QUOTE(T231H @ Aug 29 2021, 12:02 PM)

for the last 5 yrs,...still same 0.57%

no increase...

guess it themed to follows the last 2 digit of 1957 year

Opps...corrected haha thanks.no increase...

guess it themed to follows the last 2 digit of 1957 year

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Aug 29 2021, 01:54 PM Aug 29 2021, 01:54 PM

Return to original view | IPv6 | Post

#61

|

Senior Member

1,618 posts Joined: Mar 2020 |

|

|

|

|

|

|

Aug 30 2021, 10:27 AM Aug 30 2021, 10:27 AM

Return to original view | IPv6 | Post

#62

|

Senior Member

1,618 posts Joined: Mar 2020 |

QUOTE(2387581 @ Aug 30 2021, 10:04 AM) Why on earth do you want to increase the sales charge? Even if their promo sales charge increase, its still lower than their normal sales charge.If follow the logic someone else above, bad for investors, also bad for FSM PR lol If based on your logic, since eunittrust give 0% sales charge for many funds every month, why FSM still charge sales charge? Bad for fsm customers bad for fsm pr. This post has been edited by thecurious: Aug 30 2021, 10:28 AM |

|

|

Sep 1 2021, 11:27 AM Sep 1 2021, 11:27 AM

Return to original view | IPv6 | Post

#63

|

Senior Member

1,618 posts Joined: Mar 2020 |

QUOTE(2387581 @ Sep 1 2021, 11:05 AM) What I mean here is anchoring effect. Which platform gives the best promotion at the time then I will use which platform. Which by the way, I use FSM because of their partner's promotion. Not because FSM is great itself. In the current world, cost of doing business should get lower over time with increased adoption of technology or scaling. They are two different business with different business models, it is a different comparison. If eunittrust is all perfect it should be able to monopolise the sector. But here you are in the FSM forum though... If what you said will be applied to FSM then great, lower costs is better. |

|

|

Sep 4 2021, 05:13 PM Sep 4 2021, 05:13 PM

Return to original view | IPv6 | Post

#64

|

Senior Member

1,618 posts Joined: Mar 2020 |

QUOTE(onthefly @ Sep 4 2021, 04:28 PM) I am confused now. i thought expense ration INCLUDING management fees + lain lain? Ignore that comment.So now total fees is 2% or 0.2 ? Firstly, note that Amchina is a feeder fund. So the majority of the fund is invested in the Target fund "Allianz China A-shares". The 1.8% management fee is charged for the portion that excludes the Target fund portion. So from the fund fact sheet, Allianz China A-shares comprise of 95.81% of the entire fund, so the 1.8% is charged on the remaining 4.19% of the Amchina A-shares fund. This post has been edited by thecurious: Sep 4 2021, 05:16 PM |

|

|

Sep 5 2021, 02:32 PM Sep 5 2021, 02:32 PM

Return to original view | IPv6 | Post

#65

|

Senior Member

1,618 posts Joined: Mar 2020 |

|

|

|

Sep 16 2021, 04:14 PM Sep 16 2021, 04:14 PM

Return to original view | IPv6 | Post

#66

|

Senior Member

1,618 posts Joined: Mar 2020 |

QUOTE(KingArthurVI @ Sep 16 2021, 04:05 PM) Yeah sorry I meant after the correction I'll enter, but what's the most efficient manner of getting exposed to US index funds? Is it via unit trust or directly buying ETFs? Idk if the nonresident alien tax 30% is a big factor that would be a con for buying directly? Your post seems to be implying that through UT wont get US alien tax? Thats not true. Is it?This post has been edited by thecurious: Sep 16 2021, 04:15 PM |

|

|

|

|

|

Sep 16 2021, 04:28 PM Sep 16 2021, 04:28 PM

Return to original view | IPv6 | Post

#67

|

Senior Member

1,618 posts Joined: Mar 2020 |

QUOTE(KingArthurVI @ Sep 16 2021, 04:22 PM) Not sure how it works, but I was under the assumption some funds that are incorporated in another locale that has tax treaty with US may be charged lower tax? Or maybe it depends on the unit holders in which case that is probably false then. Not quite sure, which is why I'm asking what's the most efficient manner to get exposed to US index funds The funds in FSM MY should be domiciled in MY which doesn't have a tax treaty with US. So don't think there is any benefit compared to direct purchase.Perhaps feeder funds would be able to reap that benefit if the underlying fund was domiciled in a country that has tax treaty with the US. |

