QUOTE(moosekaka @ Aug 13 2018, 06:04 PM)

OK I think I make mistake. here is how the daily repayment amount should be calculated based on What I think

S3phiroth trying to give example:

1) Grab interest 1% per week on 10K amount, daily repayment, loan period 1year. daily repayment = (1.52 x 10000) ÷ 365 = 41.64 a day.

2) Credit card 18% per annum but give you only 9.5K because they deduct 5% advance fee. daily repayment = (0.18*10000 +9500)÷365 = 30.96 a day.

real interest rate, based on daily amortization of the loan :

1) 146.7% !!

2) 42.85%

BTW, credit card real interest rate by law in some countries cannot exceed 30%. otherwise is considered usury.

1st, I wish to clarify that I am not an actuary or financial planner. I am just an sceptical oldman who loves to study things on my own rather than listen to what a professional tells me. So correct me if I am wrong, i'll be happy to learn something new.

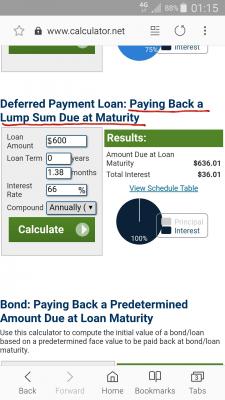

1) Based on the original rm600 principal and 42days of RM15.15 daily repayment, i already worked out that the real interest rate is 172%

[Calculation here]. The interest rate will remain unchanged if i just change the principal and loan period. Think about it, the interest rate of your bank loan is not going to change if u borrow different sum of money or choose a different loan period, isnt it? The only changes are the total interest and the installment amount. Of course unless CrapAhLong says they give u better rate if u borrow more money or choose a longer loan period then it is a different story.

So in this case, the effective rate for CrapAhLong is still

172% per annum on daily rest basis.2) 1st correction, if u withdraw 10k using credit card, the ATM will still give u 10k, not 9.5k. However, a 5% of cash advance fee will be charge instantly, which also means your starting principal is rm10.5k.

Since CrapAhLong doesnt need u to pay a cash advance fee, it is difficult to find out which one has better offer because u cant compare apple to apple despite u know that credit card charge u 18% per annum.

So how to turn the 2nd case into apple? Simple, consider that your principal is 10.5k. If i plug the relevant number into the calculator

[Calculation here], I get RM31.2 as a daily repayment amount.

Now change the principle back to 10k and change the interest rate a few times (trial and error) until u get the same RM31.2 as daily repayment amount

[Calculation here]. Now u turned the orange into apple successfully (because u have removed the cash advance fee as a variable) which allow u to do a direct comparison.

So in this case, the effective rate for credit card cash advance is

30.5% per annum on daily rest basis.Now u guys can see for obvious how CrapAhLong makes a windfall profit out of u.

Oklah i rest my case here. I already gone too far and i apologize for hijacking the topic.

This post has been edited by S3phiroth: Aug 13 2018, 09:37 PM

Aug 10 2018, 05:07 PM

Aug 10 2018, 05:07 PM

Quote

Quote

0.4919sec

0.4919sec

0.44

0.44

7 queries

7 queries

GZIP Disabled

GZIP Disabled