QUOTE(w3sley @ Apr 28 2019, 07:40 PM)

Tentative listing date means the date available for the public to buy and sell right?

Anyway, some conflicting opinion from klse.i3investor such as:

1. ipo to pay debt ,good or bad ?

<<< from lchipo I didnt see to pay debt, and i didnt read its full prospectus, correct if im wrong 2. gearing high dao like KLCC how la

<<< havent till klcc la  somewhere near TRX tower jer

somewhere near TRX tower jer3. why the Private Equity want to exit if this company is soooo good?

<<< as some forumer asked before, can track back. not sure if they explain in prospectus, also can go read if you wantIs everyone here just for short term trading?

<<< most probably me..hahaha...if only I dapat allocation from big sea of investorsQUOTE(Pewufod @ Apr 28 2019, 08:08 PM)

are they raising funds for debts ?

<< same from lch and other source, didnt state so.i was under the impression that the bulk of it will go to expansion in PH for fund raising, others under offer for sale for PE to exit

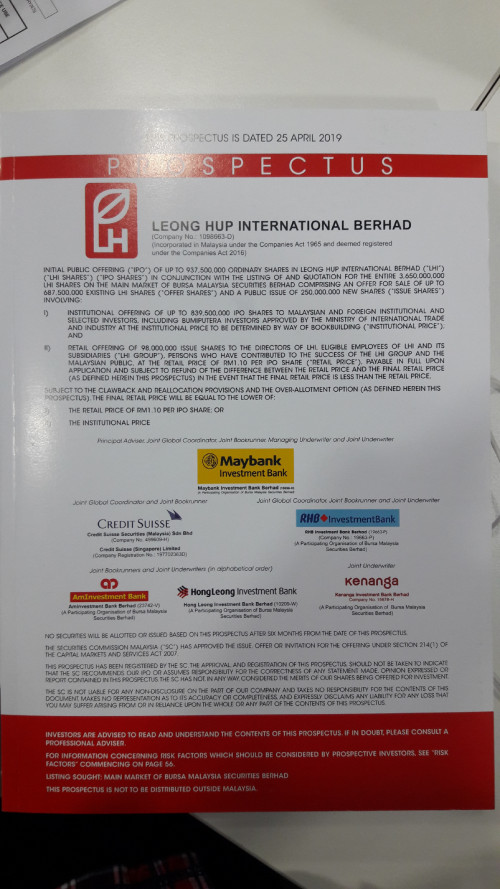

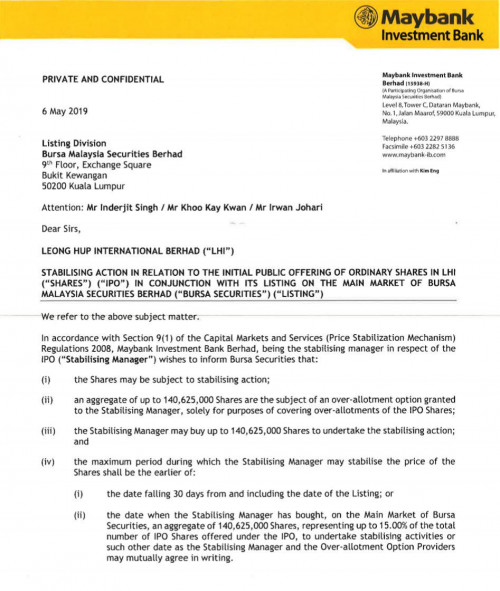

<<< not sure but I somehow agree, maybe PE feel boring for too stable? need more researchLeong Hup International Berhad

IPO Rating (3.0 star out of 5.0)

Copyright@http://lchipo.blogspot.com/

Date

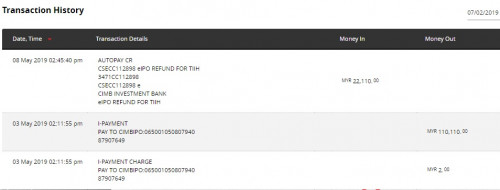

Open to apply: 25/04/2019

Close to apply: 03/05/2019

Listing date: 16/05/2019

Share Capital

Market Cap: RM 4.015 bil (published prospecture book wrote 1.5bil is typo)

