QUOTE(koala225 @ Jun 23 2019, 03:10 PM)

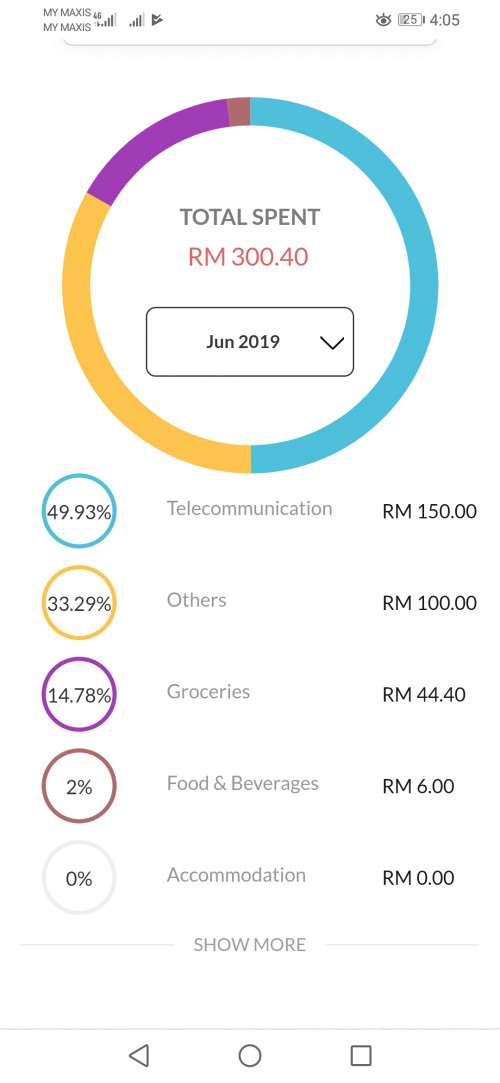

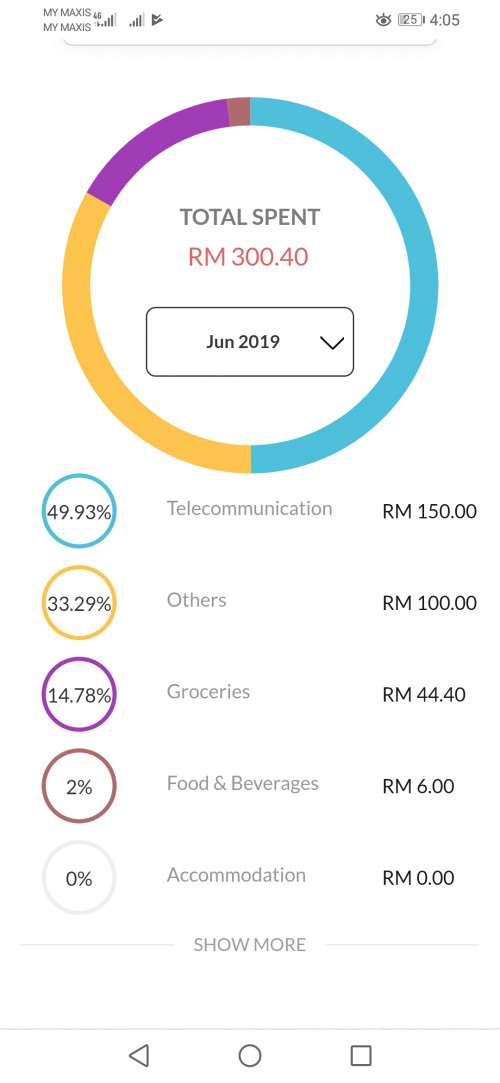

Top up boost on 8/6/19 telecommunications Top up boost 22/6/19 others

Credit Cards Maybankard 2 Gold & Platinum Cards V20, 5% M2 Amex on weekend spending (NOT ALL)

