QUOTE(Smurfs @ May 31 2019, 08:37 AM)

LolBWC

BWC

|

|

May 31 2019, 11:51 AM May 31 2019, 11:51 AM

Return to original view | Post

#821

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

|

|

|

Jun 2 2019, 03:53 PM Jun 2 2019, 03:53 PM

Return to original view | Post

#822

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Boon3 @ Aug 10 2018, 10:39 AM) Haha... yes we not eperts lah.... just talking chickens and what nots... This from post #1584I wanna blow more steam on US imports from China, I mean US the consumer and lets talk from a business perspective ... With the Trump Tariffs, the Chinese goods are some 20-25% higher (are the figures right?). I would break it into 2 group buyers, ie manufacturers or end users. For manufacturers (buyers of chinese raw materials or component parts), the buyers are either... 1. Looking for cheaper alternative... a. buying from a local source or getting someone to produce locally. I believe the manufacturers bought from the Chinese cause they were cheaper ... now with this new tariff, would the manufacturers be able to source from US itself? Or can it be produced as cheaply? If can, would someone want set up plant to produce these component parts? (this one is tricky... cos the Americans have to account for the risk of Trump reign as a president and once he is out, will the tariffs stay or be removed?) b. sourcing from another country. This is logical but then.... I am left scratching my head.. Trump, proclaimed the trade deficit was too high. So when the manufacturers buy component parts from another country, it's just a shifting of source, as the trade deficit still remain high and in fact, it COULD EVEN END UP HIGHER. For example, say US don't buy from China this component part. The next best source (price) is Turkey. But the Turkish part is say 15% higher (15% still cheaper than the tariff imposed) than the price they used to buy from China. So how would it help reduce the Americans trade deficit? c. the manufacturers buy like normal but with higher prices. which means, these American factories would have to bear the higher cost or they pass on the American consumers... either way, not a good picture ... Some links on the impact on Americans itself... This US TV manufacturer which relied on Chinese component parts... https://money.cnn.com/2018/08/08/news/compa...cuts/index.html Other reading links on how things are felt locally... https://www.10news.com/news/inside-san-dieg...ng-felt-locally This car part manufacturer,Magna says they will take the tariff hit... quote ""If the tariffs stay the way they are – and who knows if anything more gets ratcheted up in China – it's about a $60 million a year hit," https://www.cnbc.com/2018/08/09/magna-inter...pportunity.html and the story of Pegasus... https://www.theguardian.com/business/2018/a...ade-war-with-us Anyway back to point b. Sourcing from another country.. So a US company might move its supply chain from China to a country like Mexico... Companies like GoPro or Hasboro, they shifted some of their supply chain to Mexico. https://www.nytimes.com/2019/04/05/business...decoupling.html Then this happened.... https://www.cnbc.com/2019/05/31/surprise-me...nt-chances.html Key word : How could you trust Duck... |

|

|

Jun 3 2019, 12:21 PM Jun 3 2019, 12:21 PM

Return to original view | Post

#823

|

All Stars

15,942 posts Joined: Jun 2008 |

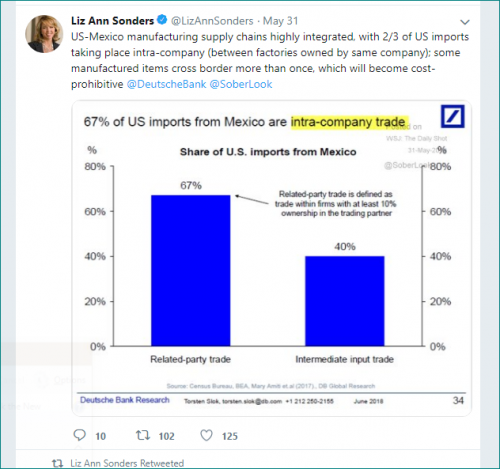

QUOTE(Boon3 @ Jun 2 2019, 03:53 PM) This from post #1584 Liz Ann Sonders, CIS Charles Swabb twitted...Anyway back to point b. Sourcing from another country.. So a US company might move its supply chain from China to a country like Mexico... Companies like GoPro or Hasboro, they shifted some of their supply chain to Mexico. https://www.nytimes.com/2019/04/05/business...decoupling.html Then this happened.... https://www.cnbc.com/2019/05/31/surprise-me...nt-chances.html Key word : How could you trust Duck... https://twitter.com/LizAnnSonders/status/1134413617380675587  Some argued 'These tariffs are about stopping the re-branding of Chinese imports as being from Mexico' Vietnam? What if ...... |

|

|

Aug 3 2019, 08:06 PM Aug 3 2019, 08:06 PM

Return to original view | IPv6 | Post

#824

|

All Stars

15,942 posts Joined: Jun 2008 |

Hmmm... rather interesting.

