Does anyone know if Stashaway deposits can be made using credit cards via JomPay? It seems like its possible under my internet banking page, but I've never tried it.

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Apr 6 2020, 11:20 AM Apr 6 2020, 11:20 AM

Return to original view | IPv6 | Post

#1

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

Does anyone know if Stashaway deposits can be made using credit cards via JomPay? It seems like its possible under my internet banking page, but I've never tried it.

|

|

|

|

|

|

Apr 10 2020, 05:24 PM Apr 10 2020, 05:24 PM

Return to original view | IPv6 | Post

#2

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

Damn, the market is surging a bit. Luckily I bought some two weeks ago. But my risk index is just 18%.

MWR: 7.57% TWR: -0.57% Should have just all in at 36% |

|

|

Apr 10 2020, 05:28 PM Apr 10 2020, 05:28 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

|

|

|

Apr 15 2020, 09:55 PM Apr 15 2020, 09:55 PM

Return to original view | IPv6 | Post

#4

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

Sunk more money in SA and raised my risk index.

Wanna break my usual DCA rule a bit since I have a bit of saving from not going out all the time due to the MCO. Hope I can make a small fortune out of this |

|

|

Apr 30 2020, 03:21 PM Apr 30 2020, 03:21 PM

Return to original view | IPv6 | Post

#5

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

The US markets are performing much better than I thought lol

My TWRR: 3.86% while MWRR: 13.95% I don't know if I want to top up a bit. Europe VGK is still not so good. |

|

|

May 20 2020, 12:53 PM May 20 2020, 12:53 PM

Return to original view | IPv6 | Post

#6

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

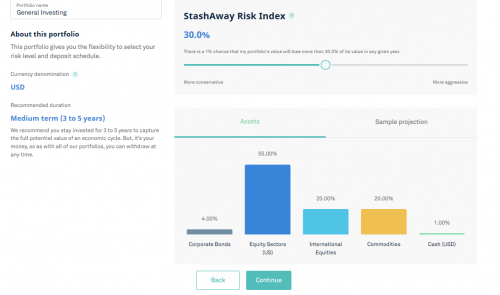

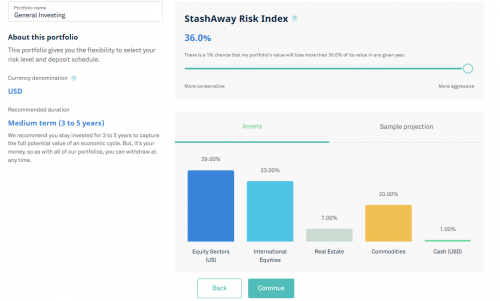

QUOTE(tehoice @ May 20 2020, 09:39 AM) Based on what you know so far, which risk index portfolio has the biggest US equities in the portfolio component? For mine. Its 30% risk index for from the higher risk portfolio. There is 55% US equities in here. Even higher than the 36% risk index, which has more even split between US and International Equities30% risk index  36% risk index  |

|

|

|

|

|

May 22 2020, 12:18 PM May 22 2020, 12:18 PM

Return to original view | IPv6 | Post

#7

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

QUOTE(ahpooki @ May 22 2020, 11:20 AM) started at 36% risk, got burnt initially, switched to 26%. second time went in at 26%, then moved up to 30%, then created another portfolio at 20%. so from experience, if stay at about 26% is generally quite good... Oof, I just started a 36% portfolio alongside my current 22% with just a few hundred RM to see how volatile it looks. Already starting to lose a bit kek |

|

|

May 27 2020, 07:29 PM May 27 2020, 07:29 PM

Return to original view | IPv6 | Post

#8

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

The SA country manager of Malaysia has about RM 70k in his own SA account lol. And he too has some money in the 36% portfolio

|

|

|

May 27 2020, 07:41 PM May 27 2020, 07:41 PM

Return to original view | IPv6 | Post

#9

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

|

|

|

May 27 2020, 07:53 PM May 27 2020, 07:53 PM

Return to original view | IPv6 | Post

#10

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

QUOTE(red streak @ May 27 2020, 07:48 PM) You're forgetting one thing. It might not be legit or it might not even be his own money. Showing off 70k is nothing for a company like SA if it's worth building investor confidence in your platform by showing that you yourself trust them Well, there is no way to truly verify. But he seems nonchalant about showing an account under his name as a demonstration on how to use SA in a recent webninar. I have no reason to distrust him, so.... |

