QUOTE(alexkos @ Jan 26 2019, 11:41 PM)

tuan tuan dan puan puan

alex looking for standalone critical illness policy.

coverage RM120k. Early payout allowed. Please quote tq

Don’t think there is such plan for early payout yet, normal critical illness yes

QUOTE(unknownhuman @ Jan 27 2019, 11:28 AM)

I've been doing PRS for a few years now, but the idea of having some extra insurance coverage out of the same money put in intrigues me

Oic, well it’s more of a [fail-safe] in the event that you pass on earlier than you can wait for the money to be accumulated.

Just don’t expect high % of return, if you can accept this fact then it’s a viable plan for your financial planning

QUOTE(Leo the Lion @ Jan 27 2019, 12:14 PM)

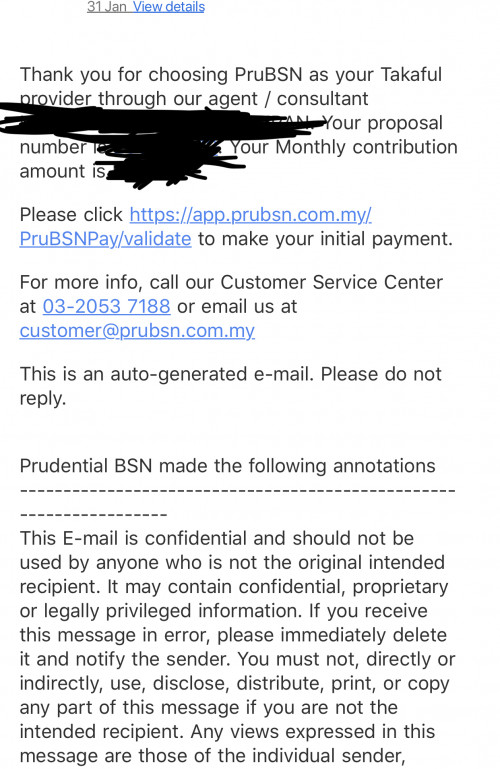

I still have my PruBSN takafulink.

I am planning to move out and look for medical insurance plus life insurance (sum covered min RM100k).

PruBSN has a Life Insurance which is PruBSN warisan, but sum covered RM250k so the monthly is higher...

What’s your budget, age, gender, smoker or not and your occupation

And the amount you’re paying for it at the moment ?

QUOTE(eddydo @ Jan 27 2019, 01:40 PM)

Hi guys,

23, M, non-smoker.

Just reviewed my very old policy from GE.

Paying RM110 per month:

out patient cancer treatment rm15k only

out patient kidney dialysis rm15k

emergency accident out patient rm3k

room n board rm150 per day

overal lifetime limit rm150k

looks pretty low

Any advice moving forward?

That depends on your current budget and what your future planning for yourself with the salary that you’re earning at the moment, will probably need to talk to a life planner to help you understand your insurance better.

Jan 25 2019, 10:17 AM

Jan 25 2019, 10:17 AM

Quote

Quote

0.1296sec

0.1296sec

0.06

0.06

7 queries

7 queries

GZIP Disabled

GZIP Disabled