|

|

Jun 23 2019, 04:07 PM Jun 23 2019, 04:07 PM

Return to original view | IPv6 | Post

#61

|

Junior Member

590 posts Joined: Dec 2015 |

|

|

|

|

|

|

Jun 27 2019, 07:23 AM Jun 27 2019, 07:23 AM

Return to original view | IPv6 | Post

#62

|

Junior Member

590 posts Joined: Dec 2015 |

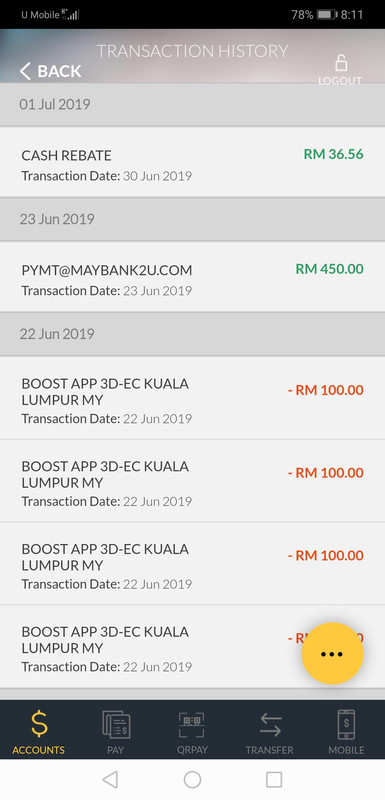

QUOTE(borneoman1 @ Jun 27 2019, 12:55 AM) I was checking out the pie chart for my cards in modern M2U. From the category breakdown, it seems that: - Boost App top-up is under (Telecommunications) [Top-up full using AMEX] - BigPay top-up (Financial Services) [Top-up full using Maybank FCB] - Agoda (Transportation) [AMEX] - Astro (Utilities) [AMEX] - Netflix (Utilities) [AMEX] These are all based on the amount I paid to the services. They all line-up together. FCB only used to top-up BigPay. I only use Amex for Agoda, Astro & Netflix autodeduct, for cashback, all to Boost App. The breakdowns should be accurate. Anything under Financial Services will be for e-wallets, right. Boost App is under Telecommunications though. So, maybe can still earn cashback from it? Some say Unifi/Astro still can earn cashback, but Astro seems to be listed as Utilities...hmm. Unless Maybank puts them in the categories, but still able to differentiate what is what within that category. QUOTE(talexeh @ Jun 27 2019, 01:00 AM) Recently Boost has been moved to the "Others" category instead. For all we know, Maybank might be identifying eWallet transactions via name instead of MCC or category. All we can do now is just to speculate & the final results will be made known only on 2-AUG. QUOTE(borneoman1 @ Jun 27 2019, 01:03 AM) Oh, I see. My Boost top-up was in the beginning of the month, so if they moved it to Others already, then yeah, maybe they already thought how to close the loophole. Top up boost on 8/6/19 telecommunications Will see what category it is again when I top up Boost before 8th Jul. Top up boost 22/6/19 others  My suggestion: top up RM10 on 14/7, check whether you have received 50 sen on 2/8. |

|

|

Jun 29 2019, 11:34 AM Jun 29 2019, 11:34 AM

Return to original view | IPv6 | Post

#63

|

Junior Member

590 posts Joined: Dec 2015 |

I failed to use my Amex at tesco. I suspect my card is damage.

Do we need to pay for damage card? If I request to change to Amex with pay wave, is there any charges? How long will it process? This post has been edited by engyr: Jun 29 2019, 12:19 PM |

|

|

Jun 29 2019, 03:03 PM Jun 29 2019, 03:03 PM

Return to original view | IPv6 | Post

#64

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(c2pidyee @ Jun 29 2019, 11:33 AM) anyone encounter problem of top up boost & grab pay today? Manage to top up boost with Amex 10 min ago.try to top up both grab pay & boost with amex but transaction not successful. called to customer service told that my card is ok no problem wondering why i've try my FC Barcelona for the top up.. can go through.. no problem at all |

|

|

Jun 29 2019, 07:02 PM Jun 29 2019, 07:02 PM

Return to original view | IPv6 | Post

#65

|

Junior Member

590 posts Joined: Dec 2015 |

|

|

|

Jun 30 2019, 08:20 AM Jun 30 2019, 08:20 AM

Return to original view | IPv6 | Post

#66

|

Junior Member

590 posts Joined: Dec 2015 |

|

|

|

|

|

|

Jun 30 2019, 08:02 PM Jun 30 2019, 08:02 PM

Return to original view | IPv6 | Post

#67

|

Junior Member

590 posts Joined: Dec 2015 |

|

|

|

Jun 30 2019, 09:25 PM Jun 30 2019, 09:25 PM

Return to original view | IPv6 | Post

#68

|

Junior Member

590 posts Joined: Dec 2015 |

|

|

|

Jul 1 2019, 09:35 PM Jul 1 2019, 09:35 PM

Return to original view | Post

#69

|

Junior Member

590 posts Joined: Dec 2015 |

|

|

|

Jul 3 2019, 08:45 PM Jul 3 2019, 08:45 PM

Return to original view | Post

#70

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(GTA5 @ Jul 3 2019, 08:08 PM) I have used rm 1k on my Amex for June, but I didn't get the max rm 50 cashback. Any spend on government services and utilities? Is it due to my Boost top up? How come? Anyone faced the same issue? I only got around RM 36 cashback.   Are all your transactions done on Saturday and Sunday? This post has been edited by engyr: Jul 3 2019, 08:45 PM |

