QUOTE(ZZMsia @ Dec 28 2020, 01:02 PM)

what rumours?Oil & Gas Careers V12 - Upstream & Downstream, Market still slump, slow, snail pace...

Oil & Gas Careers V12 - Upstream & Downstream, Market still slump, slow, snail pace...

|

|

Dec 28 2020, 04:27 PM Dec 28 2020, 04:27 PM

Return to original view | Post

#21

|

Junior Member

80 posts Joined: Oct 2020 |

|

|

|

|

|

|

Dec 30 2020, 09:30 PM Dec 30 2020, 09:30 PM

Return to original view | Post

#22

|

Junior Member

80 posts Joined: Oct 2020 |

|

|

|

Dec 30 2020, 10:53 PM Dec 30 2020, 10:53 PM

Return to original view | Post

#23

|

Junior Member

80 posts Joined: Oct 2020 |

|

|

|

Dec 31 2020, 09:55 AM Dec 31 2020, 09:55 AM

Return to original view | Post

#24

|

Junior Member

80 posts Joined: Oct 2020 |

|

|

|

Dec 31 2020, 09:57 AM Dec 31 2020, 09:57 AM

Return to original view | Post

#25

|

Junior Member

80 posts Joined: Oct 2020 |

|

|

|

Dec 31 2020, 02:00 PM Dec 31 2020, 02:00 PM

Return to original view | Post

#26

|

Junior Member

80 posts Joined: Oct 2020 |

|

|

|

|

|

|

Jan 5 2021, 09:23 AM Jan 5 2021, 09:23 AM

Return to original view | Post

#27

|

Junior Member

80 posts Joined: Oct 2020 |

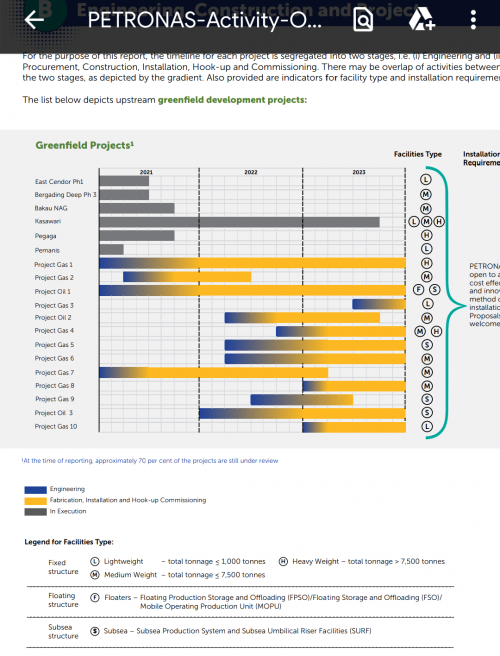

QUOTE(contestchris @ Jan 4 2021, 04:37 PM) Guys has Limbayong FPSO project been delayed further? Petronius activity outlook says the project sanction date has been deferred from 2020 to 2022! Limbayong is Greenfield or brownfield?if Greenfield, i don't think it will be delayed because 1 floater (could be limbayong) will start to execute the engineering by mid 2021 and fabrication on late 2021  |

|

|

Jan 7 2021, 01:38 AM Jan 7 2021, 01:38 AM

Return to original view | Post

#28

|

Junior Member

80 posts Joined: Oct 2020 |

|

|

|

Jan 7 2021, 09:37 PM Jan 7 2021, 09:37 PM

Return to original view | Post

#29

|

Junior Member

80 posts Joined: Oct 2020 |

QUOTE(Maverick85 @ Jan 7 2021, 05:26 PM) although, the mmhe commercial bid is lower than sapura. i think the main factor why sapura win the project is because, mmhe yard is a bit utilized by kasawari cpp, hti and other substructures until next year and reserve for limbayong (maybe). Not sure where to fabricate another giant cpp. meanwhile sapura got no project after pegaga. congrats! |

|

|

Jan 9 2021, 11:03 AM Jan 9 2021, 11:03 AM

Return to original view | Post

#30

|

Junior Member

80 posts Joined: Oct 2020 |

|

|

|

Jan 9 2021, 11:30 AM Jan 9 2021, 11:30 AM

Return to original view | Post

#31

|

Junior Member

80 posts Joined: Oct 2020 |

QUOTE(abgkik @ Jan 7 2021, 02:19 PM) I believe MISC resource is good. They are the only Malaysia FPSO company taking the initiative to hire, and they gonna get excellent engineers as many of them are available. hopefully, misc will get limbayong too, or maybe MTC or Bumi Armada but please not the "Y". i think it is better to award the project to contractor that will hire and utilize local engineers/resources. |

|

|

Jan 12 2021, 09:55 AM Jan 12 2021, 09:55 AM

Return to original view | Post

#32

|

Junior Member

80 posts Joined: Oct 2020 |

so now the Agong declare emergency, what will happen to the upcoming oil n gas projects in Malaysia? does it affect?