Shares Issue to sell: 937.5 mil shares (IPO 98 mil, private placement 839.5 mil)

Enlarged Issued Shares: 25.68%

Business

Feedmill 39.3%, Livestock & other poultry related product 61.0%

Geo

Msia: 28.8%

Indonesia: 31.7%

Singapore: 19.8%

Vietnam: 19.20%

Philippines: 0.5%

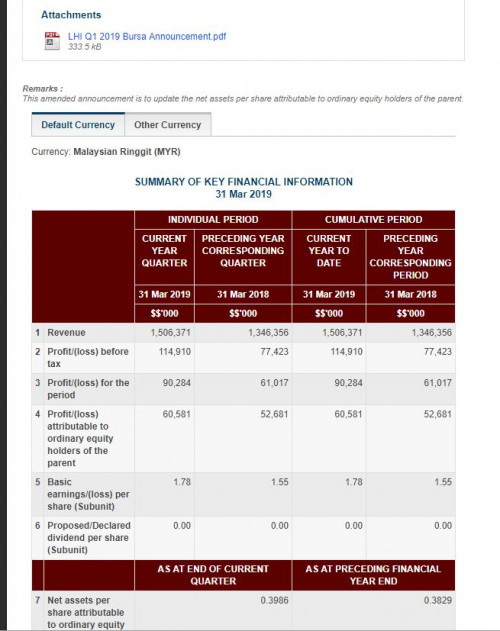

Fundamental

Market: Main Market

Price: RM1.10 (eps: RM0.0566)

P/E & ROE: PE20.8, ROE12.5%

Cash & fixed deposit after IPO: RM0.15 per shares

NA after IPO: RM0.42

Total debt to current asset after IPO: 1.30 (Debt: 2.985 bil, Non-Current Asset: 2.659 bil, Current asset: 2.304 bil)

Dividend policy: Target payout ratio 30% on Net profit.

Financial Ratio

Trade receivable: 37.2days

Trade Payable: 23.7days

Past Financial Proformance (Revenue, EPS)

FPE 2018: RM4.690 bil (10mths eps: 0.0513)

2017: RM5.501 bil (eps: 0.0566)

2016: RM5.257 bil (eps: 0.0537)

2015: RM4.714 bil (eps: 0.0323)

Net Profit Margin

FPE 2018: 4.7% (10 mths)

2017: 4.5%

2016: 5.1%

2015: 3.5%

After IPO Sharesholding

Emerging Glory: 52.8%

Director Remuneration for FYE2019 (from gross profit 2017)

Lau Chia Nguang: RM5.90 mil

Dato' Lau Eng Guang: RM4.86 mil

Tan Sri lau Tuang Nguang: RM5.04 mil

Lau Joo Hong: RM5.66 mil

Lau Joo Han: RM4.86 mil

Lau Joo Keat: RM4.90 mil

Other 8 director: RM0.902 mil

Total director remuneration from gross profit: 3.52%

Use of fund

Capital Expenditure: 75.5%

Working Capital: 12.0%

Lisitng Expenses: 12.5%

Competitor PE & ROE

QL:PE50.32, ROE11.48

Teoseng: PE11.86, ROE10.88

CP Food: PE n/a, ROE10.1

Japfa: Pe n/a, ROE0.2

Industry Analysis (Asean 2012-2018)

oultry Meat Consumption growth average per year: 5.2%

Animal Feed import average per year: 12.92%

Animal Feed production: 8.15%

Conclusion

Good thing is:

1. Produce necessity product (e.g. Egg)

2. Only depend on M'sia market 28.8%, other is export.

3. Trade receivable is less than 3 month.

4. Revenue is increase over 3 years.

5. 75.5% IPO fund use to expand business.

