QUOTE(MUM @ Dec 26 2020, 07:01 PM)

Yes, it has a "D".Thank you everyone for very helpful replies.

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Dec 26 2020, 11:30 PM Dec 26 2020, 11:30 PM

Return to original view | IPv6 | Post

#41

|

Junior Member

124 posts Joined: Oct 2011 |

|

|

|

|

|

|

Dec 29 2020, 09:53 PM Dec 29 2020, 09:53 PM

Return to original view | IPv6 | Post

#42

|

Junior Member

124 posts Joined: Oct 2011 |

QUOTE(killdavid @ Dec 28 2020, 02:42 PM) Agree that it's a good time to enter funds with Alibaba holdings, can anyone share which funds? I have to read all the fact sheets one by one to get a sense of this - will take time but I want to go in fast. |

|

|

Dec 29 2020, 11:00 PM Dec 29 2020, 11:00 PM

Return to original view | IPv6 | Post

#43

|

Junior Member

124 posts Joined: Oct 2011 |

QUOTE(LoTek @ Dec 29 2020, 10:47 PM) I topped up principal greater china, principal dynamic growth, and global emerging markets. They all have baba and Tencent in the top holdings. Maybe others will have better suggestions. Thank you LoTek!I starting reading some factsheets already, found the following so far: Manulife Greater China with 8.2% Alibaba holdings https://www.fsmone.com.my/admin/buy/factshe...sheetMYMGCF.pdf Principal China India Indonesia with 9% Alibaba holdings https://www.fsmone.com.my/admin/buy/factshe...etMYCIMB016.pdf Still looking through. I don't know if there is a faster way that looking one by one? Please share if anyone knows. |

|

|

Dec 30 2020, 12:08 AM Dec 30 2020, 12:08 AM

Return to original view | IPv6 | Post

#44

|

Junior Member

124 posts Joined: Oct 2011 |

|

|

|

Dec 30 2020, 12:13 AM Dec 30 2020, 12:13 AM

Return to original view | IPv6 | Post

#45

|

Junior Member

124 posts Joined: Oct 2011 |

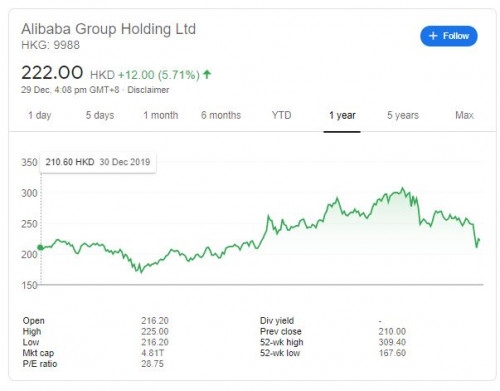

QUOTE(vit @ Dec 29 2020, 11:42 PM) Hi, may I know why is it good time to buy/top up unit trust with top alibaba & tencent holdings? Thanks. Because of the current probe by the CCP into Alibaba: https://www.nytimes.com/2020/12/23/business...st-jack-ma.htmlLook at the 1 year trend on Alibaba share price  |

|

|

Jan 7 2021, 09:16 AM Jan 7 2021, 09:16 AM

Return to original view | Post

#46

|

Junior Member

124 posts Joined: Oct 2011 |

QUOTE(GrumpyNooby @ Jan 6 2021, 08:28 PM) From SC webinar Thank you for sharing, I find this very usefulKEY TAKEAWAYS 1. Vaccine distribution, fiscal and monetary policy support, bond yields, the US Dollar weakening and the Value vs Growth debate are five factors that will likely define financial markets in 2021. We expect these to benefit equities, credit and multi-asset income strategies, ‘vaccinating’ them against optically elevated valuations. 2. The rapid development of COVID-19 vaccines suggests 2021 is likely to be a better year than 2020 - We expect most major equity markets to perform well. Within equities, Asia ex-Japan ranks highest in our preference order, followed by the US. - Within bonds, Asia USD, Emerging Market bonds (the USD and local currency) and Developed Market High Yield bonds are attractive. - Within currency markets, we expect the USD downtrend to gain momentum. The EUR and AUD are likely to be prime beneficiaries of the USD downtrend. 3. Potential risks include hiccups in vaccine distribution and/or any virus mutation. There is also the risk of policy mistakes through tightening too early and the future of trade relations. |

|

|

|

|

|

Jan 21 2021, 04:36 PM Jan 21 2021, 04:36 PM

Return to original view | IPv6 | Post

#47

|

Junior Member

124 posts Joined: Oct 2011 |

Since there was some discussions earlier about 0% sales charge, I am just sharing some info that I just saw today. Eunittrust 28 funds at 0% sales charge

https://www.eunittrust.com.my/ https://www.eunittrust.com.my/Home/Chinese-...-Year-Promotion Disclaimer: I am not affiliated with Eunittrust in any way and this is not a recommendation. It is merely sharing of info for those who could be interested. |

