Dear all traders here

How and where do you park money if you are not trading

Assuming you are staying in turkey and Lira just fallen more than 50% in 1 year, 100% in 3 years and 150% in 5 years?

Do you hedge in gold or USD?

BWC

BWC

|

|

Nov 5 2020, 08:37 AM Nov 5 2020, 08:37 AM

Return to original view | Post

#41

|

Senior Member

1,075 posts Joined: Apr 2010 |

Dear all traders here

How and where do you park money if you are not trading Assuming you are staying in turkey and Lira just fallen more than 50% in 1 year, 100% in 3 years and 150% in 5 years? Do you hedge in gold or USD? |

|

|

|

|

|

Nov 8 2020, 10:05 AM Nov 8 2020, 10:05 AM

Return to original view | Post

#42

|

Senior Member

1,075 posts Joined: Apr 2010 |

|

|

|

Nov 9 2020, 01:27 PM Nov 9 2020, 01:27 PM

Return to original view | Post

#43

|

Senior Member

1,075 posts Joined: Apr 2010 |

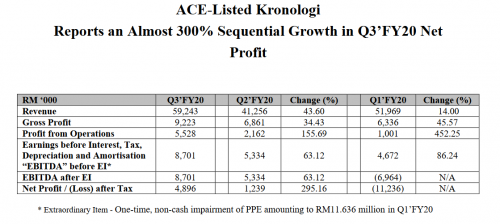

QUOTE(Boon3 @ Nov 9 2020, 08:49 AM) » Click to show Spoiler - click again to hide... « Hence, as you noted, a better QR would be better cos you would want to see more profit recovery in the next quarter and hopefully Krono see profit recover back up to 4mil + since as it is, profit is way too small... » Click to show Spoiler - click again to hide... «  price would be gap up. paper trade buy at opening price This post has been edited by squarepilot: Nov 9 2020, 01:29 PM |

|

|

Nov 10 2020, 12:35 PM Nov 10 2020, 12:35 PM

Return to original view | Post

#44

|

Senior Member

1,075 posts Joined: Apr 2010 |

Hi Boon,

how about industrial Reits like Axis (KLSE) and Mapletree Industrial/Sabana (SGX) that doesnt rely on retail? It goes up because of speculation? |

|

|

Nov 15 2020, 03:12 PM Nov 15 2020, 03:12 PM

Return to original view | Post

#45

|

Senior Member

1,075 posts Joined: Apr 2010 |

|

|

|

Nov 17 2020, 10:12 AM Nov 17 2020, 10:12 AM

Return to original view | Post

#46

|

Senior Member

1,075 posts Joined: Apr 2010 |

QUOTE(Boon3 @ Nov 17 2020, 09:23 AM) p/s ..... I do not think I could got into such a trade... agree on point 2 and point 31. I will be guessing when and at what price the stock would turn/reverse .... 2. Things are so pretty bad all around ... lots of small business suffering badly/closing .... layoffs... 3. Yeah... market is priced to future expectations.... I could be wrong but I strongly C19 has a long, long way to go...... hence recovery theme is so far fetch at current moment.... first we need to see actual decline of new cases and then we need to see businesses actually recover..... which I reckon is many, many moons away.... only way... I would be in such a trade is if I just jumped in and follow the herd blindly.... okay... time to find my spider .... but then the thought of FOMO kicks in When Actual decline of new cases and then we need to see businesses actually recover due to the support and speculation of traders and Institutional. price of stocks may already reach peak, or new peak |

|

|

|

|

|

Nov 17 2020, 11:23 AM Nov 17 2020, 11:23 AM

Return to original view | Post

#47

|

Senior Member

1,075 posts Joined: Apr 2010 |

QUOTE(Suicidal Guy @ Nov 17 2020, 10:52 AM) Probably euphoria is starting for Covid19 beaten stocks.. next stage is realisation stage which will bring stocks down.. and then there will be real recovery.. with the fast movement due to technology and robo automated trading. i have some reservation on thisThat's what I think la.. |

|

|

Nov 24 2020, 08:43 AM Nov 24 2020, 08:43 AM

Return to original view | IPv6 | Post

#48

|

Senior Member

1,075 posts Joined: Apr 2010 |

|

|

|

Nov 29 2020, 01:54 PM Nov 29 2020, 01:54 PM

Return to original view | IPv6 | Post

#49

|

Senior Member

1,075 posts Joined: Apr 2010 |

another 2010-2013 inflationary economy in the making?

