Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

woonsc

|

May 31 2020, 11:39 PM May 31 2020, 11:39 PM

|

|

QUOTE(stormseeker92 @ May 31 2020, 10:28 PM) True. However I'll DCA only until the SP500 reached peak pre-COVID and once it stabilizes. I have one question. If suddenly the stock market drops again and lower than March lows, and Gold increases in price which increases their weightage in portfolios while other ETFs dips following the stock drop, will SAMY sell some of the GLD to balance out the weightages? If you lump sum, they will. But if you dca, they will just top up on the under performing funds This post has been edited by woonsc: Jun 1 2020, 07:41 AM |

|

|

|

|

|

woonsc

|

Jun 1 2020, 07:41 AM Jun 1 2020, 07:41 AM

|

|

QUOTE(GrumpyNooby @ May 31 2020, 11:41 PM) How come contradicting? Am I interpreting correctly? Under performing funds* I typo sorry. |

|

|

|

|

|

woonsc

|

Jun 1 2020, 10:10 PM Jun 1 2020, 10:10 PM

|

|

2.9% haha maybe that's before the OPR Drop haha

hard to maintain that high when FD rates are droping left right and centre.

|

|

|

|

|

|

woonsc

|

Jun 2 2020, 12:53 AM Jun 2 2020, 12:53 AM

|

|

QUOTE(Ash_bellerin @ Jun 2 2020, 12:48 AM) Hi, off tangent a bit. I came across another robo-advisor - Syfe. It seems like it is only available in Singapore. Is anyone here investing with Syfe too? They have a Global and REIT protfolio. Wondering if there is any comparisson that can be made between them and SA, and if it is worth it for someone looking for dividend investment. Link: https://www.syfe.com/I just invested into it yesterday. You need referral code? Not bad for a diversified reit. |

|

|

|

|

|

woonsc

|

Jun 3 2020, 09:57 PM Jun 3 2020, 09:57 PM

|

|

QUOTE(stormseeker92 @ Jun 3 2020, 09:46 PM) Funny to see profits in USD going up but in MYR remains the same even reduced a bit. Go Malaysia! Well MYR strengthen.. I wish it strengthen when economy is good. Weaken when down times like this. So when top up, buy more.. When no money, can earn more.. |

|

|

|

|

|

woonsc

|

Jun 4 2020, 09:27 AM Jun 4 2020, 09:27 AM

|

|

QUOTE(no6 @ Jun 4 2020, 02:47 AM) voucher cannot be applied.... sigh You can msg them, say you forgot to key in referral. |

|

|

|

|

|

woonsc

|

Jun 6 2020, 02:48 PM Jun 6 2020, 02:48 PM

|

|

QUOTE(blibala @ Jun 6 2020, 02:37 PM) Lolz. RM strengthening really not good. I got daily negative return despite yesterday us market increased so muxh...  dump in more, buy more |

|

|

|

|

|

woonsc

|

Jun 8 2020, 04:36 PM Jun 8 2020, 04:36 PM

|

|

QUOTE(ChipZ @ Jun 8 2020, 04:35 PM) I just reg an account. Too late for referal? Still can msg them and get referral. SG or MY?  |

|

|

|

|

|

woonsc

|

Jun 8 2020, 07:29 PM Jun 8 2020, 07:29 PM

|

|

QUOTE(stormseeker92 @ Jun 8 2020, 05:49 PM)  22% Risk MYR TWR -2.89% MWR +14.24% USD TWR -4.71% MWR +16.44% Looking forward for longer bulls   better to have dips once in a hwile, then can buy in cheap once in a while  |

|

|

|

|

|

woonsc

|

Jun 9 2020, 11:41 PM Jun 9 2020, 11:41 PM

|

|

QUOTE(honsiong @ Jun 9 2020, 06:30 PM) Oh wow same here. IJR getting sold, even with weekly DCA. 14 May was my last sell date, risk 36% no selling.. |

|

|

|

|

|

woonsc

|

Jun 11 2020, 07:33 PM Jun 11 2020, 07:33 PM

|

|

QUOTE(stormseeker92 @ Jun 11 2020, 07:24 PM) A red day but a welcome one. Can get more out of our deposit. Hopefully it doesnt go lower than March lows. LOL US weaker, MArket down. win win   |

|

|

|

|

|

woonsc

|

Jun 15 2020, 12:18 PM Jun 15 2020, 12:18 PM

|

|

QUOTE(cl.t @ Jun 15 2020, 12:13 PM) Wouldn't it be too risky to park everything with SA? I have 70% of non-FD investment with SA, and another 30% with eToro. My FD portfolio is 2 times more than non-FD investment, yielding shitty return @ 2.10% but at least protected by PIDM. Hesitating if wanna switch to SA-Simple just for the sake of additional 0.30%.      My investment portfolio also 90% SA, others is like Bursa..  but increasing the bursa portion |

|

|

|

|

|

woonsc

|

Jun 16 2020, 09:24 AM Jun 16 2020, 09:24 AM

|

|

QUOTE(John91 @ Jun 16 2020, 08:57 AM) 20k may be alot for you but spare change for others  If continue to DCA but cap at 10k kinda defeats the point innit? DCA your comfortable amount, long enough you will definately reach and surpass your targets.  |

|

|

|

|

|

woonsc

|

Jun 19 2020, 06:07 PM Jun 19 2020, 06:07 PM

|

|

QUOTE(joshtlk1 @ Jun 19 2020, 05:08 PM) So if you DCA more than usually is it considered as DCA? Say I add 500 every month, now I decided to add 100 every month, and then next year I add 200 every month instead. Lol... So is that still dca?  I do this too! When got extra saved, then dca more..  |