6. The needs of this industry is increasing because of population increasing.

The bad things:

1. Net profit margin very low (below 5%).

2. ROE is 12.5%, if 15% should be better.

3. NTA is RM0.42

4. Growth rate should not be very high because of net profit margin below 5%.

Conclusions

Overall is a slightly better IPO compare to normal IPO. Because of the needs of the industry, the demand will keep increasing. We should see a stable growth (but not big growth) in the company.

More suitable to investor that buy & keep as defensive portfolio.

IPO Price: RM1.10

Good time: RM1.28 (PE25)

Bad time: RM0.515 (PE10)

Credit to http://lchipo.blogspot.comMY Consideration for long term:

1) NTA vs Price big gap

2) Stable grow (necessity unless some virus breakout gg)

3) Unlike construction etc payable receivable is shorter (?)

4) Focus diff market - so MY affect also wont down all business

5) IF really is to pay debt, it consider a good approach since interest lesser, more profit for stable grow = more future, unless they always operate at lost

6) This is why so many cornerstone investor --> they wan long term stable grow, and they confidence NTA will chase up to price (?)(of course not the other way round wei)

7) Can compare to QL or Layhong (?) for PE ROE etc...i.m too lazy to do homework on this..haha

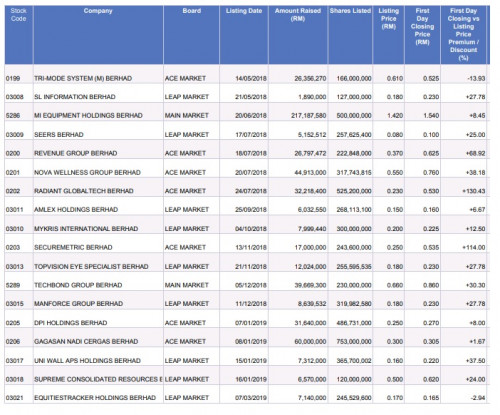

Consideration for short term:

» Click to show Spoiler - click again to hide... «

goreng need think de meh? its like going genting ma

QUOTE(raoul @ Apr 29 2019, 10:19 AM)

Sure bohh

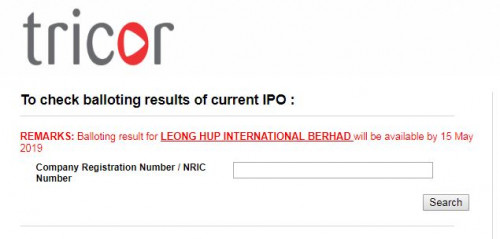

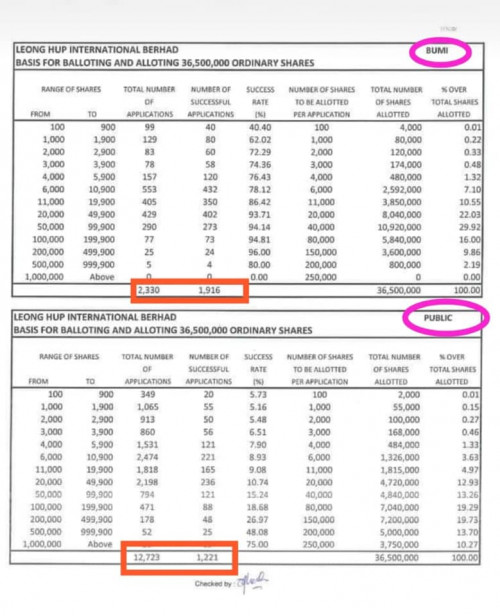

I think rate of success to get this IPO less than 1%

thats what his name said, SURE ANGPOW<<

Oct 18 2018, 03:31 PM, updated 2y ago

Oct 18 2018, 03:31 PM, updated 2y ago

Quote

Quote

0.1441sec

0.1441sec

0.63

0.63

6 queries

6 queries

GZIP Disabled

GZIP Disabled