|

|

Nov 10 2021, 01:37 PM Nov 10 2021, 01:37 PM

Return to original view | IPv6 | Post

#68

|

Senior Member

1,618 posts Joined: Mar 2020 |

QUOTE(yklooi @ Nov 10 2021, 01:31 PM) looks like not only China fund.... If its parking funds while waiting for next buy, isnt MMF safer?my Affin hwang select bond fund too....the few % of profits earned from Affinhwang Global Disruptive fund (Arkk)....got wiped out after switching & parking in that bond fund; while waiting for better opportunity to reenter Arkk talking about china bond fund,....most probably was due to fear of defaults in China property and its related industries.... Bond funds recently look unappealing, with much risk for little rewards. LoTek liked this post

|

|

|

Nov 20 2021, 11:55 PM Nov 20 2021, 11:55 PM

Return to original view | IPv6 | Post

#69

|

Senior Member

1,618 posts Joined: Mar 2020 |

QUOTE(Fledgeling @ Nov 20 2021, 10:56 PM) Amateur on ETF seeking advice/views. At least 1 word. Liquidity.https://www.fsmone.com.my/funds/research/ar...-shar?src=funds Referring to the above, is there any strong reason to buy into an ETF on the US market vs a similar that is on KLSE? Really trying to understand. |

|

|

Jan 22 2022, 03:27 PM Jan 22 2022, 03:27 PM

Return to original view | IPv6 | Post

#70

|

Senior Member

1,618 posts Joined: Mar 2020 |

QUOTE(sgh @ Jan 22 2022, 02:22 PM) I notice your US equity fund still green colour can I know how long you holding this? If it is many years ago it just confirm funds are meant for mid to long term. He started asking about investment near the end of 2020 and got in around February 2021 at the height of china UT and disruptive tech. As you know, china and disruptive tech bled from then till now. Then he tried to diversify to US tech and others for the rest of 2021. And now the dip in US. Most likely his portfolio is bleeding now.My year 2000 bought Greater China fund still green colour despite the bloodbath in 2021. Those bought later all bled red. |

|

|

Apr 6 2022, 08:23 PM Apr 6 2022, 08:23 PM

Return to original view | IPv6 | Post

#71

|

Senior Member

1,618 posts Joined: Mar 2020 |

QUOTE(jonoave @ Apr 6 2022, 08:20 PM) Hm, no Fund of the month promo for April? Only saw one for ETF. 0.8% sales charge on Principal ASEAN Dynamic FundI was thinking of topping up some funds this month, is there any expected promotion or sales coming soon? scroll down a little on their website, dont just look at the top. |

|

|

Feb 10 2024, 02:37 PM Feb 10 2024, 02:37 PM

Return to original view | IPv6 | Post

#72

|

Senior Member

1,618 posts Joined: Mar 2020 |

QUOTE(Sitting Duck @ Sep 5 2023, 10:18 PM) I'm happy with FSM and i feel that the fee is reasonable compared with UT (not IBKR). Thanks for sharing your experience.I have no bad experience with FSM customer service nor ETF RSP. Only thing to take note is probably there's a fix schedule monthly to sell partial unit (unit less than 1). and make sure you have sufficient fund in the cash account for the RSP. I think the 0 processing fee is only applicable to buy orders and not sell order. Not sure anyone has any info about fees when selling. Started RSP to VOO in May 2022 with RM200 then slowly increased to RM1000/month. So far the return is about 12% (note that the market was really good since June 2023). Btw, this is my own experience and not financial advice to invest. I'm not an expert nor certified financial planner. Just a small duck trying to save as much as possible for golden years. Thanks for advice. Probably I'm just lazy to go through the whole process. Now that there's FSM, I'm happy with FSM for now. Will explore IBKR in the future if FSM disappoints me. For now I don't want to deal with a foreign investment company and I feel safer with FSM since FSM is regulated in Malaysia. VOO has dividends right? Does FSM charge for the dividend handling? How much do they charge if there is? |