|

|

|

Dec 4 2020, 12:32 PM Dec 4 2020, 12:32 PM

Return to original view | IPv6 | Post

#50

|

Senior Member

1,075 posts Joined: Apr 2010 |

|

|

|

Dec 5 2020, 10:32 AM Dec 5 2020, 10:32 AM

Return to original view | Post

#51

|

Senior Member

1,075 posts Joined: Apr 2010 |

|

|

|

Dec 6 2020, 01:34 PM Dec 6 2020, 01:34 PM

Return to original view | Post

#52

|

Senior Member

1,075 posts Joined: Apr 2010 |

QUOTE(Smurfs @ Dec 5 2020, 11:22 AM) Moving Averages(MA) presents a "smoothen" version of price's general direction, ie averages of stock prices. i was thinking a lagging indicator will be a confirmation sign for entry Some trader use MA as support / resistance. They sometimes act as support or resistance within a trend; and in some cases, they are similar to trend lines. The main difference between MA & trend line will be ; MA is calculated, trend line is drawn by human. If you ask 10 people to draw trend line, you might get 10 slightly different trend lines. But if you ask 10 people to generate MA on the chart, all 10 should arrive at the same result. Some trader use the "golden cross" & "death cross" to catch big moves. However, they produce really infrequent signal. And it is not foolproof too. Some trader see when the stock price crossed MA 50 line with volume commitment, they long the stock, this could be the case for OCK. They place a bet on possible directional change in the market. But to me Moving average (MA), be it SMA / EMA / LWMA, to me is still a laggard indicator. It can be use as REFERENCEs, but dont jump into trade because MA told you to do so. It didn't yield much results Cheers P/S In terms of sensitivity, LWMA > EMA > SMA. Sometimes too much signal can become interference, ie noises. Less is more. QUOTE(billy_overheat @ Dec 5 2020, 02:48 PM) For trading wise especially during shorter timeframe, how's VWAP consistency? I've been doing backtesting and couldn't see much of a use for me but many are adoring this particular indicator. A simple trend line is much more useful for me. Lol. Anyway, how's everybody doing? VWAP is monitored to ensure no last minute price manipulating before market closing. especial using candlestick, some joker can really push/pull the price right below closing to create a fake buy/sell signal once VWAP is not suspicious, ok to trade based on signal. i guess? This post has been edited by squarepilot: Dec 6 2020, 01:35 PM |

|

|

Dec 6 2020, 01:36 PM Dec 6 2020, 01:36 PM

Return to original view | Post

#53

|

Senior Member

1,075 posts Joined: Apr 2010 |

QUOTE(Boon3 @ Dec 5 2020, 01:19 PM) Lol!!! MI last quarter was a big turn off. On what circumstances it will upside breakout?UWC already say too much. Yes, spot on. Such triangles are tricky. Bias is towards the downside. So atm, it's at no man's land. Watch that 3.8 level... or watch the breakout. This type of stock, cannot anticipate.. react is the better way. |

|

|

|

|

|

Dec 9 2020, 12:39 AM Dec 9 2020, 12:39 AM

Return to original view | IPv6 | Post

#54

|

Senior Member

1,075 posts Joined: Apr 2010 |

QUOTE(HereToLearn @ Dec 8 2020, 10:53 PM) Can also la, whichever that you think the upward momentum is intact, hentam and pray only I don't really trust recovery theme especial steel and hospitality counter which are still making lossI suggested 1. recovery - because of the recovery theme 2. plantation - because of the rising CPO price To me, most of the techs to me are a bit too pricy though Boon, not happy I slightly off topic in this thread is it I rather buy current fundemental intact company. You can trade based on fundemental. Nothing wrong with that... Although sometimes it will be very slow HereToLearn liked this post

|

|

|

Dec 10 2020, 02:09 PM Dec 10 2020, 02:09 PM

Return to original view | IPv6 | Post

#55

|

Senior Member

1,075 posts Joined: Apr 2010 |

QUOTE(HereToLearn @ Dec 9 2020, 09:10 AM) Yes agree. But the outlook for construction in Malaysia is... CloudyCan the chart tell you this? Doubt so HereToLearn liked this post

|

|

|

Dec 14 2020, 01:22 PM Dec 14 2020, 01:22 PM

Return to original view | Post

#56

|

Senior Member

1,075 posts Joined: Apr 2010 |

QUOTE(Boon3 @ Dec 14 2020, 09:15 AM) Ah..... see how MI is doing right now ... classic!!! but watch out for another support at 3.70» Click to show Spoiler - click again to hide... « This post has been edited by squarepilot: Dec 14 2020, 01:23 PM |

|

|

Dec 15 2020, 08:50 AM Dec 15 2020, 08:50 AM

Return to original view | Post

#57

|

Senior Member

1,075 posts Joined: Apr 2010 |

|

|

|

Dec 15 2020, 08:56 AM Dec 15 2020, 08:56 AM

Return to original view | Post

#58

|

Senior Member

1,075 posts Joined: Apr 2010 |

|

|

|

Dec 15 2020, 10:34 PM Dec 15 2020, 10:34 PM

Return to original view | IPv6 | Post

#59

|

Senior Member

1,075 posts Joined: Apr 2010 |

|

|

|

Jan 4 2021, 03:57 PM Jan 4 2021, 03:57 PM

Return to original view | IPv6 | Post

#60

|

Senior Member

1,075 posts Joined: Apr 2010 |

QUOTE(Boon3 @ Nov 7 2020, 05:00 PM) Oh Kenanga platform and Krono (one of my old winner last time. Krono charts topping 75 sen soon» Click to show Spoiler - click again to hide... « This post has been edited by squarepilot: Jan 5 2021, 02:03 PM |

| Change to: |  0.0500sec 0.0500sec

0.60 0.60

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 26th November 2025 - 01:13 AM |