QUOTE(mois @ Jan 22 2022, 09:04 AM)

If want add some, at least wait until they wipe 2021 gain first. If keep DCA for every dip, sooner or later no money buy in already.

Wiping 2021 gain, meaning wipe all the gain since March 2020.

We all waiting next week what in store in March before taking next step buy8ng lump sum

QUOTE(sgh @ Jan 22 2022, 01:06 PM)

I think the definition of a correction I read is about 10% so Xmas may not be defined as such so everyone thought it is just your typical blip on radar.

I don't think it is only affecting tech and small cap basically any stock that is US or even Europe is hit. I got both US and Europe and non-tech in funds all kena. Only diff is how red is the colour.

Not ending at 10% I read may go down further to 20% so wait to decide at the 20% mark.

Usually correction is defined 20% is a technical correction while 10% was the speed of the correction was within the entire based on broader index

If you take a look at ARKK iinm it was barely 100 Xmas and now hovering at 70+ range which correction earlier in fact

All are getting hit red because broad macro news but the most affected is Tech and small caps this round

Go take a look at Invesco 2022 outlook and you can see which rotational base and alternative to give you some 8nsight on it based on s3ctors

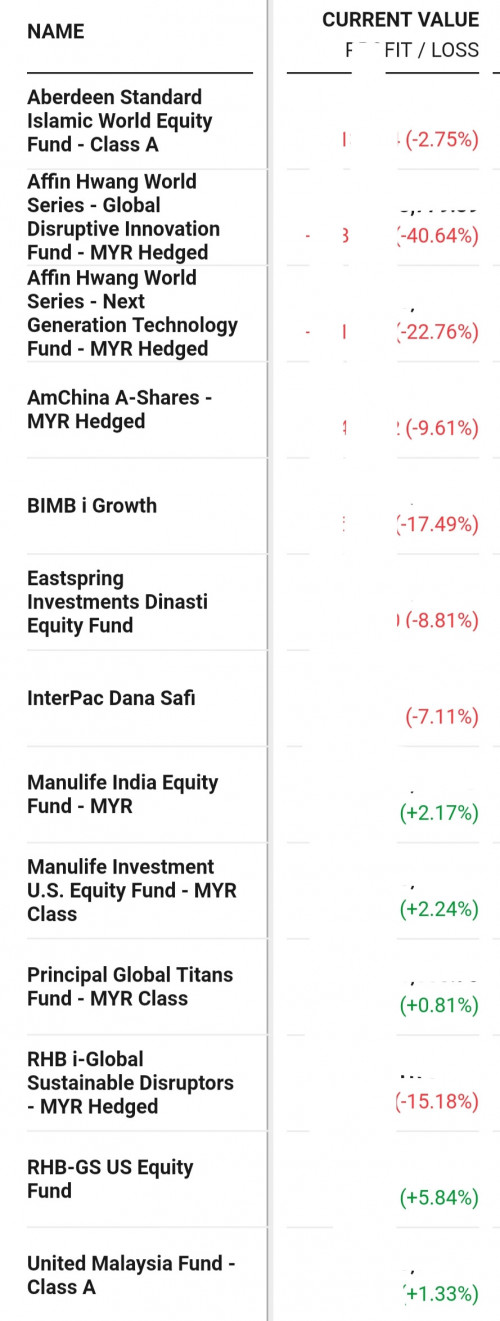

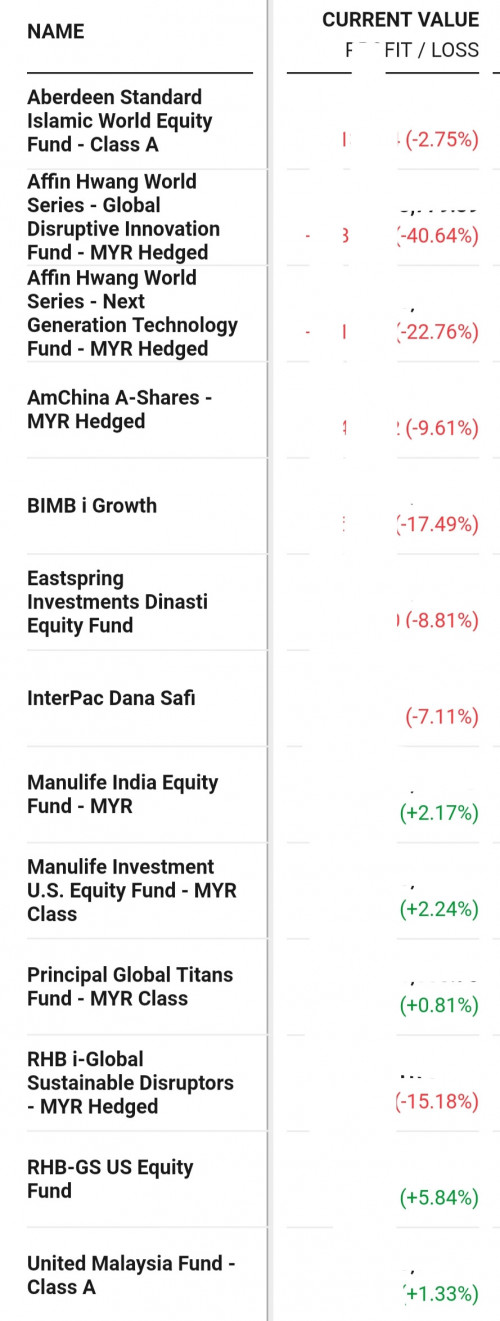

QUOTE(ganesh1696 @ Jan 22 2022, 01:29 PM)

I'm a failed investor

All my hard earned money.

Even bank fd could get at least 2% or crypto fd at 12 %.

My decisions are worst when it comes to investments.

Any opinion on my worthless decisions?

Opinions welcome.

And those with profit will turn red on Monday as I already the prices.

The problem is you are buying chasing growth while not patiently waiting

UT is a long term and only after 3 years you can see whether it is performing or not

Dec 24 2021, 07:30 PM

Dec 24 2021, 07:30 PM

Quote

Quote

0.0639sec

0.0639sec

0.45

0.45

7 queries

7 queries

GZIP Disabled

GZIP Disabled