Outline ·

[ Standard ] ·

Linear+

Conditional High Yield Savings Account

|

GrumpyNooby

|

Aug 8 2020, 05:02 PM Aug 8 2020, 05:02 PM

|

|

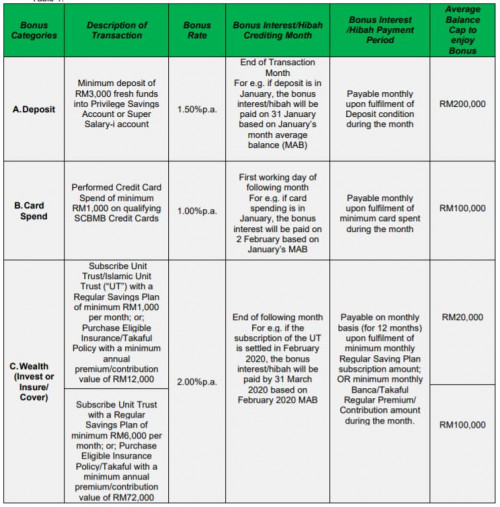

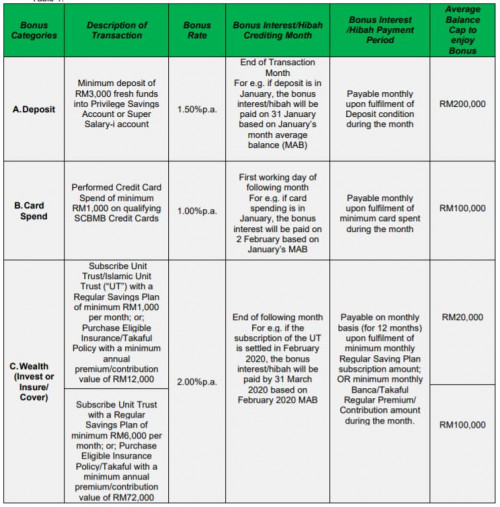

QUOTE(Hobbez @ Aug 8 2020, 04:58 PM) No, the base PSA account only gives you 2.1% (next month 1.5%). But by investing into their Bancassurance (unit trust) plan, bank offer the PSA another 2%. That is the Invest Bonus for PSA that I was pointing:  If your contribution to their WMP is RM 12k per year, the Invest Bonus will be eligible for the 1st RM 20k. For Priority Banking Clients, if your contribution to their WMP is RM 72k per year, the Invest Bonus will be eligible for the 1st RM 100k. This post has been edited by GrumpyNooby: Aug 8 2020, 05:44 PM |

|

|

|

|

|

GrumpyNooby

|

Aug 11 2020, 08:20 PM Aug 11 2020, 08:20 PM

|

|

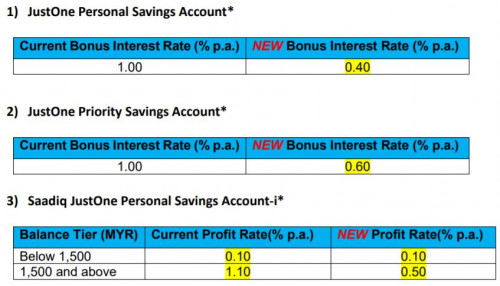

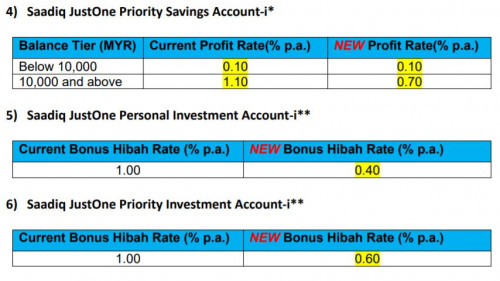

JUSTONE PRODUCT STREAMLINING AND REVISION OF BONUS INTEREST/BONUS HIBAH/PROFIT RATEKindly be informed that to simplify our product offerings, we are streamlining some of our products. Therefore, effective 1 September 2020, the accounts as mentioned in Table 1, Section A below will be known as the accounts named in Table 1, Section B. All other product features, account numbers, fees and charges will remain unchanged. | Table 1 | | | Section A | Section B | | Current Product Name | Now Known As | | JustOne Preferred Current Account | JustOne Personal Current Account | | JustOne Preferred Savings Account | JustOne Personal Savings Account | | Saadiq JustOne Preferred Account-i | Saadiq JustOne Personal Account-i | | Saadiq JustOne Preferred Investment Account-i | Saadiq JustOne Personal Investment Account-i |

