QUOTE(joshtlk1 @ Jun 17 2020, 07:37 PM)

Might as well I transfer from my bank acc directly then. At least that's a couple days fasterInvestment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Jun 17 2020, 07:45 PM Jun 17 2020, 07:45 PM

Return to original view | IPv6 | Post

#21

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

|

|

|

|

|

|

Jul 26 2020, 04:56 PM Jul 26 2020, 04:56 PM

Return to original view | IPv6 | Post

#22

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

Sounds like a good year for SA this time around. I have 11.76% TWR on my 22% portfolio. Though just 11.04% on my 36% portfolio

|

|

|

Jul 28 2020, 07:07 PM Jul 28 2020, 07:07 PM

Return to original view | IPv6 | Post

#23

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

Got glitch? Where? My account seems ok

|

|

|

Jul 28 2020, 07:16 PM Jul 28 2020, 07:16 PM

Return to original view | IPv6 | Post

#24

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

QUOTE(GrumpyNooby @ Jul 28 2020, 07:09 PM) QUOTE(joshtlk1 @ Jul 28 2020, 07:11 PM) SA customer rep explains to me that only those that scheduled a direct deposit yesterday, will be affected. So if you did not you are fine. But I would still recommend deleting your direct deposit with SA at least for now. Until they give a clear explanation of the steps they took to avoid this problem in the future Ah ok it affects direct deposits.I don't have direct deposits with SA. My money goes in via JomPay instead. |

|

|

Jul 29 2020, 12:06 AM Jul 29 2020, 12:06 AM

Return to original view | IPv6 | Post

#25

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

|

|

|

Jul 29 2020, 12:58 AM Jul 29 2020, 12:58 AM

Return to original view | Post

#26

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

QUOTE(!@#$%^ @ Jul 29 2020, 12:56 AM) i agree with the post, other than saying sorry and blaming it on curlec, SAMY didn't really explained what happened. So far I see that they have only reached out to those accounts that have been affected. Though I'm not affected since I used JomPay, i also wanna know what happened since they are managing my money, but no emails came to me about it."On Stashaway’s end, it is extremely important that they will need to be transparent about providing the exact details of: What had happened, What factors caused it to happen, Who the parties responsible for it were, What initiatives StashAway and its Direct Debit service provider, Curlec will be taking to prevent something like this from happening again in the future." |

|

|

|

|

|

Jul 30 2020, 05:13 PM Jul 30 2020, 05:13 PM

Return to original view | IPv6 | Post

#27

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

|

|

|

Jul 30 2020, 05:14 PM Jul 30 2020, 05:14 PM

Return to original view | IPv6 | Post

#28

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

QUOTE(Tronoh @ Jul 30 2020, 04:54 PM) We've just released a post-mortem detailing the root cause of the #DirectDebit issue that happened on Monday, 27 July, and the steps we've taken to prevent this from happening again. Read it here: Why didn't they send this to all customers, not just the ones who are affected?https://t.co/P5emmbNnfe for those who are interested I would also wanna know what happened. But luckily got this forum |

|

|

Jul 30 2020, 05:29 PM Jul 30 2020, 05:29 PM

Return to original view | IPv6 | Post

#29

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

QUOTE(Ancient-XinG- @ Jul 30 2020, 12:43 PM) After all this Saga. One could also use manual debiting methods like Interbank GIRO and JomPay too. Also won't have auto debit issue.I strongly recommend you guys to have auto debit from their own SIMPLE instead of from BANK. Transfer enough money every Q and left it. Let them do their job. Confirm no wrong auto debit issue. I did this to FSM too. I don't do in SA because I want it weekly instead of monthly. Also. Weekly debit is disabled after few months they introduce auto debit. You guys must be saying I bias or what. My investment journey started with ASNB SA FSM RT. I know what am I doing and who to trust. I may be bias, I can be ignorance sometimes but at least I know what am I doing. Plus its a bit faster since your money in Simple needs a few extra days to be liquidated and then only can be used to buy the units in the normal investment accounts. |

|

|

Aug 15 2020, 05:51 PM Aug 15 2020, 05:51 PM

Return to original view | IPv6 | Post

#30

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

QUOTE(Gabriel03 @ Aug 15 2020, 05:42 PM) Mine was removed because I had an existing promotion from referral. Once it has expired a few days ago, Stashaway put back the promo. Oh, thats really nice of them to make sure your 6 months doesn't clash with existing referralThat's way, the 6 months waiver do not concurrently. I wish they did the same for me when I reviewed them on Google Play. They gave a 3 month free management promo, but it had to run concurrently with an existing referral promo I had and so wasted sia honsiong liked this post

|

|

|

Aug 17 2020, 11:17 PM Aug 17 2020, 11:17 PM

Return to original view | IPv6 | Post

#31

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

|

|

|

Aug 27 2020, 02:13 AM Aug 27 2020, 02:13 AM

Return to original view | Post

#32

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

QUOTE(MiKE7LIM @ Aug 26 2020, 10:23 PM) Am waiting for this too. I was surprised when they didn't revise the projected rate even after the OPR cut back in July.With quite a few ppl expecting another 25 bps cut in Sept, it would be interesting to see what happens next |

|

|

Sep 5 2020, 08:24 PM Sep 5 2020, 08:24 PM

Return to original view | Post

#33

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

Quite a big drop yesterday. But at least I'm still in the green.

