QUOTE(sjteh @ May 13 2019, 10:58 AM)

hello, give me a bit story for me to elaborate. Are you currently working?[DIY] S&P 500 Index w/ 0.07% Annual Fee, Buy the best companies in the world

[DIY] S&P 500 Index w/ 0.07% Annual Fee, Buy the best companies in the world

|

|

May 13 2019, 08:19 PM May 13 2019, 08:19 PM

|

Senior Member

2,275 posts Joined: Jun 2010 |

|

|

|

|

|

|

May 13 2019, 09:05 PM May 13 2019, 09:05 PM

|

Senior Member

1,042 posts Joined: Jan 2003 |

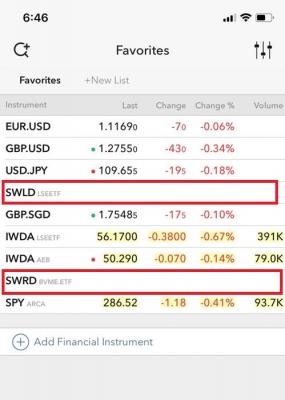

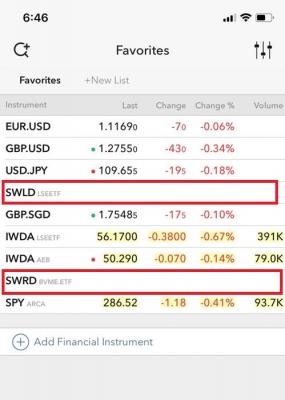

QUOTE(alexkos @ May 13 2019, 10:09 AM) Hehe... Found another convert. To become a member, you're required to disclose your asset allocation and fund size (joke). Great - SPDR's SWRD 0.12% Total Expense Ratio vs iShares' IWDA 0.2%. Once the volume and AUM grows (which shouldn't be too long), I'll start collecting unless iShares drop their TER to compete.Happy on board. Feel free to contribute. Gula: SPDR new fund on all world index launched Jan 2019. |

|

|

May 13 2019, 09:16 PM May 13 2019, 09:16 PM

|

Senior Member

2,275 posts Joined: Jun 2010 |

QUOTE(roarus @ May 13 2019, 09:05 PM) Great - SPDR's SWRD 0.12% Total Expense Ratio vs iShares' IWDA 0.2%. Once the volume and AUM grows (which shouldn't be too long), I'll start collecting unless iShares drop their TER to compete. ya....itu new Spider macam gooding..... now i'm still with SP500, if in out the commission fee quite pain for now.... |

|

|

May 13 2019, 09:59 PM May 13 2019, 09:59 PM

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(alexkos @ May 13 2019, 09:16 PM) ya....itu new Spider macam gooding..... now i'm still with SP500, if in out the commission fee quite pain for now.... You have the option to keep it, and add all world index ETF from now on. Lump both as your global portion, and when it's time to rebalance and sell global because it is over weighted in your portfolio - sell SXR8 first. |

|

|

May 13 2019, 11:13 PM May 13 2019, 11:13 PM

|

Senior Member

2,275 posts Joined: Jun 2010 |

|

|

|

May 14 2019, 01:28 PM May 14 2019, 01:28 PM

|

Junior Member

222 posts Joined: May 2010 |

|

|

|

|

|

|

May 14 2019, 03:32 PM May 14 2019, 03:32 PM

|

Senior Member

2,106 posts Joined: Jul 2018 |

what is FI? lol, Fund index?

|

|

|

May 14 2019, 04:12 PM May 14 2019, 04:12 PM

|

Senior Member

1,004 posts Joined: Oct 2007 |

|

|

|

May 14 2019, 04:13 PM May 14 2019, 04:13 PM

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

May 14 2019, 04:15 PM May 14 2019, 04:15 PM

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

May 14 2019, 04:22 PM May 14 2019, 04:22 PM

|

Senior Member

1,042 posts Joined: Jan 2003 |

|

|

|

May 14 2019, 07:25 PM May 14 2019, 07:25 PM

|

Senior Member

2,275 posts Joined: Jun 2010 |

|

|

|

May 14 2019, 07:26 PM May 14 2019, 07:26 PM

|

Senior Member

2,275 posts Joined: Jun 2010 |

QUOTE(sjteh @ May 14 2019, 01:28 PM) Yea. It's been working for 10yrs and still shifting FI goal post due to family commitment. Hopefully can FI in 5-10yrs time. gooding boss. You are way ahead of me, I should learn from you instead.By the way you talk, I suppose you already know what you need to do. Like budgeting, live below means, indexing etc. |

|

|

|

|

|

May 14 2019, 09:42 PM May 14 2019, 09:42 PM

|

Junior Member

222 posts Joined: May 2010 |

QUOTE(alexkos @ May 14 2019, 07:26 PM) gooding boss. You are way ahead of me, I should learn from you instead. Have been silent reader in lyn for few years and finally brave enough to put some words in this space.By the way you talk, I suppose you already know what you need to do. Like budgeting, live below means, indexing etc. Plan and execute the idea is totally 2 different thing. Indexing is new thing to me. Hope it can accelerate and become another source of moolah. |

|

|

May 14 2019, 09:45 PM May 14 2019, 09:45 PM

|

Senior Member

2,275 posts Joined: Jun 2010 |

QUOTE(sjteh @ May 14 2019, 09:42 PM) Have been silent reader in lyn for few years and finally brave enough to put some words in this space. Hehe silent reader... If u avid reader, search up John bogle index investing. See how ppl laugh him. Now he gg d, but his fund is the largest. Many active fund already gg long time ago.Plan and execute the idea is totally 2 different thing. Indexing is new thing to me. Hope it can accelerate and become another source of moolah. |

|

|

May 15 2019, 12:02 AM May 15 2019, 12:02 AM

Show posts by this member only | IPv6 | Post

#156

|

Senior Member

2,275 posts Joined: Jun 2010 |

|

|

|

May 15 2019, 12:05 AM May 15 2019, 12:05 AM

Show posts by this member only | IPv6 | Post

#157

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

May 17 2019, 08:05 PM May 17 2019, 08:05 PM

Show posts by this member only | IPv6 | Post

#158

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(roarus @ May 13 2019, 09:05 PM) Great - SPDR's SWRD 0.12% Total Expense Ratio vs iShares' IWDA 0.2%. Once the volume and AUM grows (which shouldn't be too long), I'll start collecting unless iShares drop their TER to compete. Hi roarus, the SWRD / SWLD seem has no changes or changes % at all on IB/TradeStation, why is that so?I checked on on the opening price for today is 0.00 as well is that because no trading at all?

|

|

|

May 17 2019, 08:49 PM May 17 2019, 08:49 PM

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(tadashi987 @ May 17 2019, 08:05 PM) Hi roarus, the SWRD / SWLD seem has no changes or changes % at all on IB/TradeStation, why is that so? Yup, simply there's no trade on those 2 counters - it's not UK holiday today, the other 2 world indexes IWDA and VWRD are kicking and exchanging handsI checked on on the opening price for today is 0.00 as well is that because no trading at all?

|

|

|

May 17 2019, 08:56 PM May 17 2019, 08:56 PM

Show posts by this member only | IPv6 | Post

#160

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

| Change to: |  0.0166sec 0.0166sec

0.35 0.35

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 01:08 AM |