Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

preducer

|

Mar 4 2020, 05:14 PM Mar 4 2020, 05:14 PM

|

|

QUOTE(xcxa23 @ Mar 4 2020, 04:44 PM) I'm just curious Can any of you 36% risk post SS of the asset? From my observation The asset Energy are very underperforming even before the virus issue [attachmentid=10441157] I reduced the risk to 30% just to get rid of energy which is going down the drain |

|

|

|

|

|

preducer

|

Mar 4 2020, 05:18 PM Mar 4 2020, 05:18 PM

|

|

QUOTE(GrumpyNooby @ Mar 4 2020, 05:17 PM) At 30% don't have XLE?  No instead they replaced it with GLD and XLP |

|

|

|

|

|

preducer

|

Mar 4 2020, 05:37 PM Mar 4 2020, 05:37 PM

|

|

QUOTE(xcxa23 @ Mar 4 2020, 05:23 PM) Interesting Mind sharing the screenshot of all the holding in 30%? And may I know when is your 1st deposit? They removed XLC XLE and added XLP GLD. I started off in Dec 2018 but i withdrew everything in Dec 2019 and started fresh again in Jan 2020 with 2 portfolios 6.5% and 36% equally split. |

|

|

|

|

|

preducer

|

Mar 4 2020, 06:03 PM Mar 4 2020, 06:03 PM

|

|

QUOTE(bourse @ Mar 4 2020, 05:53 PM) how is the 6.5% and 36% performance so far? The 36 has been reduced to 30 which is currently doing really really bad but atleast 6.5 is holding relatively alright bc of 99% is on fixed income. Reason I setup my portfolios in this way bc i don't want any overlapping etf. |

|

|

|

|

|

preducer

|

Mar 4 2020, 10:06 PM Mar 4 2020, 10:06 PM

|

|

QUOTE(honsiong @ Mar 4 2020, 08:14 PM) I think its bout 60% fixed income. 99% fixed income is also very volatile. It helps to cushion the losses from 30% which is what im hoping for |

|

|

|

|

|

preducer

|

Mar 8 2020, 01:04 PM Mar 8 2020, 01:04 PM

|

|

QUOTE(Barricade @ Mar 8 2020, 09:22 AM) New to StashAway. Any idea if I should deposit lump sum RM12k or spread it twelve months of RM1k? The market looks very attractive at the moment but nobody knows how low can it go. I would suggest if you cash other than that 12k, use that future cash to dca and put lump 12k now. Ringgit not gonna get any stronger against usd. |

|

|

|

|

|

preducer

|

Mar 11 2020, 11:04 PM Mar 11 2020, 11:04 PM

|

|

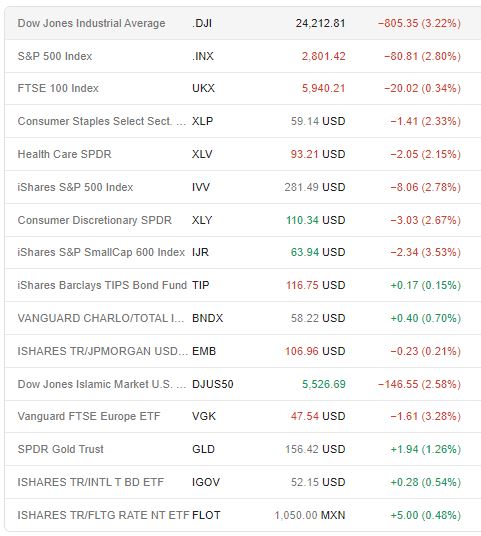

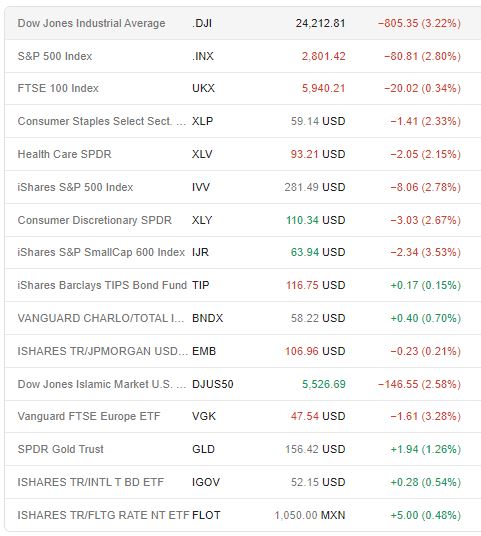

QUOTE(palm05wince @ Mar 11 2020, 10:12 PM)  I believe this is majority of the ETF selected by Stashaway. Ratio will be dependent on your risk profile |

