QUOTE(max880930 @ Mar 1 2019, 04:24 AM)

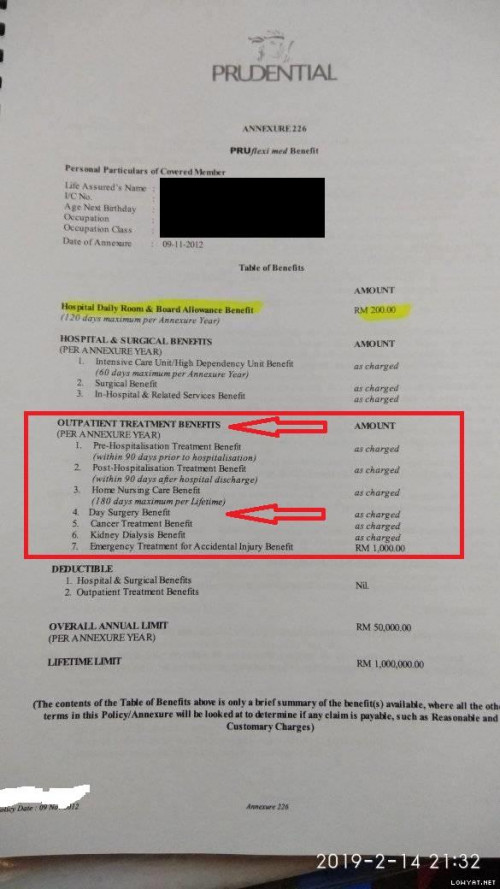

Thanks for your long details which alot prudential agent arent well trained in all this anyway. What happen on that day was Agent and I called Customer service, even agent confirmed our old plan doesnt cover any day surgery Or outpatient treatment due to any illness even you fainted unless accident.

As i say, i RECORDED the full calling to customer service and they confirmed MANY times ANY outpatient/day surgery is not cover for our old plan. Pruflexi med

I can confirm to you that Day Surgery benefit is applicable to ALL Prudential medical card (irrespective of old or new). As mentioned earlier, the reason for the insurer to have the Day Surgery Benefit is to cut the cost of having minor admission.

I believe the Customer Service has misunderstood on your request and for that I do apologise as they are not directly involved in the claims process. There are a lot of things not made known to the Customer Service especially when it comes to claims

For example the cataract surgery, before the introduction of the Day Surgery Benefit, the client will still need to be admitted for 1 day even though it is not required. This incur room charges of 1 day, which translates to extra cost to the insurer.

For your information, the Day Surgery Benefit is a PRE-PLANNED, non emergency day surgical procedure with the ISSUANCE of Guarantee Letter.

This has to be applied 7 days before the intended surgery. The benefit of this is that the client do not need to wait for the issuance of the Guarantee Letter. This means that it has to be requested by a Panel Hospital, but unfortunately in your case, PPUM is not under a panel hospital.

Since you had been admitted to the PPUM, for the PPUM claims, my advice is to get the Dr to write the Doctor’s Report as stated in my previous reply.

QUOTE

RAI 131 Is consider as radiotherapy which can be opt for day surgery.

Radioactive iodine treatment is a type of internal radiotherapy. The treatment uses a radioactive form of iodine called iodine 131 (I-131).

STILL, Alot agent Assume that Day surgery is cover for old plan and didnt INFORM THEIR CUSTOMER TO CHANGE TO NEW PLAN immediately which CAUSING WHAT HAPPEN AS NOW.

I believe the confusion is due to Customer Service and how Day Surgery works. In your case for PPUM, you should claim under normal admission, not under day surgery.

QUOTE

IF ITS COVER,WHATS THE POINT IM SPENDING MONEY FOR ADMISSION UNKNOWN CLAIMABLE OR NOT. LUCKY THAT I HAVE SOME CASH.

PAY AND CLAIM WITH UNKNOWN ITS CLAIMABLE OR NOT CAUSE THEY CONFIRMED NOT COVER. IF YOU ARE ADMITTED TO GOVERNMENT HOSPITAL DUE TO EMERGENCY AND PRUDENTIAL WILL SAY SORRY GOVERNMENT IS NOT PANEL, PLEASE TRANSFER TO OTHERS HOSPITAL. IF YOU CHOOSE TO DO AT GOVERNMENT HOSPITAL CAUSE URGENT DEADLY..PAY YOURSELF AND CLAIM LATER FOR THAT 20K+...ROFL..

May I concur that you were not informed by your agent that if you were admitted to a non-panel hospital, you need to pay and file a claim later? If that is the case, at least you may feed back to your agent for his/her improvement.

Yes it is a known fact that if you are admitted to a non-panel, it is on reimbursemnent basis aka, PAY AND CLAIM, irrespective of ANY INSURER.

If you are overseas on a holiday, unless it is accidental, you will also need to pay and claim and the reimbursement will be customary to what is being charged in a hospital in Malaysia. For eg, dengue at Singapore, cost SGD 8K, of which you will only be reimbursed RM10K.

There are many reasons why some hospitals are not a panel for the insurer as there are lots of criteria to qualify to be a panel. The Medical Insurance is a MULTI-MILLION ringgit business and for us to qualify the hospital, it has to be of certain standards, from the equipments, specialist, facilities, billings, comformance of standards and many more.

The medical reports/test & billing details must be made available to the insurer when a person is admitted to the hospital. Some of the doctor reports can only be given after 2 months, in

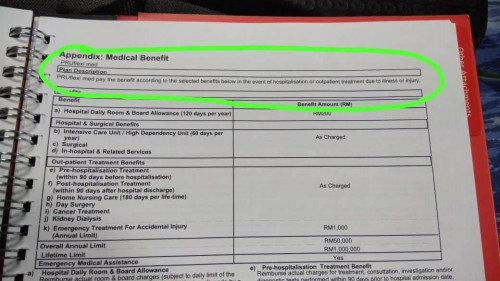

which directly translates to delay in paying the claims to the customer.FYI the PruFlexi Med will reimburse the room differences back to the customer, eg, if your room is RM200, and you stayed in a RM150 room, Prudential will reimburse RM50/day once you are discharged from the panel hospital. The fastest reimbursement that I had seen is 5 working days upon discharge. Of course all these are with facts and proof, not simply bla at an open forum

QUOTE

Can you confirm to us here GOVERNMENT hospital is cover or not? i called the hotline they say not cover.. so if accident or emergency..die die must go panel hospital...if not pay yourself ..

Attachment is private wing for um hospital..prudential is not in although almost all insurance company is there.. Beware prudential owner..

See above on the process for getting treatment at a non-panel hospital.

This post has been edited by roystevenung: Mar 1 2019, 09:40 AM

Feb 28 2019, 12:29 AM, updated 7y ago

Feb 28 2019, 12:29 AM, updated 7y ago

Quote

Quote

0.0237sec

0.0237sec

0.92

0.92

5 queries

5 queries

GZIP Disabled

GZIP Disabled