|

|

|

Jan 13 2021, 10:59 AM Jan 13 2021, 10:59 AM

Return to original view | Post

#33

|

Junior Member

80 posts Joined: Oct 2020 |

QUOTE(feekle @ Jan 13 2021, 09:27 AM) KUCHING: Serba Dinamik Holdings Bhd will spend RM100mil on the revival project of its recently-acquired Teluk Ramunia (TR) yard in Kota Tinggi, Johor. can't wait!!The revival project, which is expected to commence in the current quarter is to restore the yard’s operational capability of up to 50,000 tonnes in offshore platform steel fabrications and other structures. “The revival of the TR Yard’s operations is at the preliminary planning stage and the group has formed a dedicated project management team to oversee the restoration works and yard operations. “Works to revive the TR Yard’s operations are expected to take up to 24 months and entails, among others, site clearing, setting up of security and perimeter fencing and installation of fabrication-related machineries and equipment, ” according to independent non-executive chairman Datuk Mohamed Nor Abu Bakar in a circular to shareholders last week. The circular is related to Serba Dinamik’s proposed private placement, which is expected to raise gross proceeds of RM538.9mil. The fund raising exercise entails the issuance of 336.83 million placement shares or 10% of the company’s existing number of issued shares. The issue price of the placement shares will be determined by a book-building exercise expected to be participated by local and foreign institutional investors. Serba Dinamik will seek its shareholders approval for the proposed placement of about 101 million shares to its group managing director/CEO Datuk Mohd Abdul Karim Abdullah at an EGM on Jan 20. This private placement is the second in eight months to be carried out by the company. In May 2019, Serba Dinamik raised RM456.7mil from another private placement. Of the proceeds, RM200mil is utilised to pare down bank borrowings and RM245.6mil for group’s working capital. Mohamed Nor said revival of the TR yard would enable the group to differentiate itself from other competitors by having in-house fabrication capabilities, particularly when bidding for offshore and marine contracts in the oil and gas sector. The project is expected to be completed in phases by fourth quarter-2022. Concurrently, Serbia Dinamik plans to commence leasing of certain areas and buildings within the yard, and perform minor fabrication works under the group’s engineering, procurement, construction and commissioning (EPCC) segment this year. Serba Dinamik paid RM320mil in cash to acquire the TR Yard from Petronas Assets Sdn Bhd, a wholly-owned unit of Petroliam Nasional Bhd (Petronas) last September. The yard, which covers 169.96 acres, comprises four adjoining parcels of industrial land, sitting on which are industrial buildings that housed warehouses, workshops, fabrication yard and other ancillary buildings. “With the acquisition of the TR Yard, the group will be able to participate in various seizable projects, such as decommissioning works, offshore transport and installation, integrated hook-up and commissioning services, topside maintenance and other related services. “The TR Yard will complement the group’s upstream offshore and marine engineering services with its existing onshore engineering capabilities by leveraging its service offering through future strategic partnerships and business synergies with the group’s Pengerang Eco-Industrial Park and Bintulu Integrated Energy Hub which will give the group access to suitable facilities, resources and network of expertise for its one-stop engineering services, ” said Mohamed Nor. The group plans to emerge as a global one-stop engineering solutions provider for various industries in the next three to five years. Mohamed Nor said Serba Dinamik group’s order book had received a major boost after securing the Abu Dhabi Innovation Hub project and Abu Dhabi Data Centre project with contract value of RM7.7bil and RM1.5bil respectively. From the proceeds of the private placement, the group intends to set aside RM326.5mil to fund the two mega projects and for general working capital. According to Mohamed Nor, both the Abu Dhabi projects are currently in the planning stage and the their initial construction phase is expected to commence in the current quarter. Serba Dinamik will utilise RM100mil from the impending private placement to further reduce its bank borrowings which currently stood at more than RM4bil. New player is coming to rock the boat guys |

|

|

|

|

|

Jan 14 2021, 09:09 AM Jan 14 2021, 09:09 AM

Return to original view | Post

#34

|

Junior Member

80 posts Joined: Oct 2020 |

|

|

|

Jan 14 2021, 09:12 AM Jan 14 2021, 09:12 AM

Return to original view | Post

#35

|

Junior Member

80 posts Joined: Oct 2020 |

QUOTE(contestchris @ Jan 13 2021, 06:50 PM) but they need to have experience first before can snatch big projects from mmhe and sapura, maybe starting small scale first on early 5 years operation. mmhe should level up their game starting from now |

|

|

Jan 17 2021, 08:24 PM Jan 17 2021, 08:24 PM

Return to original view | Post

#36

|

Junior Member

80 posts Joined: Oct 2020 |

|

|

|

Jan 22 2021, 02:55 PM Jan 22 2021, 02:55 PM

Return to original view | Post

#37

|

Junior Member

80 posts Joined: Oct 2020 |

|

|

|

Jan 22 2021, 02:59 PM Jan 22 2021, 02:59 PM

Return to original view | Post

#38

|

Junior Member

80 posts Joined: Oct 2020 |

QUOTE(mohdyakup @ Jan 22 2021, 12:03 PM) Biden policy towards O&G. I think, before this oil price got plunged because of overproduction in us, and since biden want to cut down production in us. So? Price might increaseBiden, as all known, is a tree lover. He is strong to push renewable agenda, unlike Trump. Thats why on the first day Biden in the Oval Office, he declare wanted to rejoin Paris Climate Declaration. And he revoked Keystone Xl pipeline projects. I think, ongoing FID for the major LNG projects in the US will be shelved or revoked too - coming soon? Also, do expect incoming news about fracking, mesti kena revoked juga rasanya. So, expect another four years of "cold" O&G environment, under investment, not enough funding, puts more pressure on O&G development. Huhu.  |

|

|

Jan 26 2021, 11:22 AM Jan 26 2021, 11:22 AM

Return to original view | Post

#39

|

Junior Member

80 posts Joined: Oct 2020 |

|

|

|

Feb 3 2021, 08:49 AM Feb 3 2021, 08:49 AM

Return to original view | Post

#40

|

Junior Member

80 posts Joined: Oct 2020 |

mohdyakup liked this post

|

|

Topic ClosedOptions

|

| Change to: |  0.0324sec 0.0324sec

0.64 0.64

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 04:19 PM |