Would you, or are you spending more than 60% of your net income for home loan, and why?

How much would your ideal % of income be tucked away for home loan?

Would you spend over 60% of your income?, For home loan

|

|

Apr 12 2017, 08:22 PM, updated 9y ago Apr 12 2017, 08:22 PM, updated 9y ago

Show posts by this member only | Post

#1

|

Senior Member

4,546 posts Joined: Jun 2009 From: Selangor / Sarawak / New York |

As per title, just for the purpose of discussion.

Would you, or are you spending more than 60% of your net income for home loan, and why? How much would your ideal % of income be tucked away for home loan?     |

|

|

|

|

|

Apr 12 2017, 08:26 PM Apr 12 2017, 08:26 PM

Show posts by this member only | Post

#2

|

Senior Member

1,765 posts Joined: Jul 2010 |

Anything above 50% of nett income just for loan repayments, for me that's living close to the edge already.

|

|

|

Apr 12 2017, 08:38 PM Apr 12 2017, 08:38 PM

Show posts by this member only | Post

#3

|

Senior Member

9,616 posts Joined: Dec 2013 |

60% for home loan only, no.

|

|

|

Apr 12 2017, 08:43 PM Apr 12 2017, 08:43 PM

Show posts by this member only | Post

#4

|

Senior Member

4,546 posts Joined: Jun 2009 From: Selangor / Sarawak / New York |

QUOTE(8sg9ft @ Apr 12 2017, 08:26 PM) Anything above 50% of nett income just for loan repayments, for me that's living close to the edge already. QUOTE(heavensea @ Apr 12 2017, 08:38 PM) But for starters, generally the millenials are having tough time, tend to fall into the 60+% bracket.Salary will go up in time, maybe suffer for 2 years, then as salary goes up, things will be better? This post has been edited by Michaelbyz23: Apr 12 2017, 08:52 PM |

|

|

Apr 12 2017, 08:44 PM Apr 12 2017, 08:44 PM

Show posts by this member only | Post

#5

|

Senior Member

1,780 posts Joined: Nov 2010 |

firstly, your question is wrong and not making any sense, please this close this thread and google DSR....

|

|

|

Apr 12 2017, 08:50 PM Apr 12 2017, 08:50 PM

Show posts by this member only | Post

#6

|

Senior Member

4,546 posts Joined: Jun 2009 From: Selangor / Sarawak / New York |

QUOTE(Nikmon @ Apr 12 2017, 08:44 PM) firstly, your question is wrong and not making any sense, please this close this thread and google DSR.... Mind further your explanation? My question was simple and simply for discussion purpose, on whether will you be willing to spend 60% of net income for home loan. Do I need to close my topic as per ordered by you, simply because I posted a discussion thread? Please advise me, sifu If it's wrong, or offensive, I apologize, you are free to hit the report button as well. |

|

|

|

|

|

Apr 12 2017, 09:00 PM Apr 12 2017, 09:00 PM

Show posts by this member only | Post

#7

|

Senior Member

2,812 posts Joined: Dec 2011 |

worth if salary above 10k

|

|

|

Apr 12 2017, 09:02 PM Apr 12 2017, 09:02 PM

Show posts by this member only | IPv6 | Post

#8

|

Senior Member

1,359 posts Joined: Aug 2013 |

Mine 80% got for loan repayment 😂

|

|

|

Apr 12 2017, 09:06 PM Apr 12 2017, 09:06 PM

Show posts by this member only | Post

#9

|

Senior Member

2,812 posts Joined: Dec 2011 |

|

|

|

Apr 12 2017, 09:10 PM Apr 12 2017, 09:10 PM

|

Senior Member

7,343 posts Joined: May 2005 |

|

|

|

Apr 12 2017, 09:18 PM Apr 12 2017, 09:18 PM

|

Senior Member

1,780 posts Joined: Nov 2010 |

QUOTE(Michaelbyz23 @ Apr 12 2017, 08:50 PM) Mind further your explanation? My question was simple and simply for discussion purpose, on whether will you be willing to spend 60% of net income for home loan. Do I need to close my topic as per ordered by you, simply because I posted a discussion thread? if you want to gauge how many rich and poor pp in this forum, than your poll's question is make sense.Please advise me, sifu If it's wrong, or offensive, I apologize, you are free to hit the report button as well. 60% is affordable for high income but not low income. This post has been edited by Nikmon: Apr 12 2017, 09:24 PM |

|

|

Apr 12 2017, 09:21 PM Apr 12 2017, 09:21 PM

Show posts by this member only | IPv6 | Post

#12

|

Senior Member

1,359 posts Joined: Aug 2013 |

|

|

|

Apr 12 2017, 09:22 PM Apr 12 2017, 09:22 PM

|

Junior Member

319 posts Joined: Nov 2012 |

i believe in work hard now relax later.. first few year is abit harder but at least at later age we can relax more.. if we dint give a go now with high commitments, then few years later our life will be more difficult..

