QUOTE(krayzie @ Sep 19 2019, 04:00 PM)

Hi all, I'm in midst of looking for an upgrade for my life insurance but I don't have time to shop around.

I already have a personal life + medical card coverage but I'd like to increase my life insurance coverage and was told it'd cost me +RM150/mo just to top up 100k from my existing policy.

Or alternatively I can get a new investment life policy that cost RM400/mo for 500k+100k (TPD), or RM300+/mo for 500k life.

I'm 31 male non smoke, no illness etc.

The price sounds quite expensive to me but I haven't got the time to look into line-by-line if they'd added irrelevant items into it.

To those that shop around a lot for insurance, is this normal price? Or that it sounds like a lot of stuff has been added into the policy unknowingly?

hi krayzie. additional 150/month for 100k life+CI sounds kinda on a high side premium. btw whats your occupation?I already have a personal life + medical card coverage but I'd like to increase my life insurance coverage and was told it'd cost me +RM150/mo just to top up 100k from my existing policy.

Or alternatively I can get a new investment life policy that cost RM400/mo for 500k+100k (TPD), or RM300+/mo for 500k life.

I'm 31 male non smoke, no illness etc.

The price sounds quite expensive to me but I haven't got the time to look into line-by-line if they'd added irrelevant items into it.

To those that shop around a lot for insurance, is this normal price? Or that it sounds like a lot of stuff has been added into the policy unknowingly?

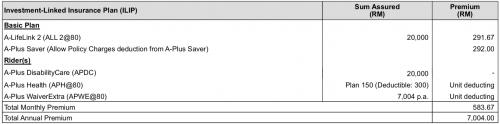

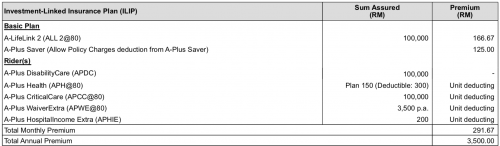

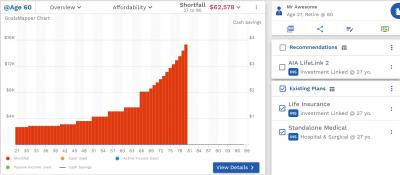

im not sure what is the life insurance coverage amount you need and until what age you need it to cover you. Assuming you need 500k life insurance (death+TPD), the premium will be 400/month (20 years payment term only), covers up to age 70.

Sep 19 2019, 05:02 PM

Sep 19 2019, 05:02 PM

Quote

Quote

0.1319sec

0.1319sec

0.58

0.58

7 queries

7 queries

GZIP Disabled

GZIP Disabled