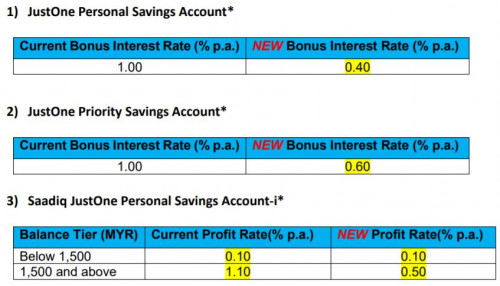

Please take note that effective 1 September 2020, the bonus interest/bonus hibah/profit rate for JustOne Accounts will be revised as follows.   https://av.sc.com/my/content/docs/Announcem...-Sept-20-v3.pdf https://av.sc.com/my/content/docs/Announcem...-Sept-20-v3.pdf

|

|

|

|

|

|

GrumpyNooby

|

Aug 12 2020, 02:33 PM Aug 12 2020, 02:33 PM

|

|

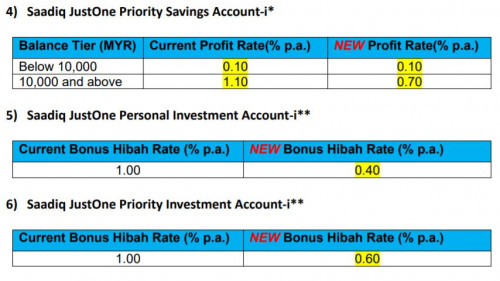

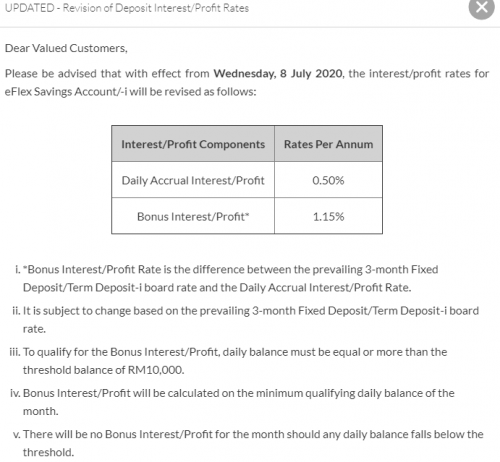

QUOTE(Hobbez @ Aug 12 2020, 02:32 PM) What other conditional savings acct plans have very low tiers or no tiers to pay out an interest? AmBank eFlex: https://www.ambank.com.my/eng/eflex This post has been edited by GrumpyNooby: Aug 12 2020, 02:35 PM This post has been edited by GrumpyNooby: Aug 12 2020, 02:35 PM |

|

|

|

|

|

GrumpyNooby

|

Aug 12 2020, 08:13 PM Aug 12 2020, 08:13 PM

|

|

|

|

|

|

|

|

GrumpyNooby

|

Aug 25 2020, 04:50 PM Aug 25 2020, 04:50 PM

|

|

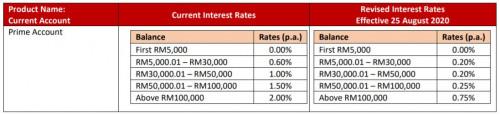

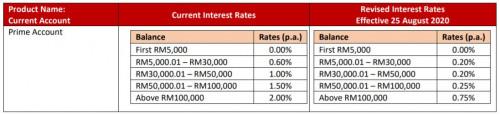

IMPORTANT NOTICE ON REVISION OF INTEREST RATES FOR PRIME ACCOUNT [for CIMB]Dear Valued Customers, Effective 25 August 2020, our interest rate for Prime Account will be revised as below.  https://www.cimb.com.my/content/dam/cimb/pe...ime_Account.pdf https://www.cimb.com.my/content/dam/cimb/pe...ime_Account.pdf

|

|

|

|

|

|

GrumpyNooby

|

Sep 8 2020, 09:06 PM Sep 8 2020, 09:06 PM

|

|

QUOTE(gvr @ Sep 8 2020, 09:05 PM) I had a similar experience as well last month, which in the end I brought my payslip over the next day. The first day when I mentioned I can place an FD, they even asked me to bring the bank draft from other banks first  I thought we can only open account at the nearest branch to our IC address? I thought we can only open account at the nearest branch to our IC address?Yes but you can provide other supporting document such as employment letter or utilities bill of your current residential address if it does not match with the address printed on your NRIC. |

|

|

|

|

|

GrumpyNooby

|

Sep 15 2020, 07:47 PM Sep 15 2020, 07:47 PM

|

|

QUOTE(kart @ Sep 15 2020, 07:41 PM) For RHB Smart Account, the Deposit Interest of 1.80% p.a. and Pay Interest of 0.5% p.a. are calculated, based on daily account balance calculated from 1st till last day of the month, or from 15th till 14th of next month? Thank you for your information.  Calendar month QUOTE 2.5 Accountholder will earn Base Interest Rate, which is calculated based on daily account balance. Base Interest Rate earned will be credited to the Account on the last day of each month. 3. Accountholder who fulfills the below requirements within a calendar month will be entitled for additional Bonus Interest Rate: 3.1 Monthly Average Balance (MAB)*must be RM1,000 and above. *MAB is defined as the sum of end day daily account credit balance for the month/number of calendar days of the month. 3.3 Bonus Interest Rate earned will be credited into the Account on 15th calendar day of the next occurring month. https://www.rhbgroup.com/files/personal/cur...2019_Eng_BM.pdf |

