QUOTE(victorian @ Aug 17 2023, 12:03 AM)

I swear UOB is really messing up this migration.

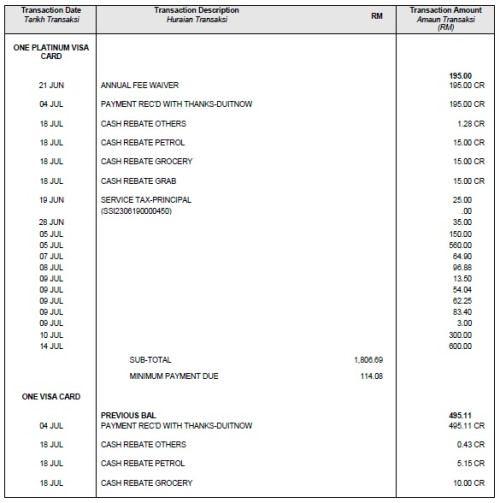

I reloaded rm500 to my grab just now and did not get any reward.

I'm assuming something is wrong with their system, look at the OTP I received

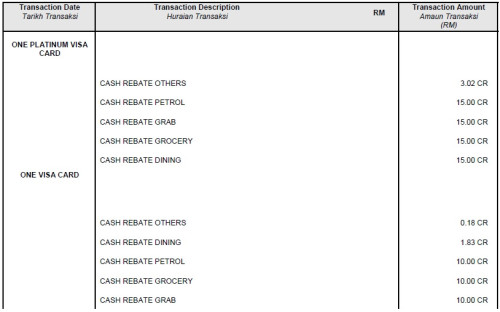

nah, unlike citi, uob does not display (accumulate) the cashback u r entitled to until statement is released

only contact/report when your statement does not credit the cashback u r entitled to

QUOTE(Nshade @ Aug 17 2023, 02:19 AM)

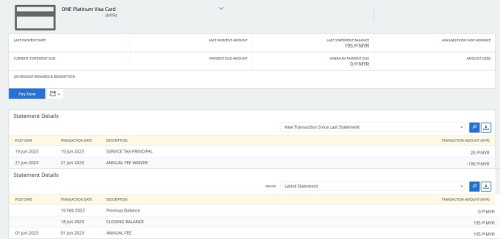

I got 1 time where i didn't get my cash back because of the post date.

I pumped my petrol 8 days before my statement due. The petrol station only posted after 10 days later which exceeded my statement date. UOB can't help much from there even after I escalated.

So i had to spend everything at least 14 days before the statement day. No choice, else all the things i spent would be for naught.

damn, i usually just cutoff 3 days ahead, 14 days is epic

QUOTE(jerantut2011 @ Aug 17 2023, 04:46 AM)

For existing cardmembers, is it easy to apply for additional (principal) cards?

relatively easy if able to contact their credit card team, and the additional card has equivalent or lower income requirement

Feb 7 2023, 02:59 PM

Feb 7 2023, 02:59 PM

Quote

Quote

0.0456sec

0.0456sec

0.50

0.50

7 queries

7 queries

GZIP Disabled

GZIP Disabled