QUOTE(whirlwind @ Nov 6 2020, 06:11 PM)

Noted

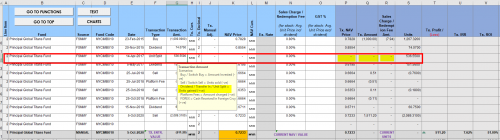

Would like to avoid the mistake I did switching out my Principal Global Titan Fund before the election. Now it’s doing so well.

Unless you're legendary investors, don't try to time the market. Not especially with mutual funds as it may cost you sales charges. Would like to avoid the mistake I did switching out my Principal Global Titan Fund before the election. Now it’s doing so well.

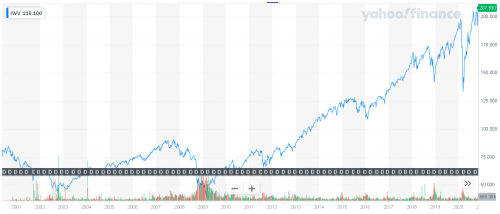

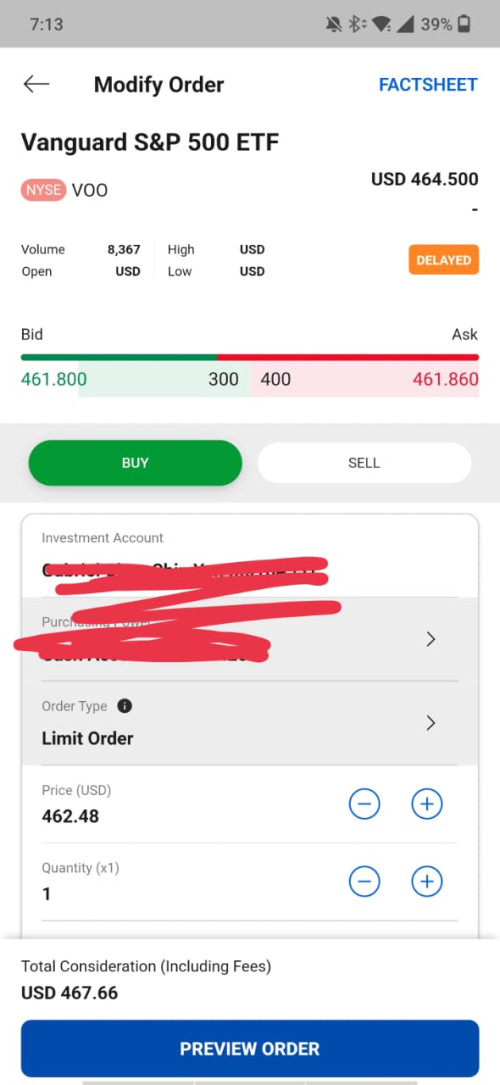

Even via direct ETF / stock we won't recommend doing it as well. Typically speaking, time IN THE market matters more than TIMING THE market. There's many studies about it, in the long run, a DCA person into SNP500 earned even more than a best market timer whom accumulated cash up to market bottom and lumpsum invested everything.

Heck, even a worst timer of accumulating lumpsum and dump in during market PEAK before crash had a sizable portfolio size after 35+ years tenure.

Nov 7 2020, 11:04 AM

Nov 7 2020, 11:04 AM

Quote

Quote

0.6541sec

0.6541sec

0.50

0.50

7 queries

7 queries

GZIP Disabled

GZIP Disabled