Question:

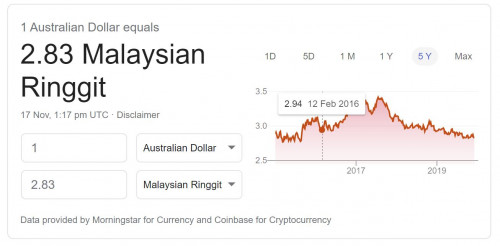

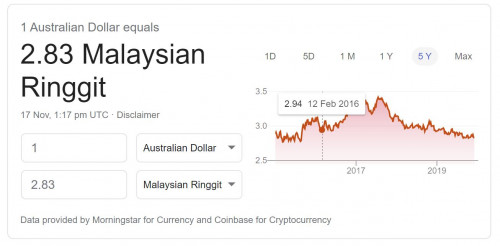

Given that AUD is fairly low now against RM, would it make sense to invest in a Fund denominated in AUD? example: https://www.fundsupermart.com.my/fsmone/fun...tunity-Fund-AUD

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Nov 17 2019, 09:21 PM Nov 17 2019, 09:21 PM

Return to original view | IPv6 | Post

#1

|

Junior Member

124 posts Joined: Oct 2011 |

Good evening, I'm an amateur investor, trying my hand now at Fundsupermart as a move away from the high 5% sales charge of Public Mutual. In the past, bulk of my savings are in FD but interest rates lately are so low.

Question: Given that AUD is fairly low now against RM, would it make sense to invest in a Fund denominated in AUD? example: https://www.fundsupermart.com.my/fsmone/fun...tunity-Fund-AUD  |

|

|

|

|

|

Jan 27 2020, 03:32 PM Jan 27 2020, 03:32 PM

Return to original view | Post

#2

|

Junior Member

124 posts Joined: Oct 2011 |

Any thoughts on the upcoming LBS Bina Bond? In my opinion, the coupon rate of 6-7% looks attractive in view of low FD rates currently of 3-4% BUT the company is highly geared at 80+% Debt/Equity ratio.

See attachment and also FSM link: https://www.fundsupermart.com.my/fsm/bonds/...tual-note-11702 Attached File(s)  LBS_Bina_IPO.pdf ( 211.78k )

Number of downloads: 2

LBS_Bina_IPO.pdf ( 211.78k )

Number of downloads: 2 |

|

|

Mar 2 2020, 11:44 AM Mar 2 2020, 11:44 AM

Return to original view | IPv6 | Post

#3

|

Junior Member

124 posts Joined: Oct 2011 |

QUOTE(kenny79 @ Feb 29 2020, 08:37 PM) Mondays need to switch eq to bond later sale off have loss confidential of malaysia ... Explore to other region is better I agree that there is loss of confidence in Malaysia and we should explore other region. What do you think of exploring Japan?https://www.ft.com/brandsuite/nikkei/now-is...g-in-japan.html I am considering some Japan based funds:https://www.fundsupermart.com.my/fsmone/funds/fund-info/factsheet/MYUOBJDM/United-Japan-Discovery-Fund-MYR-Hedged Any one have thoughts to share with me? This post has been edited by Fledgeling: Mar 2 2020, 11:45 AM |

|

|

Mar 15 2020, 05:24 PM Mar 15 2020, 05:24 PM

Return to original view | IPv6 | Post

#4

|

Junior Member

124 posts Joined: Oct 2011 |

This Eastspring Investments Japan Dynamic MY Fund - USD Hedged - looks like it's at an all time low. Worth a look?

