

|

misutā supākoru

|

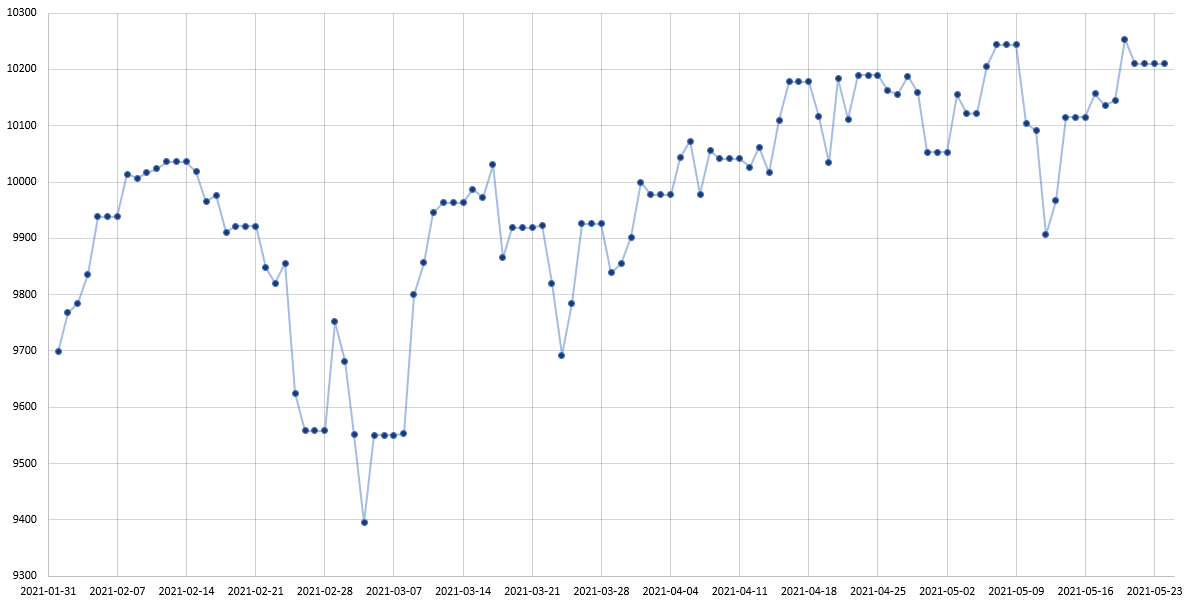

Ok since my previous post got a number of likes I'll explain a bit more. On average it takes 2-3 days for a deposit to take effect on SA. When there's a public holiday, like the recent Hari Raya, it took 6 days. I haven't withdrawn before so I don't know how long that takes, but let's say the sell is done at 1-2 days after placing it. Here's a chart of my portfolio; it's not a lump sum chart but I've adjusted away my regular deposits and normalized it to 10000. Ask yourself, if you were looking at this, at which points would you be making a decision to enter or exit? Would you be profitable if you were to use the price on that decision day? Would you still be profitable if you were to use the price 2-3 days later? That's how much disadvantage you are at when you try to "trade" with SA.  |

|

|

|

|

|

wKkaY

|

May 27 2021, 01:52 PM May 27 2021, 01:52 PM

|

misutā supākoru

|

QUOTE(xander83 @ May 27 2021, 04:07 AM) No because ETF buy order price are different from account to account even though on a same risk profile 2nd any dividends or payout would be less because the lesser the unit size bought less payout or dividends especially for those on fixed incomes and bond ETFs 3rd because of fractional buy order price on ETFs compounding gains would be less compared to consolidated units 1 and 3. SA already said that all accounts that execute on the same day get the same price. It's averaged across them all. But even if it isn't, how does that make the larger portfolio have always better return? Executing at different prices doesn't mean always executing at worse prices. 2. In SA dividends are fractional, so it's the same difference. 20c dividend on 15 units = 20c dividend on 7.5 + 7.5 units. 😅 |

|

|

|

|

|

wKkaY

|

May 27 2021, 08:13 PM May 27 2021, 08:13 PM

|

misutā supākoru

|

QUOTE(xander83 @ May 27 2021, 06:37 PM) The buy price order are determined by the weightage of your portfolio because the markets are fluid hence if any additional cash deposits it will buy the most under weighted equities then only follows back by balancing based on asset allocation % Fractional dividends are given based on unit holdings because if the unit holdings doesn’t meet the requirements of minimum units hence dividends will not be given out because fractional dividends are given to those with minimum requirements of unit holdings with at least 0.1 units If you look at it those accounts less than USD500 chances are because the units are fractional dividends will not be given because it doesn’t meet the required minimum of usd0.01 and for example IVV at USD420 with 10% allocation in 30% SRI the unit holdings 0.1190 units with dividends of usd1 per unit the dividends are only is usd0.001190 hence doesn’t meet the required the ETFs to distribute back the dividends back to the holder Ok.... so you're saying that there's a maximum possible shortfall of 1c for each dividend event. On average there's 2 every month, so in a year that totals 24c or RM1. To put that into perspective, you possibly fall short of one piece of keropok lekor. A year. |

|

|

|

|

|

wKkaY

|

May 29 2021, 01:35 PM May 29 2021, 01:35 PM

|

misutā supākoru

|

At first I simply dismissed him when I saw that his argument was all about the sub-cent range, which I expected anyway from his post history.