|

|

Jul 4 2019, 09:40 PM Jul 4 2019, 09:40 PM

Return to original view | Post

#71

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(shazmiey @ Jul 4 2019, 09:03 PM) thanks for suggestion, i did called the number and it seems my application has been approved. Its just wondering how my card can be approved though I didnt submit any of my documents. Is your salary credited to Maybank? They said they will post to my billing address. |

|

|

Jul 6 2019, 03:57 PM Jul 6 2019, 03:57 PM

Return to original view | IPv6 | Post

#72

|

Junior Member

590 posts Joined: Dec 2015 |

|

|

|

Jul 6 2019, 04:36 PM Jul 6 2019, 04:36 PM

Return to original view | IPv6 | Post

#73

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(BRY7 @ Jul 6 2019, 04:23 PM) No. Only PrestoMall (previous 11street) and Zalora accept Amex. https://forum.lowyat.net/topic/3532126 This post has been edited by engyr: Jul 6 2019, 04:37 PM |

|

|

|

|

|

Jul 7 2019, 10:46 AM Jul 7 2019, 10:46 AM

Return to original view | Post

#74

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(tan_aniki @ Jul 7 2019, 10:41 AM) you can imagine a lot of users leaving them because no longer able to top up e-wallet which is used to be common nowadays but others such as HLB is very hot now, even though some didn't get RM7 they still feel satisfy because they got chances to get more CB and bank also earn a lot due to the volume as compare to 150 winners only per hour. That's non-bumi marketing vs bumi marketing mindset QUOTE(tan_aniki @ Jul 7 2019, 10:27 AM) i think Maybank should not remove e-wallet and do something like others did, with FCFS so that more people spend their card rather than after today lost a lot of customers Back to pre-ewallet era. Most of my expenses belonged to online shopping, petrol and grocery. I will reduce usage of e-wallet instead of stop using maybank cards. This post has been edited by engyr: Jul 7 2019, 10:49 AM |

|

|

Jul 7 2019, 01:26 PM Jul 7 2019, 01:26 PM

Return to original view | IPv6 | Post

#75

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(tan_aniki @ Jul 7 2019, 11:03 AM) smart users will cash out on those 0.3%/0.5%/1% unlimited CB to do what u said, not Maybank anymore lo... QUOTE(ClarenceT @ Jul 7 2019, 11:05 AM) Not many people will do so. Simply reason that I top up boost with Amex because of double rewards (5% from Amex + shake rewards from boost). Between 5% from Amex and shake rewards, I will opt for Amex. But if one day later maybank reduce the benefit till cashback for dining only (like before 2017), I believe that many customers will cancel the card. This post has been edited by engyr: Jul 7 2019, 01:29 PM |

|

|

Jul 7 2019, 04:13 PM Jul 7 2019, 04:13 PM

Return to original view | IPv6 | Post

#76

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(ClarenceT @ Jul 7 2019, 03:22 PM) You are one of the lucky 44% not paying CC interest. 56% of CC users are paying CC interest so it is a good option for them to reduce CC interest. Many of them are allowed to have CC from up to 2 banks only. How do you know ccard will no longer give rewards from 2021 onwards?CC is toxic to a lot of people so I support it is SST-able item to discourage them to own a CC. I will cut down the number of CC I am holding after 2021, when CC no longer give reward/CB in general. This post has been edited by engyr: Jul 7 2019, 06:35 PM |

|

|

Jul 7 2019, 07:04 PM Jul 7 2019, 07:04 PM

Return to original view | IPv6 | Post

#77

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(BRY7 @ Jul 7 2019, 07:01 PM) Just to confirm, transaction for petrol with Amex on weekends have 5% rebate? Yes. Cap is RM50 per month. Please refer to first post. @alexwsk did a good summary. But there’s a cap right? QUOTE(cybpsych @ Jul 7 2019, 06:56 PM) all these unconfirmed speculation based on leading to BNM reform on card framework. Oh, I see.yes, less fee may lead to less card benefits, such as what we've seen these few month's of announcements. which bank, when reduce, what will be reduced, how bank react; only respective bank to plan and announce later. just use what we have now. This post has been edited by engyr: Jul 7 2019, 07:14 PM |

