This post has been edited by GrumpyNooby: Jul 7 2020, 06:49 PM

Conditional High Yield Savings Account

|

|

Jul 7 2020, 06:48 PM Jul 7 2020, 06:48 PM

Return to original view | IPv6 | Post

#21

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Jul 10 2020, 09:32 AM Jul 10 2020, 09:32 AM

Return to original view | Post

#22

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jul 10 2020, 07:02 PM Jul 10 2020, 07:02 PM

Return to original view | IPv6 | Post

#23

|

All Stars

12,387 posts Joined: Feb 2020 |

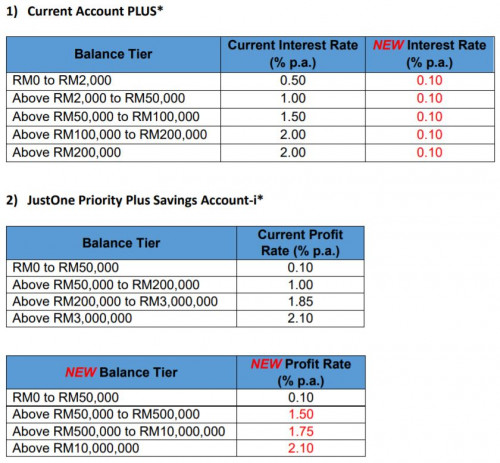

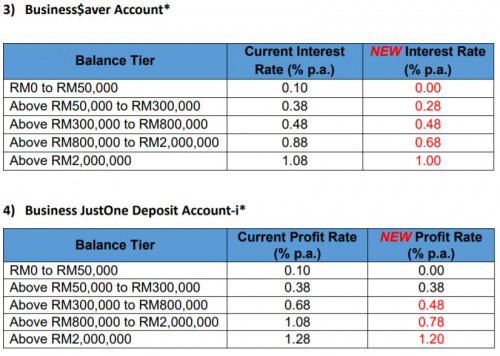

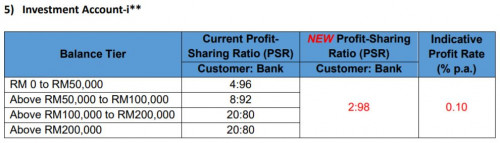

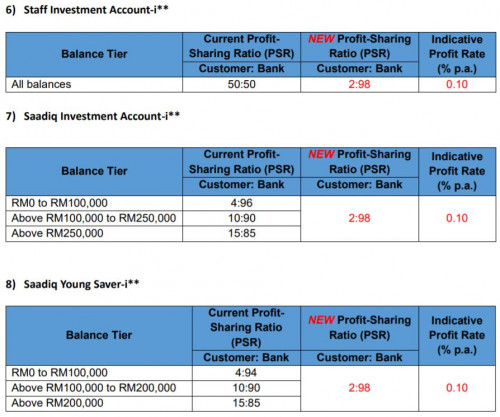

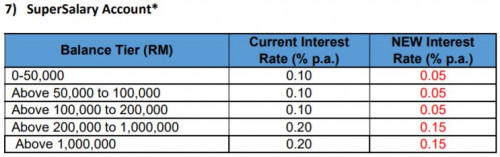

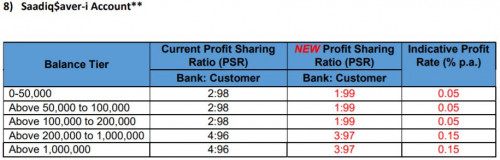

Revision of Product Board Rates and Profit-Sharing Ratio

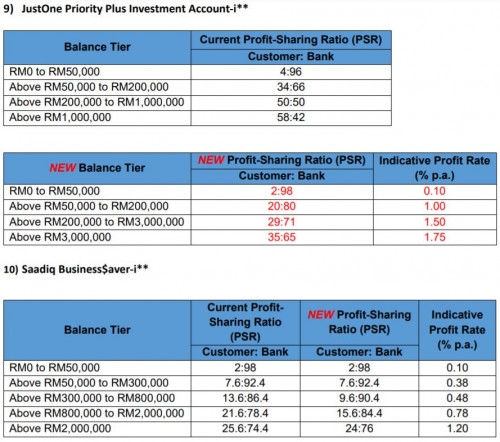

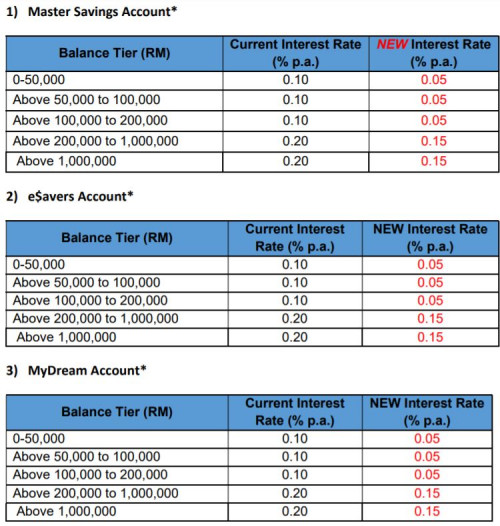

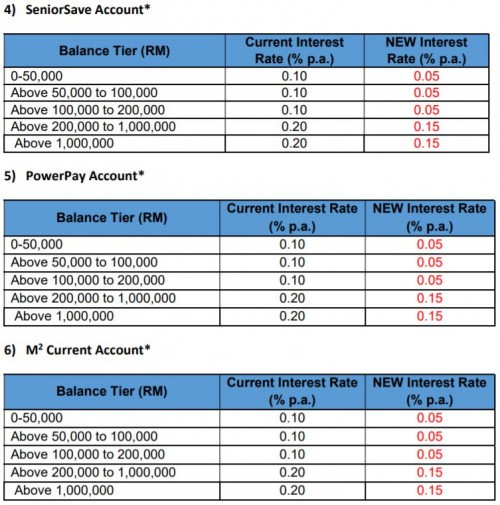

Kindly be informed that the board rates and profit-sharing ratio (PSR) for the following products will be revised effective 14 JULY 2020 and 1 AUGUST 2020 as per details below. All other product features, fees and