QUOTE(red streak @ Aug 21 2022, 05:56 PM)

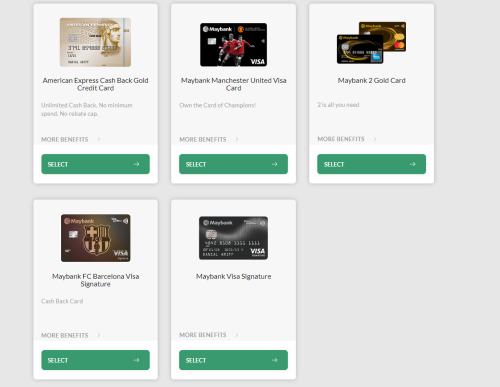

What convenience could you possibly get with a useless VISA card with no benefits at all?

C'monlah chacha your reasoning makes no sense. The cashback is as good as either the Affin Duo or the PBB Quantum without any minimum spending per swipe or other restrictive T&C and you're saying it's peanuts. Might as well cancel it entirely instead of paying the RM25 SST every year for the useless half of the cards. Even I don't really go out on weekends. I do all my spending online. I reload on fuel via Setel on shopee and buy groceries and stuff online. Heck, Setel is a pretty good e-Wallet on its own and is getting more widespread adoption from merchants.

Some ppl dont spend online much

some ppl dont have alot of amex merchant near them

some dont spend at amex merchants, alot.

everyone has a different spending pattern. That's why u'll never see ppl recommending CCs to others directly but asking "what's ur spending pattern/lifestyle?" and so on.

To some ppl, they loyalty to bank >>>>>>>> CC benefits. Heck, MAYBE their connections with the bank has landed them some special offer/algo that gives them more TP or even CB.

Also, maybe to these ppl RM1 : 1TP can be enticing enough for their spending usage.

So don't call it useless. There's still usefulness, to each user. To you, it's useless but to others, maybe they can get something beneficial out of it.

Apr 28 2022, 09:32 AM

Apr 28 2022, 09:32 AM

Quote

Quote

0.0364sec

0.0364sec

0.58

0.58

7 queries

7 queries

GZIP Disabled

GZIP Disabled