Anyway, if anyone wants to post charts and do some TA, please feel free to do so. 🍻 |

|

|

Aug 4 2019, 05:24 PM Aug 4 2019, 05:24 PM

Return to original view | Post

#825

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Aug 4 2019, 08:14 PM Aug 4 2019, 08:14 PM

Return to original view | IPv6 | Post

#826

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(iwubpreve @ Aug 4 2019, 07:38 PM) both also do export. now trade war this 2 counter will be benefited. but pccs have low pe and high nta. seems very good. Lol. You seem to have answered yourself... But anyway.....pccs first. In its notes... QUOTE On a year-to-year basis, the Group recorded lower revenue of RM436 million as compared to RM529 million achieved in the previous corresponding period as China Apparel Division’s operation has slowed down. The pre-tax profit of the Group for the period under review recorded at RM27 million as compared to pre-tax profit of RM10 million recorded for the corresponding period. This was mainly due to the better results achieved by Apparel Business and Printing and Embroidering Business in Cambodia and Labelling Business in Malaysia. Other than that was the gains derived from disposals of assets. China business had slowed down but was countered by better apparel result in Cambodia and labelling business from Malaysia. And then the disposal of assets helped the bottom line. This doesn't sound like PCCS benefiting from the trade war at all since (1) the total revenue dropped a lot from business year, which indicates business not so good. If it had benefitted from the trade war theory, sales would have increased yes? (2) the bread and butter is the apparel business and the slowdown can be seen. Given those 2... It doesn't sound like a good bet that pccs super good profits this fiscal would carry forward... Low pe high nta. This is badly preached.. so much risk involved if one simply assume and insist that its a holy grail.... Want an example? London Biscuits...... |

|

|

|

|

|

Aug 4 2019, 08:15 PM Aug 4 2019, 08:15 PM

Return to original view | IPv6 | Post

#827

|

All Stars

15,942 posts Joined: Jun 2008 |

BTW that's my opinion la... don't simply trust me as I could easily be wrong.

|

|

|

Aug 30 2019, 02:50 PM Aug 30 2019, 02:50 PM

Return to original view | IPv6 | Post

#828

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Aug 30 2019, 03:17 PM Aug 30 2019, 03:17 PM

Return to original view | IPv6 | Post

#829

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Aug 30 2019, 04:23 PM Aug 30 2019, 04:23 PM

Return to original view | IPv6 | Post

#830

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(iwubpreve @ Aug 30 2019, 03:37 PM) I just realised you are asking about Naim. The following is what I can recall on my notes. Naim, should always be considered as a holding company first and foremost and one should not forget its property development. As such valuation based on earnings tends to be unreliable. Furthermore, earnings from property sector tends to be lumpy.... |

|

|

Sep 3 2019, 09:06 AM Sep 3 2019, 09:06 AM

Return to original view | IPv6 | Post

#831

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Boon3 @ Aug 4 2019, 08:14 PM) Lol. .... and PCCS earnings came crashing down.. You seem to have answered yourself... But anyway.....pccs first. In its notes... China business had slowed down but was countered by better apparel result in Cambodia and labelling business from Malaysia. And then the disposal of assets helped the bottom line. This doesn't sound like PCCS benefiting from the trade war at all since (1) the total revenue dropped a lot from business year, which indicates business not so good. If it had benefitted from the trade war theory, sales would have increased yes? (2) the bread and butter is the apparel business and the slowdown can be seen. Given those 2... It doesn't sound like a good bet that pccs super good profits this fiscal would carry forward... Low pe high nta. This is badly preached.. so much risk involved if one simply assume and insist that its a holy grail.... Want an example? London Biscuits...... |

|

|

Sep 3 2019, 12:08 PM Sep 3 2019, 12:08 PM

Return to original view | Post

#832

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Sep 25 2019, 05:07 PM Sep 25 2019, 05:07 PM