|

|

Jan 23 2021, 04:16 PM Jan 23 2021, 04:16 PM

Return to original view | Post

#48

|

Junior Member

124 posts Joined: Oct 2011 |

QUOTE(jj_jz @ Jan 23 2021, 03:45 PM) Tentative Plan for now: My plan is to invest in Nikko Am Singapore Dividend Fund because the speaker mentioned that it is lagging in recovery (as Singapore is an open economy and subject to external 'shocks' vs China which is more self sustaining for example).- Topup on my current china portfolio (greater china) - Increase my allocation of AsiaXJ in my portfolio by adding Principal Asia Pacific Dynamic Income Fund - MYR - Looking around KAF Tactical Fund & KAF Core income fund to increase my exposure in local Any advice or sharing are always welcome Still thinking hard about Greater China - not sure if it's too high but of course there is potential here. ASEAN could be worth a look in my opinion as one of the speakers mentioned that valuations are still attractive. |

|

|

Jan 25 2021, 11:05 AM Jan 25 2021, 11:05 AM

Return to original view | IPv6 | Post

#49

|

Junior Member

124 posts Joined: Oct 2011 |

Good morning everyone! The comments here have been very useful and I've been thinking carefully about what to buy for this 1 week "shopping spree" with 0% sales charge.

Here's what I have in my cart: Principal ASEAN Dynamic Fund https://www.fsmone.com.my/admin/buy/factshe...etMYCIMB017.pdf Reason: I do not have much exposure to ASEAN currently. This is more diversified that the NIKKO Am Singapore Dividend Fund I had my eye on earlier (I got good feedback from this forum that there could be low growth potential for Singapore alone given the market size and also past historical NAV). Principal China-India-Indonesia Opportunities Fund https://www.fsmone.com.my/admin/buy/factshe...etMYCIMB016.pdf I feel that China still has good potential but I'm balancing it with other markets. I already have about 10% exposure to Greater China currently and 23% to Asia ex Japan FSM Managed Portfolio split equally into Aggressive Moderately Aggressive Any feedback/input before I check out by Friday? I still have some time to think through. Much appreciated. P/S: sharing a commentary on Asian markets that just opened today: https://www.rttnews.com/list/asian-commentary.aspx |

|

|

Jan 25 2021, 11:29 AM Jan 25 2021, 11:29 AM

Return to original view | IPv6 | Post

#50

|

Junior Member

124 posts Joined: Oct 2011 |

QUOTE(yklooi @ Jan 25 2021, 11:22 AM) what are the funds do you have in your UT portfolio? what are the % of each of them? Currently, I already have 23% in Asia ex Japan as mentioned above =)as you mentioned you wanted ASEAN,...then why not Asia pac?...but to know why...thus need to know if you have Asia Pac in your port already and how big allocation into it? Exact portfolio breakdown: Global: 31% Asia ex Japan: 23% Asia: 15% Malaysia: 14% (mostly bonds as I have low confidence in KLCI) China: 10% Japan 2% US: 3% Others 2% I know that US looks too low but I am of the opinion that Dow Jones is overheated and will pass for now (take a wait and see approach). https://www.marketwatch.com/story/stock-mar...oom-11611411473 Thanks for your feedback. |

|

|

Jan 25 2021, 11:51 AM Jan 25 2021, 11:51 AM

Return to original view | IPv6 | Post

#51

|

Junior Member

124 posts Joined: Oct 2011 |

QUOTE(yklooi @ Jan 25 2021, 11:22 AM) what are the funds do you have in your UT portfolio? what are the % of each of them? Interesting approach..... let me try and see....as you mentioned you wanted ASEAN,...then why not Asia pac?...but to know why...thus need to know if you have Asia Pac in your port already and how big allocation into it? it would be a useful tool/info (for me and may not for others), to try use an excel sheet to compile the countries and % allocated for each of the countries.....data can be obtained from each of the Fund Factsheet....then try to compile the total allocated in each of the country/region in relation to all the funds in your portfolio. then evaluate which you think is lacking/over allocated to adjust if ncessary. you can also do it in sectorial basis if you want too. Thanks once again for the valuable feedback. |

|

|

Jan 26 2021, 05:15 PM Jan 26 2021, 05:15 PM

Return to original view | Post

#52

|

Junior Member

124 posts Joined: Oct 2011 |

Hi sifus!

I am exploring going into FSM Managed Portfolio for the first time. I already checked the FAQ on the FSM website but can't find the answer I'm looking for: https://www.fsmone.com.my/support/frequently-asked-questions Since FSM already charges subscription fee and managed portfolio fee of 0.5% per quarter, can I ask whether there is still a sales charge when they buy into the selected funds for our portfolio? |

|

|

Jan 27 2021, 11:57 AM Jan 27 2021, 11:57 AM

Return to original view | Post

#53

|

Junior Member

124 posts Joined: Oct 2011 |

QUOTE(5p3ak @ Jan 27 2021, 10:51 AM) One of my transactions got caught yesterday, emailed FSM they say didn't receive due to the service interruption. Called banked and now they opened report for me. I also have a transaction that got stuck. Maybank deducted the money from my account but FSM said they didn't receive? My money in limbo. Transaction pending.Called Maybank 5 times but cannot get through to their customer service due to high volume. *Headache* Be warned in case you plan to make any transactions. This incident has totally spoilt my mood to invest in FSM for now This post has been edited by Fledgeling: Jan 27 2021, 11:59 AM |