|

|

Apr 2 2024, 04:41 PM Apr 2 2024, 04:41 PM

Return to original view | IPv6 | Post

#73

|

Senior Member

1,618 posts Joined: Mar 2020 |

QUOTE(Ramjade @ Apr 2 2024, 04:27 PM) For us fund, just pick TA global tech fund. Others don't bother. What's your strategy for EPF though? KAF Core?KAF core only good for EPF as all holdings are Malaysia unless you don't mind holding Malaysia stuff. Doesn't seem to have any US fund available for EPF route... |

|

|

|

|

|

Apr 25 2024, 07:20 PM Apr 25 2024, 07:20 PM

Return to original view | IPv6 | Post

#74

|

Senior Member

1,618 posts Joined: Mar 2020 |

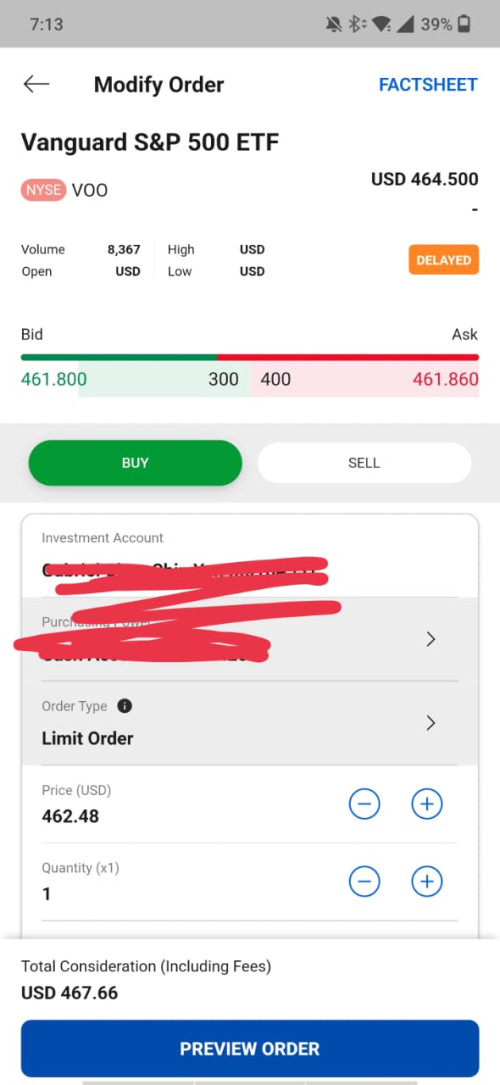

QUOTE(gccy1997 @ Apr 25 2024, 07:17 PM)  Hi guys, can someone teach me why is my order not fulfilled when it is already much higher than the ask price? Few hours dy This post has been edited by thecurious: Apr 25 2024, 07:21 PM gccy1997 liked this post

|

|

|

May 14 2024, 05:54 PM May 14 2024, 05:54 PM

Return to original view | Post

#75

|

Senior Member

1,618 posts Joined: Mar 2020 |

|

|

|

May 20 2024, 11:27 PM May 20 2024, 11:27 PM

Return to original view | IPv6 | Post

#76

|

Senior Member

1,618 posts Joined: Mar 2020 |

QUOTE(victorian @ May 20 2024, 10:58 PM) For Vanguard S&P 500 ETF, how do we sell all our holdings ya? Order type select schedule to sell instead of limit/market order.System only allows to sell unit by unit, and I have fractional left. Sitting Duck, brokenbomb, and 1 other liked this post