charges will remain unchanged. The new rates are also available on the Standard Chartered website. A) REVISION OF PRODUCT BOARD RATES EFFECTIVE 14 JULY 2020  B) REVISION OF PRODUCT BOARD RATES AND PROFIT-SHARING RATIO EFFECTIVE 1 AUGUST 2020      https://av.sc.com/my/content/docs/Homepage_...ate_and_PSR.pdf |

|

|

Jul 13 2020, 04:23 PM Jul 13 2020, 04:23 PM

Return to original view | Post

#24

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jul 15 2020, 07:51 PM Jul 15 2020, 07:51 PM

Return to original view | IPv6 | Post

#25

|

All Stars

12,387 posts Joined: Feb 2020 |

A new tier/band created for Alliance SavePlus?

https://www.alliancebank.com.my/banking/per...us-account.aspx Promo with SavePlus: https://www.alliancebank.com.my/promotions/...e-campaign.aspx  This post has been edited by GrumpyNooby: Jul 15 2020, 09:51 PM |

|

|

Jul 16 2020, 12:56 PM Jul 16 2020, 12:56 PM

Return to original view | Post

#26

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Jul 16 2020, 05:54 PM Jul 16 2020, 05:54 PM

Return to original view | IPv6 | Post

#27

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jul 19 2020, 08:43 AM Jul 19 2020, 08:43 AM