|

|

|

|

|

GrumpyNooby

|

Sep 15 2020, 10:26 PM Sep 15 2020, 10:26 PM

|

|

QUOTE(kart @ Sep 15 2020, 10:22 PM) Someone did mention before that it is not profitable for banks to open savings accounts. As such, some bank branches may choose to impose such weird and unnecessary requirements, to deter the less knowledgeable customers from opening savings accounts. SA and FD are regulated by BNM and NIM is tightly tied to OPR trend. BSA & BCA are must have products imposed by BNM to offer basic banking services to the general public. That's why banks normally like to up sell its potential customers (especially those in privileged banking segment) with wealth management products inclusive but not restricted to various insurance and unit trusts. This post has been edited by GrumpyNooby: Sep 15 2020, 10:29 PM |

|

|

|

|

|

GrumpyNooby

|

Sep 15 2020, 10:35 PM Sep 15 2020, 10:35 PM

|

|

QUOTE(rhodry @ Sep 15 2020, 10:32 PM) Seems ridiculous. If someone wants to open an account means they want to deposit money into the account. If a customer wants to give you cash then why say no To comply with AMLATFA, the source of fund especially cash is very crucial. Banks nowadays won't really want to accept heavy deposit of untraceable cash. That's why during open accounting stage, the basic screening test is to ensure that the account that you open at that particular branch has real purpose; not for suspicious activities inclusive not restricted to money laundering. The basic test is to provide proof that you're living or working nearby. If you're opening privileged banking account service, they'll ask more questions like an interview session. This post has been edited by GrumpyNooby: Sep 15 2020, 10:37 PM |

|

|

|

|

|

GrumpyNooby

|

Sep 15 2020, 10:41 PM Sep 15 2020, 10:41 PM

|

|

QUOTE(!@#$%^ @ Sep 15 2020, 10:39 PM) but scammers on mudah and carousell still a lot. Those are under KPDNHEP and PDRM jurisdiction. |

|

|

|

|

|

GrumpyNooby

|

Sep 21 2020, 07:09 PM Sep 21 2020, 07:09 PM

|

|

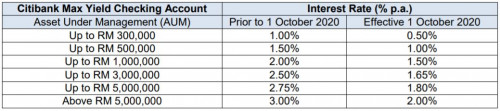

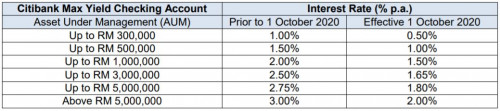

Revision of interest rates to Citibank Max Yield Checking AccountEffective 1 October 2020, Citibank Max Yield Checking Account and Australian Dollar Currency Call Account interest rates will be revised as per tables below:  https://www.citibank.com.my/global_docs/pdf...ate_changes.pdf https://www.citibank.com.my/global_docs/pdf...ate_changes.pdfThe great Max Yield is also impacted in current low OPR rate environment.

|

|

|

|

|

|

GrumpyNooby

|

Oct 1 2020, 04:00 PM Oct 1 2020, 04:00 PM

|

|

QUOTE(mbam @ Oct 1 2020, 03:52 PM) Is there any high yield savings that is better than FD? There're 3 in the market: 1. RHB Smart Account @ 2.85% 2. SC Privileged Saver @ 2.6% 3. OCBC 360 @ 2.45% Each has its own unique requirements to fulfill. |

|

|

|

|

|

GrumpyNooby

|

Oct 8 2020, 06:13 PM Oct 8 2020, 06:13 PM

|

|

QUOTE(lilsunflower @ Oct 8 2020, 05:48 PM) I've been transferring 100k every first of the month, then transferring out 99,995 just before the end of every month to SCB PSA / RHB Smart / OCBC 360 since the programme launched a couple of years ago. Used to be 5% before this whole covid thing. Just be prepared to get a few calls from HSBC from time to time. I've always been honest and said - "because you put the condition incremental balance... if you give me same interest on the balance I will lock in 100k forever". It doesn't normally take that long. Usually a month and I've never had problems with interest calculation...always accurate. Mine is normal HSBC Premier. To become a member of HSBC Premier, this is considered "normal"?  |