|

|

|

|

|

preducer

|

Mar 21 2020, 09:08 PM Mar 21 2020, 09:08 PM

|

|

It's good now they allowed you to invest even tho you have drb. Last time they would reject you outright

|

|

|

|

|

|

preducer

|

Apr 4 2020, 09:07 PM Apr 4 2020, 09:07 PM

|

|

QUOTE(MNet @ Apr 4 2020, 09:01 PM) Any reason why they can't release? The numbers are not high enough I guess. It was asked before in an interview with astro. |

|

|

|

|

|

preducer

|

Apr 5 2020, 10:21 PM Apr 5 2020, 10:21 PM

|

|

Most of the concerns/questions are already answered in the faq.

|

|

|

|

|

|

preducer

|

Apr 16 2020, 09:14 PM Apr 16 2020, 09:14 PM

|

|

QUOTE(afif737 @ Apr 16 2020, 06:12 PM) 33 years to retirement (age 65). For me I do diversify, but using money from my salary and investments, not EPF. Personally I try to achieve my financial target outside of EPF without using money contributed into EPF. For me EPF money, no touchy touchy :lol2: . Just my opinion though. Hopefully we all live long enough to see the money  |

|

|

|

|

|

preducer

|

May 21 2020, 05:46 PM May 21 2020, 05:46 PM

|

|

QUOTE(GrumpyNooby @ May 21 2020, 05:09 PM) Just discovered that their 6.5% and 8% portfolio has exposure to Japanese equity.  insignificant |

|

|

|

|

|

preducer

|

May 29 2020, 10:15 PM May 29 2020, 10:15 PM

|

|

QUOTE(kelvinfixx @ May 29 2020, 09:10 PM) Unit trust funds, same like bimb's robo |

|

|

|

|

|

preducer

|

May 29 2020, 10:22 PM May 29 2020, 10:22 PM

|

|

QUOTE(GrumpyNooby @ May 29 2020, 10:18 PM) Like that, don't waste my time!  It's clearly stated on their website. Let's just wait for them to officially launch and see what's their offering "Raiz recommends a portfolio based on your financial situation and goals. Every portfolio is structured with unit trust funds from a reputable unit-trust management company" This post has been edited by preducer: May 29 2020, 10:25 PM |

|

|

|

|

|

preducer

|

May 29 2020, 10:28 PM May 29 2020, 10:28 PM

|

|

QUOTE(GrumpyNooby @ May 29 2020, 10:25 PM) Because I can't see their offerings in MY website. I went to AU website: The portfolios are constructed using ETFs quoted on the Australian Securities Exchange. As with all investments there are risks dependent upon the performance of the markets, interest rates and the economy. https://raizinvest.com.au/u cannot compare like that I guess, different country different offering, same like any other robos but u definitely cant find any 'ETF' on malaysian site |

|

|

|

|

|

preducer

|

May 31 2020, 02:37 PM May 31 2020, 02:37 PM

|

|

QUOTE(MNet @ May 31 2020, 11:46 AM) If pay by jompay, how much SA need to absorb the jompay fee? |

|

|

|

|

|

preducer

|

May 31 2020, 03:27 PM May 31 2020, 03:27 PM

|

|

QUOTE(GrumpyNooby @ May 31 2020, 03:18 PM) The recurring deposit is using direct debit (FPX) right? They have same fee structure? |

|

|

|

|

|

preducer

|

May 31 2020, 03:40 PM May 31 2020, 03:40 PM

|

|

QUOTE(GrumpyNooby @ May 31 2020, 03:30 PM) JomPay is at least 15 cents lower from what I read: if they want me to use direct debit then they have to absorb the fees to make it enticing. as of now im still sticking with jompay, dont see any reasons/benefits to use other methods |

|

|

|

|

|

preducer

|

Jun 4 2020, 02:41 AM Jun 4 2020, 02:41 AM

|

|

QUOTE(no6 @ Jun 4 2020, 02:27 AM) Hi all, newly registered with SA without clicking on any referral. is there any way that still can get the 6 months fee waiver? TQ try entering code in promotion, no harm trying |

|

|

|

|

|

preducer

|

Jun 19 2020, 03:49 PM Jun 19 2020, 03:49 PM

|

|

I guess many ppl dont really understand the concept behind robo advisory.

|

|

|

|

|

Mar 4 2020, 05:14 PM

Mar 4 2020, 05:14 PM

Quote

Quote

0.4628sec

0.4628sec

1.27

1.27

7 queries

7 queries

GZIP Disabled

GZIP Disabled