QUOTE(squarepilot @ Nov 1 2020, 03:06 PM)

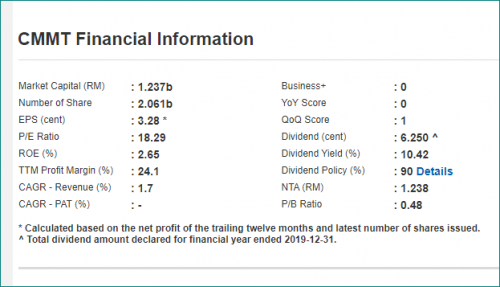

It's now always rain and storm in IGB reits. when Covid issues is resolved, it will go back to it's glorious day

well unless they inject mid valley JB into IGB reits, that will create another different story

so.. assuming we as trader, we look at support.

what support does IGB Reits have

psychological support - checked

share price is at support level

fanboy support - checked

Do you think uncle aunty, UT fund and their mother (IGBB) reduce stake in IGB? yes but not much

On the reason why i do support elderly opinion of investing in Reits

- FD gives much lower returns than Reits

- Reits have income payout policy

- Reits are inflation best friend

then comes to trading Reits, advisable? good to go?

No

but if you ask me where do i put my spare money for retirement? keep in it bank? No. Reits is a better option

trade my retirement money in growth stocks? No. It's too risky until i master some of sure win technique in trading

but that's just me. I was once a very passive investor (buy KLCI Component stocks). but i'm venturing into mid to long term trading. and while i'm learning it. might as well park some money in Reits?

Okay.... well unless they inject mid valley JB into IGB reits, that will create another different story

so.. assuming we as trader, we look at support.

what support does IGB Reits have

psychological support - checked

share price is at support level

fanboy support - checked

Do you think uncle aunty, UT fund and their mother (IGBB) reduce stake in IGB? yes but not much

On the reason why i do support elderly opinion of investing in Reits

- FD gives much lower returns than Reits

- Reits have income payout policy

- Reits are inflation best friend

then comes to trading Reits, advisable? good to go?

No

but if you ask me where do i put my spare money for retirement? keep in it bank? No. Reits is a better option

trade my retirement money in growth stocks? No. It's too risky until i master some of sure win technique in trading

but that's just me. I was once a very passive investor (buy KLCI Component stocks). but i'm venturing into mid to long term trading. and while i'm learning it. might as well park some money in Reits?

your main reason(s) to buy is ....

1. C19 will be resolved..... one day. (what if the one day is far longer than you expected? time is the enemy of a struggling biz too)

2. it pays more than FD. ( LOL! ... EPF pays more.

well...... you already stated your strong opinion on it ..... all I can and will say..... is best luck.

Mark this post down.... Bookmark it .....

comeback next year... same time..... see if the decision to buy around 1.67 (1.60 la) is a wise move or not...

Nov 1 2020, 04:56 PM

Nov 1 2020, 04:56 PM

Quote

Quote

0.1809sec

0.1809sec

0.44

0.44

7 queries

7 queries

GZIP Disabled

GZIP Disabled