QUOTE(alandhw @ Aug 19 2019, 01:35 PM)

By looking at the one you quoted, looks like only can claim first time. But i will always try to submit rather than assuming cannot be claimed. At least put in effort to file claim.QUOTE(Gaza @ Aug 19 2019, 05:14 PM)

hi, i currently have allianz medical card (1m annual limit, no lifetime limit) with rm80k life insurance with CI & early CI.

i’m a 32 year old male smoker and i’m looking for life insurance to protect my wife & son in case anything happen to me so they can have some emergency funds like maybe rm200k-300k.

after doing some reading i think term life insurance is the one i should go for because i’m not looking for cash value to offset higher insurance cost like those medical card. but my main concern for taking term life is let’s say after 10 years if my health deteriorate the insurance can choose not to renew my life insurance? if i want guaranteed renewal have to take whole life insurance (with those cash value) is it?

thanks

If you are not going to set it up as an independent trust fund, you can actually top up from your existing plan.i’m a 32 year old male smoker and i’m looking for life insurance to protect my wife & son in case anything happen to me so they can have some emergency funds like maybe rm200k-300k.

after doing some reading i think term life insurance is the one i should go for because i’m not looking for cash value to offset higher insurance cost like those medical card. but my main concern for taking term life is let’s say after 10 years if my health deteriorate the insurance can choose not to renew my life insurance? if i want guaranteed renewal have to take whole life insurance (with those cash value) is it?

thanks

QUOTE(beyinbe @ Aug 19 2019, 05:31 PM)

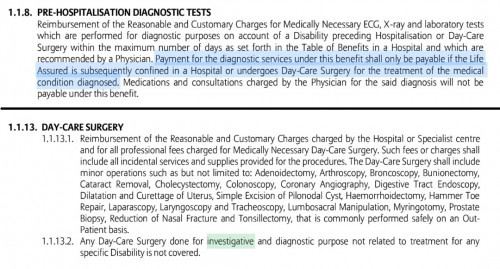

Hi. I'm on Allianz power link. I've been asking my agent about procedures for endoscopy so he told me it's claimable if there's diagnosis and required for further treatment. So I asked if I got admitted will the fees be covered and he said most likely.

Today I went to do the scope procedures, only to be told that I'm getting "non guarantee" status and that I'll have to pay myself.

This is because my procedure is investigative in nature, unless it's followed by surgery I won't be able to claim. The agent did ask me to submit all bills to try for claims.

What are the chances of me actually getting reimbursed in this case? Already paid for everything and now I'm broke

Thanks

Are you admitted? Anyway at least you try to submit your claims. Though chances of claiming is low, but at least you tried.Today I went to do the scope procedures, only to be told that I'm getting "non guarantee" status and that I'll have to pay myself.

This is because my procedure is investigative in nature, unless it's followed by surgery I won't be able to claim. The agent did ask me to submit all bills to try for claims.

What are the chances of me actually getting reimbursed in this case? Already paid for everything and now I'm broke

Thanks

QUOTE(perfect10 @ Aug 19 2019, 07:11 PM)

I want to check, i had a fall and injured my hips, the ER recommended a few options, but can i demand for chiropractic for my treatment, i am having allianz but they say have limited rm1k for chiro, but not sure how to go about it, also the dr not so helpful as they dont recommend chiro. Anyone got dr that can recommend chiro as the treatment?

Holocene every chiro center treatment can be claimed? What are the criteria for chriro treatment claims?

Aug 19 2019, 09:40 PM

Aug 19 2019, 09:40 PM

Quote

Quote

0.2467sec

0.2467sec

0.31

0.31

7 queries

7 queries

GZIP Disabled

GZIP Disabled