|

|

Jun 5 2020, 11:22 PM Jun 5 2020, 11:22 PM

Return to original view | IPv6 | Post

#11

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

QUOTE(chiangth @ Jun 5 2020, 02:42 PM) Hi, newb here. Have two portfolios. One in 22% and the other in 36%. My main one is the 22% one and most of my money is there, while the 36% one is mostly for fun to see how volatile things can get. So far, the 22% one is faring a bit better with TWRR at 5.20% while the 36% is at 4.55%.May I ask everyone here have different portfolios on different risk index? Or do you only invest in just 1 risk index portfolio? And which risk index do you recommend putting in? I putting in 20% because it has lower corp bond compared to the other lower risk index. Again, I am really a novice in investing so seeking a little advise from various sifus here. Generally, which risk index would depend on your goals. If you aim to invest in long-term (i.e. 5 - 10+ years), then risky portfolios may be better. Mainly coz of a chance to get a higher return while having plenty of time to recover from losses if you have any. If you need the money on a shorter term basis, go for safer ones (<18% risk index). Less of a chance of losing capital. Don't worry if you don't know anything about investing. The beauty about StashAway is you don't need to know much about investing to earn satisfactory return. Just choose a risk level that you're comfortable with, deposit on a periodic basis (once a month or so) and relax. This post has been edited by Eurobeater: Jun 5 2020, 11:24 PM |

|

|

Jun 5 2020, 11:27 PM Jun 5 2020, 11:27 PM

Return to original view | IPv6 | Post

#12

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

|

|

|

Jun 6 2020, 04:58 PM Jun 6 2020, 04:58 PM

Return to original view | IPv6 | Post

#13

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

Portfolio is really surging now. The S&P 500 is almost back at its pre-COVID19 crash levels.

|

|

|

|

|

|

Jun 6 2020, 08:54 PM Jun 6 2020, 08:54 PM

Return to original view | IPv6 | Post

#14

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

|

|

|

Jun 11 2020, 08:10 PM Jun 11 2020, 08:10 PM

Return to original view | Post

#15

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

Oof, value dropping a bit. But still in the black so no big deal

|

|

|

Jun 12 2020, 06:11 PM Jun 12 2020, 06:11 PM

Return to original view | Post

#16

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

Time to put in some more money lol

|

|

|

Jun 13 2020, 02:56 PM Jun 13 2020, 02:56 PM

Return to original view | IPv6 | Post

#17

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

QUOTE(zhuanko @ Jun 13 2020, 03:22 AM) Hey guys, am very new with SA. I briefly read the thread it does look like they perform well in uptrend? As far as I'm aware, they do not trade actively or take short positions. All they do is buy ETFs and hold for long periods of time. Some re-balancing probably to your portfolio if needed. Every now and then (Once per year), they will re-optimise your portfolio by buying new assets.Do they short when the market is down? |

|

|

Jun 15 2020, 10:30 AM Jun 15 2020, 10:30 AM

Return to original view | IPv6 | Post

#18

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

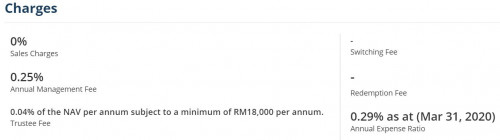

QUOTE(GrumpyNooby @ Jun 15 2020, 10:12 AM) The underlying fund has its own charges. It seems cheaper to buy into the fund via SA. The annual expense ratio in the app is 0.165%, after rebates.There's no charges for buying into or selling the fund like you buy from FSM:  Anyway, just put in RM 500 to see how much I can make in a month and see how fast the withdrawal might take |

|

|

Jun 15 2020, 10:58 AM Jun 15 2020, 10:58 AM

Return to original view | IPv6 | Post

#19

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

QUOTE(xcxa23 @ Jun 15 2020, 10:51 AM) The annualised for the fund is around 3.3% Probably those annualised returns were when the OPR was higher. This year the OPR fell about 1.5% compared to last year anyway.But SA only give projected 2.4% Hmm.. Downside for buying directly, the completion date for buy and sell will take up to 5 business days Wondering how SA will do. I remember saw SA sg user complain it take at least 3 working days. The long processing time is a slight issue. Esp when this one doesn't involve buying ETFs and hence shouldn't take so long |

|

|

Jun 15 2020, 11:00 AM Jun 15 2020, 11:00 AM

Return to original view | IPv6 | Post

#20

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

QUOTE(joshtlk1 @ Jun 15 2020, 10:48 AM) Same. I some money in it to test out the feature. Also, Stashaway should design something like Simple, but shorten their processing time when transferring to investment portfolio. It seems like this is one of the most common pain points among forumers here. My thoughts exactly on the processing times. Since SA Simple involves buying units in a fund and not ETFs overseas, it shouldn't need to take longer than if you went to buy units directly in FSM.Hopefully, they can shorten the deposit and withdrawal times significantly. |

| Change to: |  0.3265sec 0.3265sec

0.41 0.41

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 10:56 PM |