https://www.fundsupermart.com.my/fsmone/fun...Fund-USD-Hedged |

|

|

Apr 2 2020, 09:57 AM Apr 2 2020, 09:57 AM

Return to original view | IPv6 | Post

#5

|

Junior Member

124 posts Joined: Oct 2011 |

Are there any funds that invest primarily in the US market? I have done a search on FSM but can only find this:

https://www.fundsupermart.com.my/fsmone/fun...d-Markets-USD-R I've been advised by FSM that to invest in foreign currency funds, I need to do a TT over the counter ;p That's quite inconvenient in view of the lock down currently. Is there any other way? |

|

|

Apr 8 2020, 02:35 PM Apr 8 2020, 02:35 PM

Return to original view | IPv6 | Post

#6

|

Junior Member

124 posts Joined: Oct 2011 |

https://www.fundsupermart.com.my/fsmone/art...t-In,-First-Out

According to the webinar today, China is on the road to recovery and it's a good time to invest. Anyone agree/disagree? |

|

|

|

|

|

Apr 9 2020, 09:32 PM Apr 9 2020, 09:32 PM

Return to original view | IPv6 | Post

#7

|

Junior Member

124 posts Joined: Oct 2011 |

I am still a noob in the unit trust realm but am trying my best to learn.

https://secure.fundsupermart.com/fsm/articl...s-share-classes I have read the article above to try and understand the advantage of investing in foreign currency hedged unit trust e.g. https://www.fundsupermart.com.my/fsmone/fun...Fund-GBP-Hedged Am I right to say that if I believe the GBP will strengthen against ringgit, I should invest in this fund? |

|

|

Apr 9 2020, 10:04 PM Apr 9 2020, 10:04 PM

Return to original view | IPv6 | Post

#8

|

Junior Member

124 posts Joined: Oct 2011 |

QUOTE(T231H @ Apr 9 2020, 09:55 PM) Hedging Currency Risk Thank you. Good article. To hedge or not to hedge? That’s probably the question on the minds of most investors, as they look outwards for their investments and seek to add to their allocation overseas. However, this also runs the risk of increasing their exposure to foreign currencies, leaving them potentially vulnerable to movements in exchange rates. Sometimes, the currency swings are so large that it could impact your portfolio’s overall returns. Does that mean you should fully hedge your position? The answer probably lies somewhere in the middle, depending on the investor’s own objectives and risk-tolerance. more in ... https://affinhwangam.com/hedging-currency-risk/ I also realised that there are some unit trusts that are not hedged but are bought in the foreign currency e.g. AUD https://www.fundsupermart.com.my/fsmone/fun...amic-Growth-AUD How is this different from hedging? Sorry I am getting a bit confused but trying my best to learn. |

|

|

Apr 10 2020, 10:01 AM Apr 10 2020, 10:01 AM

Return to original view | IPv6 | Post

#9

|

Junior Member

124 posts Joined: Oct 2011 |

QUOTE(abcn1n @ Apr 10 2020, 01:53 AM) Thanks. That article is good. I like the below especially. Very very helpful - thanks sooo much. I understand now - woo hoo!"Investors investing in a fund with its base currency different from their own local currency are subject to the risk of currency fluctuations between their local currency and the fund's base currency. Without currency hedging, European investors e.g. would record a profit or loss due to the fluctuating EUR-USD exchange rate. If the fund generates a positive performance in its base currency, the currency translation into the local currency of the investor may nevertheless lead to a negative result, if the base currency has lost against the local currency during the investment period." WHAT IS NAV SHARE CLASS HEDGING? The intention is to reduce the impact of movements in the exchange rate between the currency used by an investor to buy shares in a fund and the base currency of that fund. It is an attempt to make the NAV performance consistent for shareholders of two different currency classes e.g. to provide a EUR investor with approximately the same returns as a USD investor. Note: The returns will not be the same due to the cost of the hedge (primarily interest rate differential) and short term over and under hedging due to subscriptions and redemptions activity. AUD don't do well whenever China's economy's not well If one expects MYR to weaken, go for MYR unhedged. Base currency for Affin Hwang global healthscience is USD. Thus, if MYR weakened and we do not hedge, each USD will get more MYR. See the below. You can see, MYR hedged performed much worse than USD portfolio when MYR weakened https://my.morningstar.com/ap/fundselect/results.aspx https://my.morningstar.com/ap/quicktake/ove...ceId=0P0001H2NC https://my.morningstar.com/ap/quicktake/ove...ceId=0P0001H2NE |