|

|

|

Jan 18 2025, 01:14 AM Jan 18 2025, 01:14 AM

Return to original view | IPv6 | Post

#77

|

Senior Member

1,618 posts Joined: Mar 2020 |

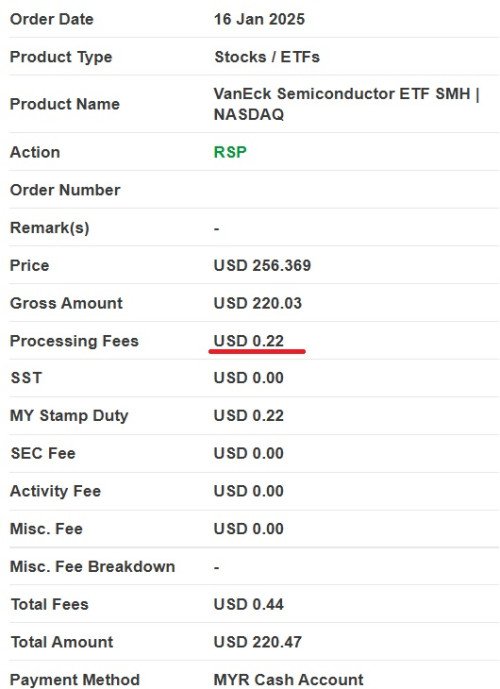

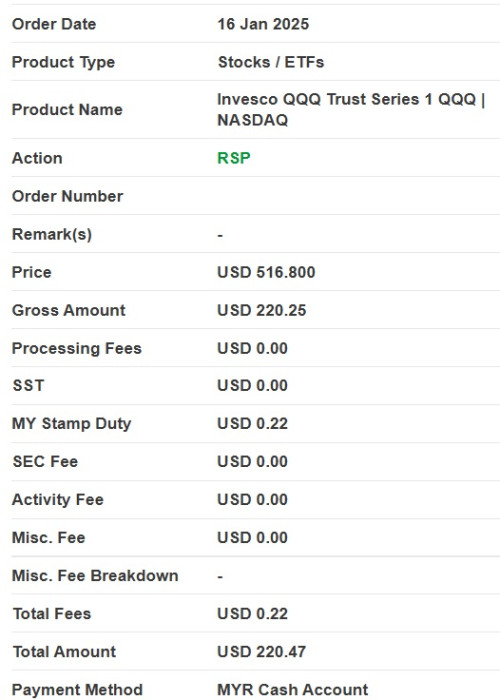

QUOTE(Sitting Duck @ Jul 28 2023, 12:44 PM) Received an email from FSM on RSP promotion for ETF. "Dear Valued Investor, Great news! We're thrilled to announce our latest ETF Regular Savings Plan enhancement and a 0% subscription fee promotional campaign from 28 July 2023 to 31 December 2024, making it more rewarding to invest with us." I wonder what is 0% subscription fee? Isn't it always been 0% subscription fee for RSP. I've been RSP'ing into VOO for the past year about RM1000/month. I only know there are these fees for RSP ETF: 1. Processing Fees (USD 1.00) 2. MY Stamp Duty (USD 0.22) I don't think these are "subscription fee". Any idea? QUOTE(Sitting Duck @ Jan 17 2025, 10:28 PM) Hi Sifus, Sounds like your promo period ended for your earlier RSPs.For those that subscribing to US ETF RSP, did you notice in the Jan 2025 RSP, that FSM has started charging Processing fee of USD0.22 for every RM1,000 RSP? The weird thing is that the processing fees is charged on my VOO and SMH RSP but not on QQQ RSP with the same RM1,000 on each of the fund. Anyone has similar experience or know what's going on? Here's the screenshot of the transaction: SMH with Processing Fees:  QQQ without Processing Fees:  QQQ RSP was probably started later than your VOO and SMH during a different promo. This post has been edited by thecurious: Jan 18 2025, 01:15 AM |

|

|

May 23 2025, 11:17 AM May 23 2025, 11:17 AM

Return to original view | Post

#78

|

Senior Member

1,618 posts Joined: Mar 2020 |

QUOTE(zebras @ May 23 2025, 11:12 AM) ya, plan to keep DCA for very long time, like >5 years and not gonna sell it anytime you gonna keep your current RSP or setup a new RSP to replace?will use their scheduled sell with lower fee too if wan to sell, not going to put urgent money in Is the performance between the LSE and US etf significant enough to warrant a new position instead of continuing? |

| Change to: |  0.2437sec 0.2437sec

0.88 0.88

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 12:23 PM |