|

|

|

|

|

woonsc

|

Jun 20 2020, 10:49 AM Jun 20 2020, 10:49 AM

|

|

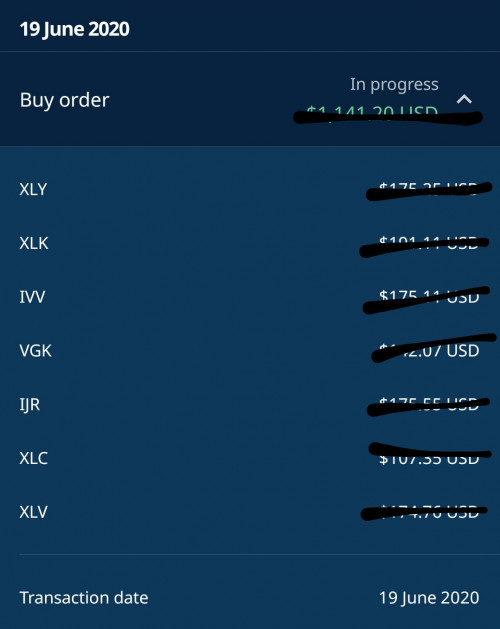

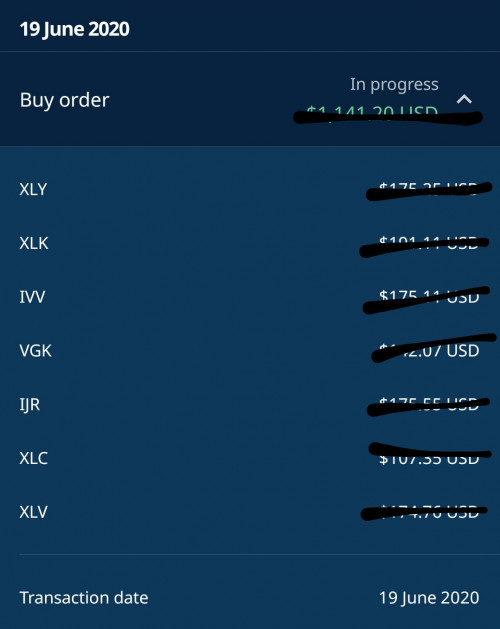

QUOTE(backspace66 @ Jun 20 2020, 02:38 AM) I see no problem for XLY, XLV and IJR since those are part of the bulk of other portfolio. What i can see as well , they are no longer executing any buy for XLE(at least for my case), and almost 20% of fresh fund was not allocated to any investment (in cash) for 2-3days after confirmation on the deposit. Although 80% of the fresh fund is executed on day 1 itself. Btw, this is latest deposit. 80++% allocated to US market.  China allocation is good thou, don't you want to switch? And woah haha I can see 5k lump sum.. |

|

|

|

|

|

woonsc

|

Jun 20 2020, 10:54 AM Jun 20 2020, 10:54 AM

|

|

QUOTE(thesnake @ Jun 20 2020, 10:52 AM) so far on 36% risk, i am getting about 6.8% returns. Have been DCA every week RM1K with no failure. I plan to do some minor lump sum (10k - 20k) when market is down, as i have about rm200k funds ready parked aside. Did you lump sum in the march crash? I feel if you deposited close to the low, you could have ++20% Envy you guys with big wallets, been trying hard to put as much as I can each month.. |

|

|

|

|

|

woonsc

|

Jun 20 2020, 11:12 PM Jun 20 2020, 11:12 PM

|

|

QUOTE(wendygoh @ Jun 20 2020, 11:06 PM) Do u alllocate ur portfolio to Simple portfolio? Wendy Goh from KK, Sabah? HAHA Well, Simple can be your place to put your Bank Savings Account balance in. Not that liquid, redrawal more then 4 days, but better then FD with lock in tenure.  maybe keep 1 month expense in Bank Account, the rest can be in Simple.  |

|

|

|

|

|

woonsc

|

Jun 20 2020, 11:20 PM Jun 20 2020, 11:20 PM

|

|

QUOTE(seanlam @ Jun 20 2020, 11:17 PM) can even move to other money market fund should the return are higher Stashaway Simple is Money Market Fund already. It's just the branding, I took a look at the fund, the historical returns was around 3% per annum, they put it 2.4% just because interest rate is coming down.  |

|

|

|

|

|

woonsc

|

Jun 23 2020, 05:50 PM Jun 23 2020, 05:50 PM

|

|

QUOTE(bourse @ Jun 23 2020, 05:45 PM) Example: Health Care Select Sector SPDR Fund (XLV) | Decl Date | Ex Date | Rec Date | Pay Date | Amount $ | | Jun. 19, 2020 | Jun. 22, 2020 | Jun. 23, 2020 | Jun. 25, 2020 | 0.425 |

net dividend after 30% WHT 0.425 x 0.70 = 0.2975 0.2975 X the XLV unit before 22/6/2020 = the net dividend received. it will record in the transaction and bank into your SAMY cash account. This dividend can be use for next purchase. https://www.dividendinvestor.com/dividend-h...ory-detail/xlv/ I thought 0.425 is after tax?  |

|

|

|

|

|

woonsc

|

Jun 23 2020, 05:56 PM Jun 23 2020, 05:56 PM

|

|

QUOTE(GrumpyNooby @ Jun 23 2020, 05:54 PM) 0.425 is gross dividend. 0.2975 is nett dividend. What i meant is the dividend value we see from stashaway is Nett dividend right? w  sorry i misunderstood your post/. |

|

|

|

|

May 31 2020, 11:39 PM

May 31 2020, 11:39 PM

Quote

Quote

0.8331sec

0.8331sec

0.47

0.47

7 queries

7 queries

GZIP Disabled

GZIP Disabled