GLD is the biggest loser. -5% drop since 1 month |

|

|

|

|

|

Sep 24 2020, 09:45 PM Sep 24 2020, 09:45 PM

Return to original view | IPv6 | Post

#34

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

Why are people so concerned over the drop lol? It's just a minor correction. After all, we invest in here for long term kan? Drop a bit is pretty normal. It should resurge sooner or later

|

|

|

Sep 24 2020, 09:48 PM Sep 24 2020, 09:48 PM

Return to original view | IPv6 | Post

#35

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

|

|

|

Oct 25 2020, 11:46 PM Oct 25 2020, 11:46 PM

Return to original view | IPv6 | Post

#36

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

One thing I always wondered. Since one can easily see his/her holdings in Stashaway, wouldn't it be possible for anyone to just replicate the holdings they see in another broker say like eToro? I recently checked and every ETF that Stashaway uses can be bought on eToro or some other broker as well.

Wouldn't this entail more cost savings since you don't need to pay any management fee to SA, especially if you have a fairly large investment amount (RM 50k - RM 100k). You would be exposed to the same risks as in SA since the ETFs are the same and the currency conversion will happen anyway. The ETF expense ratio needs to be paid too. The only fee you need to pay is the spreads for using an online broker, but I suspect this should be cheaper than SA's management fee. In terms of SA sometimes changing their portfolio, it should be no big deal. They very rarely rebalance or reallocate their portfolio anyway (Historically they only reoptimise once a year). If you still have some money within the app, you can easily see the results of any reoptimisation / rebalance excerise and can do it yourself if you want to. Shouldn't take long too since its just selling and buying ETFs in a liquid market Not sure if my logic makes sense or not. Feel free to let me know otherwise This post has been edited by Eurobeater: Oct 25 2020, 11:50 PM |

|

|

Nov 2 2020, 04:34 PM Nov 2 2020, 04:34 PM

Return to original view | IPv6 | Post

#37

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

QUOTE(Green_lemontea @ Nov 1 2020, 11:36 PM) Does anyone know how to unlock this high risk in my portfolio? I wanted to create a new high risk portfolio and buy more. It is still showing as a lock here and I can't click on it. I'm a bit surprised at this cap of risk. Mine was never restricted when I first signed up in May. I can access all 12 portfolios even at the highest risks of 36% risk level without taking any tests. How they evaluate the suitability of the investors during onboarding, I wonder. Thank you. |

|

|

Dec 2 2020, 12:10 AM Dec 2 2020, 12:10 AM

Return to original view | IPv6 | Post

#38

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

I probably was lucky that I started investing near the trough in March. Since then I just DCA every two weeks. I had to increase the amount when I realised I'm holding on to a lot of cash. So far my investments are positive despite the fall in GLD. Still this is luck I suppose. honsiong and WhitE LighteR liked this post

|

|

|

Jan 4 2021, 08:52 AM Jan 4 2021, 08:52 AM

Return to original view | Post

#39

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

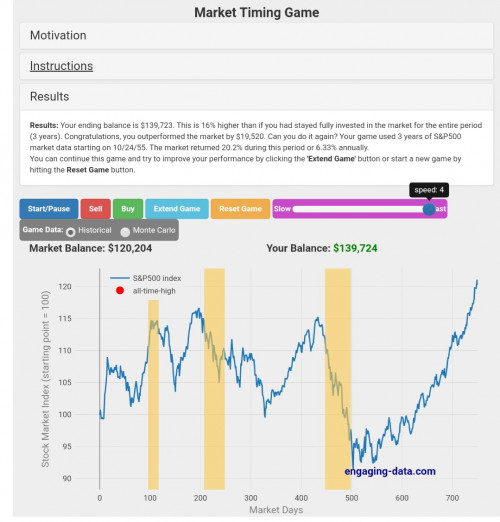

QUOTE(idyllrain @ Jan 1 2021, 11:43 AM) For those who subscribe to the profit-taking ideology when investing in broad market investments, ask yourself this question: what would you do with the cash you have on hand? I got lucky and beat the market on my first try If you think you can predict the market better than pure luck consistently, I invite you to test your skills here: https://engaging-data.com/market-timing-game/  |

|

|

Jan 9 2021, 08:49 PM Jan 9 2021, 08:49 PM

Return to original view | Post

#40

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

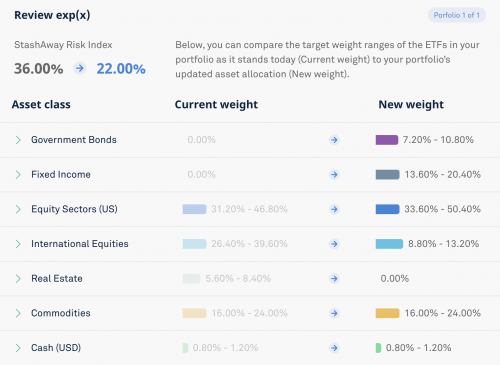

QUOTE(Higgsboson8888 @ Jan 9 2021, 08:43 PM) Hey guys, I've just updated my financial and tax information on StashAway and they sent me an email suggesting a change in my portfolio. While my goal is to maximize the returns, do you think I should accept their recommendation? If yes, can anyone share with us how did they come up with the recommendation (solely for learning purposes) If you don't mind, would it be possible for you to share with us what you may have changed? No need to specific figures, range or numbers like salary is RM100k - RM 120k per year also can. Reason being is to understand the circumstances that may have prompted SA to suggest lowering your portfolio risk. |

| Change to: |  0.4522sec 0.4522sec

0.60 0.60

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 11:59 PM |