QUOTE(Avangelice @ Mar 3 2024, 05:00 PM)

I hope I'm not derailing the topic but I feel my situation suits it as I operate my own business where I put myself as an employee. To use the tax relief and off set the corporate tax vs personal tax.

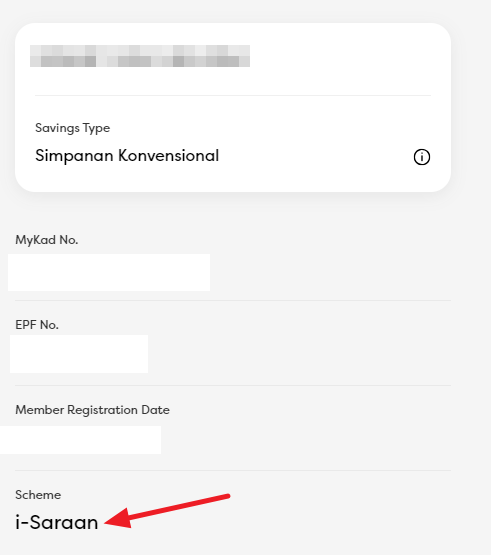

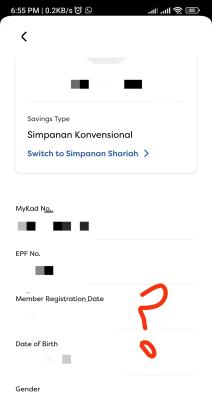

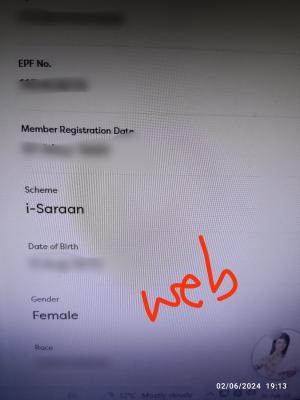

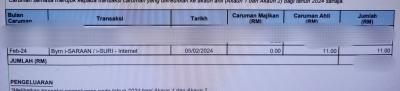

That said I have been toying the idea of removing myself as an employee to stop my contribution to epf. It wasn't today's interest that pissed me off is that there isn't any public audit of epf to explain why conventional was near equal to syariah

EXACTLY. Weird huh, this cannot invest, that cannot invest.

But returns almost on par. Oh well....

QUOTE(Wedchar2912 @ Mar 3 2024, 05:34 PM)

still want to contribute more after today's spectacular result that defies logic? lol...

on serious note, employee's contribution technically can be 100%, but it all depends on the HR department + all other deductions such as socso and taxes.

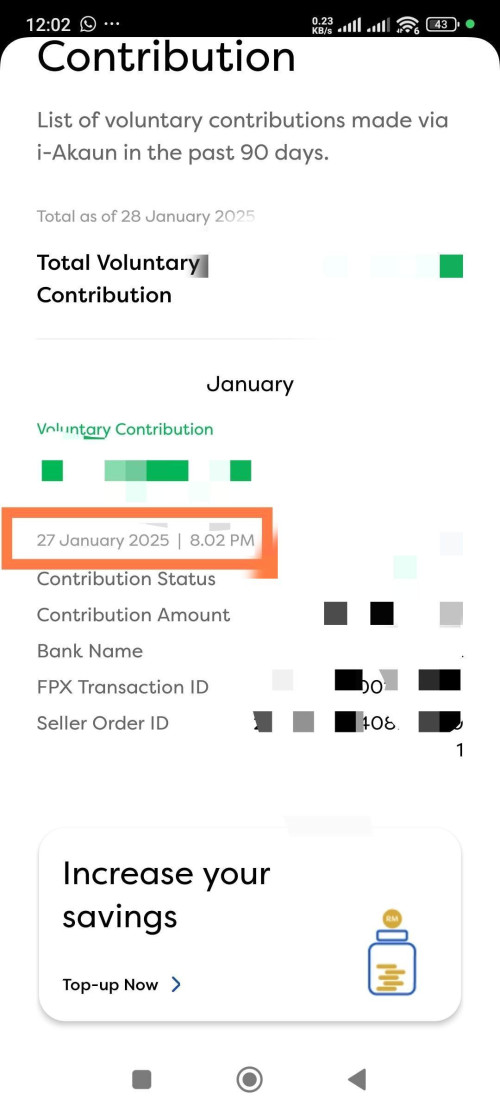

furthermore, the form to fill is "additional topup" on top of the statutory rate of 11% currently. so, the max one can write is 89%.

Still better than FD for now. It's OK, as and when we behsong, we can just withdraw.

This post has been edited by sweetpea123: Mar 4 2024, 01:48 AM

Feb 6 2024, 10:12 AM

Feb 6 2024, 10:12 AM

Quote

Quote

0.0296sec

0.0296sec

0.79

0.79

7 queries

7 queries

GZIP Disabled

GZIP Disabled