|

|

|

|

|

GrumpyNooby

|

Oct 8 2020, 08:38 PM Oct 8 2020, 08:38 PM

|

|

QUOTE(lilsunflower @ Oct 8 2020, 08:33 PM) Yes it's a relatively low requirement for Premier. Im sure it's their KPI to sign people up for Premier as I was rejected by 2 HSBC branches when I tried to open a Basic account (on the basis that can't just open an account without a real purpose) but when I complained to the GM of my home branch he was hard selling Premier. Makes no sense since I don't use any of their facilities. No need minimum assets under management etc. I literally only use it for 100k in and out every month, no other products with them and never talk to my RM. So you attain HSBC Premier membership by meeting this requirement? QUOTE Premier by Perks@Work - Minimum monthly salary of RM16,500 credited continuously each month into HSBC account in Malaysia |

|

|

|

|

|

GrumpyNooby

|

Oct 8 2020, 09:09 PM Oct 8 2020, 09:09 PM

|

|

QUOTE(lilsunflower @ Oct 8 2020, 09:06 PM) No wonder. Understood. |

|

|

|

|

|

GrumpyNooby

|

Oct 9 2020, 12:33 PM Oct 9 2020, 12:33 PM

|

|

QUOTE(leo_kiatez @ Oct 9 2020, 12:18 PM) izit a requirement to in out 100k every month? Because of incremental balance requirement. |

|

|

|

|

|

GrumpyNooby

|

Oct 9 2020, 04:45 PM Oct 9 2020, 04:45 PM

|

|

Best High Interest Savings Accounts In Malaysia (October 2020)(Last update: 9 October 2020) It’s no secret that all of us would love for our savings to earn more money over time. Fixed deposits aren’t as liquid as savings accounts in the event you need immediate cash, but savings accounts basically give no interest these days… right? As it turns out, there are several savings accounts in Malaysia that offer high interest rates – some with over 5% p.a.! Of course, there are certain conditions that need to be met to “unlock” the high interest, but there are also some savings accounts that easily offer more than 10 times the interest of a basic savings account. Link: https://ringgitplus.com/en/blog/budgeting-s...y_-0QVr7oPBFpf0

|

|

|

|

|

|

GrumpyNooby

|

Oct 13 2020, 05:13 PM Oct 13 2020, 05:13 PM

|

|

QUOTE(lifekiat @ Oct 13 2020, 04:41 PM) Want to ask: for RHB smart account, the 3 bills monthly include other bank credit card bill/payement? Here's what the T&C said: 3.5 In relation to the stipulate requirements in Table 1 requirements for “PAY” category: 3.5.1 “PAY” means the payment made from the Account of the Accountholder via RHB Now or RHB Now Mobile Banking to pay utilities bill or other bills under participating billing organizations. “Pay” is divided into two categories as shown in the table below.  https://www.rhbgroup.com/files/personal/cur...2019_Eng_BM.pdf https://www.rhbgroup.com/files/personal/cur...2019_Eng_BM.pdf |

|

|

|

|

|

GrumpyNooby

|

Nov 2 2020, 07:02 AM Nov 2 2020, 07:02 AM

|

|

QUOTE(hakkai0810 @ Nov 2 2020, 12:18 AM) The CS told me before like can using instant transfer but i didnt inquire further. Mayb can call up the bank to ask further 3.25% pa is only applicable for HSBC Amanah Premier Account-i and HSBC Amanah Advance Account-i only? And for these two account, one needs to attain membership for Premier and Advance, right? If you're just attaching HSBC Amanah Basic Savings Account-i, the max attainable interest is just 1.75% pa. Premier Membership: Maintain AUM of RM 250k or earns a monthly gross salary of RM16,500 and above Advance Membership: Maintain AUM of RM 100k or earns a monthly gross salary of RM5,000 and above Normal (Basic): Earns a monthly gross salary of RM 3,000 and above and holds HSBC Amanah Credit Card-i Step Up Campaign T&C: https://cdn.hsbcamanah.com.my/content/dam/h...savings-tnc.pdfPerks@ Work T&C: https://cdn.hsbcamanah.com.my/content/dam/h...twork-terms.pdf |

|

|

|

|

|

GrumpyNooby

|

Nov 6 2020, 09:56 AM Nov 6 2020, 09:56 AM

|

|

QUOTE(GrumpyNooby @ Aug 12 2020, 08:13 PM) This campaign is extended to 31/01/2021: Campaign period: From 1 November 2020 until 31 January 2021. *Terms and conditions apply.  Campaign link: https://www.uob.com.my/personal/promotions/stash-up.page |

|

|

|

|

Aug 8 2020, 05:02 PM

Aug 8 2020, 05:02 PM

Quote

Quote

0.0620sec

0.0620sec

0.73

0.73

7 queries

7 queries

GZIP Disabled

GZIP Disabled