Return to original view | IPv6 | Post

#28

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(zenquix @ Jul 19 2020, 02:53 AM) take PSA and apply for a JOP card. if you have insurance / petrol.. you can use the card and load the rest up to 2.5k to bigpay and withdraw. That will allow you to meet the credit card spend for 3.6% QUOTE(Tronoh @ Jul 19 2020, 08:41 AM) alternatively, instead of JOP, take the visa platinum (no annual fee) and transfer to big pay just enough to meet 1k spend. Feel funny that you guys kept proposing people to alter spending behaviour when he has already said that he specifically said that "Not paying any bills as I still live with family and my spending only around 500 per month, so can save a lot"? |

|

|

Jul 20 2020, 08:40 PM Jul 20 2020, 08:40 PM

Return to original view | IPv6 | Post

#29

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Xflkekw @ Jul 20 2020, 08:25 PM) Thanks for the idea. Transferring to big pay and withdraw does seem like a good way to fulfill the condition. Never thought of that before. The Spend Bonus of 1.5% pa is limited to first RM 100k only.Will look into it. If I can get the 3.6% by transferrring to big pay and withdraw while having the balance to break even with the RM6 charge. I dont see the need to open an FD unless I have more money to spare. I just started working and wont have the money to dump into FD anyway. Only thing beyond that amount will earn 2.1% pa. *Provided no revision to the current rate. |

|

|

Jul 21 2020, 08:05 PM Jul 21 2020, 08:05 PM

Return to original view | IPv6 | Post

#30

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Xflkekw @ Jul 21 2020, 08:00 PM) Besides bigpay, is there any other e-wallet that allows you to withdraw money / transfer money to your bank accounts with minimal charge so that I can abuse it to get the 1.5% spend interest of SC PSA account? SarawakPay is the best e-wallet you can abuse. As far as I know, boost, grabpay, and TnG ewallet don’t allow you to withdraw. ShopeePay also can be used for abuse too. |

|

|

Jul 22 2020, 06:02 PM Jul 22 2020, 06:02 PM

Return to original view | IPv6 | Post

#31

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jul 24 2020, 09:05 PM Jul 24 2020, 09:05 PM

Return to original view | IPv6 | Post

#32

|

All Stars

12,387 posts Joined: Feb 2020 |

Revision of Product Board Rates and Profit-Sharing Ratio effective 1 August 2020 [for SC]

https://av.sc.com/my/content/docs/my-revisi...ates-august.pdf |

|

|

Aug 3 2020, 09:00 PM Aug 3 2020, 09:00 PM

Return to original view | IPv6 | Post

#33

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(rocketm @ Aug 3 2020, 08:55 PM) Anyone is using UOB One account? Yes, can open onlineDoes the interest rate is giving out monthly 1st or 15th? Since this saving account will need to tie to UOB credit card, does my annual card fee for my credit card will have any change and also debit card? Can this One account set up can be done online without require to branch?  If you have PIB access, can also open from PIB:    Product link: https://www.uob.com.my/personal/save/saving...ne-account.page This post has been edited by GrumpyNooby: Aug 3 2020, 09:02 PM |

|

|

|

|

|

Aug 4 2020, 01:13 PM Aug 4 2020, 01:13 PM

Return to original view | Post

#34

|

All Stars

12,387 posts Joined: Feb 2020 |

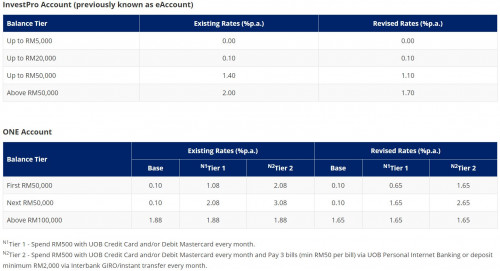

QUOTE(rocketm @ Aug 4 2020, 01:09 PM) Just to clarify the meaning of first RM 50k in this table for UOB One account: MAB up to RM 50k will earn 1.65% pa[attachmentid=10548193] If I keep my monthly saving about RM3k -4k and fulfill the 2 criteria, am I eligible for 1.65% pa interest for that month? Does the first RM50k means the minimum of monthly saving of RM50k and also fulfill the 2 criteria? Next RM 50k (MAB from RM 50,001 to RM 100,000) will earn 2.65% pa (max EIR = 2.15% pa) And of course, all conditions need to be fulfilled. MAB = monthly average balance This post has been edited by GrumpyNooby: Aug 4 2020, 01:14 PM |