Return to original view | IPv6 | Post

#833

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Cubalagi @ Sep 25 2019, 04:19 PM) This is called a secular trend. In terms of charts, you can look at some Elliot Wave theories on this. I don't want to pretend to be an expert n talk bullshit. The one chart that I do look at of gold is the weekly chart drawn against the USD.Fundamentally though, I believe gold price will get much higher in RM terms within the next 5 years. The bullish ascending triangle break of 1400 happened near end June recently. I would never use the MYR chart because the need to factor in the USDMYR factor. One extra risk factor. One extra headache. |

|

|

|

|

|

Sep 26 2019, 01:52 PM Sep 26 2019, 01:52 PM

Return to original view | IPv6 | Post

#834

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Cubalagi @ Sep 26 2019, 12:44 PM) Yes.. Basically 2 things in play in the chart above. If one followed the usd$gold the entry would have been around 1400 or so.Gold vs USD USD vs MYR Long term Im bullish both gold and USD based on fundamental factors.. However, you should be aware both the gold and the usd are pretty much 'controlled' items. (Duckie would probably use the manipul... word 🤣) |

|

|

Oct 6 2019, 10:09 AM Oct 6 2019, 10:09 AM

Return to original view | Post

#835

|

All Stars

15,942 posts Joined: Jun 2008 |

Regarding Mayban....

The strategy... First. To have a target of 10... for me... it's right off the charts. Which means ur strategy is dictated by the chart... If that was the case, the buy is supported by the fact the stock did have a support of around 8.50 recently. However how strong of a support is that? I for one, would be worried of the immediate down channel which is looking rather prominent.. Can u see that channel/trend? If basing on this I would be asking if the risk/reward justifies the trade. Doesn't look like too much meat there.... ** here is the chart **

**addum** so if one buy at 8.50 with the target set at 10, the potential upside is 1.50 or about 17% ... and the stop loss? 7%? 7.5%? 10%? The gain is not that much , yes? Yeah dividends can help... but then this is a time factor issue where if it was me, I would probably factor in other stuff... for example, previously at 10, Mayban was trading with a trailing dps of 57 sen or a pretty generous 5.7% yield. Yet here we are, despite that generous 5.7% yield, the stock is now at 8.44 and the yield is 6.75% (higher yield due to the falling stock price). So definitely the dividend doesn't seem to help the 'investor' at all. Of course this could drag on forever, if one starts insisting by holding the stock on a longer time frame, such as more than one year... but then... this would have gone against the initial strategy of betting to win 1.50 from this mayban trade, yes? The meat in the initial trade isn't really that fat in the first place. Now if I have to hold it longer, then my compounded returns would be down for this stock play.... and then what about the DRP factor if I were to hold it on a longer time frame? Would earnings dilutions be a factor (I have yet to look see into this...so... ~~~~~~~~~~~~~~~~~~~~ Stocks are priced to its future prospects... right now, the banking sector is not looking too good as global banks are cutting its rates. A lower Opr from Bank N would cause lower loan interest rates which means the risk is that Bank earnings would decline in the near future. Less earnings would means the possibly of lesser dividends. Adding to its problems, its already been reported that loan growths are already declining... So.. atm.. I would not jump in. Just sharing la... I could always be wrong by being too conservative.... And this ain't an attack. |

|

|

Oct 6 2019, 05:50 PM Oct 6 2019, 05:50 PM

Return to original view | IPv6 | Post

#836

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Oct 6 2019, 06:00 PM Oct 6 2019, 06:00 PM

Return to original view | IPv6 | Post

#837

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Cubalagi @ Oct 6 2019, 04:59 PM) Haha.. Move reply to ur home ground issit? Move is better lo. Else ppl complain lots, how? But seriously thanks for sharing your thoughts. Something for me to think about.. To be honest I wasn't really considering the technical part so much. Arguable even whether can call it a trade, more like investment. But for discussion let's call it a trade. At the end of the day it's all about making money. I guess when I go in Maybank, I was calculating target is RM10 and I do see the downside risk potentialy going down to RM7.50 based on historical prices. As u say this is where dividends help improve the loss reward calculation. So when I keyed in order at RM8.40 (I didn't get hit btw), a very good outcome will be: Price go up to 10 bucks maybe by September next year + final FY19 dividends of 30 sen (FY18 was 32 sen) in May 20. For a total RM1.90 profits, or a 22. 6% gain. Of cuz this is dream one..😆 But another thing, bank valuations are commonly measured by price-book, n current PB is about 1.2 which is 2016 level n 2016 was a good time to buy Maybank. Now on the downside risk, there is no cut loss price in this strategy. Cutting loss will be a mistake. You average down! (haha.. I know u completely against this). U do the Warren Buffett cut loss i. e. You cut loss not based on price but only if there is any material change to the business that makes u realize this business is gone case. So need to keep watch on the business tho. In the meantime, the challenge is to stomach the volatility. As the price goes down, the risk reward calculation gets better. So the strategy is buy more. The main risk control in this strategy is position size. How much % of Maybank u allow in your portfolio. I would say 10-20%. This is also where u don't want to run out of bullets too early n max your allocation Fundamentally, it's a challenging year so far for the banks. I'm expecting slightly lower earnings and slightly lower dividends FY19. Maybe 54-55 Sen divvy (25 sen already paid). FY20, market is expecting worse based on the price so far. But the market could be wrong and things can quickly change. Now u can tell me that I'm being stupid.. 😆 Here is one extra thing to note... that 7.50 thingy.. Open your historical chart ..look at the 10 year chart... From 2013 the stock had a multi year correction...a slow multi year correction to your 7.50... And guess what... during this period...dividends declined... Like I say b4, dividends a good bonus but.. if and when dividends decline... the stock can have a huge decline... So jaga lo This post has been edited by Boon3: Oct 6 2019, 06:18 PM |

