QUOTE(Michaelbyz23 @ Apr 12 2017, 08:22 PM)

As per title, just for the purpose of discussion.

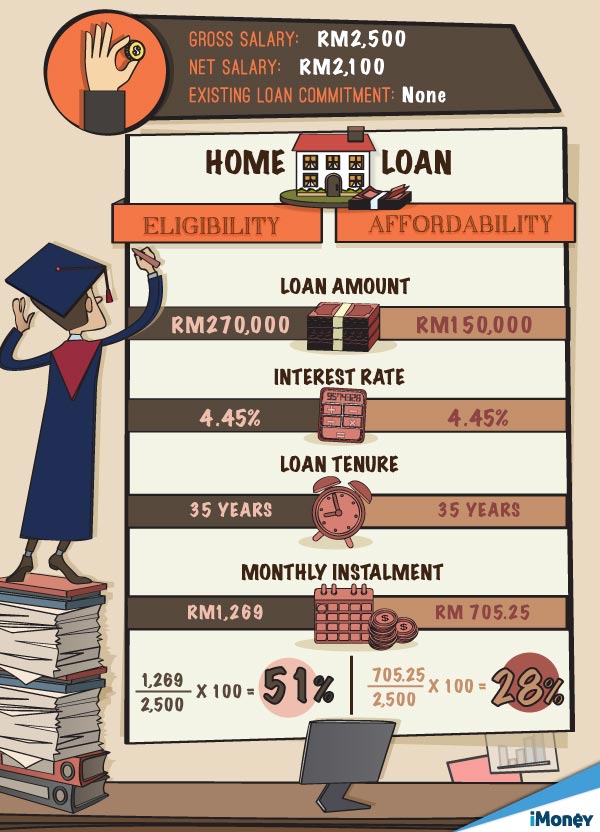

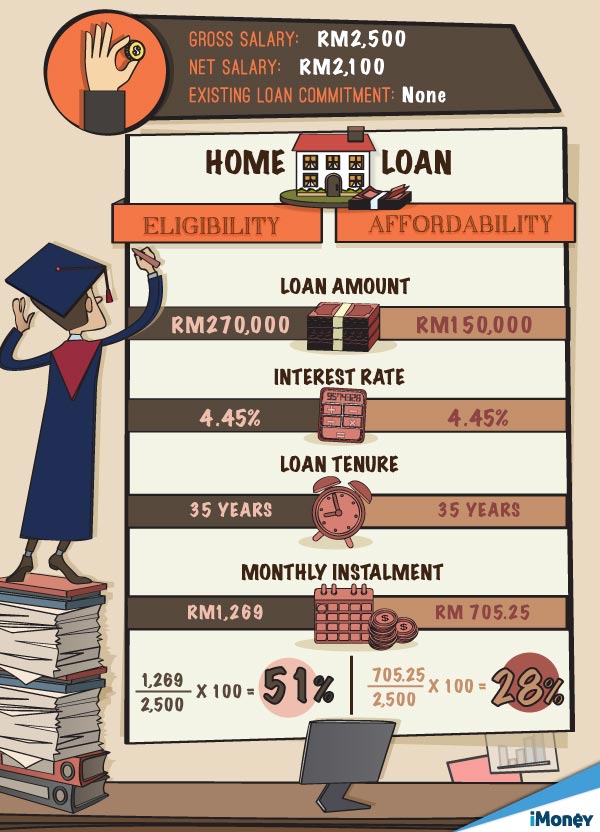

Would you, or are you spending more than 60% of your net income for home loan, and why?

How much would your ideal % of income be tucked away for home loan?

Very simple question but yet, has stir up quite some contrasting views and opinions. For me, yes, technically on paper, I’ve more than 70% of my nett employment income for home loan. But at the same time, from this 60% that goes to home loan, I do get back a fair amount of money from the rental generated. The 60% is also spread out among few home loans (few properties).

If I were to consider rental income as part of my total income, then the figure drops to about 50%.

Why am I leveraging so much? Isn’t 70% dangerous one might ask? Well, I would still consider myself young (early 30’s) and about to start a family. Rather take the risk (meticulously calculated risk), and hopefully make it big through properties than regretting later in life. So far, things are good. My only worry moving forward is not about having insufficient properties, but rather not being able to further increase this DSR figure of mine which is currently at the 70% level. I have not done the detailed calculations yet, but with a 20% pay rise, I am hoping that I can further push this 70%++ figure to 80%.

Noticed that another forummer commented on this thread and told you to close the thread as the topic is irrelevant. The DSR can also be googled up easily. Not sure what is his/her level of involvement or experience in property investment but it pretty much shows that he doesn’t have it both. For seasoned investor who have an impressive portfolio (and also very deep pockets), DSR can go easily cross 60% and way more than that. I’ve known of individuals who have breached the 100% mark. Imagine an individual having a nett worth of RM20mil (properties, securities, cash), borrowing a RM3mil home loan but with a monthly repayment that will clock his/her DSR at 100%. With the right and relevant supporting documents, chances of the home loan getting approved is very high. Of course, this policy differs from bank to bank. Each financial institution have their own risk appetite and evaluate opportunities differently.

Anyway, good luck in your investment journey!

Apr 12 2017, 11:00 PM

Apr 12 2017, 11:00 PM

Quote

Quote

0.1273sec

0.1273sec

1.20

1.20

7 queries

7 queries

GZIP Disabled

GZIP Disabled