|

|

|

|

|

|

Apr 12 2017, 09:28 PM Apr 12 2017, 09:28 PM

|

Junior Member

331 posts Joined: Mar 2017 |

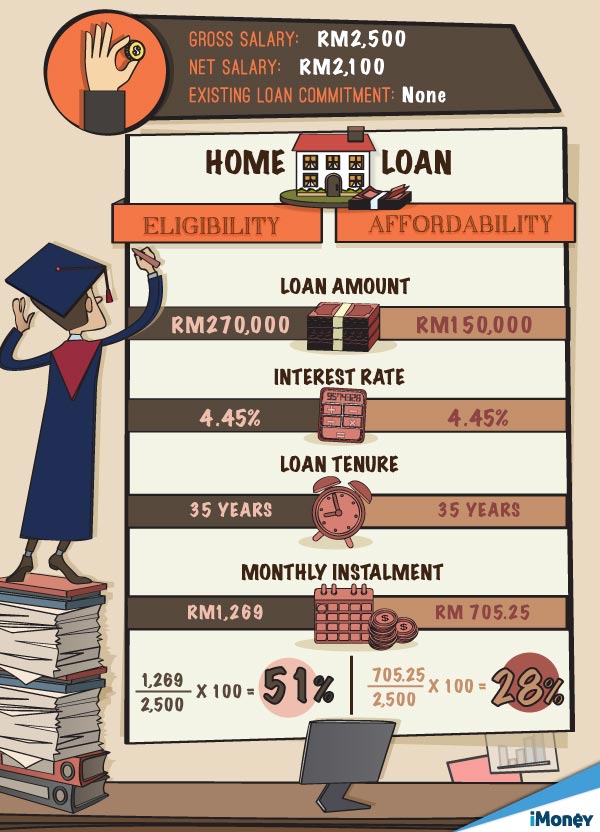

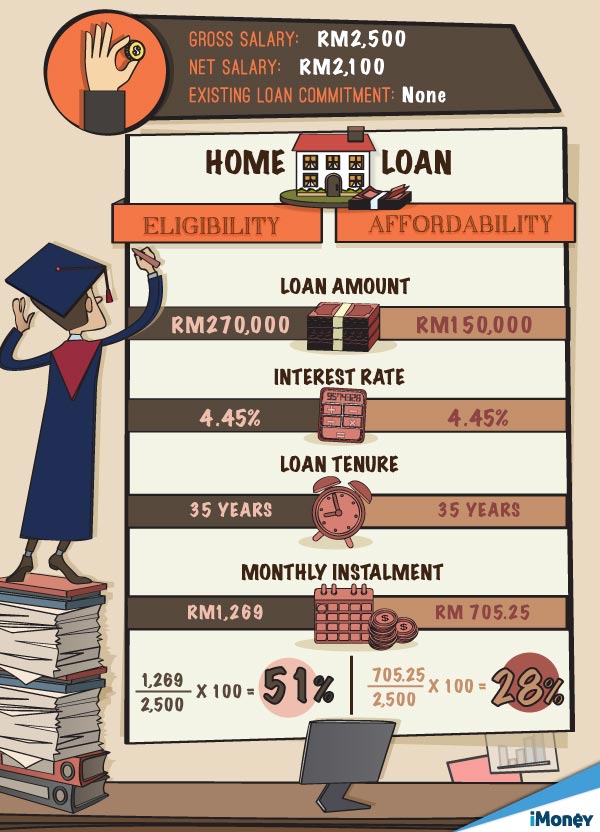

Doubt the bank would approve the loan 270k wit juz 2.1k nett income nowadays

|

|

|

Apr 12 2017, 09:28 PM Apr 12 2017, 09:28 PM

|

Senior Member

3,838 posts Joined: Sep 2013 |

QUOTE(Nikmon @ Apr 12 2017, 09:18 PM) if you want to gauge how many rich and poor pp in this forum, than your poll's question is make sense. correct. 60% for person with 1.8k salary is madness. prob wont hv enough to eat. 60% of 20k on the other hand is still comfortable.60% is affordable for high income but not low income. |

|

|

Apr 12 2017, 09:28 PM Apr 12 2017, 09:28 PM

|

Junior Member

115 posts Joined: Mar 2017 |

This is a very subjective question, if your annual income is like Lim Kok Thay, then you can well afford to spend more than 60% of your income on a home loan, as the balance income (after minus the home loan) is still tens of millions, and a small fraction of this is sufficient for you to sustain your living expenses.

On the other hand, if you income is 2k a month, if you pay 60% for home loan, the balance income is hardly sufficient to sustain a living. In any event, please note that Bank Negara only allows around 30%-40% of one's income for payment of home loan, so even if you wish to use 60% of your income to pay your home loan, no bank will agree to this. |

|

|

Apr 12 2017, 09:38 PM Apr 12 2017, 09:38 PM

Show posts by this member only | IPv6 | Post

#17

|

Senior Member

1,416 posts Joined: Feb 2015 |

|

|

|

Apr 12 2017, 09:39 PM Apr 12 2017, 09:39 PM

|

Senior Member

9,616 posts Joined: Dec 2013 |

QUOTE(Michaelbyz23 @ Apr 12 2017, 08:43 PM) But for starters, generally the millenials are having tough time, tend to fall into the 60+% bracket. imno,Salary will go up in time, maybe suffer for 2 years, then as salary goes up, things will be better? everyone have to anticipate adverse future such as retrenchment, losing ability to work (touch wood) and etc. don't say 60%, 50% also considered risky as putting own-self in the edge of cliff already; especially in current malai bole land economy/market which is bleak like Death Metal music. |

|

|

Apr 12 2017, 09:41 PM Apr 12 2017, 09:41 PM

Show posts by this member only | IPv6 | Post

#19

|

Senior Member

1,416 posts Joined: Feb 2015 |

What if monthly income RM3000 but have FD 500k and use the interest to pay housing loan?

|

|

|

Apr 12 2017, 09:48 PM Apr 12 2017, 09:48 PM

|

Senior Member

2,396 posts Joined: Aug 2016 |

|

| Change to: |  0.0503sec 0.0503sec

0.63 0.63

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 05:32 PM |