|

|

Jul 13 2019, 08:19 PM Jul 13 2019, 08:19 PM

Return to original view | Post

#78

|

Junior Member

590 posts Joined: Dec 2015 |

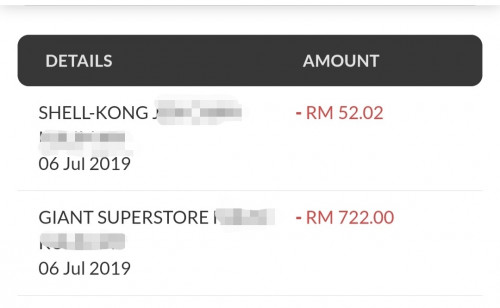

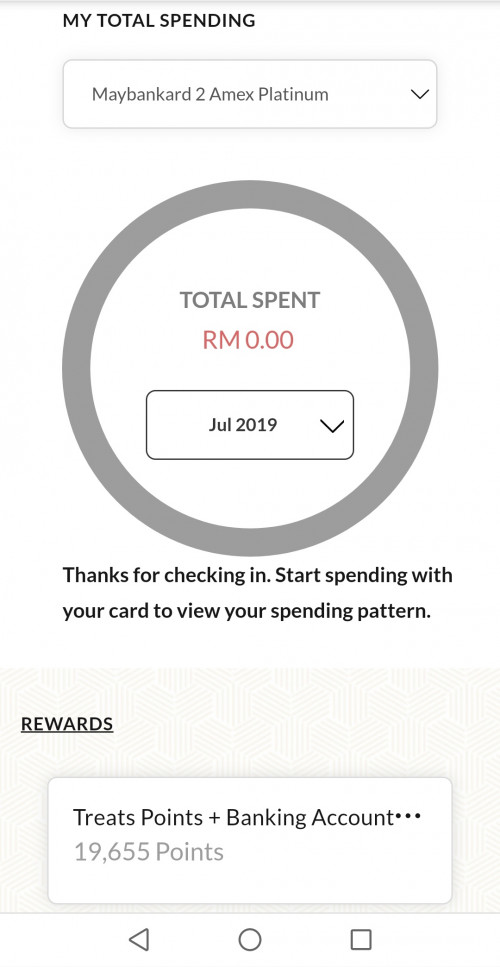

I am wondering why my pie chart do not capture the transaction. Anyone has similar problem?

QUOTE(eddie2020 @ Jul 13 2019, 07:53 PM) guys, abit weird, my cc statement 6july... Overseas transactions do follow overseas time so in june i spent over 2k+. . for airbnb and boost. airbnb i spent on 8june 7pm,(saturday) but my transaction captured on 7june (1 day early) GBP. it should follow local time instead of airbnb server time? i didnt get cash back for this transaction... then on 30 june i reloaded to my boost.. till today i see my outstanding did not show the boost payment.. my outstanding only air bnb and other expenses... i scare later sudden charge me interest for the boost reload.. as i cant pay more than outstanding.. first time.... i send email regarding my cashback.. wait them reply... Boost transaction is posted on the same day if you do it before 11pm. This post has been edited by engyr: Jul 13 2019, 08:55 PM |

|

|

Jul 14 2019, 03:45 PM Jul 14 2019, 03:45 PM

Return to original view | Post

#79

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(IzaakC @ Jul 14 2019, 02:54 PM) New card holder here, applied my card on last Wednesday, Approved on Thursday, Received the cards on Friday. Default statement date is 28th of each month. You need to pay statement balance within 20 days (before payment due date). My question is since my statement is not specified (N/A), when should I pay my outstanding amount? We pay statement amount before payment due date to prevent getting slapped by interest right? It will be updated next month. This post has been edited by engyr: Jul 14 2019, 03:46 PM |

|

|

Jul 15 2019, 06:15 AM Jul 15 2019, 06:15 AM

Return to original view | IPv6 | Post

#80

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(xeon1989 @ Jul 14 2019, 11:57 PM) QUOTE(charlesj @ Jul 15 2019, 03:12 AM) As we dont know the statement date, sometimes it will caught us in surprise. My maybank 2card was approved early April 2018. I did encounter receiving statement after 2 weeks of receiving my CC (instead of 30 days), by the time I noticed, it was already half of the 20-day buffer gone. Else I will have to pay for late payment. My first statement date was 28/4/18. This is my first credit card. I was quite anxious. I log in maybank2u weekly to check transactions. You will be able to view dates from your maybank2u, roughly 2 days after first statement out. |

| Change to: |  0.0332sec 0.0332sec

0.45 0.45

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 1st December 2025 - 10:44 PM |