QUOTE(ganesh1696 @ Jan 22 2022, 01:29 PM)

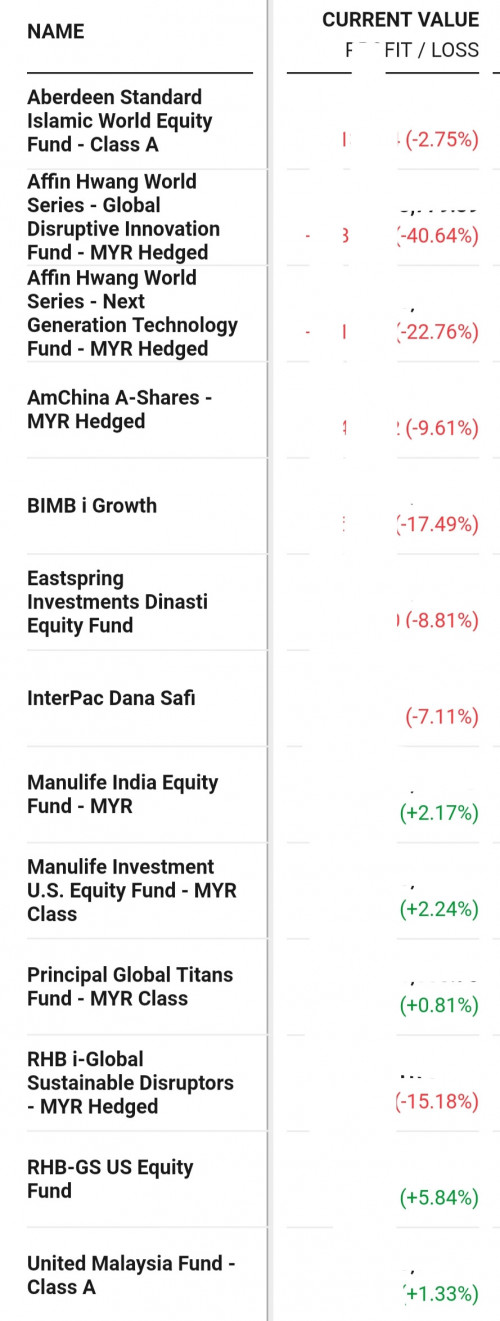

I'm a failed investor

All my hard earned money.

Even bank fd could get at least 2% or crypto fd at 12 %.

My decisions are worst when it comes to investments.

Any opinion on my worthless decisions?

Opinions welcome.

And those with profit will turn red on Monday as I already the prices.

no worries bro, i also took a hit. and i thought i have learned. lol.

in any case, i reflect back upon myself.

before last year, i prioritize my own investment (which makes loses, i think my investment all time still losing) instead of maximizing more assured vehiche like sspn (tax deduction) and PRS (again, tax).

now at least my mindset is max those first. any other investments will have to wait.

i venture into US market last year and though for now I'm not making a loss, but most my earning wiped out because of the current trend. but i still think a move to US market, to hedge against MYR is a good move. i wonder if i should just stick to VOO for this year first.

i am also questioning myself on my investment. i am good with small money but a squandered them in investment.

so perhaps back to basic for me this year is the theme.

Oct 5 2021, 09:59 AM

Oct 5 2021, 09:59 AM

Quote

Quote

0.0893sec

0.0893sec

0.57

0.57

7 queries

7 queries

GZIP Disabled

GZIP Disabled