Gg affin hwang disruptive technology fund.

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Mar 9 2021, 06:53 PM Mar 9 2021, 06:53 PM

Return to original view | IPv6 | Post

#21

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

Gg affin hwang disruptive technology fund.

|

|

|

|

|

|

Jul 9 2021, 09:59 PM Jul 9 2021, 09:59 PM

Return to original view | IPv6 | Post

#22

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

|

|

|

Jul 29 2021, 05:07 PM Jul 29 2021, 05:07 PM

Return to original view | IPv6 | Post

#23

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

|

|

|

Jul 29 2021, 05:17 PM Jul 29 2021, 05:17 PM

Return to original view | IPv6 | Post

#24

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

|

|

|

Aug 1 2021, 11:13 PM Aug 1 2021, 11:13 PM

Return to original view | Post

#25

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

wonder if its a good time to buy Principal Global Titans Fund now.

the price is quite high. |

|

|

Aug 1 2021, 11:59 PM Aug 1 2021, 11:59 PM

Return to original view | Post

#26

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

QUOTE(WhitE LighteR @ Aug 1 2021, 11:35 PM) you are right. i will put it in my watch list first. actually i was looking for a US market UT eligible for kwsp investment for quite some time. not sure why i missed that out throughout mco lol. |

|

|

|

|

|

Aug 2 2021, 12:14 AM Aug 2 2021, 12:14 AM

Return to original view | Post

#27

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

|

|

|

Aug 3 2021, 11:33 PM Aug 3 2021, 11:33 PM

Return to original view | Post

#28

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

|

|

|

Aug 4 2021, 10:18 AM Aug 4 2021, 10:18 AM

Return to original view | Post

#29

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

|

|

|

Aug 4 2021, 05:39 PM Aug 4 2021, 05:39 PM

Return to original view | Post

#30

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

QUOTE(WhitE LighteR @ Aug 4 2021, 11:38 AM) U could buy direct from FSM but need to pay 1.5% sales fee. Only by going thru epf website u get 0%. Unforunately this is not possible according to FSM customer service rep. As a result, I created an account directly with RHB to get the 0%. But RHB Asset Management sux. Dont have proper account to login n view. Need view from epf. yeah. feel abit malas to open rhb account. so must open rhb account? i was thinking is it possible to just go through epf website to purchase then monitor from rhb common website without login.edit: oh..just tried to proceed further. must have login. zzz This post has been edited by cempedaklife: Aug 4 2021, 05:42 PM |

|

|

Aug 21 2021, 04:17 PM Aug 21 2021, 04:17 PM

Return to original view | IPv6 | Post

#31

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

QUOTE(Merubin @ Aug 21 2021, 04:13 PM) too deep d bro...cannot understand. i have briefly look into the argument on this on and off, didn't really follow. as its not my interest (yet, maybe) to got for FSM managed portfolio.i understand that all fund ll have incurred annual management fee, but for this managed portfolio, i saw there is a quarterly fee of 0.5%, what i m refering is whether i need to pay twice the fee, one to FSM and the other one to the fund purchase by them but MUM actually make me understand a lot of things in just one post of his. i think what he means is basically... think of it this way, if you buy and manage all the funds you still have to pay the fund fee? right? so if you want someone else to help you to manage what funds to buy, it reduces your work, it must be worth something right? there in the purpose of the fee for managed portfolio. if you feel you are double paying, then go ahead and buy the funds and manage it yourself MUM liked this post

|

|

|

Aug 23 2021, 11:25 AM Aug 23 2021, 11:25 AM

Return to original view | Post

#32

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

QUOTE(Fledgeling @ Aug 23 2021, 09:07 AM) Let's see what happens today: I will add to my position in China centric UT too, a little bit by bit. https://www.ewfpro.com/index.php/en/market/...wilayah-bearish I am still looking to go into China ETF |

|

|

Aug 23 2021, 04:30 PM Aug 23 2021, 04:30 PM

Return to original view | Post

#33

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

QUOTE(Red_rustyjelly @ Aug 23 2021, 03:27 PM) i top up bit by bit. no rush. wongmunkeong liked this post

|

|

|

|

|

|

Aug 27 2021, 10:44 PM Aug 27 2021, 10:44 PM

Return to original view | IPv6 | Post

#34

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

QUOTE(ericlaiys @ Aug 27 2021, 12:33 PM) Affin Hwang World Series - Global Disruptive Innovation Fund - MYR Hedged you still have faith in Affin Hwang World Series - Global Disruptive Innovation Fund - MYR Hedged?Affin Hwang World Series - Next Generation Technology Fund - MYR Hedged just curious. QUOTE(amateurinvestor @ Aug 26 2021, 11:33 PM) Hi all, looks like china equities dipped again today I'm still buying bit by bit. longer term a bit. i still believe. coz it's the "dip" now. though for me. i just started buying after it dipped This post has been edited by cempedaklife: Aug 27 2021, 10:45 PM |