|

|

Apr 10 2020, 10:15 AM Apr 10 2020, 10:15 AM

Return to original view | IPv6 | Post

#10

|

Junior Member

124 posts Joined: Oct 2011 |

QUOTE(xuzen @ Apr 8 2020, 02:59 PM) One month ago masuk RM 6K into CIMB Greater China fund, as of today profit is +8% Hi there, I noticed quite a few people here mentioned investing into CIMB/Principal Greater China Fund. I have just done a comparison of a few Greater China funds below and I noticed that AmChina A shares has a better performance consistently (look at 5 year, 3 year etc comparison) and less volatility (overall more greens than red).Today masuk lagi another RM 3.5K. Xuzen I think I will put my investment into AmChina A shares. Could those who invest into CIMB/Principal Greater China Fund or any other China-based fund share on why you choose those particular funds instead of AmChina A shares? (somehow this fund hardly gets any mention here in this forum)  This post has been edited by Fledgeling: Apr 10 2020, 10:19 AM |

|

|

Apr 10 2020, 10:56 AM Apr 10 2020, 10:56 AM

Return to original view | IPv6 | Post

#11

|

Junior Member

124 posts Joined: Oct 2011 |

Thanks for the feedback @yklooi and @Holocene.

Yes, Am China invests in A shares (Shenzhen stock exchange) if I'm not mistaken. For CIMB-Principal, I'm not sure as I can't find the info here in the factsheet. https://www.fundsupermart.com.my/fsmone/adm...etMYCIMB011.pdf |

|

|

Apr 10 2020, 12:54 PM Apr 10 2020, 12:54 PM

Return to original view | IPv6 | Post

#12

|

Junior Member

124 posts Joined: Oct 2011 |

Great discussion and lots of very good replies to give me food for thought.

Really appreciate it. I'm going to try one-off investment of RM5k into AmChina A for now. However, I do have one more question. There is 1) AmChina A - MYR https://www.fundsupermart.com.my/fsmone/fun...na-A-Shares-MYR 2) AmChina A - MYR hedged https://www.fundsupermart.com.my/fsmone/fun...ares-MYR-Hedged However, the one with MYR hedged has no data on past performance. Is it the same fund but just with/without hedging? I had been learning about hedging and got really good insights from this forum earlier. This is a follow-up - putting my learnings into action! This post has been edited by Fledgeling: Apr 10 2020, 12:59 PM |

|

|

Apr 10 2020, 02:19 PM Apr 10 2020, 02:19 PM

Return to original view | IPv6 | Post

#13

|

Junior Member

124 posts Joined: Oct 2011 |

Thanks so much @tadashi987

I will read through the documents. Like you, I am also not a big fan of MYR. But curious - why you would not recommend MYR-Hedged then? If I believe the MYR would weaken further, wouldn't it make sense for me to buy the MYR-hedged one? |

|

|

|

|

|

Apr 10 2020, 02:23 PM Apr 10 2020, 02:23 PM

Return to original view | IPv6 | Post

#14

|

Junior Member

124 posts Joined: Oct 2011 |

QUOTE(Fledgeling @ Apr 10 2020, 02:19 PM) Thanks so much @tadashi987 I actually called FSM hotline twice today to try and ask for more info from their investment specialists, but both times they are not free/out for lunch - a bit disappointed with their lack of customer service =(I will read through the documents. Like you, I am also not a big fan of MYR. But curious - why you would not recommend MYR-Hedged then? If I believe the MYR would weaken further, wouldn't it make sense for me to buy the MYR-hedged one? |