|

|

Oct 6 2019, 06:17 PM Oct 6 2019, 06:17 PM

Return to original view | IPv6 | Post

#838

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Cubalagi @ Oct 6 2019, 04:59 PM) Haha.. Move reply to ur home ground issit? The last 2 paragraphs... This is where we defer. But seriously thanks for sharing your thoughts. Something for me to think about.. To be honest I wasn't really considering the technical part so much. Arguable even whether can call it a trade, more like investment. But for discussion let's call it a trade. At the end of the day it's all about making money. I guess when I go in Maybank, I was calculating target is RM10 and I do see the downside risk potentialy going down to RM7.50 based on historical prices. As u say this is where dividends help improve the loss reward calculation. So when I keyed in order at RM8.40 (I didn't get hit btw), a very good outcome will be: Price go up to 10 bucks maybe by September next year + final FY19 dividends of 30 sen (FY18 was 32 sen) in May 20. For a total RM1.90 profits, or a 22. 6% gain. Of cuz this is dream one..😆 But another thing, bank valuations are commonly measured by price-book, n current PB is about 1.2 which is 2016 level n 2016 was a good time to buy Maybank. Now on the downside risk, there is no cut loss price in this strategy. Cutting loss will be a mistake. You average down! (haha.. I know u completely against this). U do the Warren Buffett cut loss i. e. You cut loss not based on price but only if there is any material change to the business that makes u realize this business is gone case. So need to keep watch on the business tho. In the meantime, the challenge is to stomach the volatility. As the price goes down, the risk reward calculation gets better. So the strategy is buy more. The main risk control in this strategy is position size. How much % of Maybank u allow in your portfolio. I would say 10-20%. This is also where u don't want to run out of bullets too early n max your allocation Fundamentally, it's a challenging year so far for the banks. I'm expecting slightly lower earnings and slightly lower dividends FY19. Maybe 54-55 Sen divvy (25 sen already paid). FY20, market is expecting worse based on the price so far. But the market could be wrong and things can quickly change. Now u can tell me that I'm being stupid.. 😆 I am like win big or don't bother.... |

|

|

Oct 7 2019, 10:17 AM Oct 7 2019, 10:17 AM

Return to original view | Post

#839

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Cubalagi @ Oct 6 2019, 04:59 PM) But another thing, bank valuations are commonly measured by price-book, n current PB is about 1.2 which is 2016 level n 2016 was a good time to buy Maybank. I did write on Maybank several times before. post #1878 That post highlighted the severe stock down trend back then. The classical decline in earnings and also the declining dividends.... the issues on Maybank before OCT 2016. the chart posted then....  and then .... post #1911 ... where I did give a hint .... that the down trend has changed..... (also do read the comments Smurf made (my hint was given in a reply to him) (post was made on 11 Oct 2016 ) quote: QUOTE .... it's like Mayban... the charts are perhaps slightly suggestive right now ... suggesting that one should be on the lookout for any trading opportunity.... you can refer to this other chart ... see how the trend changed in Oct 2016?  Notice how the earnings improved in Nov. There was no longer the double digit declines in profits. Then notice the huge turnaround, the huge improvement in earnings in Feb 2017..  So for me, I think it's not necessary to jump into the stock which is in a clear downtrend.... instead, perhaps it's better to kiv the stock, put it in the stock watchlist, and patiently wait for the change in stock trend. |

|

|

Oct 7 2019, 10:29 AM Oct 7 2019, 10:29 AM

Return to original view | Post

#840

|

All Stars

15,942 posts Joined: Jun 2008 |

|

| Change to: |  0.1903sec 0.1903sec

0.36 0.36

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 08:57 PM |