|

|

Aug 28 2021, 02:31 PM Aug 28 2021, 02:31 PM

Return to original view | Post

#35

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

|

|

|

Sep 4 2021, 04:42 PM Sep 4 2021, 04:42 PM

Return to original view | Post

#36

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

QUOTE(onthefly @ Sep 4 2021, 04:28 PM) I am confused now. i thought expense ration INCLUDING management fees + lain lain? Actually it doenst really matter. Check the NAV performance, all the fees has been taken into consideration before they come out with the numbers for NAV.So now total fees is 2% or 0.2 ? :confused: Check the performance better than fees. Its like this, you buy something from the store, you dont care how much of the price is used to pay employees, transportation, warehouse, tax, etc. What you should care is the price (NAV) and the quality of the item you get (performance) jj_jz, brokenbomb, and 4 others liked this post

|

|

|

Sep 5 2021, 05:10 PM Sep 5 2021, 05:10 PM

Return to original view | Post

#37

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

QUOTE(MUM @ Sep 5 2021, 03:44 PM) just for comparison on a Sunday discussion...not a tell you to buy things... strictly for informational purposes only and shall not be construed as an offer or solicitation to deal in the funds or products referred to or contained in this post Out of the list, i boughtjust checked EPF approved funds in FSM platform .... this EXCLUDES public Mutual funds based on past, there are approximately 50% chances of getting Better than EPF....in getting above 6% annualised returns there are some "Repeatedly" good "past" performance funds check them out yourself using FSM fund selector tool https://www.fsmone.com.my/funds/tools/fund-selector these are BUY and HOLD funds...no switching or take profits or exit to protect money and come back to buy at low again... oooh, the usual notes,...Past performance is not indicative of future performance. The value of the unit trusts and the income from them may fall as well as rise Eastspring small cap. Sold. Just bought recently: Principal china Eastspring dynasty Principal global titan This post has been edited by cempedaklife: Sep 5 2021, 05:11 PM |

|

|

Sep 8 2021, 11:48 AM Sep 8 2021, 11:48 AM

Return to original view | Post

#38

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

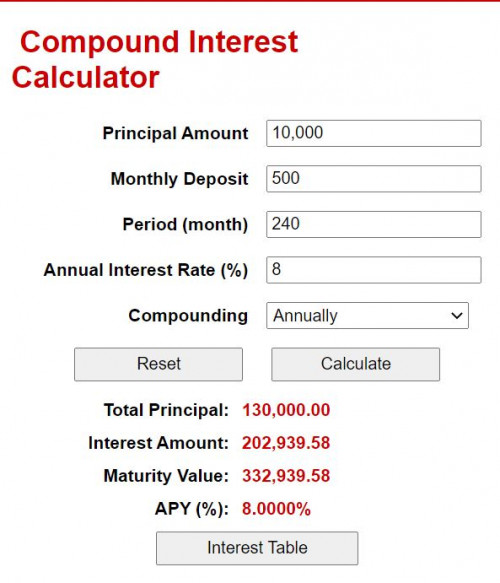

QUOTE(Red_rustyjelly @ Sep 7 2021, 01:54 PM) Just to share some investment strategies for children. thank you for sharing.in 2015 I started investing in Unit trust. My target was and is to generate 8-12% of return from few portfolios. Regardless of China/US/ Asia Pacific. And also to beat country inflation rate of 3-4% average. Assuming I put my principal amount of RM 10k into few good portfolios and a monthly depo of RM 300-500 for 20 years. This is the result. I would say enough for a good private University locally but for overseas education, I will require to use my own savings and other investment by then. Relying on EPF is not always the best option because after minus the inflation rate, we are only getting back 1-2% recently. So far, my target is on track. My second kid, I did the same. The only challenge I have is emotion, when the market is down I have to train myself from panic. and to look at bigger picture.  i was hotheaded, and hence, i make a lost in my investments. now my thinking become uncle. i don't want to aim for myself, but for my kids. so similar with your line of thought. and it make me more peaceful and view investment as a longer term thingy. |

|

|

Sep 8 2021, 03:03 PM Sep 8 2021, 03:03 PM

Return to original view | Post

#39

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

QUOTE(Red_rustyjelly @ Sep 8 2021, 02:35 PM) Hard to have that kind of mentality exactly!Wish I can reverse back 10-15 years ago. if not today, the return and capital appreciation could be more. But i sure done a lot of mistakes in the past myself, panic sell, listen to wind too much and etc. but we have to start somewhere no matter how late, and we have only ourselves to compare to, no need compare to other ppl. else, we will never start nike89 liked this post

|

|

|

Oct 4 2021, 05:00 PM Oct 4 2021, 05:00 PM

Return to original view | IPv6 | Post

#40

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

|

| Change to: |  0.0864sec 0.0864sec

0.58 0.58

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 09:40 AM |