But only when Kadaj pointed it out did I realize that he took a round-about way to calculate dividends and it was off by a factor of 10x or 100x (depending on the point he's trying to make).

And that, is the shaky basis of his advice to the married couple 😅

xander oh xander. People here are not trying to weekly DCA the RM100 that they got for duit raya. They are most likely working professionals with considerably more disposable income.

|

|

|

|

|

|

wKkaY

|

Jun 2 2021, 04:04 PM Jun 2 2021, 04:04 PM

|

misutā supākoru

|

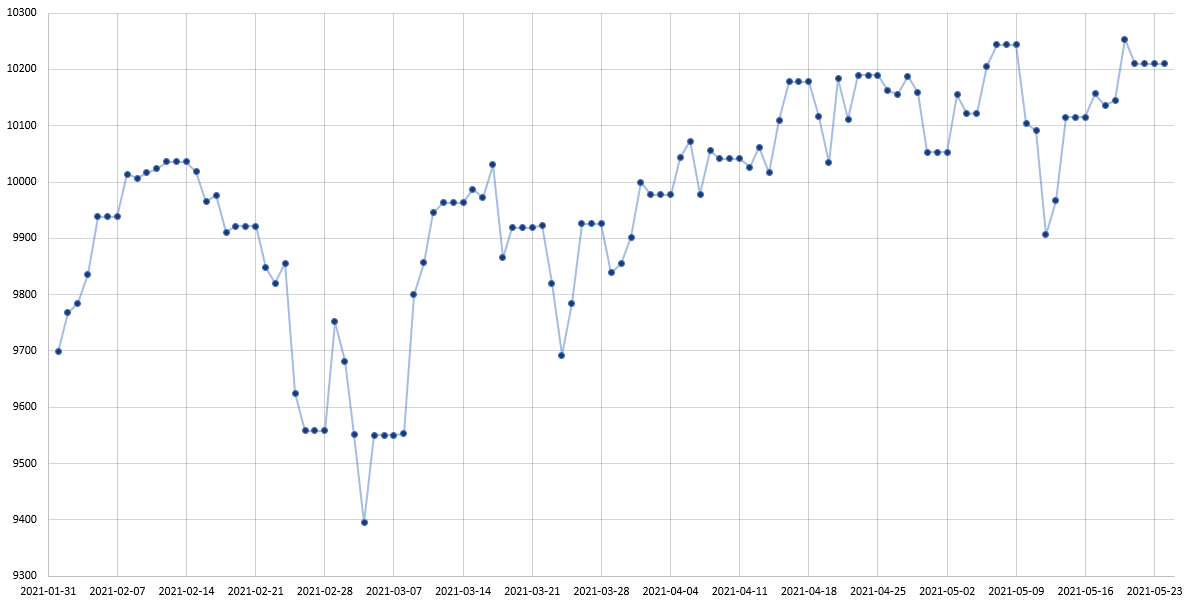

QUOTE(prophetjul @ Jun 2 2021, 11:44 AM) i think we are hitting a top with SA now. i am seeing my portfolio unable to breach this level in the past few weeks. Are you all seeing the same? Not in my case. Here's what my portfolio returns look like on a longer timescale (year to date). The trend has been positive, even in the past few weeks.  |

|

|

|

|

|

wKkaY

|

Jun 7 2021, 11:46 AM Jun 7 2021, 11:46 AM

|

misutā supākoru

|

QUOTE(Tronoh @ Jun 7 2021, 09:10 AM) Depends on what you understand by AI. Using historical ETF performance and risk profile of investor for mean-variance optimisation to determine (or establish the baseline for) the optimal ETF style allocation is classic textbook application of AI. It's the classic textbook application of statistics. |

|

|

|

|

|

wKkaY

|

Jun 15 2021, 01:12 AM Jun 15 2021, 01:12 AM

|

misutā supākoru

|

QUOTE(blibala @ Jun 14 2021, 10:50 PM) Hi. want to ask normally buy order will be based on previous day closing price or current price when market opens? When your deposit is processed, SA calculates the quantities of the individual funds to buy based on the previous closing price. The price SA actually buys it at will depend on the current price when market opens. Detailed info at https://assets.stashaway.com/documents/my/S...tion-Policy.pdf |

|

|

|

|

|

wKkaY

|

Aug 11 2021, 03:39 PM Aug 11 2021, 03:39 PM

|

misutā supākoru

|

Has anyone been charged management fee for August? It usually happens in the first week of the month, but mine hasn't.

I'm curious to see whether the JASON promo worked.

|

|

|

|

|

May 24 2021, 11:51 AM

May 24 2021, 11:51 AM

Quote

Quote

0.3033sec

0.3033sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled