QUOTE(ChAOoz @ Aug 6 2020, 07:32 PM)

Hehe. Yes gold run. See a good story, camp on it and sell it once its hype.

Jewelry counter Positive Spin:Many gold inventories. Due to low sales during MCO. So old stock = low raw material cost, so with rising gold price you can profit from the difference between cheap raw material and high price finish goods.

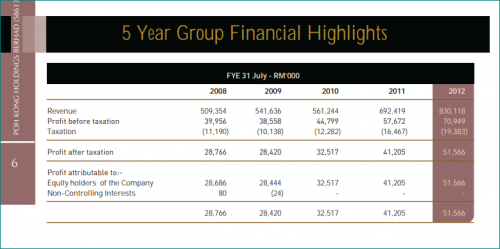

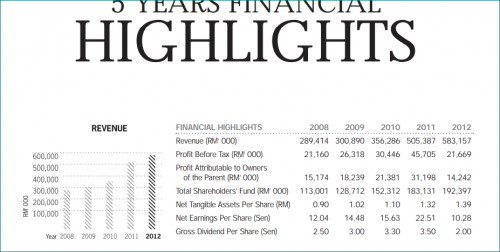

Tomei vs Poh KongPoh kong 500+m inventories. Tomei 300+m inventories (as per last QR report) (We assume all their inventories are gold

) (i feel abit scientist like now).

This would mean if all their inventory holdings never sold since pre MCO. Tomei and Poh Kong inventory would now be value at increase 20% = (600m - Poh Kong), (360m - Tomei)

Assuming cost structure the same, this would mean next QR, we are expecting Net Profit to increase exponentially. As commodity trading, any small uptick in margin, would translate to big net profit difference. This is the nature of trading business, wont go too deep into this.

OK if you read until here, you would think. Wah all good, lets whack jewelry counters. But but but, what "analyst" wont mentioned is:

ValuationAssuming today due to rising gold price poh kong earn 100m windfall profit and Tomei earn 60m windfall profit due to the rising gold price. How would it impact their valuation if everything remain the same ?

Poh Kong original market cap 200m+. So a 100m windfall profit, would justify a new 300m market cap = 50% increase from RM0.48 to RM0.72 +- share price

Tomei original market cap 70m+. So a 60m windfall profit would justify a new 130m market cap = 90% increase from RM0.45 to RM0.85 +- share price

But you see how much market value them now.

Jewelry counter Risk:

Jewelry counter Risk:Last run on Tomei / Poh Kong was circa 2017, shot up in expectation of rising gold price. Puncture after a few months, trap many bag holders.

What people don't realized is Tomei / Poh Kongs are essentially jeweler. They buy gold and manufactured jewelry. So rising gold price is a one time inventory gain effect. As their future buy in raw material price had increased, so essentially if gold were to go down, they would suffer a big one-off as well due to high raw material price and low sell price to customer.

Also rising gold price, would mean their future jewelry become expensive, hence with expensive jewelry pieces, this would mean lower sales. So actually a rising gold price is a one off effect and a negative long run effect for business.

TLDR: Can trade jewelers counters on sentiment and a good story to spin, but don't invest for long term. It's a shitty business with low margins and cyclical due to gold price.

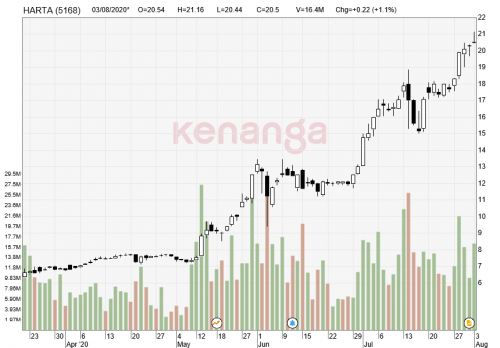

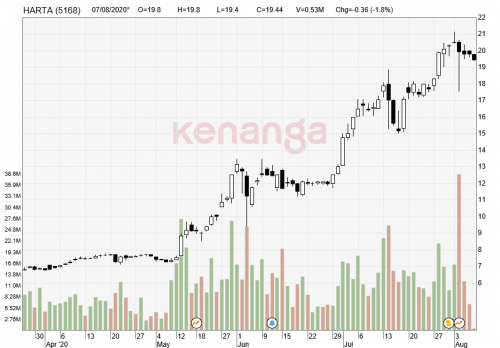

If you look back at my chart .... during the 2008-2010 gold bull .... poh kong did not go crazy as it did today.

But back then... the market crashed and it certainly isn't driven to a frenzy like the current glove driven bull market...

it might be different.... perhaps one could dig back and examine Poh Kong's earnings as a reference... (just like what I did for gloves.. remember that postng) ..

and yea... the posting yesterday... was really half...

i already drawn a picture but I certainly wasn't gonna color it....

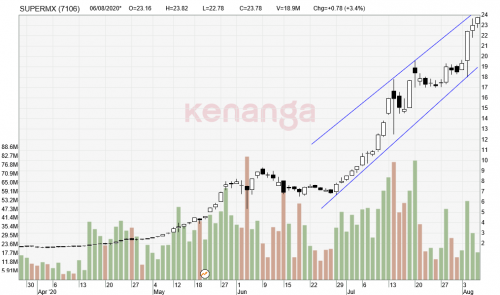

the run up by Nice is crazy and err '*******' .....

cos the one which is a better alternative was Zhulian, which pays a decent dividend (lol) and a better track record

The problem with AH Lian is that it's business is a mixture of mlm with their jewelry (fake la) business...

the last time... many folks did buy tons of fake stuff... no money nvm, gaya mesti ada... :lol

and needless to say... the concern is the impact of C19 on the mlm business...

and then the so called miners...

macam macam got ...

but yes... jewelry business is not as simple as suggested.

you need the old stock...

but you still need to order in new stock...

you need skill here...

and the marketing .... very important also ....

it's not so simple like you have gold inventory in your jewelry store, you would untung straight away....

cos your product (your finished jewelery) still needs to be seductive...

yeah Pok Kong rally is really .....

Aug 5 2020, 04:25 PM

Aug 5 2020, 04:25 PM

Quote

Quote

0.0233sec

0.0233sec

0.51

0.51

6 queries

6 queries

GZIP Disabled

GZIP Disabled