|

|

Aug 4 2020, 01:22 PM Aug 4 2020, 01:22 PM

Return to original view | Post

#35

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(rocketm @ Aug 4 2020, 01:20 PM) ok, in this case MAB 3k-4k and fulfill all conditions can get 1.65% pa and from RM50,001, the whole MAB is 2.15% pa? Right? If your MAB is RM 3k to 4k, then you earn 1.65% pa If your MAB is RM 50,001, then you earn 2.15% pa This post has been edited by GrumpyNooby: Aug 4 2020, 01:22 PM |

|

|

Aug 4 2020, 03:59 PM Aug 4 2020, 03:59 PM

Return to original view | IPv6 | Post

#36

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Aug 5 2020, 06:16 PM Aug 5 2020, 06:16 PM

Return to original view | IPv6 | Post

#37

|

All Stars

12,387 posts Joined: Feb 2020 |

Revision of Privilege$aver Campaign Terms & Conditions

Please take note, effective 1 Sep 2020, Deposit Bonus Interest of Privilege Savings Account /Deposit Bonus Hibah of Super Salary-i and Credit Card Spend Bonus Interest will be revised as follows: Clause 11 Table 1. • Deposit Bonus Interest/Hibah will be revised from 2.00% p.a. to 1.50% p.a. with average balance cap of RM 200,000 during the month • Credit Card Bonus Interest will be revised from 1.50% p.a. to 1.00% p.a. Clause 14 Eligible Account holders can earn up to 4.60% p.a. (from 5.60% p.a.) in the promotion account based on total interest/return earned from the Base Rate and total Bonus Rates on all Bonus Categories of Deposit, Card Spend and Wealth Management as seen in Table 1 of the Campaign Terms and Conditions. https://av.sc.com/my/content/docs/my-revisi...egeaver-tcs.pdf |

|

|

Aug 5 2020, 07:18 PM Aug 5 2020, 07:18 PM

Return to original view | IPv6 | Post

#38

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Hobbez @ Aug 5 2020, 07:16 PM) Hmmm, why the SC bank staffs never mentioned these to me and instead tried to sell me a package of "Savings Plan" + FD? I guess they only get commission thru this.... The Savings Plan is to earn extra 2% Invest Bonus interest for PSA?The thing I don't like about Saving Plans is the banks tie you up for many years and you cannot ever withdraw the capital, only the interest. Typically 10-20 years thing. Or should I insist on the basic savings plus FD only. |

|

|

Aug 5 2020, 07:26 PM Aug 5 2020, 07:26 PM

Return to original view | IPv6 | Post

#39

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Hobbez @ Aug 5 2020, 07:25 PM) I'm not sure, but I was shown this plan they have going with Prudential, where you must commit to a sum to save every year and they pay a guaranteed payment annually. And then at the end of the maturity (when you are old and maybe dead and gone), they will pay a big lump sum. That's why it is called "Savings Plan". The problem is, this one ties you up long term for 15 years I believe. Premature withdrawal will lead to loss of capital as the penalty. |

|

|

Aug 8 2020, 12:49 PM Aug 8 2020, 12:49 PM

Return to original view | IPv6 | Post

#40

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Hobbez @ Aug 8 2020, 12:47 PM) I think the best option is to sign up for their Bancassurance or Unit Trust to meet the criteria to get 2% interest for the Saving Account which is 2.1% but will drop to 1.5% in Sept. Make sure the product you selected to commit will have a decent return; other you might as well invest yourself.Put some money into their unit trust and then can get overall rate of 3.5% which is still very attractive. What do you think? Then, the Invest Bonus is up to RM 20k for normal banking customer. |

| Change to: |  0.0777sec 0.0777sec

0.71 0.71

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 03:18 AM |