|

|

|

|

|

Jan 28 2021, 09:20 AM Jan 28 2021, 09:20 AM

Return to original view | Post

#54

|

Junior Member

124 posts Joined: Oct 2011 |

QUOTE(TOS @ Jan 28 2021, 08:02 AM) I noted a mistake in Fledgeling's post. It should be 0.5% p.a., not 0.5% per quarter. Thanks for pointing up. Thank you @TOS and @matyrze for your kind replies.As for why fund houses are not taking any fee from FSM portfolio, actually they are taking fees, if you look into each fund's individual report, you will notice the charges. The charges are incurred whether you buy the fund directly (without portfolio) or indirectly (part of a portfolio). Illustrating this with Kenanga Growth Fund, https://www.fsmone.com.my/admin/buy/factshe...heetMYKNGGF.pdf The annual management fee is 1.5%. A portion of this is trailer fee to FSM, and the rest is profit to the fund house and to cover the cost of fund management. Fund houses also take a portion of the subscription fee, I think. I am not aware of any "profit-sharing schemes" between iFAST and the fund houses though. You can read more on the charges payable to fund houses below: https://www.investopedia.com/articles/inves...-make-money.asp My money that was in limbo for 1.5 days was finally refunded to Maybank this morning (after many follow-ups). I got my appetite back to invest. Another follow-up question: If I already have unit trusts holdings where I am charged the FSM platform fee, will I be charged platform fee again for Managed Portfolio? Or is it once time only? |

|

|

Jan 30 2021, 12:17 PM Jan 30 2021, 12:17 PM

Return to original view | Post

#55

|

Junior Member

124 posts Joined: Oct 2011 |

https://markets.businessinsider.com/news/st...21-1-1030021399

US market is down. I'm interested to top up. I know this has been discussed but please remind me what was the final conclusion (if any?) on public holidays and the impact. Let's take a specific example: Manulife Investment US Equity Fund. https://www.fsmone.com.my/funds/tools/facts...c=fund-selector Monday 1 Feb is a public holiday only for KL, hence FSM is not working. HOWEVER, it is NOT a fund holiday as stated in the link above. Hence, if I buy and pay on Monday 3pm, I will get the fund NAV as of Monday 1 Feb price? I tried my luck calling the FSM hotline just now but of course, it was closed and I believe it will be closed on Monday too. Can anyone with experience help? |

|

|

Jan 30 2021, 03:05 PM Jan 30 2021, 03:05 PM

Return to original view | Post

#56

|

Junior Member

124 posts Joined: Oct 2011 |

Thank you for those who took the time to share their input and thoughts.

Kudos to FSM, I actually got a reply from their Facebook page: Please be informed that it is Malaysia Public Holiday on 1 Feb, hence when you buy on Monday, it will capture next business days NAV. |

|

|

Jan 31 2021, 07:44 PM Jan 31 2021, 07:44 PM

Return to original view | IPv6 | Post

#57

|

Junior Member

124 posts Joined: Oct 2011 |

Enlightening commentary about the Gamestop saga in the past week

Edward Jones opinion of what happenned. https://www.edwardjones.com/market-news-gui...ekly-recap.html Hmmmm...... should I still invest in US unit trusts? Will wait till Tues and see (can't do anything on Monday since FSM is closed anyway). |

|

|

Feb 23 2021, 10:06 AM Feb 23 2021, 10:06 AM

Return to original view | IPv6 | Post

#58

|

Junior Member

124 posts Joined: Oct 2011 |

|

|

|

Mar 16 2021, 09:57 PM Mar 16 2021, 09:57 PM

Return to original view | Post

#59

|

Junior Member

124 posts Joined: Oct 2011 |

QUOTE(yklooi @ Mar 15 2021, 12:22 PM) Emerging Markets bond funds holders....just a note... I have RHB Emerging Market bond funds bought in Dec 2020 and now showing -1.69%. Time to sell?Rate hikes coming to emerging markets Alarm bells are starting to ring across emerging markets as countries brace for a new era of rising interest rates. After an unprecedented period of rate cuts to prop up economies shattered by Covid-19, Brazil is expected to raise rates this week and Nigeria and South Africa could follow soon, according to Bloomberg Economics. Russia already stopped easing earlier than expected and Indonesia may do the same. Behind the shift: Renewed optimism in the outlook for the world economy amid greater US stimulus. That’s pushing up commodity-price inflation and global bond yields, while weighing on the currencies of developing nations as capital heads elsewhere. https://www.bangkokpost.com/business/208391...debt-at-records |

|

|

Mar 18 2021, 09:12 AM Mar 18 2021, 09:12 AM

Return to original view | Post

#60

|

Junior Member

124 posts Joined: Oct 2011 |

|

| Change to: |  0.0589sec 0.0589sec

0.74 0.74

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 1st December 2025 - 12:54 PM |