|

|

Apr 10 2020, 03:49 PM Apr 10 2020, 03:49 PM

Return to original view | IPv6 | Post

#15

|

Junior Member

124 posts Joined: Oct 2011 |

QUOTE(oldies1950 @ Apr 10 2020, 03:02 PM) If the UT ( Normal RM ) you buy are in US $( Example ) Then ..... ....... Say When you Bought it in April 2020 at Rm4 = Us 1 ( Example ) . Thus say I bought RM 4000 or US 1,000 ( of UT ). Yes, I understand. Thank you so much for the example.THEN In DEC 2020 Say Rm 4.4 = US 1 ( Exchange Rate ) . So I have US 1,000. Convert it back to RM ...... I have RM 4,400. So I have made .... Rm 4,400 - 4,000 = Rm 400 . Just Because of Currency Fluctuations. IF the UT price have gone up..... Then double GAIN. But the AMChina funds are in MYR or MYR-hedged. Not USD? So isn't MYR-hedged better than MYR? |

|

|

Apr 10 2020, 04:22 PM Apr 10 2020, 04:22 PM

Return to original view | IPv6 | Post

#16

|

Junior Member

124 posts Joined: Oct 2011 |

QUOTE(tadashi987 @ Apr 10 2020, 03:57 PM) if you want to burn your brain cell, MYR-HEDGED means you are confident with MYR Ahhhh... super helpful explanation, I really appreciate it. This forum is so useful to me, thanks a million!so taking the same example, mean in APRIL 2020, when you buy MYR-HEDGED, you locked the ratio of RM4 = USD1 so come to DEC 2020, even now the ratio is RM4.40 = USD 1 you WILL NOT get RM4,400 instead you will get 4000. because your fund is MYR-HEDGED. CURRENCY-HEDGE means you are confident and betting on that currency, it DOESN'T MEAN HEDGING AGAINST THE CURRENCY |

|

|

Apr 13 2020, 05:06 PM Apr 13 2020, 05:06 PM

Return to original view | IPv6 | Post

#17

|

Junior Member

124 posts Joined: Oct 2011 |

QUOTE(MR_alien @ Apr 13 2020, 03:27 PM) anyone notice FSM is slower than usual? Just guessing - maybe it was public holiday for some countries (e.g. Hong Kong, Singapore, Indonesia) last Friday for Good Friday?i've purchased something on 8th april, until now it's still hasn't entered my portfolio yet previously it's much faster around 3 days |

|

|

Apr 19 2020, 12:45 PM Apr 19 2020, 12:45 PM

Return to original view | IPv6 | Post

#18

|

Junior Member

124 posts Joined: Oct 2011 |

QUOTE(ericlaiys @ Apr 19 2020, 08:39 AM) 1. It is easy to open an account. Just fill up some details. Hi there, please PM me referral code.2. Once done, u can buy fund. No supporting doc require 3. U can use fpx or top up into cash fund before buy fund. Top up first into cash fund will make transaction faster. 4. First time buyer will get 1 month - 1% transaction sales com. So you can buy fund without incur expensive fees. 5. PM your email so can send you invite for referral in case you want to have more discount fees. No hard feeling if you want to use or not during registration. After 2-3 transaction, then you will familiar about the interface. Besides, there is webinar coming next week to teach newbies on how to use. |

|

|

Apr 19 2020, 02:32 PM Apr 19 2020, 02:32 PM

Return to original view | IPv6 | Post

#19

|

Junior Member

124 posts Joined: Oct 2011 |

Fundsupermart Paperless PRS

Few months ago, FSM had an announcement that a few PRS can go paperless (without filling up paper forms, just online signature). Affin Hwang was one of them. Can anyone tell me the others? I checked FSM FAQ and website but couldn't find the answer. Thinking that it's a good time to top up PRS for income tax purposes now. |

|

|

Apr 19 2020, 03:10 PM Apr 19 2020, 03:10 PM

Return to original view | IPv6 | Post

#20

|

Junior Member

124 posts Joined: Oct 2011 |

Yes, that's exactly what I was looking for. Thank you so much @GrumpyNooby and @Tadashi987

|

| Change to: |  0.0533sec 0.0533sec

0.44 0.44

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 12:05 AM |